ILCT Ltd. | View firm profile

On the 2nd of January 2024, the cabinet granted its approval for substantial tax reductions and exemptions on alcoholic beverages, marking a strategic initiative to fortify the tourism sector.These tax amendments, expected to take effect shortly, include alterations to both Excise Tax and Customs Tax frameworks. This article provides a thorough analysis of the endorsed modifications and their ramifications for various categories of alcoholic beverages.

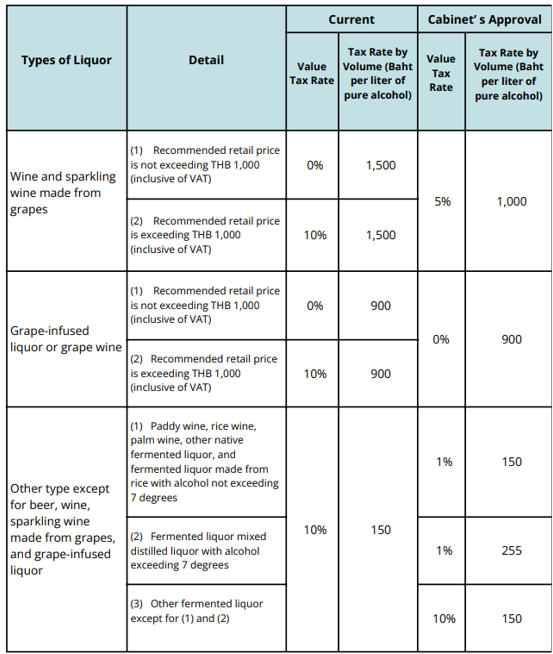

Excise Tax Amendments: The approved changes in Excise Tax encompass a transition from tax collection based on price tiers to a unitary rate system, aimed at optimizing the tax collection process. Below is a concise overview of the prevailing Excise Tax rates vis-à-vis the rates sanctioned by the cabinet:

- Wine and Sparkling Wine Made from Grapes:

-

- Existing:

-

Recommended retail price not exceeding THB 1,000 (inclusive of VAT): Value Tax Rate 0% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 1,500

Recommended retail price exceeding THB 1,000 (inclusive of VAT): Value Tax Rate 10% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 1,500

-

-

- Cabinet’s Approval:

-

Value Tax Rate 5% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 1,000

- Grape-Infused Liquor or Grape Wine:

-

-

- Existing:

-

Recommended retail price not exceeding THB 1,000 (inclusive of VAT): Value Tax Rate 0% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 900

Recommended retail price exceeding THB 1,000 (inclusive of VAT): Value Tax Rate 10% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 900

-

-

- Cabinet’s Approval:

-

Value Tax Rate 0% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 900

3. Other Types Except for Beer, Wine, Sparkling Wine Made from Grapes, and Grape-Infused Liquor:

(1) Paddy wine, rice wine, palm wine, other native fermented liquor, and fermented liquor made from rice with alcohol not exceeding 7 degrees

-

-

- Existing: Value Tax Rate 10% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 150

- Cabinet’s Approval: Value Tax Rate 1% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 150

-

(2) Fermented liquor mixed with distilled liquor with alcohol exceeding 7 degrees

-

- Existing: Value Tax Rate 10% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 150

-

- Cabinet’s Approval: Value Tax Rate 1% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 255

(3) Other fermented liquor except for (1) and (2) – the Tax Rate for this remains the same as outlined below

-

- Existing: Value Tax Rate 10% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 150

-

- Cabinet’s Approval: Value Tax Rate 10% and Tax Rate by Volume (Baht per liter of pure alcohol) Baht 150

Customs Tax Amendment: In tandem with Excise Tax amendment, the cabinet has granted exemptions from import duty for specific wines categorized under Tariff Code 22.04 and 22.05. The exempted wines comprise:

- Wine of Fresh Grapes, Including Fortified Wines (Tariff Code: 22.04)

- Vermouth and Other Wine of Fresh Grapes Flavored with Plants or Aromatic Substances (Tariff Code: 22.05)

To conclude, the cabinet’s endorsement of tax reductions and exemptions on alcoholic beverages, coupled with the recalibration of Excise and Customs Taxes, underscores a targeted effort to invigorate the tourism sector. Stakeholders within the alcohol industry should vigilantly monitor the execution of these amendments and tailor their strategies accordingly.

Below, you will find a table that our team has designed to help illustrate the information in this article. For any questions, please do not hesitate to reach out to law@ilct.co.th for expert legal guidance on this matter.