New Legislation

Business Licence Act, 2023 (the “New Act”) which repeals and replaces the Business Licence Act, 2010 (the “Repealed Act”) is now in force along with the ancillary Business Licence Regulations, 2023 (the “New Regs”).The New Act is a consolidation and amendment of the law relating to business licences from the period commencing 2010 to 2022. To download the New Act CLICK HERE.

Who does the New Act apply to?

The applicability of the New Act has not changed, it is the same as previous years. The New Act applies to persons carrying on business in or from within The Bahamas.

Exemptions

Entities that do not engage in commercial activities are not subject to the New Act, such as holding of financial assets, holding of real estate assets, and pure equity holding. Foundations are not subject to this legislation.

The New Act does not apply to the Smart Funds.

The New Act also applies to Financial Services entities?

Yes. Financial services entities are those subject to the payment of a licensing or other fee and are regulated in accordance with: the Banks and Trust Companies Regulation Act, 2020 (“BTCRA”); the Securities Industry Act, 2011 (“SIA”); the Financial and Corporate Services Providers Act, 2020 (“FCSPA”); the IFA; the Digital Assets and Registered Exchanges Act, 2020 (“DARE”); the Insurance Act (Ch. 350); the External Insurance Act (Ch. 348).

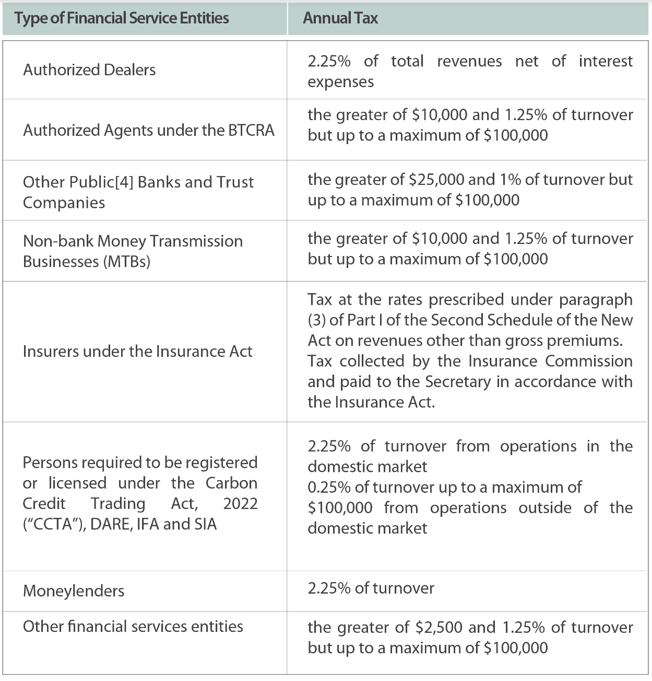

The rates of business licence tax applicable to financial services are:

Where a financial service entity carries on more than 1 category of financial service or other activities that are not financial services, tax is calculated at the highest of the rates of tax applicable to the business.

How does the New Act apply to the International Business Companies (“IBCs”)?

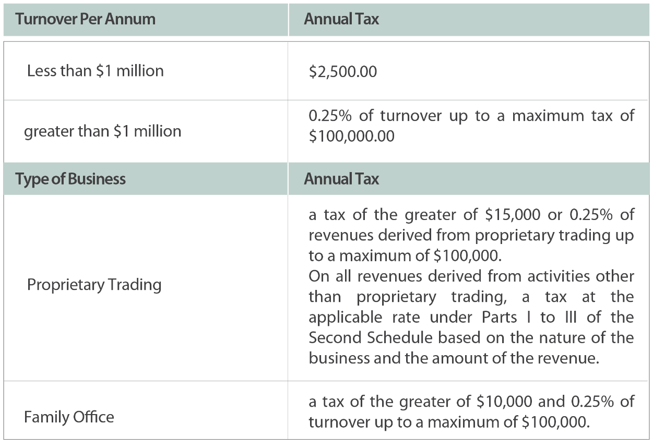

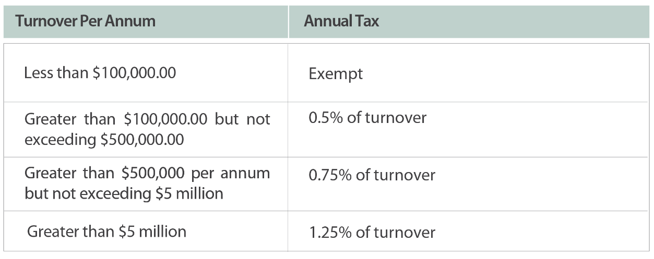

IBCs doing business from within The Bahamas (meaning their operations are exclusively outside of The Bahamas) are subject to the business licence taxes on revenue that is attributable to operations outside The Bahamas:

Revenue of an IBC derived from the following activities is deemed to be from operations from within The Bahamas: Professional services, including legal services, architectural services, consultancy services, engineering services, accountancy services and advisory services / the export of goods/

What are the annual rates of business licence tax for non-IBCs?

The rate of annual business licence taxes are applicable to entities doing business in and from within The Bahamas. The rate of taxes vary between business types and there are specific rates for financial services entities and international business companies. The rates are based on turnover.

Meaning of turnover

Means total revenues in money and money’s worth accruing to a person from his business activities in or from within The Bahamas during the year of assessment, without any deductions on account of the cost of property sold, the cost of materials used, the cost of services used, labour costs, taxes, royalties paid in cash or in kind or otherwise, interest or discount paid or any other deductions whatsoever.

When is business license tax due?

Business licences expire on 31 December of each year and must be renewed no later than 31 January of each year, with the applicable business license tax being paid no later than 31 March.

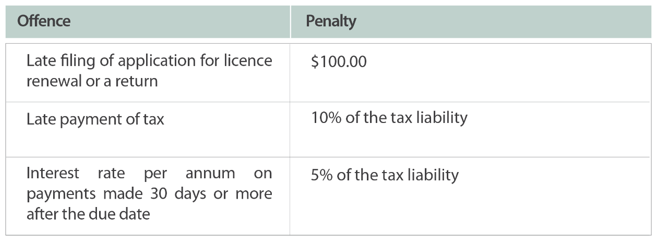

Penalties

Directors are jointly and severally liable together with a company to pay tax payable by the company, together with interest and penalties in relation to such tax.