Introduction:

In response to the considerable impact of the COVID-19 pandemic on the real estate sector, the Thai government has implemented a series of tax exemption measures to stimulate real estate investment through Real Estate Investment Trusts (REITs). This academic analysis delves into the key provisions delineated within the Royal Decree Issued under the Revenue Code Regarding Tax Exemption (No. 763) B.E. 2566 (2023), which was enacted on the 31st of May 2023.

Proactive Measures to Boost Real Estate Investment:

Recognizing the pivotal role of the real estate industry in economic recovery and growth, the Thai government has undertaken proactive measures to enhance liquidity and encourage investments in the sector. The Royal Decree introduces targeted tax exemption measures designed to incentivize real estate investment by leveraging the potential of REITs.

Effective Period:

The provisions encapsulated within the Royal Decree are slated to be operative for conversions taking place between the 2nd of June and the 31st of December 2024, offering a designated timeframe for investors to take advantage of the incentives.

Noteworthy Highlights:

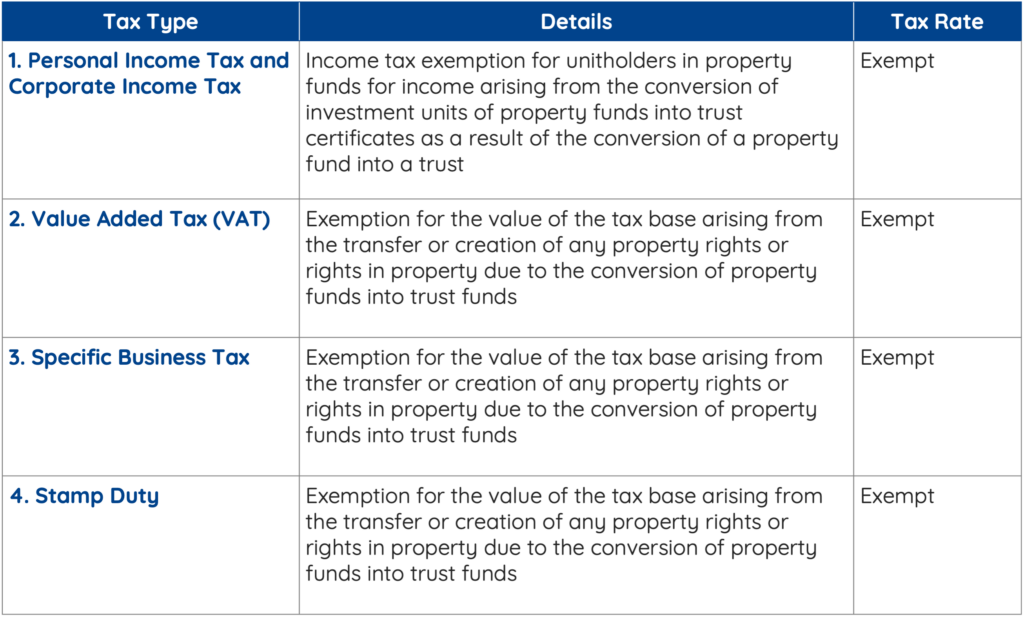

- Income Tax Exemption for Property Fund Unitholders:A noteworthy provision of the Royal Decree pertains to income tax exemption for unitholders of property funds. This exemption applies to income derived from the conversion of property fund investment units into trust certificates, a process that ensues from the conversion of property funds into REITs. The exemption encompasses income generated during the period commencing from the effective date of the Royal Decree and extending until the 31st of December 2024.

- VAT, Specific Business Tax, and Stamp Duty Exemptions:The Royal Decree extends significant exemptions to property funds in respect to Value Added Tax (VAT), Specific Business Tax, and Stamp Duty. Specifically, property funds are exempted from these taxes on the value of their income tax base, which is attributed to instrument actions arising from the transfer or creation of real rights or rights in property. The prerequisite for this exemption is that the said value emanates from the conversion of property funds into REITs. This exemption is applicable to conversions executed during the period encompassing the effective date of the Royal Decree to the 31st of December 2024.

Tax Exemption in Detail:

Government’s Focused Endeavors:

These tax exemption measures stand as a testament to the government’s concerted efforts to reinvigorate the real estate sector by promoting investment through the REIT framework. This calculated approach underscores the government’s commitment to fostering a resilient real estate landscape, thereby aiding the broader economic recovery process.

For Further Inquiries:

Should you seek to acquire a deeper understanding of these pivotal measures or require additional clarification, please address your request to [email protected]. Our dedicated team remains steadfast in delivering precise and contemporary legal insights to facilitate informed decision-making.