In a share swap transaction, consideration is discharged through the issuance or transfer of securities by the acquiring company, rather than cash.This approach alleviates liquidity constraints and may enable more effective allocation of resources towards operational needs of the business.

While share swap transactions are common in other jurisdictions, their adoption in India has been limited due to regulatory challenges and the lack of tax neutrality.

With the intent to simplify cross-border share swaps under the exchange control laws, the Government of India has recently liberalized the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 (“NDI Rules”) by a notification dated August 16, 2024 pursuant to the Foreign Exchange Management (Non-debt Instruments) (Fourth Amendment) Rules, 2024 (the “Amendment”).[1]

As stated in the press release of Ministry of Finance dated August 16, 2024, “the amendments aim to simplify cross-border share swaps and provide for the issue or transfer of Indian company equity instruments in exchange for foreign company equity instruments. This will facilitate the global expansion of Indian companies through mergers, acquisitions, and other strategic initiatives, enabling them to reach new markets and grow their presence worldwide.”[2]

Structure permitted before the Amendment

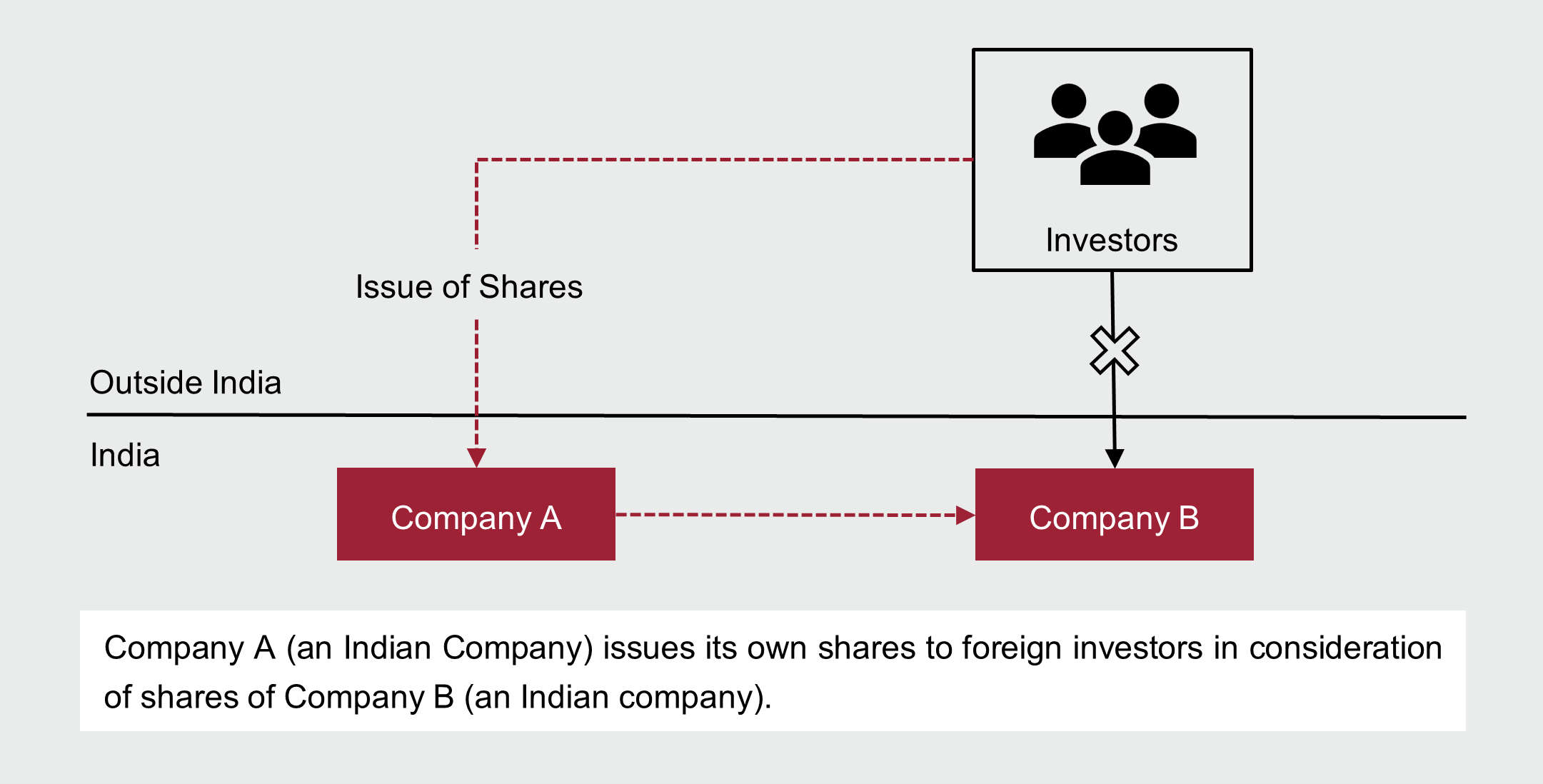

Prior to the Amendment, only an issue of “equity instruments” by an Indian company to persons resident outside India was permitted against a swap of “equity instruments”. “Equity instruments” under the NDI Rules are defined to mean equity shares, convertible debentures, preference shares and share warrant issued by an Indian company.

Therefore, prior to the Amendment, a swap could only be undertaken under the automatic route if the following conditions were satisfied:

- transfer of equity instruments by a person resident outside India; and

- in consideration, an Indian company issues (transfers not permitted) equity instruments to the foreign investors. Therefore, secondary share swaps involving transfer of equity instruments by the Indian company as consideration were not permitted.

Structures permitted by the Amendment

The Amendment has introduced Rule 9A, specifically dealing with swap of equity instruments and equity capital of a foreign company (as defined under the Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”)). Pursuant to the Amendment, the following structures have now been allowed:

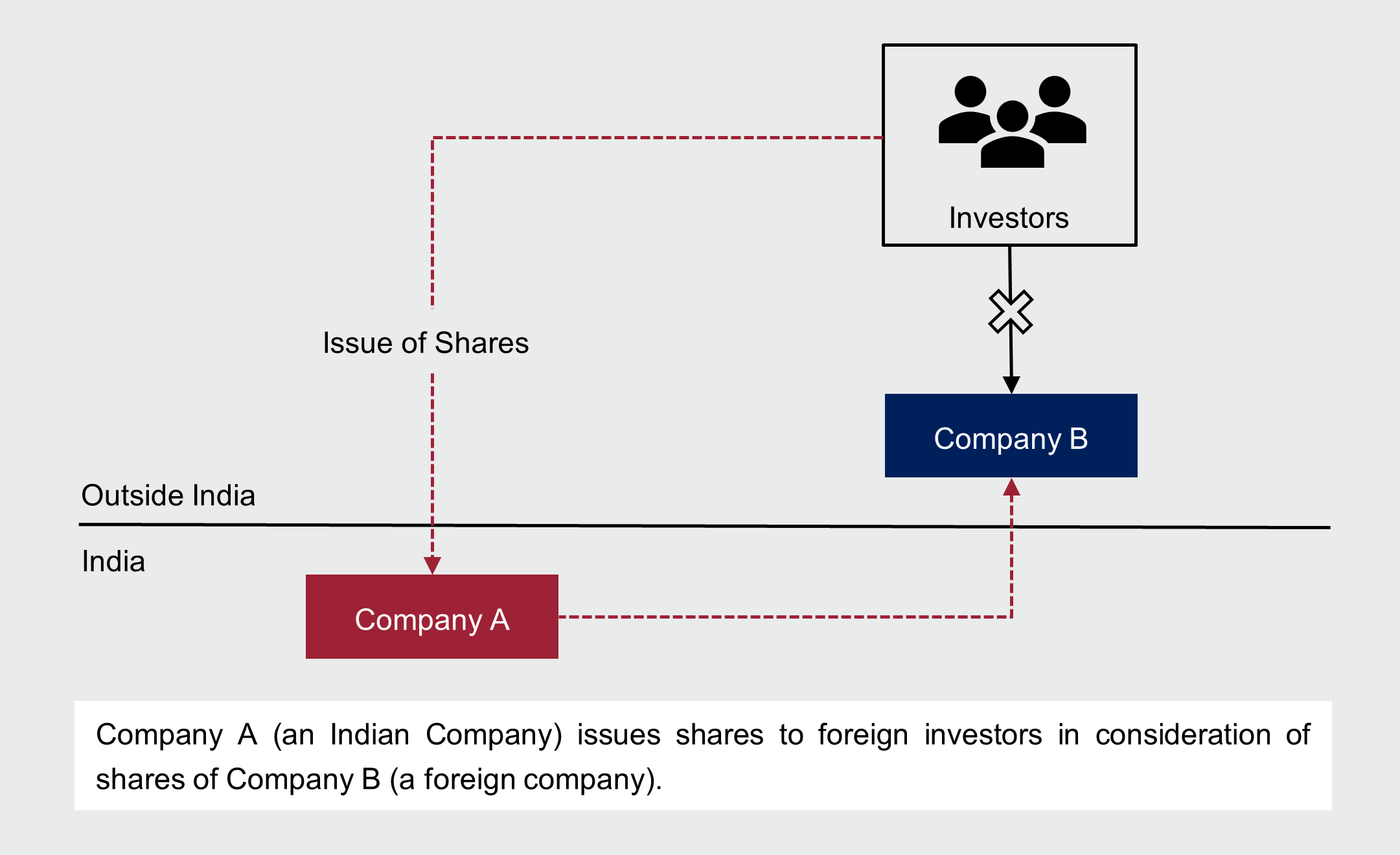

- Issue of equity instruments by an Indian company in exchange for equity capital of a foreign company;

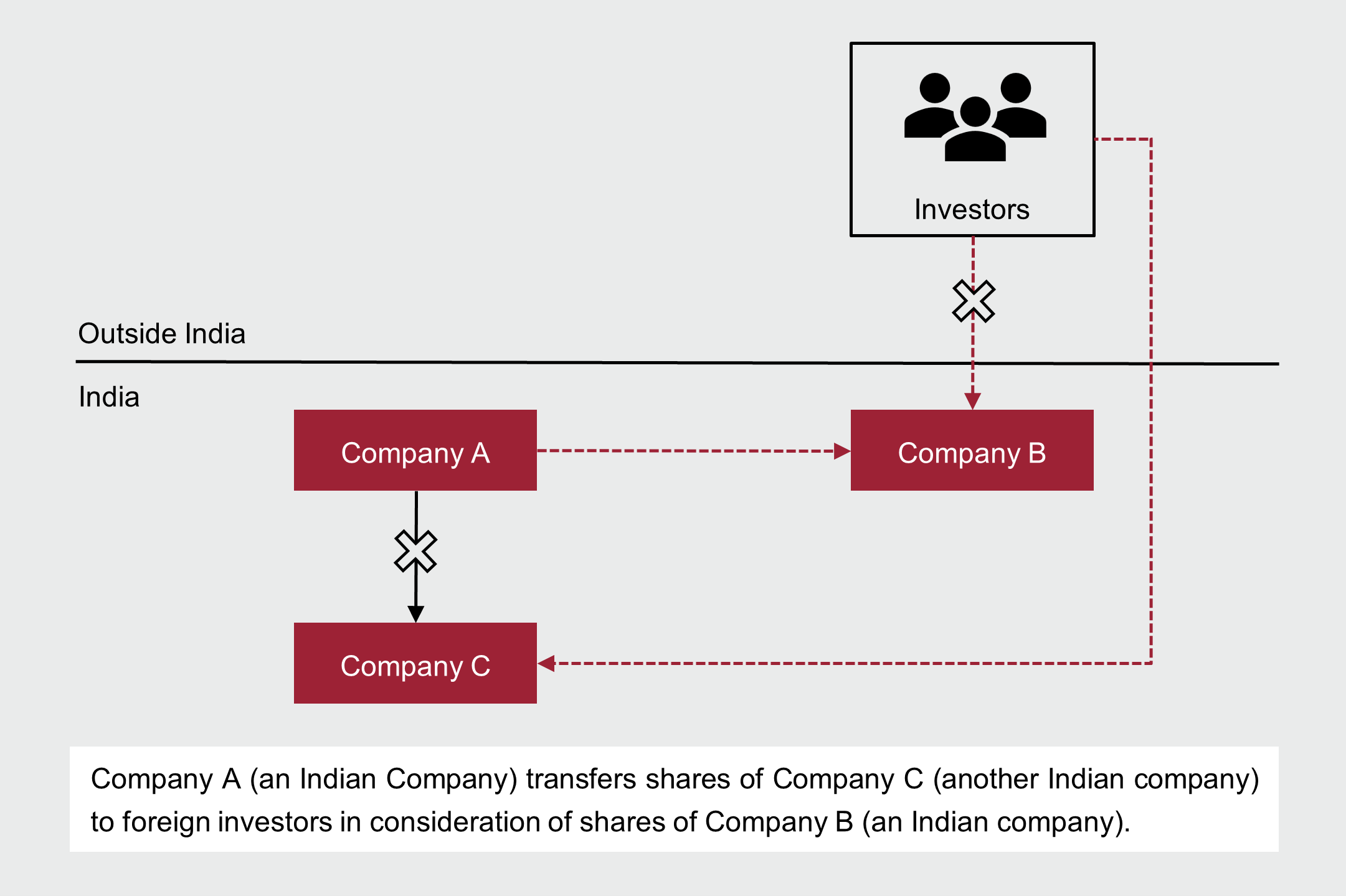

- Secondary share swaps involving transfer of equity instruments between foreign investors and an Indian company;

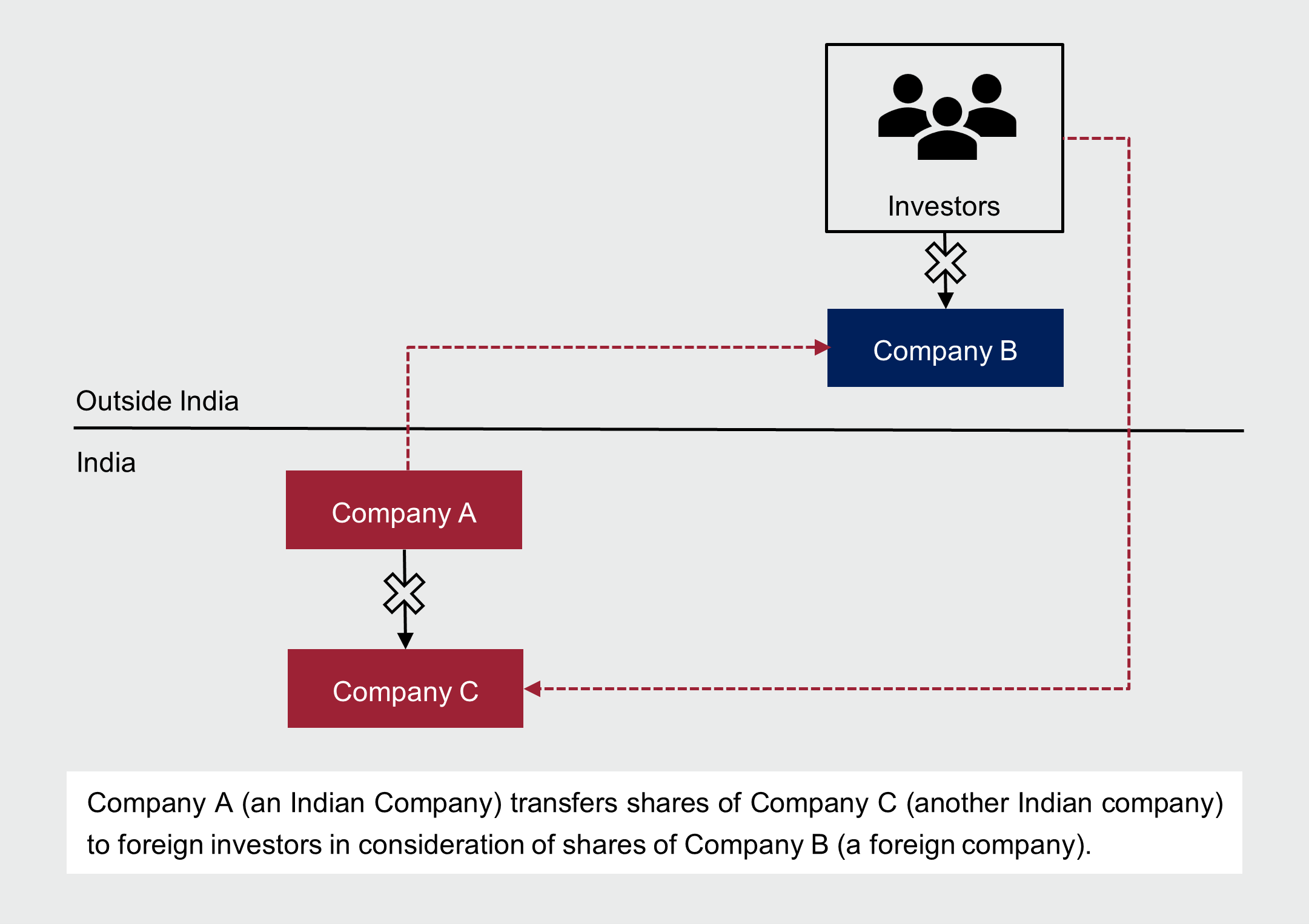

- Secondary share swaps involving transfer of equity instruments by an Indian company in exchange for equity capital of a foreign company;

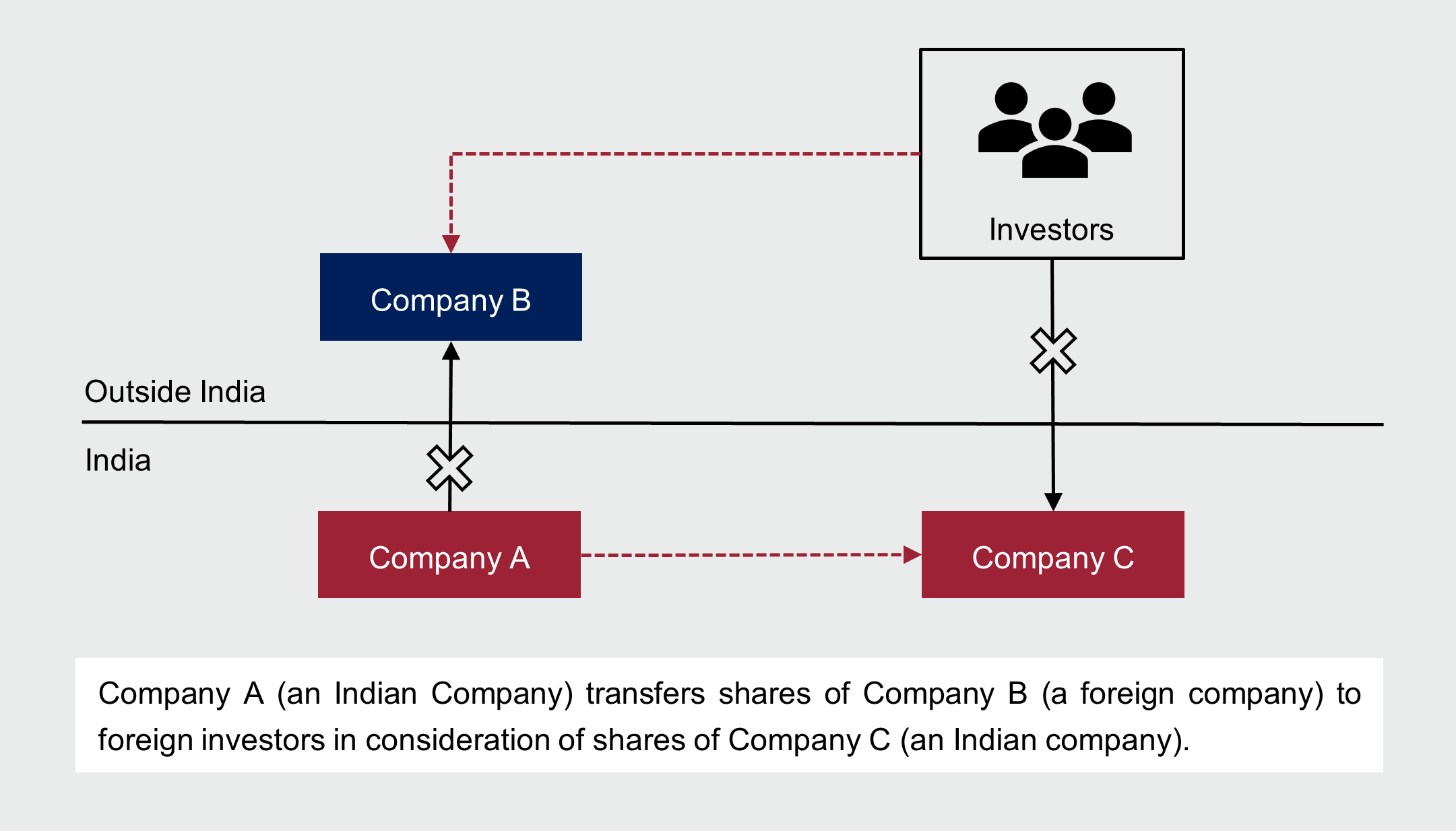

- Secondary share swaps involving transfer of equity capital of a foreign company by an Indian company in exchange for equity instruments of another Indian company;

In the given illustrations, the black arrows represent the existing structure before the swap, while the red arrows represent the steps and the final structure that will result from the swap in each illustration.

Ambiguity continues

- Under the OI Rules, a swap of equity instruments by Indian resident individuals in exchange for equity capital of a foreign company, continues to be permitted only pursuant to a merger, demerger amalgamation or liquidation.

- Schedule I of the NDI Rules continues to provide only for an issuance of equity instruments by an Indian company. To that extent, although the intent behind the Amendment is clear, residual ambiguity persists in respect of the secondary swap transactions.

- The NDI Rules stipulate that a Foreign Owned Controlled Company (“FOCC”) may make downstream investments using either its internal accruals or funds brought in from outside India. FOCCs are prohibited from utilizing funds borrowed from domestic Indian markets for downstream investments. However, the NDI Rules do not explicitly address downstream investments by FOCCs through share swaps.

Other considerations

- A share swap transaction will be subject to pricing guidelines under the NDI Rules and will need to be supported by a valuation obtained from a merchant banker registered with the Securities and Exchange Board of India and/or an investment banker outside India registered with the appropriate regulatory authority in the host country.

- Indian tax laws do not offer tax neutrality to share swaps unless such swaps are achieved through a merger or demerger and subject to conditions prescribed under the Income-tax Act, 1961. Therefore, a share swap transaction not achieved through a tax neutral merger or demerger will be liable to tax in India, subject to any tax treaty benefit available to the foreign shareholders.

- Compliance with the OI Rules will also need to be taken into account, as applicable.

- Government approval will be required for a share swap if the Indian investee company is engaged in business in a sector under government route.

- A share swap resulting in investment from an entity which is from a country sharing a land border with India or if the beneficial owner of such investment is from such a country will require government approval.

The Government of India has progressively relaxed regulations on share swaps. The recent Amendment resolves certain inconsistencies by aligning the NDI Rules and OI Rules, thereby simplifying share swap transactions.

Notably, the changes introduced pursuant to the Amendment make reverse flip transactions significantly easier to execute, and have unlocked a range of restructuring possibilities. However, providing tax neutrality to such structures is essential to make these options more sustainable and practically feasible.

Authors:

Rajat Sethi (Partner) https://www.snrlaw.in/rajat-sethi/

Sumit Bansal (Partner) https://www.snrlaw.in/sumit-bansal/

Shivani Chhabra (Tax)

Footnotes

[1] https://static.pib.gov.in/WriteReadData/specificdocs/documents/2024/aug/doc2024816377701.pdf