LEGALLANDS LLP | View firm profile

Foreign collaboration is an alliance (union or an association) incorporated to carry on the agreed tasks collectively with the participation of the resident and non-resident entities. The central concept of foreign collaboration is joint participation between host and foreign countries for the establishment of an organic form of enterprise in the host country involving profit-seeking relationships. It is an inflow of foreign capital and technology for the host country which is backed by commercial considerations of profit and private expectations.

Important points to convey the meaning of foreign collaboration:

- Strategic alliance between one or more resident and non-resident entities.

- Before starting collaboration both entities must seek prior permission from the governmental authority of the domestic country.

- During the ongoing process of seeking permission, collaboration entities prepare a preliminary agreement.

- After obtaining necessary permission, individual representatives of resident and non-resident entities sign the preliminary agreement. A signature acts as a written acceptance of each other’s expectations, terms, and conditions.

- After establishing foreign collaboration entities start a business together in the domestic country.

- The term of the foreign collaboration is specified in written form.

CLASSIFICATION OF FOREIGN COLLABORATION

As no country is self-sufficient, all countries are reliant on one another to satisfy their needs. Interdependence between countries is a common phenomenon. A foreign partnership is extremely beneficial in addressing resource shortages and obtaining advanced technology at a low cost.

Due to the consequences of liberalization, privatization, and globalization, foreign participation in the Indian market is rapidly rising. Indian companies are interested in foreign counterparts since the foreign market may provide them with technical and market expertise.

- Financial Collaboration: The in-flow of foreign investment takes place in the host country. The foreign company lends finance by:

- Purchasing ownership shares

- Giving long-term loans

- Giving credit facility

- Technical Collaboration: The inflow of foreign technology takes place in a foreign country. Integration of foreign technology with domestic technology. Various services are provided by the foreign company such as professional services and expertise, installation of automated machinery in developing countries, and many more. Helps to remove the existing technological gap and inflow of modern technology in the domestic country.

- Marketing Collaboration: The in-flow of foreign goods and services takes place in the host country. Integration of the foreign and the domestic market. The foreign country agrees to take part in the sale of goods by the domestic country.

- Management Consultancy Collaboration: The in-flow of foreign management consultancy takes place in the domestic country. Provide training or teaches various management skills for production, financing, marketing, and personnel management.

FOREIGN COLLABORATION IN INDIA

In India, foreign collaboration agreements are being made between Indian and foreign companies through the sale of technology, spare parts, and the use of foreign brand names for its final products. Foreign capital in India is governed by the Foreign Exchange Management Act, 1999 and rules and regulations made by RBI.

FOREIGN COMPANIES MAY TAKE PLACE IN THREE FORMS:

- Collaboration between the Indian and Foreign private companies;

- Collaboration between the Indian government companies and foreign private companies;

- Collaboration between the Indian Government and a foreign government.

AREAS FOR FOREIGN COLLABORATION

The Government of India periodically publishes a list of industries in which foreign investment is authorized.

Foreign Investment Promotion Board (FIPB) of the Government of India also considers technology imports in industries listed in Annexure A and Annexure B of Schedule 1 of the Foreign Exchange Management Regulations, 2000, subject to compliance with the provisions of Industrial Policy and Procedure as notified by the Ministry of Commerce and Industry Secretariat for Industrial Assistance (SIA) from time to time.

FOREIGN DIRECT INVESTMENT (FDI):

A type of cross-border investment in which an investor from one country has a long-term stake in and considerable influence over a company from another country. FDI is an important component of international economic integration because it establishes solid and long-term linkages between economies.

FDI is an important component of international economic integration because it develops stable and long-term ties between economies.

International investors can invest in India through a variety of strategies:

- Merger / Amalgamation

- Purchase of shares from the Indian Residents

- Subscription to Memorandum of Association

- Right/bonus issue

Routes Under Which Foreign Investors Can Invest in India:

- Automatic Route: Foreign entities or Non-Resident do not need the approval of the Government of India or RBI.

- Government Route: Foreign entity compulsorily needs the approval of the Government of India. Should file an application through the Foreign Investment Facilitation Portal.

PERMITTED SECTORS FOR FOREIGN DIRECT INVESTMENT

Infrastructure Sector:

Growing pressures on government funds, as well as widespread concern about the quality of services provided by incumbent corporations, culminated in a surge of private sector FDI into infrastructure, particularly in developing nations.

In the financial year 2021, India’s infrastructure industries received around 7.9 billion dollars in foreign direct investment equity. In comparison to past years, this was a significant rise. The government’s “National Infrastructure Pipeline” encourages private and foreign investment in the infrastructure sector, which might explain the increase in FDI inflows.

Aviation Sector:

The Civil Aviation sector has been divided into three sectors for the purpose of FDI policy:

- Airports

- Air Transport Services

- And Other services

Under the automatic route, 49 percent FDI is authorized in scheduled air transport services and domestic scheduled passenger carriers. The limit for non-resident Indian (NRI) investment is 100 percent. A foreign airline must invest through the approved method, and the 49 percent maximum applies to both FII and FDI.

Banking Sector:

Under the “automatic method,” which includes initial public offerings (IPOs), private placements, ADR/GDRs, and acquisition of shares from existing owners, foreign direct investment (FDI) up to 49 percent is permissible in Indian private sector banks.

- The maximum foreign investment in an insurance firm is set at 26% under the Insurance Act.

- In nationalized banks, FDI and portfolio investment are subject to total statutory restrictions of 20%.

- Such investments in the State Bank of India and its affiliated banks would be subject to a 20% cap.

VOTING RIGHTS FOR FOREIGN INVESTORS:

| Private

Sector Banks |

Not more than 10% of the total shareholders. |

| Nationalized

Banks |

Not more than 1% of the total shareholders. |

| State Bank

of India |

Not more than 10% of the issued capital. |

| State Bank of India Associates | Not more than 1%. |

Mining Sector:

- With a 2020 production of 99.6 MT, India is the world’s second-largest crude steel producer.

- India ranks fourth in the world for iron ore output, with 187.60 million tons produced in the fiscal year 2019 (up to February 19). Iron ore resources in the nation account for 8% of the world’s total.

- In India, 100 percent FDI in mining is permitted via the automatic route.

- Under the automatic method, 100 percent FDI in the mining sector is authorized in India for coal and lignite.

- Under government channels, 100 percent FDI in the mining industry is permitted in mining and mineral separation of titanium-containing minerals and ores, value addition, and integrated operations.

Health Division (International Collaboration):

- An Indo – Foreign Cell (IFC) was set up in the Indian Council of Medical Research, in the early 1980s to coordinate biomedical research between national and international agencies. To facilitate cooperation in areas of medical research India has several bilateral Science & Technology cooperation agreements with foreign countries. The purpose of these agreements has been for joint scientific meetings, seminars, exchange of scientific information, and exchange of scientists for training and support in the procuring of scientific equipment.

- In India, 100% FDI is authorized in the healthcare industry via the automatic route for green-field projects.

- The government route allows for 100% FDI in medical equipment for investments in brown-field projects.

Real Estate

In March 2005, the Indian Government changed current regulations to enable 100 percent foreign direct investment in the building industry. The liberalization act clears the way for foreign investment to fulfill the need for commercial and residential real estate development. It has also prompted a number of global financial institutions and private equity funds to form dedicated funds focused on the real estate market.

FDI IN INDIA IS PROHIBITED IN THE FOLLOWING SECTORS:

- Chit funds

- Lottery business

- Real estate business

- Manufacturing of cigars, cigarettes, tobacco, or tobacco substitutes

- Gambling and betting as well as casinos

- Construction of Farmhouses

- Trading in transferable Development Rights

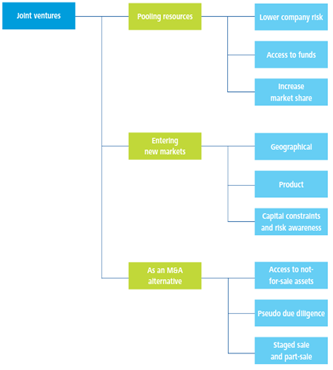

JOINT VENTURES – A PRACTICAL APPROACH

INTRODUCTION:

A JV (Joint Venture) is a type of commercial partnership wherein two or more entities commit to sharing their assets, technology, expertise, skills, etc. to achieve some certain goal. This action might be the start of a fresh initiative or some different type of commercial operation. Each partner in a JV is liable for the earnings, expenses, damages, and expenditures linked with it. Moreover, the venture is a distinct business corporation from the partners’ existing economic concerns.

A corporation can create a joint venture with an overseas entity to experience global commerce without carrying on all the responsibilities of multinational commercial operations. Overseas entrepreneurs who form a joint venture reduce the risks associated with buying a company entirely. Due diligence on the overseas destination and the partner is important in international company expansion since it reduces the risks associated with a commercial deal.

The present economic slump has further increased the attraction of leveraging strategic possibilities via global partnerships but even some of the wealthiest corporation’s dearth’s the adequate infrastructure, facilities, expertise, and managerial power to penetrate emerging foreign economies. Industrial partnerships of different types enable enterprises to penetrate the international economies quite inexpensively and efficiently. Statutory and administrative disparities, as well as cultural, linguistic, and monetary anomalies, end up making International Joint Venture (IJV) cooperation an appealing alternative.

A corporation can create a joint venture with an overseas entity to experience global commerce without carrying on all the responsibilities of multinational commercial operations. Overseas entrepreneurs who form a joint venture reduce the risks associated with buying a company entirely. Due diligence on the overseas destination and the partner is important in overseas company expansion since it reduces the uncertainties associated with a commercial deal.

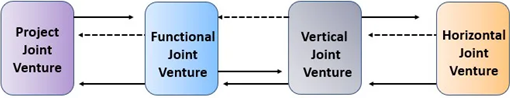

VARIOUS FORMS OF JOINT VENTURES

- PROJECT JOINT VENTURE: It is the most predominant type of joint venture. It might be used to build a toll way or a commercial establishment, among other things. The essential feature is that the objective is specified and confined to the execution of a specific endeavour according to the venture contract. The Joint Venture expires after the task is accomplished.

- FUNCTIONAL JOINT VENTURE: This is a model wherein all parties collaborate since they both have competence with one or more commercial assignments and aim to establish a synergistic ecosystem for one another and advantage from the synergies that emerge. For illustration, if one firm owns a network of transportation and the other has spare warehousing capacity, both can assist one other in stock keeping and handling and save each other’s expenditures of owning separate vehicles or warehouses and utilizing them when unoccupied.

- VERTICAL JOINT VENTURE: This Joint Venture is among two commercial organizations in the equivalent supply network. This is accomplished when one of the organizations manufactures a specific type of commodity for which it requires a specialized raw material. To that end, it can work with the vendor to create and sustain the potential of such manufacturing, avoiding the risk caused by the inadequacy of this primary raw material. This is the situation when the manufacturing business desires to preserve a predetermined degree of confidentiality or when the requirement for this raw material is minimal but the requirement for the finished goods is extremely significant.

- HORIZONTAL JOINT VENTURE: Likewise, this type of joint venture involves two businesses that produce similar products or assistance. This has the advantage of allowing one of the enterprises to participate in a foreign marketplace. The domestic collaborator possesses localized knowledge, including a preexisting supply channel, whilst the international collaborator can benefit from efficiencies of magnitude. Furthermore, rules often require the presence of a domestic firm, thus joint venture is among the available ways to access such economies.

STANDS TO BENEFIT OF A JOINT VENTURE:

Among the most significant joint venture pros is that it may assist your company, in growing faster, enhancing efficiency, and intensifying profitability. Joint ventures also provide the following advantages:

- Gaining direct exposure to new economies and supply systems

- Expanded capacity

- Exposure to fresh information and skills, as well as skilled manpower

- Increased availability of resources, such as innovation and capital

- Contingency and overheads sharing with the business collaborator.

These advantages are particularly important for a small or medium-sized company that lacks the funding, manpower, or experience to explore a possibility except it can split the business risks and expenses via a collaboration, such as an international joint venture. IJVs enable parties to operate swiftly, cost-effectively, and with reliability in the domestic economy.

An additional advantage of a joint venture is its adaptability. A joint venture, for instance, may have a finite lifespan and only encompass a portion of what you do, restricting all the partners’ engagement and the company’s risk. Joint ventures are particularly prevalent among firms that operate in many nations, such as those in the transportation and tourism industry.

DISADVANTAGES OF JOINT VENTURES:

Joint ventures also have a relatively higher rate of failure, with many failures being extremely expensive to the participating enterprises. As per the BCG analysis, over 90 Japanese companies failed between the period of 1972 and mid-1976. Most of such organizations were big initiatives involving well-known American corporations like Avis, Sterling Drug, General Mills, and TRW. Harvard Business School research found that the joint ventures were unsuccessful due to tactical and administrative modifications undertaken by the venture’s owners. These businesses were either dissolved or acquired by one of the partners, or ownership was transferred from one to the other.

If there is insufficient preparation and management, an international joint venture may be a stressful journey and, eventually, a catastrophe. Market trends, technological challenges, bureaucratic concerns, and economic slumps can all be challenging to predict and have a crippling effect on IJVs.

Revenues from an IJV are diminished since they are allocated by default. Management challenges might develop despite having proper channels in place to settle conflicts due to the partners’ diverse organizational ideologies. The collaborators may also learn that they do not end up sharing objectives and are not adaptable enough to modify and suit the business’s developing demands. Joint ventures are sometimes challenging to finance as an organization, specifically in terms of borrowing, because their life is temporary and hence lacks stability.

Thanks & Best Regards,

RAJIV TULI

LEGALLANDS

E. [email protected], W. www.legallands.com