Nagashima Ohno & Tsunematsu | View firm profile

I. Introduction

The tender offer regulations in Japan were introduced in 1971, and have not been the subject of significant amendment since 2006.Recently, however, there have been efforts to enhance the fairness and transparency of the market, in response to environmental changes in capital markets. In this regard, the working group established by the Financial Services Agency (the “FSA”) released a Working Group Report regarding the Tender Offer and Large Shareholding Reporting System (the “FSA Report”) on December 25, 2023. In the FSA Report, the working group pointed out issues concerning the current tender offer regulations and suggested a number of amendments thereto. In light of the suggestions in the FSA Report, the amendments (the “Amendments”) to the Financial Instruments and Exchange Act (the “FIEA”) were proposed and passed by the Diet on May 15, 2024. The Amendments may have a material impact on the practice of the tender offer regulations.

The Amendments related to the tender offer regulations will be effective within two years from the date of their announcement. It should be noted that while the detailed rules of the tender offer regulations are prescribed in the FIEA enforcement order (the “Enforcement Orders”) and the Cabinet office ordinances related thereto (the “Cabinet Office Ordinances”), the proposed amendments of the Enforcement Orders and Cabinet Office Ordinances are being discussed and will be released before the effective date of the Amendments.

II. Overview of the Amendments

(i) Expansion of Regulated Transactions (Applicable to On-Market Transactions)

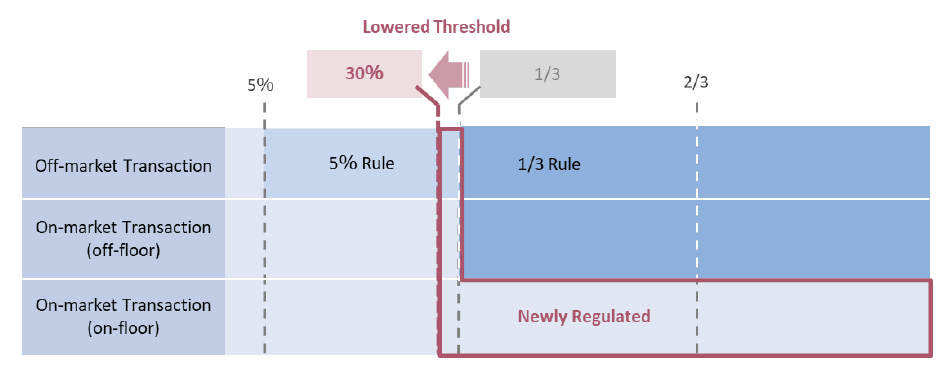

In Japan, an acquisition of listed shares which materially affects the control of the target company necessitates the implementation of a tender offer in compliance with the procedures set forth in the FIEA (the “Mandatory Tender Offer”). Under the current tender offer regime, as a general rule, the Mandatory Tender Offer applies to (a) off-market transactions involving a large number of persons (more than ten persons within a 61-day period), resulting in the acquirer’s ownership ratio exceeding 5% (the “5% Rule”); and (b) either off-market transactions (whether involving a small or large number of persons) or on-market transactions (off-floor transactions) that result in the acquirer’s ownership ratio exceeding one-third (1/3) (the “1/3 Rule”). In contrast, on-market transactions (on-floor transactions) have not been subject to either the 5% Rule or the 1/3 Rule, based on the premise that such transactions inherently ensure transparency and fairness.

In recent years, however, there have been instances where more than one-third of company’s shares have been acquired within a relatively short period through on-market transactions (on-floor transactions), and this has led to an increasing calls for the application of the 1/3 Rules to on-market transactions (on-floor transactions), in order to ensure that shareholders are provided with adequate information and time to assess and make informed investment decisions regarding such transactions. In response to these concerns, the Amendments have introduced the application of the 1/3 Rule to on-market transactions (on-floor transactions), thereby extending the scope of the Mandatory Tender Offer to such transactions.

(ii) Lowered Threshold (1/3 to 30%)

As noted above, under the current tender offer regime, the Mandatory Tender Offer applies to off-market transactions (whether involving a small or large number of persons) that result in the acquirer’s ownership ratio exceeding 1/3. This threshold is understood to reflect the percentage of voting rights that can veto special resolutions (i.e., requiring two-thirds (2/3) of the total voting rights exercised) at a general meeting of shareholders, which could materially affect the control of the company.

However, (a) based on the percentage of voting rights typically exercised by shareholders in Japanese listed companies, voting rights of 30% is generally sufficient to block a special resolution, and in certain cases, may also significantly influence the outcome of an ordinary resolution (requiring a majority vote) at a general meeting of shareholders; and (b) in most foreign jurisdictions, the mandatory tender offer threshold is set at 30%. In light of these considerations, the threshold of the 1/3 Rule has been lowered to 30% under the Amendment.

Illustrating the above, the newly regulated areas are shown in red below.

(iii) Elimination of “Rapid Acquisition” Rule

Under the current tender offer regime, there exists a “rapid acquisition” rule, which mandates that a tender offer be conducted for acquisitions that meet the following requirements.

A) Acquisitions of more than 10% of the company’s shares (regardless of type of transaction, including new shares subscriptions, on-market transactions (on-floor transaction), tender offers or exempted purchases) within a three-month period;

B) Which acquisitions include more than 5% of the company’s shares through off-market transactions or on-market transactions (off-floor transactions), excluding tender offers and exempt purchases; and

C) In which the acquirer’s ownership ratio exceeds one-third (1/3) of the shares following such acquisitions.

The purpose of the “rapid acquisition” rule is to prohibit the combination of transactions that would be subject to the Mandatory Tender Offer if they exceeded the one-third threshold (see requirement B) above) with transactions that would not be subject to Mandatory Tender Offer regardless of whether they exceeded the one-third threshold (see requirement A) above), thereby preventing circumvention of the 1/3 Rule (see requirement C) above). Under the “rapid acquisition” rule, the combination of transactions, such as the acquisition of up to 32% of the shares off-market followed by the acquisition of an additional 2% through on-market transactions (on-floor transactions), is prohibited.

The original purpose of the “rapid acquisition” rule was to prevent circumvention of the 1/3 Rule, primarily through a combination with on-market transactions (on-floor transactions). However, if on-market transactions (on-floor transaction) become subject to the Mandatory Tender Offer as described in (i) above, such transactions will be prohibited regardless of whether or not the “rapid acquisition” rule exists. Consequently, the legislator has decided to officially eliminate the “rapid acquisition” rule through the Amendments.

However, there is an effect of the elimination of the “rapid acquisition” rule over and above its obviation by the increase in scope of the Mandatory Tender Offer. For example, the following scenarios will be permissible if the rule is eliminated: (a) after acquiring 29% of a company’s shares from a major shareholder in an off-market transaction, the acquirer could then make a tender offer to acquire additional shares, resulting in a post-acquisition ownership exceeding 30%; (b) similarly, after acquiring 29% of the shares in an off-market transaction, the acquirer could make an offer to purchase additional shares through an exempted purchase, typically from a party with which the acquirer has had a “formal special relationship” (keishikiteki-tokubetukankeisha; e.g., affiliates) for more than one year.

While the elimination of the “rapid acquisition” rule would enable certain combinations of transactions that were prohibited under the current tender offer regulations, combinations of transactions may require a case-by-case analysis to avoid being deemed an attempt to circumvent the tender offer regulations even though the “rapid acquisition” rule is eliminated.

III. Conclusion

In addition to the above, the Amendments include material changes which would have impact on the practice of the tender offer; however, it should be noted that the details of the Amendments will be clarified in the upcoming amendments to the Enforcement Orders and Cabinet Office Ordinances. We recommend keeping an eye on developments with respect to these further amendments to the related orders and regulations, as well as changes to tender offer practices.

View original article here.

Author: Yu Tamura