In an increasingly interconnected global economy, understanding the origin and composition of goods has become paramount.The concept of Regional Value Content (RVC) has gained significance as countries and trade blocs aim to establish rules and regulations that promote local production, job creation, and economic growth. This study delves into the intricacies of RVC, focusing on its application within the Association of Southeast Asian Nations (ASEAN) and specifically in Thailand. We will explore the two primary methods for calculating RVC: the Transaction Value Method and the Net Cost Method, along with their implications for trade and economic dynamics.

Regional Value Content: An Overview

Regional Value Content (RVC) refers to the proportion of a product’s final value that originates from within a specific region or country. It is a crucial measure in determining the degree of local sourcing and production in traded goods. A higher RVC signifies a larger share of local inputs and production processes, which often corresponds to increased economic benefits for the region. RVC calculations serve as the basis for determining whether a product qualifies for preferential trade agreements or tariff benefits, incentivizing the growth of regional supply chains.

The ASEAN Context

ASEAN, a regional intergovernmental organization comprising ten Southeast Asian nations, has taken significant strides in promoting intra-regional trade and economic integration. RVC plays a pivotal role in ASEAN’s trade agreements, such as the ASEAN Free Trade Area (AFTA) and the ASEAN-China Free Trade Area (ACFTA), which aim to reduce or eliminate tariffs among member states. These agreements require products to meet specific RVC thresholds to qualify for preferential treatment.

RVC Calculation Methods

- Transaction Value Method

The Transaction Value Method calculates RVC based on the value of a product at the time of importation. It considers the price actually paid or payable for the product when sold for export to the importing country. The method involves subtracting certain costs, such as transportation and insurance, from the transaction value to determine the value of the imported product. Subsequently, the value of non-originating materials is deducted to ascertain the RVC.

This method is particularly relevant when a product’s primary value is added during the final stages of production. For instance, if a product is assembled in an ASEAN country but its key components are imported, the Transaction Value Method can be useful in determining the origin of the product. However, this method can pose challenges when dealing with complex supply chains and accounting for various costs and components.

- Net Cost Method

The Net Cost Method calculates RVC based on the total cost of production incurred within the region. It takes into account all costs directly related to the production of the goods, such as raw materials, labor, and overhead expenses. To arrive at the net cost, the method deducts certain expenses, including royalties, transport, and other costs not associated with production.

This method is advantageous for products with substantial value derived from the production process itself. It is particularly suitable for industries where the manufacturing process involves significant labor and local resources. The Net Cost Method provides a comprehensive view of the product’s local content, encouraging the development of supply chains that emphasize local sourcing and production.

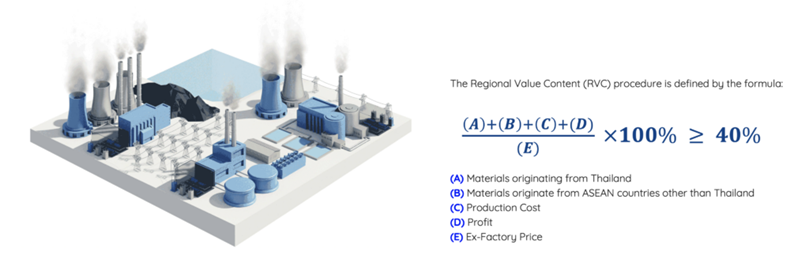

Figure. Regional Value Content (RVC) calculation method.

The Regional Value Content (RVC) procedure is defined by the formula ((A)+(B)+(C)+(D))/((E)) × 100% ≥ 40%, where:

(A) For materials originating from Thailand, the process mandates obtaining authorization from the pertinent institute under the Ministry of Industry, such as the Thai Automotive Institute (TAI). The production process must fulfill the criteria of being ‘complex,’ with the products themselves serving as the principal factor of production. Submission of the relevant certificate of origin is indispensable to provide substantiating documentation.

(B) When materials originate from ASEAN countries other than Thailand, the acquisition of an ATIGA (ASEAN Trade in Goods Agreement) Certificate of Origin is necessary. It is noteworthy that the ATIGA formula utilizes the Free On Board (FOB) price, whereas the Thailand Customs Department employs the Ex-Works (EXW) price.

(C) The Production Cost, evaluated within Thailand, encompasses both Labor Cost and Other Manufacturing Expenses, divided by Overhead. This computational approach yields insights into the expenses tied to manufacturing processes within the country.

(D) Profit is discerned by deducting the Cost of Production from the Ex-Factory Price. The Cost of Production encompasses the sum of the cost of material consumed, direct labor cost, and other manufacturing expenses divided by overhead. To conduct the calculation, the Ex-Factory Price of the selling company is required. This price encapsulates the cumulative value of the cost of material consumed, direct labor cost, other manufacturing expenses divided by overhead, and the Profit.

(E) The Ex-Factory Price is ascertained by aggregating the cost of material consumed, direct labor cost, other manufacturing expenses divided by overhead, and Profit. The RVC procedure, delineated through components (A) to (E), serves to determine the extent of local content within a product. It underscores the provenance of materials, the intricacy of production, production expenditures, and profit margins. Through the application of this formula, regulatory bodies and industries are empowered to assess whether a product aligns with the specified RVC threshold. This fosters both transparency and consistency in trade agreements, while also catalyzing the expansion of regional supply chains.

RVC in Thailand

Thailand, as a member of ASEAN, has actively engaged in promoting RVC-based trade agreements. The country’s strategic geographic location, well-developed infrastructure, and skilled labor force have positioned it as a key player in regional manufacturing and trade. Thailand has integrated RVC calculations into its trade policies to ensure that products meeting the specified thresholds can access preferential tariffs within ASEAN and other trade blocs.

Implications of RVC Calculation Methods

- Trade and Supply Chain Dynamics

The choice of RVC calculation method can significantly influence trade and supply chain dynamics. The Transaction Value Method, by focusing on the final value of the product, encourages countries to specialize in specific stages of production that offer the highest value addition. This can lead to the concentration of certain industries in particular regions, based on cost-effectiveness and expertise.

On the other hand, the Net Cost Method incentivizes countries to develop comprehensive local supply chains by considering the entire production process. This approach can lead to the creation of jobs and the growth of supporting industries, fostering economic development within the region.

- Compliance and Administration

Both calculation methods require effective administrative systems to verify and enforce RVC regulations. The Transaction Value Method demands accurate record-keeping of transaction values and detailed information on the product’s components. This approach necessitates strong customs and documentation procedures to prevent misrepresentation and ensure compliance.

The Net Cost Method, while comprehensive, can be complex to administer due to the numerous cost factors involved in production. Ensuring transparency and consistency in cost calculations becomes crucial for maintaining the integrity of the system.

- Incentives for Local Production

The RVC calculation methods act as incentives for local production and sourcing. Manufacturers have a vested interest in increasing RVC to access preferential trade benefits. As a result, industries may evolve to prioritize local sourcing, which can lead to increased investment in research and development, improved technology transfer, and the development of skilled labor.

Conclusion

Regional Value Content (RVC) holds immense significance in the modern trade landscape, particularly within the ASEAN region and Thailand. Through the Transaction Value Method and the Net Cost Method, countries assess the proportion of local content in traded goods, thereby influencing trade agreements, supply chain dynamics, and economic development. These methods, though distinct in their approaches, contribute to fostering regional integration and encouraging the growth of industries with strong local ties. As ASEAN and Thailand continue to navigate the complexities of international trade, the effective utilization of RVC calculation methods can serve as a catalyst for sustainable economic growth and cooperation.