Kudun & Partners | View firm profile

According to Thai labour laws, an employer is empowered to terminate an employee’s employment at its will, except for members of the Employee Committee which requires a court order for dismissal. However, the consequences of dismissal with and without statutory causes under the Labour Protection Act B.E. 2541 (the “Labour Protection Act”) will be different in terms of the statutory payments for which the employer is legally required to pay the employee. In this regard, the question “how much statutory payment does the employer have to pay to the employee due to dismissal?” becomes one of the most concerned and critical issues for all employers.

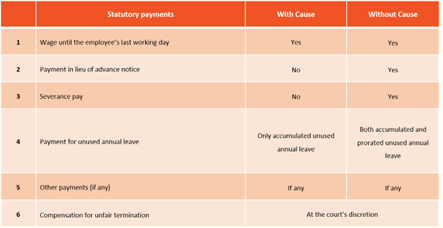

Here are key takeaways for employers and employees on statutory payments to consider when terminating or being terminated.

Statutory Cause Section 583 of the Civil and Commercial Code stipulates that if the employee wilfully disobeys or habitually neglects the lawful commands of the employer, absents himself for services, is guilty of gross misconduct, or otherwise acts in a manner incompatible with the due and faithful discharge of the employee’s duty, such employee may be dismissed by the employer without notice or compensation.

In addition, Section 119 of the Labour Protection Act also stipulates the statutory causes as follows:

- Performing the duty dishonestly or intentionally committing a criminal offence against the employer;

- Wilful acts done to cause damages to the employer;

- Committing negligent acts causing serious damage to the employer;

- Violating work regulations, regulation or order of the employer which is lawful and just for which the employer has already issued the employee a written warning, except in a serious instance for which the employer is not required to give a warning;

- Absenting from duty without justifiable reason for three (3) consecutive working days whether or not they are separated by holiday; and

- Being sentenced to imprisonment by a final court judgment.

In this regard, if the employee falls under the above requirements, the employer can terminate the employee’s employment with the statutory causes.

However, it is noteworthy that if the employer terminates the employee with the statutory cause, the employer is required by the law to specify the fact which is a cause of termination in a letter of termination of employment or inform the cause of termination to the employee at a time of termination of employment, otherwise the employer is not able to claim such statutory cause against the employee’s termination thereafter.

Statutory Payment

Once the employee’s employment is terminated either with or without statutory causes, the employee will be entitled to the statutory payments as summarized below:

In a nutshell, each of the statutory payments are prescribed below:

Wage

Wage means the money which the employer and the employee mutually agree to be payable in return for work done, regardless of its name. There are several Supreme Court judgments ruling that a fixed-monthly payment to the employee would be deemed as part of the employee’s wages.

Payment in lieu of advance notice

According to Section 17 of the Labour Protection Act, the employer who would like to terminate the employment must send the dismissal notice to the employee in advance before or on the day of wage payment so as to serve the dismissal and to be effective on the day of next wage payment. It means that the dismissal notice from the employer must be sent to the employee in advance at least one cycle of wage payment.

For example: If the wage payment is made every month on the 26th day of the month, the employer must notify the dismissal to the employee before or on 26 January 2022 and request the employee to leave his job on 26 February 2022.

Severance pay

According to Section 118 of the Labour Protection Act, the employer is required to pay severance to an employee whose employment is terminated without cause at the following rates:

| Service years with employer | Rate of severance payment |

| 120 days to 1 year | The last 30 days’ wage |

| 1 year to 3 years | The last 90 days’ wage |

| 3 years to 6 years | The last 180 days’ wage |

| 6 years to 10 years | The last 240 days’ wage |

| 10 years to 20 years | The last 300 days’ wage |

| More than 20 years | The last 400 days’ wage |

To further elaborate, the termination of employment means any action where the employer does not allow the employee to continue to do work and does not pay wages to the employee, regardless of whether the cause is the cessation of the employment agreement or other cause. Further, this also covers the cases where an employee does not work and is not paid wages for the reason that the employer is unable to carry on with the business operations.

Payment for unused annual leave

Under Section 67 of the Labour Protection Act, if the employer dismisses the employee without the statutory causes, the employer has to compensate for the unused annual leave of the employee (including unused annual leave of the current year and accrued from the previous year thereof).

Compensation for Unfair Termination

Generally, the termination of employment without statutory causes may lead to the unfair dismissal. Although the employer makes all required payments, i.e. wages until the last working day, severance payment, payment in lieu of advance notice, and wage for unused annual leave, the employee may take the employer to the Labour Court if the employee feels that their dismissal is unfair.

If the Labour Court views that the termination of employment is unfair, the Labour Court may order the employer to re-employ the employee. Or if the Labour Court believes that the employee and the employer cannot work together anymore, the Labour Court may order the employer to pay extra compensation i.e. compensation for unfair termination to the employee. The amount of compensation for unfair termination will be fixed by the Labour Court by taking the employees’ age, service period, hardship and reason for dismissal into account in accordance with section 49 of the Act on Establishment of Labour Courts and Labour Court Procedures B.E. 2522 (the “Labour Court Act”).

Based on our experience, the court, normally, will grant a compensation for unfair termination by determining the service years of the employee at the rate of one month per one service year of the terminated employee. For example, if the employee works with the employer for three years, the Labour Court would order three-months’ wages as unfair dismissal damages.

Dismissal procedure in Thailand

This section focuses on termination without statutory causes for which the dismissal procedure is more complicated than termination with statutory causes. The following procedures are preliminary undertakings of the employer under the Thai law, but this is not an exhaustive list. Apart from the below process, the employer may proceed with different processes based on the employer’s policies and agreements.

Serving of the written dismissal notice

So as to be legal evidence, the dismissal notice should be provided in a written form with the termination details, reason and date of dismissal.

Notifying to the employees in advance

According to Section 17 of the Labour Protection Act, the dismissal notice must be sent to the employee in advance at least one cycle of wage payment otherwise the employee has to compensate with the payment in lieu of the advance notice.

Paying of the statutory payments

The Labour Protection Act states that the employer has to pay wage and overtime payments within three days after the dismissal date. While, the other compensation such as severance pay, payment in lieu of advance notice, payment for unused annual leave and others

has to be paid upon the dismissal date.

Issuing of the withholding tax certificate

According to the Revenue Code, the employer is responsible to issue the withholding tax certificate on the compensation paid to the employee upon deduction of the withholding tax from the

compensation derived from the dismissal.

Issuing a job certification

According to Section 585 of the Civil and Commercial Code, upon being requested by the employee, the employer has to issue the job certificate showing the length of their service years working for the

employer and details of their works.

Closing the provident fund (if any)

The employer has to inform the dismissal to the fund manager as the fund’s manager will pay out the fund to the employee according to the Articles of Association of the fund within a period of 30 days after the date of membership termination, as stated in Section 23 of Provident Fund Act, unless the employees notifies otherwise to the fund manager.

Returning of the employer’s belongings

Regarding the employer’s belongings i.e. uniform, ID card, health insurance etc., they are subject to the employment contract. Normally, it needs to be returned to the Company on the last working day.

Get in touch

Pariyapol Kamolsilp

Partner

[email protected]

Kongwat Akaramanee

Senior Associate

[email protected]

Nattawut Cherdhirunkorn

Associate

[email protected]

Kudun and Partners

23rd Floor, Unit C and F, Gaysorn Tower 127, Ratchadamri Road,

Lumpini, Pathumwan

Bangkok, 10330, Thailand

Kudun and Partners

23rd Floor, Unit C and F, Gaysorn Tower 127, Ratchadamri Road,

Lumpini, Pathumwan

Bangkok, 10330, Thailand

August 2022