Lee & Ko | View firm profile

In connection with the recently amended Monopoly Regulation and Fair Trade Act (“MRFTA”), which amendments will take effect from August 7, 2024 (the “Amended MRFTA”),the Korea Fair Trade Commission (KFTC) has issued advance administrative notices on the enactment of the Detailed Guidelines for the Operation of the System for the Submission of Voluntary Commitments in Business Combinations (Operating Guidelines) and the amendment to the Regulations for the Operation of KFTC Committee and Case Handling Procedure (Case Handling Regulations). The KFTC has announced the Operating Guidelines to establish the procedures and method for submission of voluntary commitments and has amended the Case Handling Regulations to prescribe simplified procedures for issuing a decision when voluntary commitments are accepted by the KFTC. There is a period for public comment on the Operating Guidelines and Case Handling Regulations from June 13, 2024 to July 2, 2024, prior to their implementation also anticipated from August 7, 2024.

Also, the KFTC has issued an advance administrative notice on the amendment to the Merger Notification Guidelines (Notification Guidelines) and the Merger Review Guidelines (Review Guidelines). The amendments include (i) additional exemptions from merger notification (as stipulated in the Amended MRFTA), (ii) increase of the minimum threshold for notification of an asset/business transfer from KRW 5 billion to KRW 10 billion and (iii) clarification of the advance consultation system with the KFTC. The period for public comment on the Notification Guidelines and Review Guidelines is from June 17, 2024 to July 18, 2024.

The following are certain details on these proposals:

- System for the Submission of Voluntary Commitments in Business Combinations (Operating Guidelines and Case Handling Regulations)

-

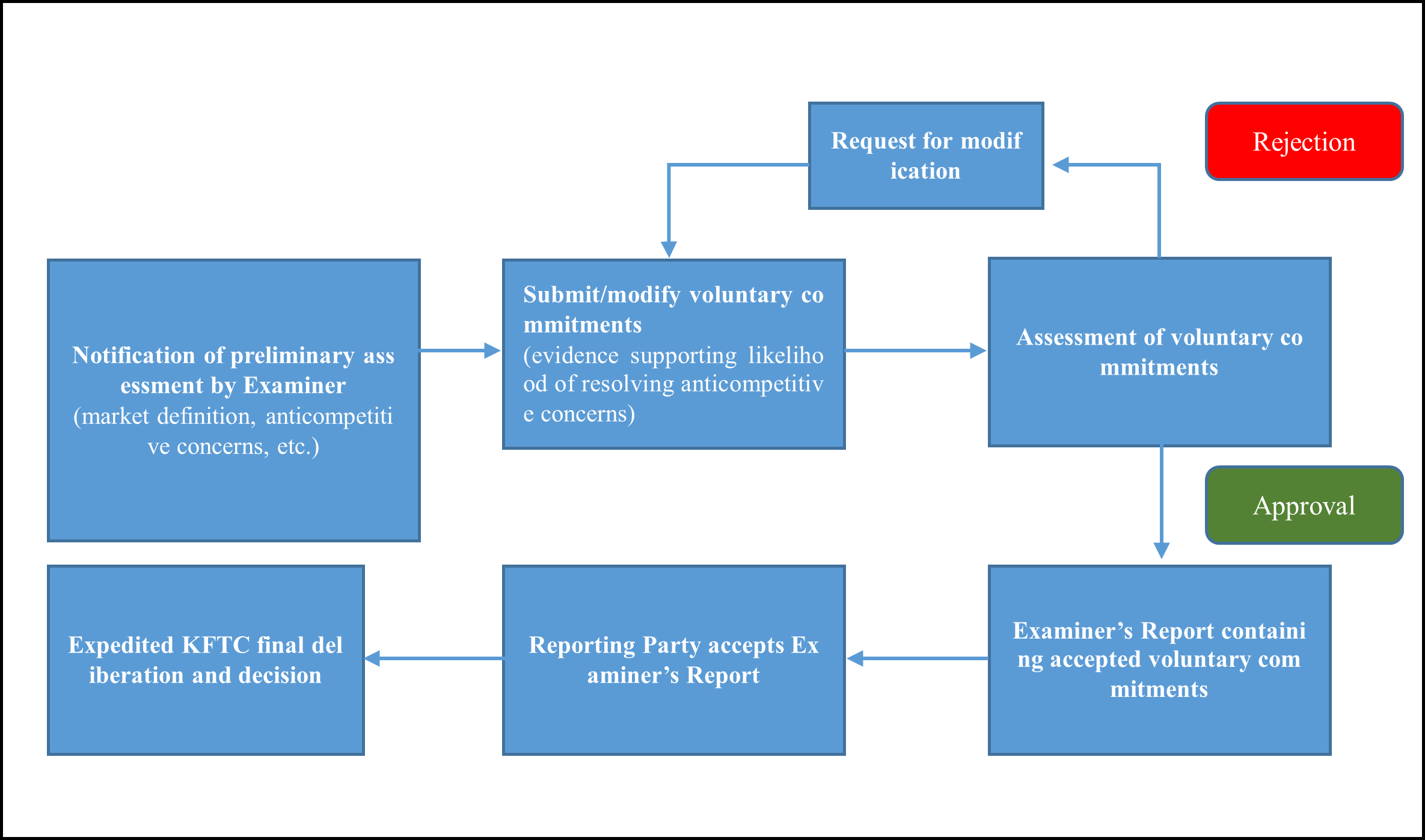

- The system for the submission of voluntary commitments will consist of the following process: (i) notification to the parties by the KFTC of its preliminary assessment, including potential anticompetitive concerns regarding the proposed business combination; (ii) submission of voluntary commitments by the parties; (iii) assessment and modification of the proposed commitments by the KFTC; (iv) if the proposed voluntary commitments are accepted, the KFTC will issue the Examiner’s Report; (v) if the parties accept the remedies as set forth in the Examiner’s Report, the KFTC final deliberation/decision will be shortened. An overview of this system is illustrated in the table below.

[Table 1] Overview of System for the Submission of Voluntary Commitments

-

- Notification of preliminary assessment: The KFTC Examiner notifies the Reporting Party of the preliminary assessment on (i) the relevant sector (market definition, etc.) and (ii) anticompetitive concerns as well as the KFTC’s opinions on the direction of remedies, by conducting an in-person meeting (Articles 3 and 4 of the Operating Guidelines).

- Submission of voluntary commitments: The Reporting Party (after consulting with the other party to the business combination) submits the proposed voluntary commitments including (i) detailed commitments and the method of implementation for such commitments and (ii) evidence supporting that the proposed commitments effectively resolve the noted anticompetitive concerns and confirming implementation within a reasonable time period (Article 6 of the Operating Guidelines).

- Assessment of voluntary commitments

- The KFTC Examiner will evaluate whether the proposed voluntary commitments adequately address the noted anticompetitive concerns and notify the parties through an in-person meeting. During the evaluation process, the KFTC Examiner may seek the opinions of interested third parties or experts, if necessary (Articles 9 and 10 of the Operating Guidelines).

- If the KFTC Examiner determines that the proposed voluntary commitments are inadequate, the KFTC Examiner may request the Reporting Party to modify the proposed voluntary commitments. In principle, although the KFTC Examiner may make the request for modification and submission of modified commitments up to 2 times, if there are unavoidable circumstances, such as significant difficulty in preparing the voluntary commitments meeting the KFTC’s stated requirements, there may be additional requests (Article 11 of the Operating Guidelines).

- The period of time spent to modify the proposed voluntary commitments (from the date of receipt of the modified proposed voluntary commitments to the date of receipt of acknowledging the completion of assessing the commitments) is not calculated as part of the KFTC overall merger review period (Article 13-2 (4) of the Operating Guidelines).

- Issuing the Examiner’s Report: If the KFTC Examiner determines that the proposed voluntary commitments adequately address the noted anticompetitive concerns, the proposed voluntary commitments will be considered and set forth in the Examiner’s Report as acceptable remedies together with the KFTC Examiner’s opinion thereon (Articles 14 and 15 of the Operating Guidelines).

- Procedures for Deliberation/Decision

- If the Reporting Party submits a written opinion confirming agreement with the Examiner’s Report (no objections), the KFTC will (i) hold a plenary session within 15 days (instead of the standard 30 days) of the submission of the written opinion and (ii) issue a written decision within 20 days (instead of the standard 35 days) of the conclusion of the plenary session (Articles 35 (2) and 62 (2) of the Case Handling Regulations).

- Reporting and Review of Business Combinations (Notification Guidelines and Review Guidelines)

-

- The following are certain key amendments to the Notification Guidelines and Review Guidelines:

[Table 2] Key amendments to Notification Guidelines and Review Guidelines

| Guidelines | Details of Amendments |

| Notification Guidelines | l Exemption from merger notification: The removal of the establishment of a PEF and interlocking directorates with less than 1/3 of directors (excluding representative director) of the counterparty subject to simplified merger notification (as these transactions will be exempt from merger filing under the Amended MRFTA) |

| l Increased threshold for notification of business transfer: The merger notification threshold for the transfer of a business or asset is KRW 10 billion (increased from KRW 5 billion) or 10% of the total assets of the transferring company | |

| l Online merger notification: Stipulated that the online notification is required for both standard and simplified notifications | |

| l Advance consultation: If a transaction is complex or involves multiple relevant markets, the parties to the transaction may request an advance consultation with the KFTC | |

| l Other: The inclusion of responses to frequent inquiries related to merger notification (i.e., whether the transaction is subject to merger notification) and the revision of the merger notification form | |

| Review Guidelines | l Exemption from merger filing obligation: The removal of the provision subjecting the establishment of a PEF to simplified merger notification (as these transactions will be exempt from merger filing under the Amended MRFTA) |

-

- The KFTC has also clarified the Notification Guidelines to address areas that were previously unclear and the subject of frequent inquiries. Specifically, the types of business combinations that will no longer be subject to merger notification or will be subject to simplified merger notification have been specified. The following amendments to the Notification Guidelines specify the types of reportable business combinations:

[Table 3] Specifications in the Notification Guidelines on reportable business combinations

| Type | Details of Amendments |

| Non-reportable transactions | l The acquisition of shares from a specially related party |

| l Transactions where a merger report is filed for the acquisition of 20% (15% for companies traded on the Korean exchange) or more of the shares of a company and the KFTC confirmed during its review that control was established, and the company becomes the largest shareholder by acquiring additional shares of the same company | |

| l For interlocking directorates if there is a change in directors without change in the number of directors or positions, or a decrease in the number of directors. | |

| l Interlocking directorates resolved prior to the expiration of the deadline for the reporting of interlocking directorates | |

| l Transfer of simple assets (real estate and equipment, which are not used directly in the business) | |

| l The acquisition of shares or the establishment of a new company, where the transaction is notified, and the merger notification describes the plan for interlocking directorates (i.e., total number of directors, total number of shared directors and the position of the shared directors) and the appointment of interlocking directorates is carried out in accordance with the plan | |

| l The establishment of a PEF | |

| Subject to simplified merger notification

(PEF) |

l New LP makes an additional investment in an existing PEF

l An existing LP makes an additional investment in the PEF l An existing LP acquires the interest of another LP |

After collecting the opinions of interested parties and related government ministries during the public comment period, there will be a KFTC plenary session convened to finalize and seek adoption of these amendments to the Notification Guidelines and Review Guidelines for implementation.

- Implications of the Amendments

With the implementation of the Operating Guidelines, the period of time required for the KFTC’s deliberation and issuance of decisions is anticipated to be shortened if the parties use the voluntary commitments procedures. However, the KFTC may be more inclined to seek opinions proactively from interested parties or experts on the proposed voluntary commitments, which may result in a more rigorous and heightened review of the adequacy of remedies than compared to the informal process of proposing remedies on an unofficial basis as has been the previously existing practice. Since it will be the first time the submission of voluntary commitments will be prescribed under the MRFTA, the actual implementation of the newly adopted voluntary commitments procedure including the Operating Guidelines and the effectiveness thereof should be monitored carefully.

Also, the increase in the minimum threshold triggering notification of business combinations is expected to ease the burden on reporting parties. With clarification on business combinations subject to simplified merger notification or exempt from merger notification, there will be greater predictability on when merger notification is mandatory.