YYC Legal LLP | View firm profile

Background

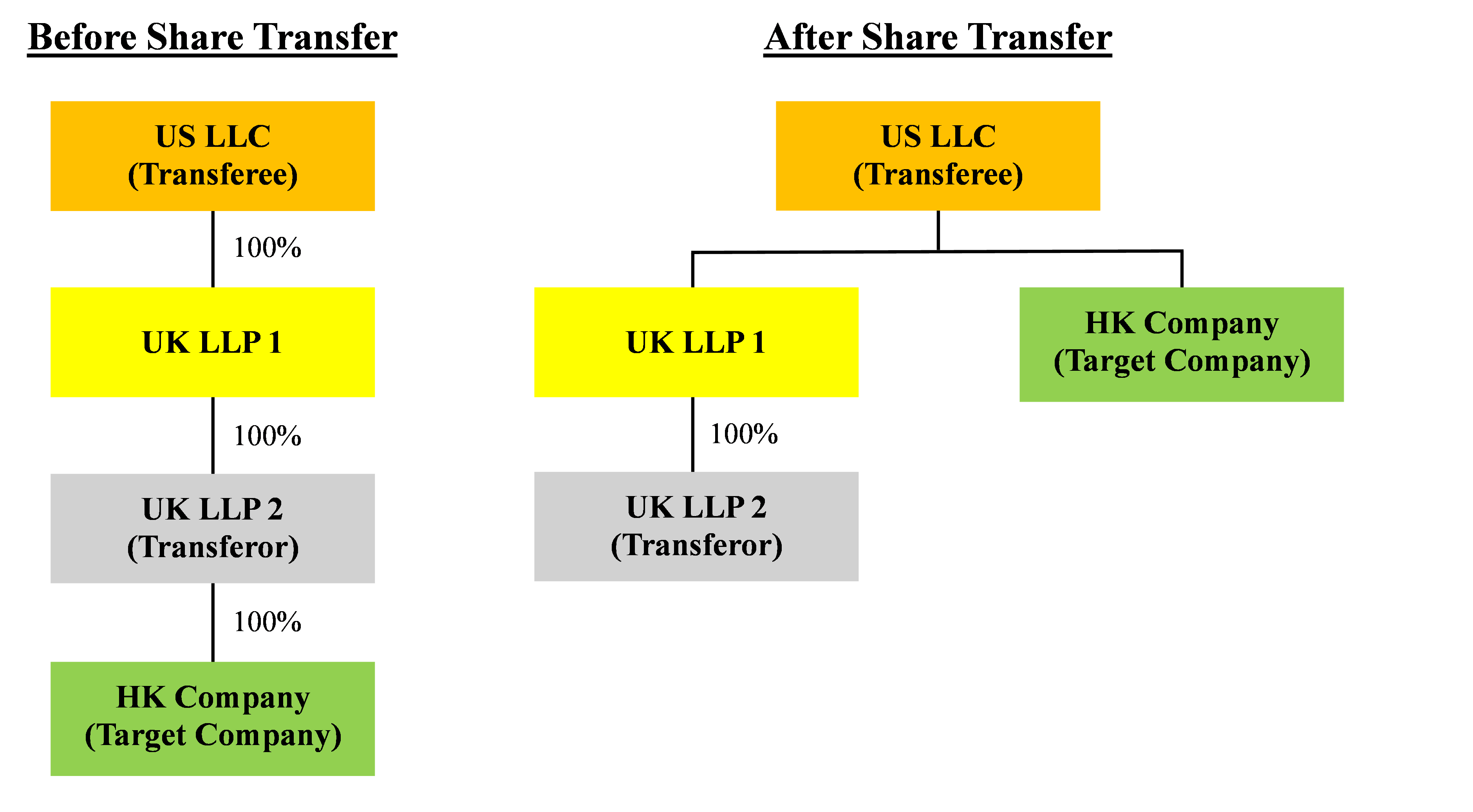

In 2020, there was a case where John Wiley & Sons UK2 LLP (“UK LLP 2”) (as a transferor) and Wiley International LLC (“US LLC”) (as a transferee),applied to the Collector of Stamp Revenue for stamp duty relief in relation to the transfer of the shares in John Wiley & Sons (HK) Limited (“HK Company”) (see the transaction structure below).

The law related to stamp duty relief

Pursuant to section 45(2) of the Stamp Duty Ordinance (Chapter 117 of the laws of Hong Kong) (“SDO”), stamp duty relief is available for the transfer of Hong Kong stock or immovable property from one associated body corporate to another. To fulfil the relief condition, the test for “associated”, which is “beneficial owner of not less than 90 per cent of the issued share capital of the other”, has to be satisfied.

The assessment by the Stamp Office

The Collector of Stamp Office rejected the section 45 stamp duty relief application on the grounds that the John Wiley & Sons UK LLP (“UK LLP 1”) and the UK LLP 2 did not have “issued share capital”, and as such, US LLC could not be a “beneficial owner of not less than 90% of the issued share capital” of UK LLP 2 for the purpose of section 45(2) of the SDO.

US LLC and UK LLP 2 then appealed to the District Court in January 2021.

The judgment by the District Court

In July 2022, the District Court held that UK LLP 2 and US LLC were entitled to stamp duty relief for an intra-group transfer of shares of a Hong Kong company.

The District Court construed “issued share capital” according to the ordinary and natural meaning and did not interpret “share capital” as meaning that the capital must necessarily be divided by way of a denomination into standard units called “shares” that are required to be registered, or are evident by share certificates in the manner the Collector contended for. Rather and in the District Court’s view, it would amount to “share capital” so long as the capital of that body corporate is divided into quantifiable portions (or shares in the ordinary use of that word, such as 1/3 share and 1/2 share or a percentage share), whether expressed in terms of monetary value or in term of proportions, and all such shares together make up 100% of the total value of the capital; and as said, such organization of its capital is legally recognized.

The Collector of Stamp Office applied for appeal at the Court of Appeal. The case was heard before Court of Appeal on 26 April 2024 and the judgment was handed down on 5 July 2024.

The judgment by the Court of Appeal

In 2024, the Court of Appeal ruled that UK LLP 2 and US LLC were not entitled to stamp duty relief.

The Court of Appeal considered the object/purpose and context of section 45 of SDO, the language used by the legislature and the offshore legal opinion produced by US LLC and UK LLP 2.

The Court of Appeal agreed that the legislative intention for section 45 relief is available only to associated companies which satisfy the 90% issued share capital requirement, but not to other kinds of corporate entities.

Further, the legal opinion produced by US LLC and UK LLP 2 stated that “[w]hilst unlike a body corporate within the meaning of the Companies Act 2006, an LLP does not, and cannot, issue and allot share capital”.

As such, the Court of Appeal ruled that no shares (in the sense of discrete or standard units) in the capital of UK LLP 2/UK LLP 1 ever existed, and no such shares have ever been issued to their respective members. Hence, no capital paid by the members to UK LLP 2/UK LLP 1 could be regarded as the “issued share capital” of UK LLP 2/UK LLP 1 within the meaning of section 45 of SDO.

This material has been prepared for general informational purposes only and is not intended to be relied upon as professional advice. Please contact us for specific advice.

Author: Beverly Fu, Associate at YYC Legal LLP