Mahanakorn Partners Group Co | View firm profile

INTRODUCTION

Public-Private Partnerships (PPPs) has become an internationally discussed topic as it provides solutions to meet the growing demand for infrastructure development, most prominent in the areas of emerging markets. PPPs allow the public sector to tap into the private sector expertise, innovation and financing capabilities. One of the forms of PPPs are ones structured around availability payment, a model particularly suited for projects where revenue generation is either uncertain or unfeasible.

I. AVAILABILITY PAYMENTS IN PPPs

Availability payments are a financing model where the private partner is compensated based on the performance of infrastructure assets rather than user-generated revenues like tolls or users’ fees. The structure is most appropriate for projects where revenue generation is either insufficient or unpredictable, but where public access is vital. Availability payment PPPs differs from user-fee based PPPs as the private sector partner does not assume revenue risk by collecting payments directly from users.

In an availability payment model:

- The private sector partner is responsible for designing, building, financing, operation, and maintaining the infrastructure.

- The public sector partner makes periodic payments depending on the availability and the performance standards, not on the volume of users or toll collection

- The government retains control over user charges if applicable, but the private partner is incentivized to meet the set quality and service benchmarks.

III. ADVANTAGES OF AVALABILITY PAYMENT STRUCTURES

The advantages of choosing a PPP structure based on payment structures ae as follows:

- Risk transfer – Availability payment models effectively transfer design, construction, and operational risks to the private sector. However, the public sector retains control over demand-related risks (e.g., fluctuating toll revenues). This is ideal in cases where the potential for revenue generation is uncertain or unlikely

- Incentivized performance – Private partners are motivated to meet high standards of quality and operational performance because their payments are directly linked to their ability to meet availability and service requirements. This ensures that the infrastructure is maintained to a high standard.

- Budget certainty – Availability payments are typically pre-agreed and structured over long-term contracts. This provides the public sector with predictable, long-term budgetary obligations, which are particularly valuable in long-term infrastructure planning.

- Faster project delivery – due to payments being contingent on the timely completion and operational readiness of the project, private partners have a strong incentive to complete projects on schedule and within budget, speeding up delivery.

III. Challenges and considerations for PPPs in Thailand

While availability payment PPPs have clear advantages, they are not without challenges:

- Higher Private Financing Costs

Private financing for PPPs typically carries a higher cost than public borrowing. The success of availability payment structures hinges on whether efficiency gains in design, construction, operation, and maintenance outweigh the additional cost of private financing.

- Risk of Underperformance

If the private partner fails to meet availability or performance standards, the public sector may reduce payments or terminate the contract. This risk can be mitigated through rigorous due diligence and well-designed contracts that clearly define performance metrics.

- Regulatory certainty

While the PPP Act lays a solid foundation, regulatory certainty is crucial, especially for long-term contracts. Investors need confidence in Thailand’s legal and regulatory environment to commit to large-scale projects, which requires a stable and predictable policy landscape.

- Political stability

Long-term infrastructure projects, particularly those involving availability payments, are sensitive to changes in government policies. Political stability is pivotal for fostering investor confidence in such projects.

- Institutional capacity

Effective PPPs require strong public sector capacity for contract management and oversight. Thailand must continue to build institutional expertise in managing complex PPP contracts, especially those with availability payment structures.

IV. PPPs in Thailand

Thailand has increasingly embraced PPPs as a means of addressing its infrastructure needs. The Public-Private Partnership Act B.E. 2562 (2019) provides a legal framework for PPPs, establishing procedures and guidelines for structuring these partnerships.

Availability payments could be highly beneficial for several key infrastructure sectors in Thailand, where user fees are not viable, or the revenue is uncertain:

- Mass transit systems

Thailand’s growing urban population and expanding mass transit systems make availability payment structures an attractive option. For instance, in Bangkok, where public transportation systems like the Skytrain and MRT are vital but do not generate enough revenue to cover operating costs, availability payment PPPs could enable private partners to manage the construction and operations while the government retains control over fares.

- Healthcare infrastructure

Public healthcare facilities often struggle to generate sufficient revenue through user fees. Availability payments could be used to finance the construction and operation of public hospitals, with payments tied to the availability and performance of these facilities.

- Educational infrastructure

Education infrastructure in rural areas or underserved regions often faces financial constraints. Availability payment frameworks could provide a solution, similar to how the model has been successfully implemented in countries like the UK and Canada for schools and universities.

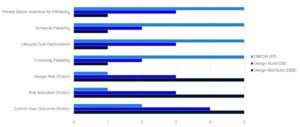

V. BEST PRACTICES FOR STRUCTURING AVAILBILITY PAYMENT PPPS

To ensure the success of availability payment PPPs in Thailand, the following best practices should be considered:

- Clear performance metric – defining clear and measurable performance standards to incentivize private partners to maintain the highest standards of the infrastructure.

- In-depth Value-for-Money (VfM) analysis – to compare the cost-effectiveness of a public procurement approach versus a PPP. The analysis should include financing costs, efficiency gains, risk transfer, and lifecycle costs.

- Transparent procurement process – to attract high-quality bids and ensuring the public sector gains the most from the beneficial characteristics of the private sector.

- Risk allocation – private sector should bear the risks associated with construction and operations, while the public sector retains control over demand and policy-related risks.

VI. CONCLUSION

As Thailand continues to develop its infrastructure to meet the needs of its rapidly growing economy, PPPs will play an increasingly important role. Availability payment models offer a flexible, performance-based solution to finance and deliver essential infrastructure projects, particularly where revenue generation is uncertain.

By leveraging global best practices, conducting thorough VfM analyses, and ensuring a stable regulatory environment, Thailand can attract private investment and successfully implement large-scale infrastructure projects.

Availability payment PPPs, when properly structured and implemented, provide a promising pathway to overcoming the financing challenges of infrastructure projects, ensuring that Thailand can continue to grow and prosper in the coming years.