Nagashima Ohno & Tsunematsu | View firm profile

Introduction

The Tokyo Stock Exchange (“TSE”) is arguably one of the most attractive stock exchanges for listed stock in the world. According to World Federation of Exchanges, as of the end of January 2024, the aggregate market capitalization of TSE-listed companies was approximately USD 6.3 trillion, the 4th largest in the world. It is also an international exchange in terms of investors. According to the TSE, since 2015, non-Japanese investors made more than 60% of the trades for the stocks that are listed on the TSE’s Prime Market.

However, the process for TSE listings and initial public offerings (IPO(s)) in Japan are somewhat unique and may not be well known to potential sellers and purchasers of Japanese shares. This article summarizes the key points to consider when selling and purchasing the shares of Japanese corporations through IPOs in a Q&A format.

Selling Shares

Q1. After an IPO is made public and the marketing activities therefor are commenced, how long would it take to complete the IPO process?

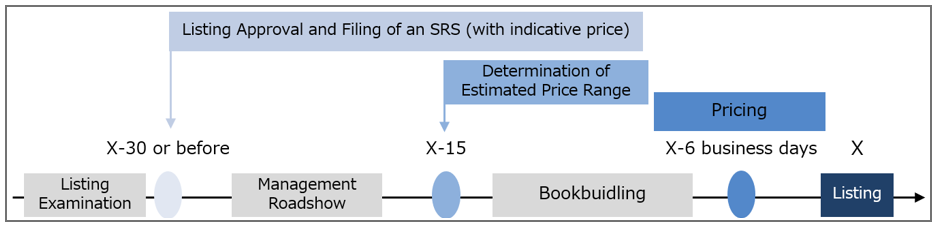

Unless the issuer adopts the “S-1” format (as discussed in Q4 below), it would generally take approximately one (1) month from the listing approval date of the IPO, which is usually when the IPO is first made public, to complete the IPO process[1],[2].

On the listing approval date, the issuer must file a securities registration statement (“SRS”), which is a publicly disclosed document, with the local finance bureau. The SRS must contain information concerning the securities, the issuing company and certain matters relating to the IPO. Upon the filing of the SRS, the issuer and the underwriters usually begin conducting the marketing activities therefor, including a management roadshow. The issuer also prepares a prospectus, which contains substantially the same information as the SRS and is delivered to potential investors at this stage.

After conducting the management roadshow and hearing from certain institutional investors, the issuer and/or the seller decide on an estimated offer price range per share (kari joken). Once such estimated offer price range is decided, the underwriters begin the book-building process based on such estimated offer price range for a period of approximately a week and upon the completion of the book-building process, the issuer and/or the seller decide the final issue/selling price per share (this process is called “pricing”). Once the pricing is completed, an underwriting agreement and related agreements are executed, and for a period of approximately 6 business days after the pricing, the payments for the shares are made and the offering closes.

[Standard Schedule of the Japanese IPO]

Q2. How is the selling price decided? Is it possible to set the selling price outside the estimated offer price range (kari joken)?

The selling price is determined once the bookbuilding process is complete, and such determination is made by collecting actual demands from investors based on the estimated offer price range.

After the amendment to the Guideline for the Disclosure of Corporate Affairs in 2023, setting the selling price outside the estimated offer price range became possible as long as all of the following conditions are met.

a. The selling price shall be equal to or greater than 80% of the lower limit of the estimated offer price range and equal to or lower than 120% of the upper limit of the estimated offer price range;

b. If, upon setting the selling price, the number of shares to be sold changes from the number disclosed at the time the estimated offer price range was decided, the number of shares to be sold after the change shall be equal to or greater than 80% of the number of shares to be sold disclosed at the time the estimated offer price range was decided and equal to or less than 120% of the number of shares to be sold disclosed at the time the estimated offer price range was decided;

c. The product of the total number of shares to be issued and sold multiplied by the selling price shall be equal to or greater than 80% of the product of the total number of shares to be issued and sold disclosed at the time the estimated offer price range was decided multiplied by the lower limit of the estimated offer price range and shall be equal to or less than 120% of the product of the total number of shares to be issued and sold disclosed at the time the estimated offer price range was decided multiplied by the upper limit of the estimated offer price range; and

d. An SRS or an amendment thereto discloses that the selling price and the number of shares to be sold would be decided within the scope outlined in a. through c. above.

Q3. What is the definition of the term “indicative price” (sotei kakaku)?

The term “indicative price” (sotei kakaku) is the issue/selling price that must be disclosed in the SRS when it is filed on the listing approval date[3]. Legally speaking, it does not bind or affect the estimated offer price range or the final issue/selling price to be decided at a later stage in the IPO process. However, since the indicative price is disclosed before the commencement of the marketing activities, it is considered to have a certain de-facto impact on the later parts of the IPO pricing process.

Q4. What is the “S-1” format? How is it different from traditional Japanese IPOs?

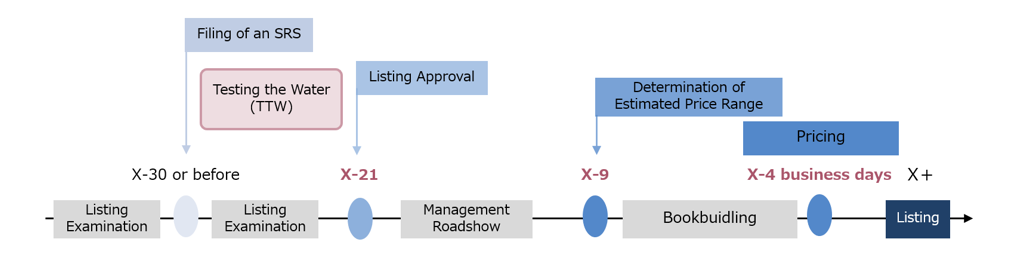

The “S-1” format is a new structure that was introduced upon an amendment to the Cabinet Office Order on Disclosure of Corporate Affairs and other regulations in 2023. It enables the issuer to file an SRS before the listing approval date, which would shorten the period between the listing approval date and the listing date. In December 2024, KIOXIA Holdings conducted the first-ever IPO using the “S-1” format.

Before the “S-1” format was introduced, it had been pointed out that, in Japanese IPOs, there is an extended period of time between the listing approval date and the listing date (approximately one month as discussed in Q1 above), this extended period of time subjects investors to price fluctuation risks due to changes in market conditions, etc. and these risks are reflected in the IPO price, which results in a large discount.

In response to such concern, in 2023, the Cabinet Office Order on Disclosure of Corporate Affairs and other regulations were amended in order to shorten the period from the listing approval date to the listing date by allowing the issuer to file an SRS prior to the listing approval date. Specifically, the amended regulations provide that, if an SRS is filed prior to the listing date, certain items in the SRS that are tied to the listing approval may be given within a certain range or be given as “undecided”. Therefore, under the “S-1” format, for example, an initially filed SRS does not need to include the indicative price, the number of shares to be sold or a specific offering timetable.

The new “S-1” format is expected not only to shorten the period between the listing approval date and the listing date but also to encourage sufficient dialogue with institutional investors before the indicative price is decided. Under the traditional Japanese IPO process, contact with institutional investors prior to the listing approval date was conducted only to the extent that it did not violate the so-called “gun-jumping rule”, which prohibits any solicitation of purchasing securities before the filing of an SRS. Therefore, in the traditional Japanese IPO process, the indicative price is decided without any solicitations being made to investors. However, under the “S-1” format, it is possible to conduct activities that would fall under “solicitations” prior to the listing approval by filing an SRS prior to the listing approval date. Such activities before the listing approval date and after the initial filing of an SRS are considered to be the Japanese version of “testing the water” (“TTW”). By engaging in TTW, the “S-1” format is expected to enable the issuer and the seller to set an appropriate indicative price based on sufficient dialogue with institutional investors.

[IPO Schedule under the S-1 format]

Q5. By when must a decision be made regarding the number of shares to be sold?

The number of shares to be sold must be disclosed on the listing approval date, but it can be amended afterwards by filing an amendment to the SRS.

However, an amendment to the number of shares to be sold on the pricing date is permitted only if the conditions under a. to c. in Q2 above are met. Otherwise, an amendment to the number of shares to be sold must be decided and disclosed 3 business days or more prior to the pricing date in order for the SRS to become effective as scheduled.

Q6. If the shareholders do not sell their shares in the IPO, would there be any lock-up restrictions on the shares not sold and held by the shareholders?

Unless the statutory lock-up restriction under the TSE rules is imposed[4], there is no legal requirement that prohibits or restricts the shareholders from selling their shares after the IPO closing. However, it is an established practice for underwriters to require large shareholders to enter into lock-up agreements with them. The typical lock-up period is 90 to 180 days after the listing.

Q7. If there is only one selling shareholder in the IPO, what would be the deadline for such shareholder to withdraw from the transaction?

Legally speaking, it would be possible for the selling shareholder to withdraw from the transaction any time before the pricing. After the pricing, it would not be possible to withdraw from the transaction unless a termination event under the underwriting agreement is triggered.

Purchasing Shares

Q1. May non-Japanese investors purchase shares through an IPO?

A Japanese IPO may accompany with an international offering outside Japan concurrently with a domestic offering pursuant to Regulation S and Rule 144A under U.S. securities laws. As long as an investor is an eligible investor, it can purchase the shares in such international offering. Otherwise, generally speaking, the investor would need to apply to purchase the shares in the domestic offering as a domestic investor.

Q2. How is the number of shares that can be purchased decided?

Except for “oyabike” mentioned in Q3 below, the number of shares to be allocated to an investor in an IPO is decided by the underwriters at their sole discretion.

Q3: Is there any “cornerstone investor” system in Japanese IPOs? What is “oyabike”?

As discussed in Q2 above, in principle, the underwriters may decide which investors will be allocated shares and the number of shares allocated to such investors at their sole discretion. However, under the rules of the Japan Securities Dealers Association (the “JSDA”), which is a self-regulatory organization for securities companies, if the requirements below are met, the issuer may decide which investors will be allocated shares and the number of shares allocated to such investors. Such allocation is referred to as “oyabike”.

(x) the underwriters decide that, even after “oyabike” is conducted, the allocations will be fair and appropriate;

(y) certain disclosures were made in the SRS regarding the investors who will be allocated shares; and

(z) the relevant investors agree not to transfer the allocated shares during the 180 day period after the closing of the offering.

The JSDA established guidelines that further provide points to consider when making the decision in (x) above. In 2022, the guidelines were amended to make it clear that allocations to an “institutional investor that contributes to improving the corporate governance or corporate value of the issuer” would be permitted under the JSDA rules and that “oyabike” is currently considered to function as a cornerstone investor system in other jurisdictions.

In addition, in recent cases, an issuer may sometimes disclose that a specific institutional investor is committed to purchase or is willing to purchase a specific number of shares at a specific price during the IPO process (such disclosure is typically made when the estimated offer price range (kari joken) has already been decided). This process is called “indication of interest”. Although the investor who showed such interest would not be exempted from the allocation rule discussed above, if the investor is an influential institutional investor, an announcement in respect of such interest by such investor during the IPO process can have a positive impact on the offering process.

View original article here.

Author: Motoki Saito

Footnotes

[1] Before the listing approval date, the underwriters and the TSE will conduct a listing examination.

[2] This can be shortened in accordance with the amendment to the Act on Book Entry of Corporate Bonds and Shares.

[3] Technically speaking, it is not a legal requirement to disclose the indicative issue/selling price “per share”, but the expected number of the shares to be issue/sold and the aggregate issue/selling price must be disclosed.

[4] Under the TSE rules, in principle, shares and stock acquisition rights issued for a certain period prior to the listing are subject to lock-up for a period of 6 months.