Mahanakorn Partners Group Co | View firm profile

INTRODUCTION

Thailand is making a significant improvement in its environmental policy by introducing the key legislations, laying down the foundations for many guidelines and regulations in the near future, with the introduction of the Draft Climate Change Act. The draft consists of 14 chapters and a transitional provision, covering topics like the climate change fund, charter plan, greenhouse has, carbon emissions, carbon tax, carbon credit. With the closing of the public hearing on 21 November 2024, the draft Climate Change signifies Thailand’s commitment to a cleaner future.

I. CARBON TAX

Amongst other regulated activities, the carbon tax mechanisms, whereby the government collect taxes from businesses and organizations based on the greenhouse gas (GHG) emissions generated by their activities, will be implemented to the fullest extent with clear guidelines stipulated in the draft Climate Change Act. The scope includes industries such as electricity generation, wastewater treatment, waste management, transportation using fossil fuel, raw material sourced from deforestation, and the use of industrial machinery.

Carbon tax will be calculated based on the volume of carbon emitted as a result from the entire process, starting with the sourcing of raw materials to deliver to consumers. The gases used in the calculation include carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and other fluorinated gases.

Importance of carbon tax in Thailand

Thailand was ranked as the 20th largest emitter of CO2 globally, contributing approximately 327 million metric tons of GHG emissions, or 0.90% of worldwide emissions.

Recognizing the urgency of the issue and the oversight of its environmental responsibilities, Thailand has taken proactive steps to address its environmental impact. In 2022, Thailand became the second country after Singapore in Southeast Asia to implement carbon tax regime, adopting the “polluter pays” principle supported by the Organization for Economic Cooperation and Development. Currently, the key regulations governing carbon tax in Thailand includes:

- Excise Act B.E. 2560 (2017) and its sub-regulations

- Ministerial Regulation Prescribing the Excise Tax Rate (No.23) B.E. 2565 (2022) – expand carbon tax applications Ministerial Regulation Prescribing the Excise Tariff Rate (No. 37) B.E. 2566 – extended tax reductions for eco-friendly vehicles

Carbon tax under the Climate Change Act

The Draft Climate Change Act outlines a comprehensive carbon tax framework in Chapter 9 (Sections 99–112). Key provisions include carbon taxes and fees, payments and penalties, deductions and exemptions, refunds, income management and appeals. Therefore, after the Act has come into effect, there will be clear rules, guidelines and requirements regarding carbon tax.

| No. | Carbon emissions from the vehicle | Tax rate (2026) | Tax rate (2030) |

|---|---|---|---|

| 1 | >200 grams/kilometer | 35% | 38% |

| 2 | 151-200 grams/kilometer | 30% | 33% |

| 3 | 121-150 grams/kilometer | 25% | 29% |

| 4 | 101-120 grams/kilometer | 22% | 26% |

| 5 | <100 grams/kilometer | 13% | 15% |

II. CROSS BORDER ADJUSTMENT MECHANISM (CBAM)

The new carbon tax mechanism, expected to be implemented in fiscal year 2025, will align with the Cross-Border Adjustment Mechanism (CBAM) set for 2026. With a proposed central rate of THB 200 per ton of CO₂—lower than the EU’s ETS and Singapore’s carbon tax—the revenue may help offset CBAM fees, preventing double taxation. Payments under this framework can be credited toward CBAM fees starting in 2026.

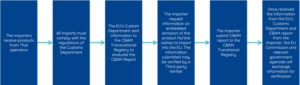

CBAM will be implemented in phases as follows:

- October 1, 2023: New CBAM regulations cover goods like cement, electricity, steel, fertilizers, aluminum, and hydrogen. Thai businesses must report both direct and indirect emissions.

- October 1, 2023–December 31, 2025: Transition period for reporting emissions data.

- December 31, 2024: Thai businesses must register with the CBAM Registry and apply for CBAM Declarant status.

- January 1, 2026: Full enforcement begins. Importers must purchase CBAM certificates to account for emissions.

- 2026 Onwards: Thai businesses will submit annual emissions reports verified by EU-accredited bodies.

- 2034 Onwards: Certification for 100% of embedded emissions will be mandatory.

III. IMPACTS ON BUSINESSES AND HOW THEY CAN PREPARE IN ADVANCE

Businesses will face increased responsibilities and operational costs. These include adapting production processes to reduce emissions, which may impact efficiency and productivity. Exporters, in particular, will experience a drastic increase in costs due to the CBAM compliance. The investments in emissions-reducing technologies and comprehensive greenhouse gas reporting may act as a strain financially and resource-wise.

Additionally, the failure to comply with the requirements set out by the draft Climate Change Act and CBAM entails penalties. For example, failure to adhere to CBAM regulations may subject the business operators to fines ranging from 10 Euros to 50 Euros per ton of carbon.

Here are some ways businesses can prepare to accommodate the changes in regulations relating to climate change:

- Adopting innovative production method – Transitioning to renewable energy and clean-energy machinery

- Integrate automation technologies – Centralize data collection, production and logistics systems

- Organizational assessment – Perform self-evaluation on the extent to which its current practices align with GHG reduction goals

- Being prepared for the GHG reporting obligation – Establish systems to measure and report emissions accurately

- Compliance with deadlines

- Staying informed on the latest legal updates

IV. CONCLUSION

Thailand’s draft Climate Change Act marks a significant step toward environmental responsibility, governing carbon emissions through measures like the carbon tax and the Cross-Border Adjustment Mechanism (CBAM). With the carbon tax structure in the draft, business will be required to adapt by adopting greener technologies and improving emissions reporting. The inclusion of a CBAM aligns Thailand with international standards, emphasizing the need for businesses to prepare for compliance, especially the additional reporting and payment obligations.

As the Act progresses toward full implementation, it will challenge businesses to reevaluate their operations and embrace sustainability to mitigate operational costs and penalties. However, the ultimate goal is a cleaner and more sustainable future. By laying down clear regulatory frameworks, Thailand not only commits to its environmental obligations but also fosters an environment initiative to green innovation and global cooperation.