FRANK Legal & Tax | View firm profile

This article will compare the legal and tax implications of a share deal with those of an asset deal. It will discuss the relevant taxes and transaction costs that will be incurred for an asset deal compared to a share deal from a Thai tax perspective.

The acquisition of a Thai business can generally be structured as an asset deal acquiring the specific assets that together make up the business to be acquired, or as a share deal by acquiring shares in a legal entity and thus such legal entity’s entire business.

In order to decide whether to pursue an acquisition of a business via an asset deal or a share deal, various aspects, advantages, and disadvantages from different perspectives should be taken into consideration.

1. Taxation of an asset deal

If the transaction is structured as an asset deal, the taxes to be considered are in particular the following:

a. Corporate income tax (“CIT”)

Corporate Income Tax at the rate of 20% of the net taxable profits generated from the sale of land or real estate or/and any company asset (moveable properties) will be subject to CIT tax at a rate of 20% and subsequent years.

b. Value-added tax (“VAT”)

VAT 7% applied for sale of the company asset according to Section 77/2 TRC (exception: in the case of an Entire Business Transfer).

c. Taxes related to the sale of immovable property

If the assets include immovable property, the following transfer fees and taxes need to be considered:

- Withholding tax (“WHT”) – Thai Withholding Tax at the rate of 1% of the actual selling price or the official appraisal price of Land Department, whichever is greater at the time of registration of ownership transfer at the Land Department in accordance with the Section 69 Ter of the Thai Revenue Code.

- Specific business tax (“SBT”) – Special Business Tax at the rate of 3.3% of the actual selling price or the official appraisal price of the Land Department, whichever is greater at the time of the ownership transfer registration at the Land Department in accordance with Section 91/6 (3) of the Thai Revenue Code.

- Transfer fee – Transfer Registration Fee of 2% of the official appraisal price of Land Department regardless of whether the actual sale price is higher or lower than the appraised value by the Land Department in which Seller and the Purchaser each pay 1% unless otherwise agreed by both parties.

d. Conclusion for an asset deal

If the company has only moveable property and no immovable property, the assets sold by the company will be subject to VAT 7% and CIT 20% of the net profit. It should be noted that assets must not be sold for less than the market value (such as a car, motorcycle, or laptop). If the market value of an asset is not available, such asset should not be sold for less than the book value.

2. Taxation of a share deal

If the transaction is structured as a share deal, the taxes to be considered are in particular the following (note that the following applies only to the sale of shares of a company limited that is not listed on the Stock Exchange of Thailand):

a. income tax

- Personal income tax (“PIT”) (if the shareholder is an individual) – Personal income tax on the capital gains in case the shares are sold/transferred with profit over the par value according to Section 40(4)(g) TRC. The personal income tax is levied at a progressive rate of 5-35%.

- Corporate income tax (“CIT”) (if the shareholder is a company) – If a company holds the shares and receives profit from the sale of these shares, then CIT at a rate of 20% on the net profit applies. If the company distributes dividends, the company’s shareholders will be subject to an additional WHT of 10% on the dividend.

b. Witholding tax (WHT)

Thai Withholding Tax at a rate of 15% applies on capital gains if the seller sells his shares with profit and the seller stays in Thailand less than 180 days, Sections 40 (4)(g), 50(2) TRC. If the seller remains in Thailand over 180 days and the seller has the duty to pay PIT, but and the buyer deducted WHT at the rate of 5-35% applies on capital gains, Sections 40 (4)(g), TRC, the seller can use the WHT paid as a tax credit. WHT will be applied in any case if the buyer is a Thai company.

c. Stamp duty

Stamp duty should be affixed to the original sale-purchase agreement (“SPA”) / share transfer agreement/share transfer instrument for the transfer of shares. The amount of tax is calculated as follows: For every 1,000 THB or fraction thereof of the paid-up value of shares, or of the nominal value of the instrument (whichever is greater), a stamp duty of 1 THB (0.1%) applies. The stamp duty is calculated according to the price of the shares stipulated. If the SPA/share transfer agreement/share transfer instrument is made in duplicate, stamp duty in the amount of 5 THB must be affixed according to Section 103 TRC.

If the company has a high profit, the shares must be sold with profit, and the stamp duty is calculated based on the value of the share transferred as shown in SPA. If the company has losses, and the purchase price of the shares is lower than the par value, the stamp duty is calculated from the par value of the shares.

It is the transferor’s duty to pay stamp duty unless agreed otherwise. If the transferee pays it, the purchase of stamp duty value must be treated as income or other benefits received by the transferor and must be included in the income tax calculation.

d. Conclusion for a share deal

If an individual sells the shares at par value and does not generate any profit/capital gain, such sale is not subject to personal income tax. If the company’s shares are sold with profit, such profit is subject to it is subject to PIT at the rate of 5-35%. As the transfer of shares is not regarded as sale of goods or provision of service, it is not subject to SBT at a rate of 3.3% and VAT at a rate of 7%. The transfer of shares is subject to stamp duty at the rate of 0.1% of the transfer price or the paid-up share value, whichever is higher.

3. Comparison of asset and share purchases

In comparison, the asset and share purchases have very different consequences from a legal and tax perspective:

a. Advantages of asset purchases

Asset purchases have the following advantages:

- The liabilities and business risks of the seller company are not transferred to the buyer. For a share transfer, the buyer will have to take on liabilities such as tax since the seller has operated the company, which could be risky with tax inspectors.

- For the transfer of shares concerning employee liabilities, the buyer has to take care of all pending contracts. If the buyer fires any employees, the buyer has to pay severance pay based on the number of years they have worked with the company.

- It is possible to acquire only some parts of the business.

- Interest to fund the acquisition of assets should be tax-deductible.

- The purchase price of the relevant assets, including goodwill, may be depreciated for tax purposes.

- The buyer does not inherit historical tax liabilities and exposures from the seller.

- The buyer can cherry-pick employees’ assets, or contracts, leaving unwanted ones for the seller to handle.

- A more limited scope of legal and financial due diligence means lower transaction costs.

- The buyer is less likely to assume any contingent liability.

b. Disadvantages of asset purchase

On the other hand, asset purchases have the following disadvantages:

- Possibility of taxable gains derived from the assets for the seller, such as land/immovable properties.

- Possibility of significant transfer taxes on the sale of the property.

- The buyer cannot get the trademark, branding name, or customer base and expert staff if the buyer runs the same business as the seller and continues their business. If the transferred shares belong to the company, the buyer can continue the business and only change the company shareholders.

- Transfer of each contract requires the contractual party’s consent and execution of a novation agreement, which is a time-consuming and lengthy process.

- No losses carried forward can be transferred to the buyer for future use.

- Certain governmental licenses/ permits can be transferred to the buyer, while others are nontransferable.

c. Conclusion: comparing the tax burden of the “Sale of Shares” and “Sale of Assets.”

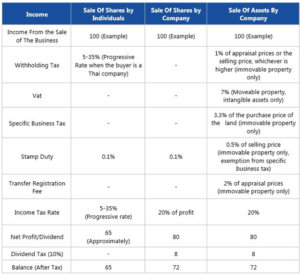

In a Sale of Business, sellers and buyers in Thailand can agree to buy a business as “Buy Shares” and “Buy Assets”, the following table shows the main fees and taxes that apply:

Please feel free to contact us if you have any inquiries regarding the information in this article at [email protected]

View the original article on the FRANK Legal & Tax website