S&R Associates | View firm profile

On August 22, 2022, the Government of India issued the much-awaited revised rules, regulations and directions applicable to overseas investments by Indian entities and individuals. These include: (i) the Foreign Exchange Management (Overseas Investment) Rules, 2022 (the “Overseas Investments Rules”) issued by the Ministry of Finance, Government of India; (ii) the Foreign Exchange Management (Overseas Investment) Regulations, 2022 (the “Overseas Investments Regulations”) issued by the Reserve Bank of India (the “RBI”); and (iii) the Foreign Exchange Management (Overseas Investment) Directions, 2022 (“Overseas Investments Directions”) issued by the RBI. The Overseas Investments Rules, the Overseas Investments Regulations and the Overseas Investments Directions are hereinafter collectively referred to as the “New Regime”.

In August 2021, the RBI had issued the draft Foreign Exchange Management (Non-debt Instruments – Overseas Investment) Rules, 2021 (the “Draft Rules”). The RBI appears to have taken into consideration the feedback received in relation to the Draft Rules in the New Regime which has overhauled and superseded inter-alia the: (i) the Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulations, 2004, as amended; and (ii) the Master Direction on Direct Investment by Residents in Joint Venture / Wholly Owned Subsidiary Abroad dated January 1, 2016 (updated until June 24, 2021) (together, the “Old Regime”).

This note discusses the changes introduced by the New Regime and its impact on cross border transactions, particularly in relation to the following:

- scope of overseas investments;

- definition of control;

- pricing guidelines;

- round tripping;

- financial commitment;

- guarantees; and

- pledge and charge.

A brief summary of certain other key changes is also included.

I. SCOPE OF OVERSEAS INVESTMENTS

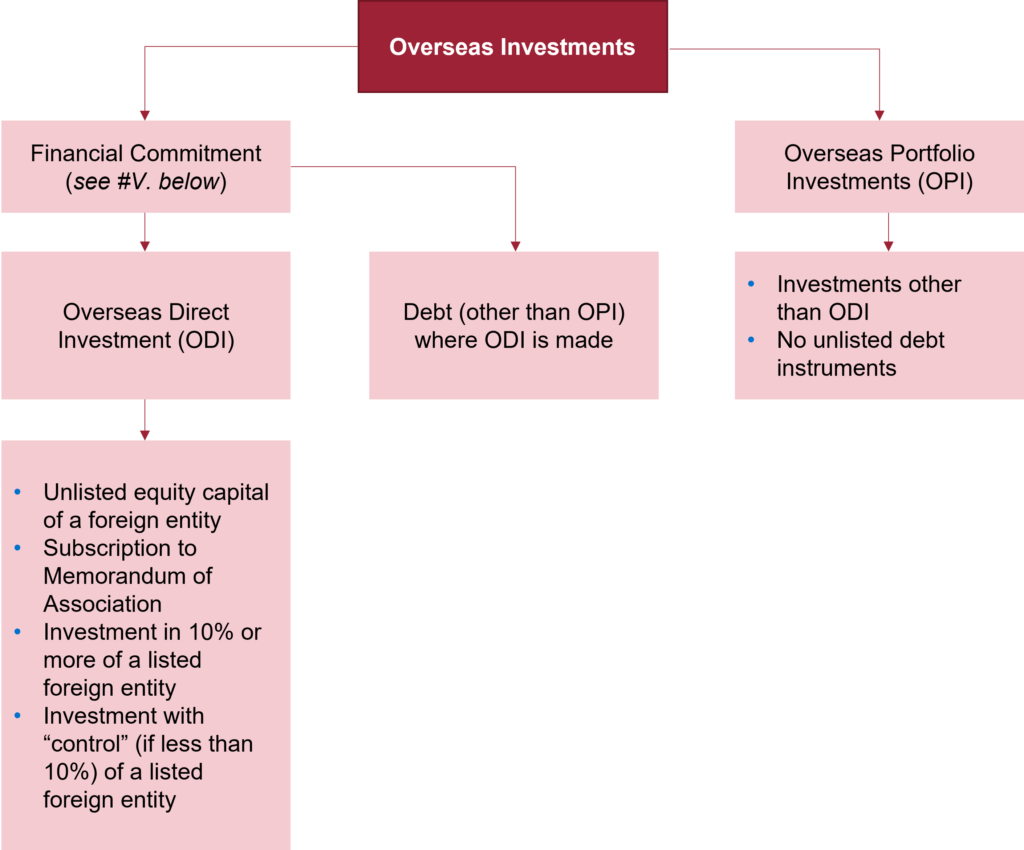

The chart below sets out the scope of overseas investments as described in the New Regime.

The New Regime brings clarity as to the type and scope of overseas investments which may be made by Indian entities and individuals. The Old Regime did not prescribe a definition for portfolio investments and the authorized dealer banks whom Indian entities and individuals designate for their overseas investments (“AD Banks”) determined whether an investment was a portfolio investment on the basis of the quantum of investment, type of security purchased (listed or unlisted) and whether the Indian investor exercised any form of management control over the target foreign entity. By specifically including OPIs under the New Regime, the RBI has brought such investments within its oversight.

The New Regime also requires an Indian investor to hold the ODI for a period of one year prior to any divestment of such investment. There was no minimum holding period under the Old Regime. The Old Regime only required the target foreign entity to have had operations for one year prior to the divestment and this requirement has been removed in the New Regime. The requirement of the minimum one-year holding period is likely to impact overseas investments by Indian entities and individuals looking to set-up special purpose vehicles (SPVs) or other entities that are then transferred to other persons within a short period.

II. DEFINITION OF CONTROL

The two key references where “control” is used in the Overseas Investments Rules are: (a) the definition of subsidiary / step down subsidiary of a foreign entity (defined as “an entity in which the foreign entity has control”); and (b) the definition of ODI which states inter-alia that ODI may be made in a listed foreign entity with “control” (if less than 10% stake is held in such listed foreign entity).

Under the New Regime, “control” has been defined to mean “the right to appoint majority of the directors or to control management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders’ agreements or voting agreements that entitle them to ten per cent. or more of voting rights or in any other manner in the entity”. (emphasis supplied)

The definition of control under the Companies Act, 2013 (the “Companies Act”) and the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (the “Takeover Code”), each, as amended, is identical to the definition included in the New Regime except for the words underlined above. Note that under the Companies Act and the Takeover Code, a company is considered to be a subsidiary of another company if it: (i) controls the composition of the board of directors; or (ii) exercises or controls more than 50% of the total voting power either at its own or together with one or more of its subsidiary companies. Accordingly, the definition of control and subsidiary under the New Regime is broader than that included in the Companies Act and the Takeover Code. The import of the additional words is unclear. However, the RBI’s intention appears to be that a holding of 10% or more of an entity automatically constitutes control for the purpose of determining layers of subsidiaries. See also our discussion in #III. below.

III. ROUND TRIPPING

Round-tripping means a combination of transactions involving transfer of money across jurisdictions, eventually resulting in a return to the jurisdiction of origin. Typically, such transactions are not bona fide transactions and are structured to receive tax benefits or for money laundering. Accordingly, the RBI, historically, has had a strict approach towards transactions which could be structured with Indian funds remitted abroad and then being used to create assets or resources in India.

There were no specific provisions in relation to round tripping under the Old Regime. However, FAQ No. 64 of the Frequently Asked Questions on Overseas Direct Investments (updated as on September 19, 2019) and available on the website of the RBI (the “FAQs”) stated as follows:

“Q. Can an Indian Party (IP) set up a step-down subsidiary/joint venture in India through its foreign entity (WOS/JV), directly or indirectly through step-down subsidiary of the foreign entity?

Ans. No, the provisions of Notification No. FEMA 120/RB-2004 dated July 7, 2004, as amended from time to time, dealing with transfer and issue of any foreign security to Residents do not permit an IP to set up Indian subsidiary(ies) through its foreign WOS or JV nor do the provisions permit an IP to acquire a WOS or invest in JV that already has direct/indirect investment in India under the automatic route. However, in such cases, IPs can approach the Reserve Bank for prior approval through their Authorised Dealer Banks which will be considered on a case to case basis, depending on the merits of the case.” (emphasis supplied)

The Draft Rules while suggesting liberalization of the round tripping related restrictions included ambiguous language stating that the financial commitment should not be designed for the purpose of tax evasion or tax avoidance.

Under the Overseas Investments Rules, the round tripping rules have been liberalized by the RBI to state that no financial commitment in a foreign entity will be permitted which has invested or invests into India either directly or indirectly, resulting in a structure with more than two layers of subsidiaries. Certain exceptions have been provided to this rule for banking companies and certain categories of non-banking financial companies. However, it is unclear as to why the restriction on the two-layer subsidiaries has been included if routing funds from abroad into India has otherwise been permitted.

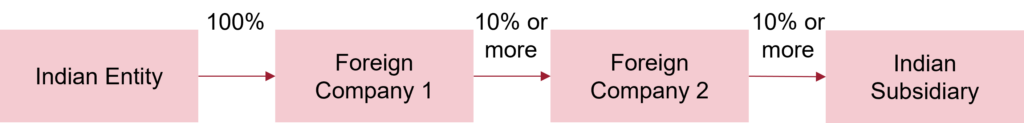

An illustration in relation to compliance with the revised round tripping restrictions to explain the impact of this restriction, read together with the definition of “control”, is set forth below:

In the illustration above, if the Indian subsidiary owns 10% or more in another company, the rule will be breached.

This is possibly the most significant change introduced pursuant to the New Regime for cross-border transactions and signals the RBI’s liberalized thinking in comparison to its previous stringent rules in this regard. While the RBI has permitted structures wherein the Indian entity invested in a foreign entity which in turn had investments in India on a case-by-case approval basis, this relaxation will provide ease of doing business for multinational companies and conglomerates with India operations. Indian companies may also now be encouraged to consider holding structures abroad on account of ease of listing abroad and becoming more accessible to other foreign investors.

Notwithstanding the New Regime, the RBI will also need to issue revised rules/regulations/directions for consistency with the New Regime in respect of areas under its supervision which included provisions in relation to overseas investments, e.g., the Core Investment Companies (Reserve Bank) Directions, 2016, as amended (the “CIC Directions”). The CIC Directions include terms and conditions for overseas investments by Indian entities which are registered as a core investment company with the RBI. One such condition states as follows: “The WOS/JV being established abroad by the CIC shall not be used as a vehicle for raising resources for creating assets in India for the Indian operations.” Accordingly, it is unclear if an Indian entity which is registered as a core investment company can avail the benefit from the liberalised New Regime until the CIC Directions are amended by the RBI.

IV. PRICING GUIDELINES

A new requirement introduced under the New Regime is to comply with pricing guidelines (i.e., arm’s length basis affirmed by a valuation undertaken in accordance with any internationally accepted pricing methodology for valuation) in respect of issue or transfer of equity capital.

It is unclear if the price determined by the valuation should be the minimum or the maximum price for purposes of compliance with the pricing guidelines. We note that the Draft Rules had specified that the price should be within 5% of the fair value. Given that the RBI will be keen to control the outflow of foreign exchange, it is likely that the RBI follows the principle similar to pricing guidelines for foreign direct investments into India, where the fair value becomes the cap where money needs to be paid by resident Indians to purchase or subscribe to foreign securities and the floor price if the money needs to be received back into India after transfer of foreign security.

It also appears that the pricing guidelines will only apply to the initial overseas investment and not to any subsequent investment by the foreign entity or in the creation of any subsidiary by the foreign entity (i.e., no guidelines have been prescribed for any downstream investments as in the case of foreign direct investments into India). However, the RBI will need to issue a clarification with regard to the issues discussed above in relation to pricing guidelines.

Further, the Overseas Investments Directions state that AD Banks are required to establish a board approved policy in relation to the documents to be sought from the Indian entities for confirming compliance with the pricing guidelines. Unless the RBI prescribes any detailed guidelines for the AD Banks to follow (certain brief guidelines have been provided in the Overseas Investments Directions), it will be interesting to note the varying policies introduced by the AD Banks, including if such policies will prescribe whether the price should be the minimum or maximum cap in terms of fair value. AD Banks will need to be mindful that a more stringent policy will impact an investor’s choice of AD Bank.

The New Regime now also permits deferred consideration for acquisition of equity capital with the deferred payment being made within the period agreed between the transacting parties, without specifying any maximum period. This is different from the RBI’s 18-month requirement in case of foreign direct investments in India, where the RBI’s intent is to ensure that foreign investment required to be brought into India is not unduly delayed.

V. FINANCIAL COMMITMENT

Lending to a foreign entity, investments in debt instruments issued by a foreign entity or extending non-fund based commitment to a foreign entity, including any level of step down subsidiary of such foreign entity has been made subject to the following conditions:

- “the Indian entity is eligible to make Overseas Direct Investment (ODI);

- the Indian entity has made ODI in the foreign entity;

- the Indian entity has acquired control in such foreign entity at the time of making such financial commitment.”

Given that the RBI has not specified “and” or “or” at the end of each condition, there is some ambiguity as to the interpretation of the above-listed conditions and it is unclear if an investor is required to satisfy any one condition, or all conditions, to be able to make debt investments in a foreign entity. Assuming a conservative approach, lending and investments in debt instruments will be permitted, provided the Indian entity has made equity investment in a foreign entity and has also acquired control in the relevant foreign entity. Previously, only direct equity participation was necessary for lending by an Indian entity to a foreign entity without the requirement of having ‘control’. Further, it has been prescribed that lending or investment in debt instruments should be documented in form of a loan agreement and the rate of interest for such lending should be determined on arm’s length basis. These conditions were not stipulated in the Old Regime and AD Banks now have to ensure that such conditions are complied with before repatriation of funds from India to a foreign entity in form of lending.

The limit for financial commitment remains 400% of the net worth as on the date of the last audited balance sheet; however: (a) the time period for the last audited balance sheet has been extended from 12 months to 18 months; (b) utilization of net worth of the subsidiary / holding company by the Indian entity is no longer permitted – this had previously assisted in increasing the net worth amount; and (c) the definition of net worth has been made consistent with the Companies Act (previously, only a reference to “free reserves” was included; however, under the Companies Act, all reserves created out of the profits, securities premium account and debit or credit balance of profit and loss account are included). Note that portfolio investments remain outside the scope of calculation of the financial commitment limit.

Separately, an individual resident in India is not permitted to lend to a foreign entity in which it has made equity investment.

VI. GUARANTEES

Set forth below is an overview of the framework for financial commitment by way of guarantee:

| Category of Guarantor | Type of Guarantee | Limitations |

|---|---|---|

| Indian investing entity | Corporate or Performance Guarantee | If guarantee provided by two or more Indian entities jointly and severally, 100% of the guarantee amount to be counted towards financial commitment limit of each such Indian entity |

| Group company of the Indian investing entity (holding company / subsidiary company / promoter group company | Corporate or Performance Guarantee | To be counted towards the financial commitment limit of the group company.Any fund-based exposure to or from the Indian investing entity to be deducted from the net worth of the group company for determining the financial commitment limit. |

| Resident individual promoter of the Indian investing entity | Personal Guarantee | To be counted towards the financial commitment limit of the Indian investing entity |

| Indian Bank | Bank Guarantee | Backed by counter-guarantee or collateral by the Indian entity or its group company |

The above revised framework is a combination of liberalizations and relaxations. The New Regime does not specify any restrictions on the levels of step-down subsidiaries on behalf of which guarantees can be provided. Under the Old Regime, guarantees could be provided by an Indian party without RBI’s approval only to the first level of operating step-down subsidiary. The only requirement under the New Regime is that the Indian entity should have ‘control’ in such subsidiaries through the foreign entity. However, if a guarantee is provided by two or more entities jointly and severally, instead of stating that the amount of the guarantee should be proportionately divided among the guarantors for purposes of determination of the financial commitment, the RBI has stated that 100% of the guaranteed amount will be counted for each guarantor.

VII. PLEDGE AND CHARGE

An Indian entity is now permitted to create security by way of pledge or charge in favor of an overseas lender (and not only an overseas bank) and debenture trustees. This is a key liberalization by the RBI as it assists foreign entities to obtain borrowings from entities other than banks. However, previously, an Indian entity was permitted to create security in respect of shares of any foreign entity in which it had made an investment, even for the borrowings of its group company or associate company in India. Now, the security can be created only in respect of shares of the foreign entity which has obtained the borrowing or its step-down subsidiary.

Certain other considerations in respect of a pledge or charge under the New Regime are as follows:

- The value of the pledge or charge or the amount of the facility, whichever is less, is to be counted towards the financial commitment limit. However, if the facility is amortizing, it is unclear if the financial commitment will be calculated on going forward basis. For the Indian entity, the financial commitment will be zero if the charge or pledge is offered for the Indian entity’s borrowing. This is a departure from the earlier position where value of charge was considered as financial commitment. Further, the New Regime does not specify whose calculation of the financial commitment limits will be binding on all relevant stakeholders.

- Negative pledge / negative charge / bid bond guarantee will not be counted towards the financial commitment limit.

- The word ‘control’ is not mentioned in the applicable regulation which permits creation of pledge and charge. It would be helpful to have some clarity from RBI as to whether Indian party should have ‘control’ in the foreign entity or in its step-down subsidiary if a pledge or charge is created for a borrowing by a foreign entity or its step down subsidiary.

- The Old Regime included an end-use restriction in respect of the pledge and charge framework as follows: “The loan / facility availed by the JV / WOS / SDS from the domestic / overseas lender shall be utilized only for its core business activities overseas and not for investing back in India in any manner whatsoever”. No such restriction is included in the New Regime and this appears to be consistent with the RBI’s approach to liberalized round tripping restrictions.

VIII. CERTAIN OTHER KEY CHANGES

OPI

Unlisted Indian entities are permitted to make OPI only through (i) acquisition of equity capital by way of rights issue or allotment of bonus shares; (ii) capitalization for realization of any amount due towards the Indian entity from the foreign entity; (iii) swap of securities; and (iv) merger, demerger, amalgamation or scheme or arrangement. Indian resident individuals are permitted to make OPI through: (i) acquisition of equity capital by way of rights issue or allotment of bonus shares; (ii) capitalization for realization of any amount due towards the Indian entity from the foreign entity; (iii) swap of securities on account of merger, demerger, amalgamation or liquidation; (iv) gift; (v) inheritance; (vi) acquisition of sweat equity shares; (vii) acquisition of minimum qualification shares issued for holding a management post in a foreign entity; and (viii) acquisition of shares or interest under stock option plans. Accordingly, it appears that unlisted Indian entities and Indian resident individuals are not permitted to make OPI through subscription as part of memorandum of association or purchase of equity capital or acquisition through bidding or tender procedure.

ODI in Financial Services

Indian entities not engaged in the financial services sector have been permitted to invest in foreign entities engaged in financial services, except banking and insurance, subject to certain conditions. This permits Indian entities to invest in businesses which may be quasi-banking in nature and developing technologies. Note that a foreign entity will be considered to be engaged in financial services activities, if it undertakes an activity which if carried out by an Indian entity will require registration or regulation by a financial sector regulator in India.

No-Objection Certificate

Certain categories of investors, i.e., any Indian investor who has any non-performing asset, has been classified as a wilful defaulter or is under investigation by a financial service regulator or by an Indian investigative agency (who are listed in the Overseas Investments Rules) are required to obtain a no-objection certificate from the bank / regulatory body / investigative authority, and such certificate is required to be provided to the AD Bank. The New Regime has clarified the entities which will be treated as ‘investigative agencies’; previously, there was ambiguity and covered all agencies who were vested with investigative powers. Additionally, the New Regime stipulates that if the no-objection certificate is not provided within 60 days of the receipt of application then it will be presumed that the relevant authority has no objection to the proposed transaction.

Supersession of Old Regime

Certain circulars issued under the Old Regime do not appear to have been superseded by the Overseas Investments Directions. These include: (a) a circular dated April 22, 2014 pursuant to which restrictions were imposed by the RBI on the issue of standby letters of credit/guarantees/letter of comforts etc. by banks on behalf of overseas joint venture / wholly-owned subsidiary / step-down subsidiary of Indian companies for the purpose of raising loans/advances of any kind from other entities except in connection with the ordinary course of overseas business; and (b) a circular dated November 25, 2014 pursuant to which restrictions were imposed in respect of routing of funds raised abroad to India. Given the RBI’s general approach to routing of funds raised abroad to India, it is likely that these circulars also stand superseded, however, a clarification from the RBI will need to be obtained.

Overall, the New Regime is a welcome change, especially in consideration of the restrictive Draft Rules issued by the RBI in August 2021. As under the Old Regime, it is expected that the RBI will issue FAQs to further clarify the changes introduced by the New Regime. It will need to wait to be seen if the RBI introduces limitations through the FAQs (like it did through FAQ 64 previously).

This insight has been authored by Divyanshu Pandey (Partner), Mohit Gogia (Partner), Lakshmi Pradeep (Partner) and Anoushka Borker (Associate). They can be reached at dpandey@snrlaw.in, mgogia@snrlaw.in, lpradeep@snrlaw.in and aborker@snrlaw.in, respectively, for any questions. This insight is intended only as a general discussion of issues and is not intended for any solicitation of work. It should not be regarded as legal advice and no legal or business decision should be based on its content.

© 2022 S&R Associates