Harvey Law Group | View firm profile

Embarking on an investment journey in Hong Kong through the Capital Investment Entrant Scheme, commonly known as the Hong Kong Investor Program (“Program”),demands not only financial acumen but also a profound understanding of its intricacies. Navigating this specialized program tailored for high-net-worth individuals requires careful planning and a thorough grasp of the nuanced immigration framework the Program operates within. To provide you with a deeper insight into this Program, our seasoned experts have meticulously curated this comprehensive FAQ guide. This guide aims to illuminate the nuances of the Program, addressing prevalent inquiries that potential investors may encounter, and enabling you to make an informed decision before proceeding with the application process.

- What is the Hong Kong Investor Program?

The Hong Kong Investor Program is a temporary residence program designed for high-net-worth individuals who wish to make a substantial financial investment in Hong Kong. Participants in this scheme can obtain residency in Hong Kong by investing at least HKD 30 million in a list of qualifying assets like stocks, funds, and bonds. Within a few months following the launch of the Program on 1 March 2024, the Program has attracted over 300 applications, making this one of the most sought-after opportunities for affluent individuals seeking to establish a financial foothold in Hong Kong and secure temporary residency in this thriving global hub.

- What are the permissible assets under the Hong Kong Investor Program?

Investors applying for the Hong Kong Investor Program have the flexibility to invest HKD 27 million across a range of approved assets, including:

- Equities, notably shares of listed companies on the Hong Kong Stock Exchange (“SEHK”);

- Debt securities listed on the SEHK, and the fixed or floating rate instruments and convertible bonds issued or fully guaranteed by the Hong Kong Government, the Exchange Fund, the Hong Kong Mortgage Corporation, MTR Corporation Limited, Hong Kong Airport Authority, and other corporations, agencies or bodies owned by the Hong Kong Government;

- Certificates of Deposits issued by authorized institutions with a remaining term to maturity of not less than 12 months at the time of purchase (subject to a cap of HKD 3 million);

- Subordinated debt issued by authorized institutions;

- Eligible collective investment schemes including Securities and Futures Commission (“SFC”)-authorized funds, SFC-authorized real estate investment trusts, SFC-authorised Investment-Linked Assurance Schemes, and open-ended fund companies managed by corporations licensed by or institutions registered with the SFC;

- Ownership interest in limited partnership funds (subject to a cap of HKD 10 million); and

- Non-residential real estate including pre-completion properties and excluding land (subject to a cap of HKD 10 million).

They must deposit their permissible financial assets into a designated account operated by an eligible financial intermediary and the designated account must be used exclusively for the transaction of permissible financial assets.

Additionally, the applicant must make a separate investment of HKD 3 million in an Investment Portfolio overseen by the Hong Kong Investment Corporation Limited. This is a fixed investment, with the portfolio focusing on enterprises or projects that contribute to the long-term economic growth of Hong Kong.

- How does a sample investment portfolio look like?

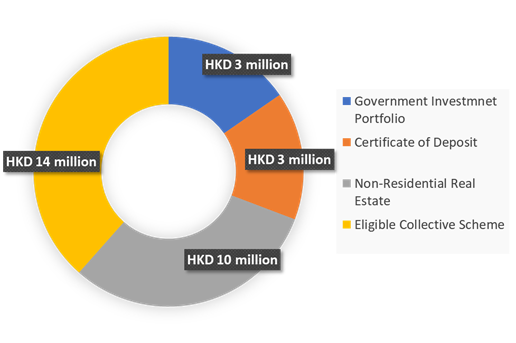

There are numerous ways for making a qualifying investment within the Program. While the HKD 3 million investment is fixed and designated for the government investment portfolio, there are fewer constraints on allocating the remaining HKD 27 million. Notably, applicants are restricted to investing a maximum of HKD 3 million in certificates of deposits, up to 10 million in limited partnership funds, and a maximum of 10 million in non-residential real estate.

An illustrative example of an investment portfolio meeting these criteria is outlined below:

- What happens upon changes in the value of investment?

In the scenario where the market value of the applicant’s investment in permissible assets drops below the minimum threshold of HKD 30 million, there is no obligation for the applicant to increase the value of the investment, even if it results in a complete loss. Conversely, if the market value of the investment surpasses HKD 30 million, the applicant is not permitted to withdraw or take out any appreciation from the allowable investment assets. Certain exceptions exist, such as the need to pay off an outstanding mortgage on non-residential real estate or the desire to withdraw cash dividend income or interest income directly generated from the permissible financial assets. It is advisable to seek professional advice to navigate such circumstances effectively.

- Can I switch between investment assets?

Certainly. The applicant has the flexibility to switch between permissible investment assets given that specific conditions are fulfilled. For instance, there should be no more than 14 calendar days between sale of the original assets and purchase of the reinvestment assets. If transitioning from one non-residential real estate property to another, the period between the contract sale and the completion of the reinvestment purchase should not exceed three calendar months.

- How does the application procedure look like?

The application process for the Hong Kong Investor Program comprises three distinct stages. Initially, the applicant must undergo a personal net worth assessment to demonstrate absolute beneficial entitlement to net assets totalling at least HKD 30 million in the two years preceding the application date. This stage typically lasts for 1 to 2 months.

Following a successful personal net worth assessment, the applicant can proceed to apply for a visa to enter Hong Kong to fulfil the necessary investment requirements. Upon completing the required investment, the applicant will receive an investment confirmation certificate, signalling the transition to the third stage of the process. This intermediate stage typically takes around 3 to 4 months to finalize.

In the concluding stage, the applicant has the opportunity to apply for a 2-year investment visa to reside and work in Hong Kong. The processing time for this final visa application stage is typically about 1 month.

- Do I need to travel to Hong Kong immediately after obtaining approval?

No. Typically, the Hong Kong immigration authority will allow some buffer time of around 3 months for the applicants before they need to travel to Hong Kong. Once the applicants arrive in Hong Kong, the border officer will provide them with the corresponding visa labels, indicating the authorized duration of their stay in Hong Kong.

- Can I renew my investment visa upon its expiry?

The applicants and their dependants may apply for an extension of stay within 3 months before their limit of stay expires, provided that the applicants do maintain the promised investment and provide investment maintenance proof on an annual basis. In this regard, the applicant is required to engage a certified accountant in evincing his fulfilment of portfolio maintenance requirements.

- Can I apply for Hong Kong permanent residency via this Program?

Under this Program, successful applicants have the opportunity to transition from temporary residency to permanent residency in Hong Kong after continuously residing in the region for 7 years. To qualify for permanent residency, applicants must have resided in Hong Kong for at least 6 months annually within these 7 consecutive years. It is important to note that the applicant may be required to explain to the Immigration authorities any absences exceeding 3 consecutive months along with supporting documentation. Therefore, it is advisable to maintain the necessary documentation to address such queries effectively.

- What happens if I fulfil the investment requirement but do not meet the residence requirement?

In situations where applicants are unable to meet the continuous ordinary residence requirement but satisfy the investment portfolio maintenance criteria, they may apply for an unconditional stay at the conclusion of the 7th year. More importantly, they will also be free to dispose of their investment assets under the Program. If granted, the applicants and their dependents will be allowed to live, work or study in Hong Kong without any restrictions. Nonetheless, unlike Hong Kong permanent residents, individuals with unconditional residency are not eligible for public and social benefits in Hong Kong.

If you are interested in learning more about this Program, please contact your local Harvey Law Group (HLG) office here for more details. Our lawyers are delighted to set up a meeting with you to discuss more on the investment requirements and application procedures. Founded in 1992, HLG is a leading multinational law firm with offices across Asia, North and South America, Europe, and Africa to cater to your specific needs for immigration and beyond.

Author: Polly Ho