I. Introduction

To achieve the early realization of a hydrogen and ammonia-based society within the country, it is crucial to swiftly establish a stable supply chain of hydrogen and ammonia, develop supply bases for manufacturing or importing these gases, and stimulate the demand for hydrogen and ammonia. Given the current stage of hydrogen and ammonia-related technologies, which is relatively immature, relying solely on private funding for these endeavors would be challenging, and government support is thus considerably essential.

With this in mind, there are ongoing efforts to rapidly advance discussions on support systems for the resilient construction of large-scale supply chains and the establishment of infrastructure to facilitate the hydrogen and ammonia supply. Additionally, the long-term Decarbonized Power Source auction scheme, which aims to encourage investments in hydrogen and ammonia-based power sources, is being considered to stimulate the demand thereof.

This paper provides an overview of the current discussions concerning government support measures directed towards the early realization of a hydrogen and ammonia-based society.

II. Support for Establishment of Self-sustaining Market for Hydrogen and Ammonia

To realize a stable supply to diversified demand for hydrogen and ammonia, the establishment of a self-sustaining market for hydrogen and ammonia is imperative. However, as the supply cost of hydrogen and ammonia is currently higher compared to conventional fuels, to establish such a market, it is necessary to reduce the overall cost, including the environmental value thereof, to a level comparable to existing fuels, and ultimately achieve economic self-sufficiency. Moreover, to ensure a stable and cost-effective supply of hydrogen and ammonia, there is a need for the creation of large-scale demand and establishment of an efficient supply chain. To achieve both objectives, it is crucial to encourage the aggregation of potential demand from surrounding entities and promote the formation of “Carbon-Neutral Fuel Supply Clusters” that contribute to enhancing the domestic industry’s international competitiveness.

To realize these objectives, the government has announced its intention to swiftly implement a leading approach that pairs regulations with support, with a focus on support for (a) the establishment of large-scale and robust hydrogen and ammonia supply chains and (b) the development of efficient supply infrastructure that contributes to the creation of demand. The specific support measures are outlined in the interim summary of the Joint Meeting of the Hydrogen Policy Subcommittee and the Ammonia and Decarbonized Fuels Policy Subcommittee, which was held on January 4, 2023[1], and the summary shall hereinafter be referred to as the ‘Interim Summary.’ An overview of these measures is presented below.

(i) Support for the Development of Large-scale Resilient Supply Chains (Supply Chain Development Support)

(a) The Policy on Supply Chain Development Support

One significant challenge in aiming to establish a self-sustaining market for hydrogen and ammonia in the future is the high supply cost thereof. Currently, the hydrogen supply cost at domestic hydrogen stations is around JPY 100 per Nm3, which is significantly higher compared to existing fuels[2]. The government has set targets for the supply cost of hydrogen, with an aim of JPY 30 per Nm3 by 2030 and JPY 20 per Nm3 by 2050. As for ammonia, by 2023, the aim is slightly below JPY 20 per Nm3 when converted to hydrogen[3]. To achieve these targets, the policy outlines the support measures for the establishment of robust and extensive supply chains to encourage the large-scale and stable procurement of hydrogen and ammonia by purchasers.

(b) Target Beneficiaries

To enhance business predictability for entities that bear significant investment risks and simplify the support mechanism, the policy indicates that, instead of providing support in relation to the purchasing costs of hydrogen and ammonia[4] for the demand-side purchasers, the focus would be on directly supporting suppliers who take risks by investing in (i) low-carbon hydrogen and ammonia and (ii) related supply projects with the goal of commencing supply domestically by around 2030 (referred to as “First Movers”).

The scope of support is envisioned to include not only domestically manufactured hydrogen and ammonia but also those produced overseas and supplied via maritime transportation. However, considering the objective of establishing a resilient supply chain that contributes to Japan’s stable supply of energy, the percentage of support for an overseas production and maritime transportation project would be primarily based on the proportion of hydrogen and ammonia production domestically compared to the total production of such project.

According to the current discussion, while support targets for specific supply chains and provider types are as follows, since there is a possibility that certain schemes would deviate from these categories, an individual assessment would be necessary for each of the schemes.

| A) Producing and transporting hydrogen by themselves, and selling it to domestic purchasers | Regardless of whether the operators are domestic or foreign, and irrespective of price, these operators should be prioritized as being eligible for support. |

| B) Selling hydrogen and related products procured from third parties to purchasers (as an intermediary) | Domestic operators should not be considered here; they should instead be considered under category A).

In the case of hydrogen procurement from overseas, the evaluation should take into account the limited contribution to the resilient supply chain due to the limitations faced by operators in reducing hydrogen supply costs and lower certainty in responding to energy security emergencies in Japan. |

| C) Producing and transporting hydrogen by themselves and using it for their own consumption (self-consumption) | Considering the objective of reducing manufacturing costs through the development of large-scale supply chains, it is worth considering whether projects that are implemented for the purpose of responding appropriately to external demand when the need arises should be included in the projects eligible for support. |

(c) Approaches to Support

In enhancing predictability for the operators, two major risks significantly impacting the foreseeability of a recovery of initial investment are price risk (the risk of low sales prices not covering manufacturing costs) and quantity risk (the risk of insufficient sales volume not enabling a recovery of equipment investment). To address these two risks, a support scheme that stabilizes sales prices and quantities through long-term contracts or other means and that promotes large-scale investments is necessary.

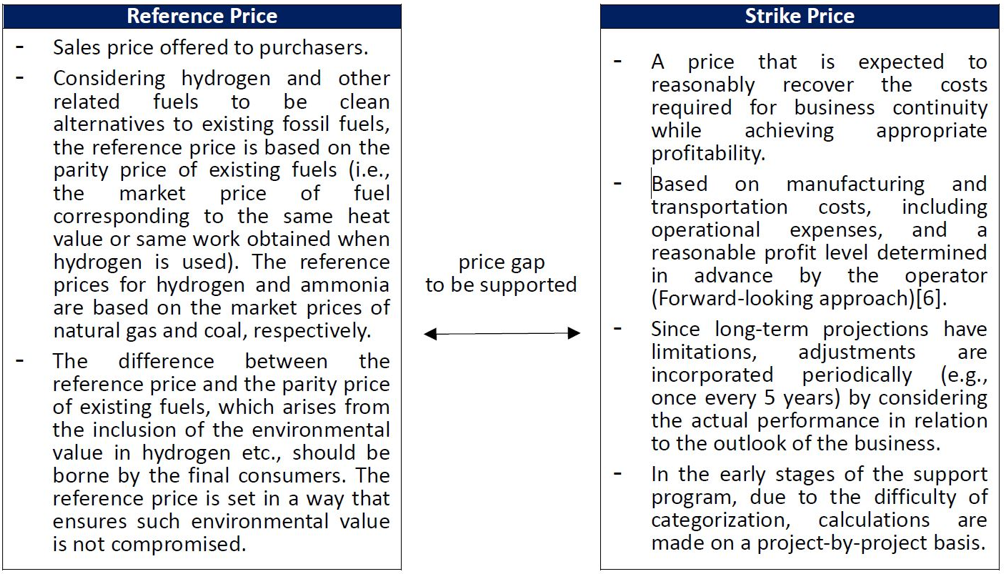

As a specific approach to such support, in the event of a sales transaction of hydrogen and ammonia between operators (suppliers) and purchasers, an approach is being considered where the difference between the total cost per unit of hydrogen and ammonia in production and supply (i.e., strike price) and the sales price to purchasers (i.e., reference price) would be partially or fully supported for a period of 15 years (up to a maximum of 20 years). The revised Hydrogen Basic Strategy, announced during the Renewable Energy, Hydrogen, and Related Ministers’ Meeting held on June 6, 2023[5], indicates that the combined public and private investment in the supply chain is currently estimated to exceed 15 trillion yen over the course of the next 15 years. Furthermore, in the event that the reference price exceeds the strike price, the operator would be required to return the excess to the government.

Through such support, operators can reasonably recover the costs required for business continuity and expect to achieve the appropriate amount of profitability if they operate the business with a certain capacity utilization rate[7] and earn income per unit of sales at the reference price.

Through such support, operators can reasonably recover the costs required for business continuity and expect to achieve the appropriate amount of profitability if they operate the business with a certain capacity utilization rate[7] and earn income per unit of sales at the reference price.

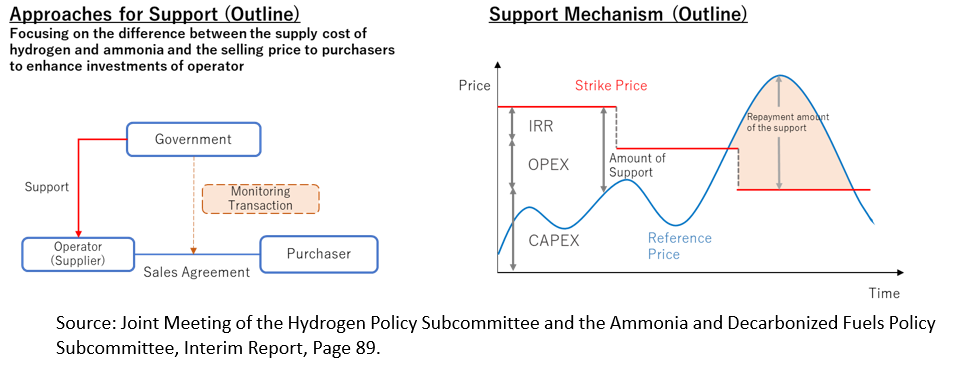

(d) Approach for selecting projects eligible for support

When selecting projects eligible for support, it is considered desirable to use a competitive bidding process with price as the primary evaluation criterion to ensure fair competition and promote economic self-sufficiency. However, given that the current stage is still in the early phase of supply chain development and considering the long-term perspective that includes support for carriers with potential future cost reductions, diversification of supply chains and contributions to energy security, it is also deemed appropriate to comprehensively evaluate factors such as supply price, energy stability, environmental impact and economic viability in the initial stages of implementing the system.

While the evaluation criteria can be outlined as follows, the specific details are subject to further deliberation as the process advances.

Source: Joint Meeting of the Hydrogen Policy Subcommittee and the Ammonia and Decarbonized Fuels Policy Subcommittee, Interim Report, Page 103

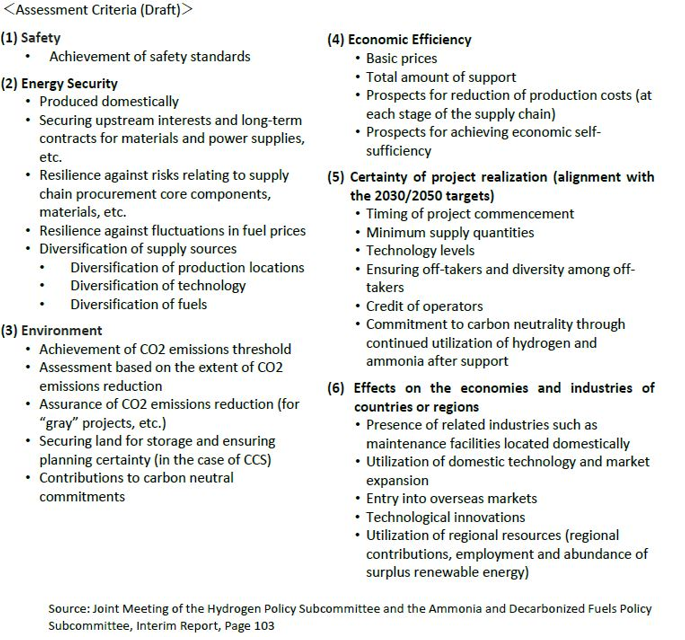

(ii) Support for the Development of Efficient Supply Infrastructure Contributing to Demand Creation (Cluster Development Support)

(a) Policy for Cluster Development Support

To achieve the efficient development of hydrogen and ammonia supply chains and create substantial demand, the development of “Carbon-Neutral Fuel Supply Clusters” is necessary to accumulate potential demand from surrounding areas. Specifically, it is necessary to generate demand on a wide scale by (a) achieving appropriate aggregation and distribution of the clusters by strategically and optimally locating such clusters from a nationwide perspective and advancing the development of each cluster according to the scale of regional demand and industrial characteristics and (b) connecting each cluster and its surrounding region through means such as maritime transportation. To implement this strategy over the next ten years, the plan is to develop approximately three large-scale clusters in major metropolitan areas with significant industrial demand and around five medium-scale clusters in regions anticipated to have substantial demand aggregation based on their industrial attributes.

(b) Target beneficiaries

To facilitate the creation of large-scale demand and the efficient development of supply chains, there is a recognized need to prioritize support for facilities that contribute to the expansion of hydrogen and ammonia usage. Thus, the development of facilities such as tanks and pipelines for receiving hydrogen and ammonia, storage, distribution and dehydrogenation as well as for CO2 capture, storage and distribution, which play a central role in the supply chain and benefit surrounding demand entities, is expected to be a target of support. However, there might be potential overlap with other support schemes concerning these facilities. The coordination and division of responsibilities between cluster development support and other forms of support are currently conceptualized as follows but specific considerations will be undertaken through subsequent discussions.

<Conceptualization of Beneficial Targeting>

(c) Stage Gate System

The cluster development support is divided into three phases to ensure efficient implementation: (i) the Feasibility Study for cluster development planning (FS), (ii) the Front-End Engineering Design (FEED) and (iii) the Infrastructure Development. During the (i) FS phase, to allow flexibility in selecting support targets, a broad range of candidate locations for clusters will be solicited. However, as the cluster development progresses, the need for clarifying support targets arises. To address this, stage gates for transitioning between phases will be proposed, limiting the support targets to promising clusters at each phase and focusing support on these viable candidate locations. Since the maturity of the technology used during the cluster development and the characteristics of the potential cluster locations may vary, it is deemed necessary to consider a support framework that accommodates multiple timelines for the cluster formation.

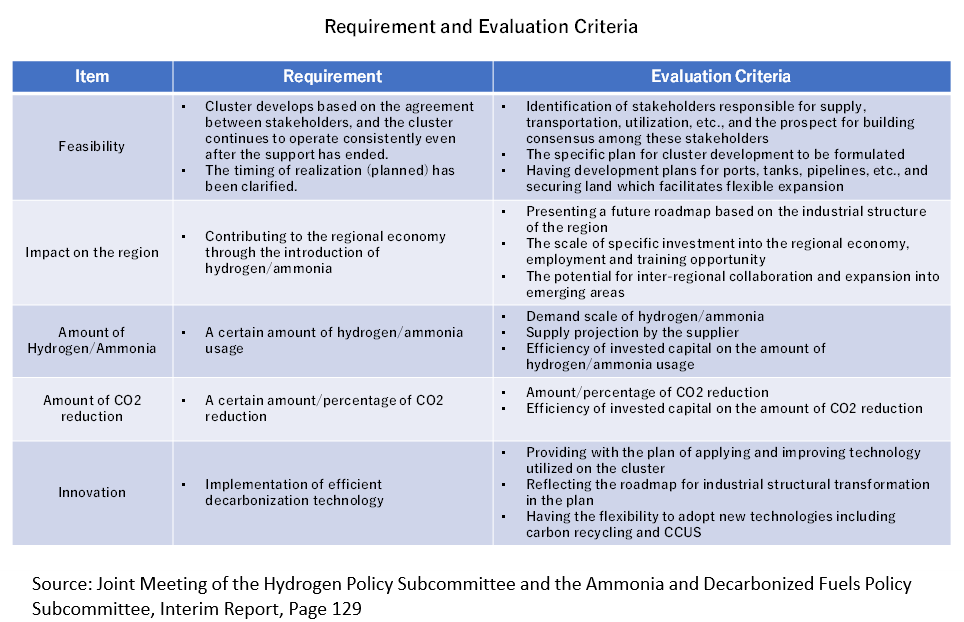

(d) Requirements and Evaluation Criteria for Support

Clusters serve as the core for generating significant demand for hydrogen and ammonia and constructing efficient supply chains. It is essential for the stakeholders involved in cluster development to: (i) engage a wide range of stakeholders, (ii) possess a clear outlook on the supply and demand for hydrogen, ammonia, etc., (iii) demonstrate the future vision of the cluster and a pathway to its realization and (iv) exhibit a medium to long-term commitment towards realizing that vision. Therefore, to encourage the involvement of aspiring entities in the cluster development and foster the formation of cluster stakeholders, prerequisites will be set for the entities responsible for the cluster development during the public call for proposals. Additionally, these prerequisites will serve as the evaluation criteria during the review of the stage gates for each phase of the cluster development. Currently, the envisioned requirements and evaluation criteria are as follows:

(iii)Coordination between Supply Chain Development Support and Cluster Development Support

For the large-scale development of hydrogen and ammonia supply chains, it is effective to combine and coordinate hydrogen/ammonia supply (supply chain development support) and the creation of large-scale demand (cluster development support).

In this regard, some companies are attempting early-stage supply chain development even before there is any progress in cluster development discussions. Therefore, after the implementation of both support systems, it is anticipated that, for a certain period, the exploration of supply chain development will precede cluster development considerations. However, going forward, cluster development discussions will advance, and there may be cases where supply chain development and cluster development discussions occur simultaneously. Thus, in either case, a mechanism favoring supply through clusters is being considered to coordinate between both support systems.

Furthermore, the government aims to coordinate with initiatives in ports such as Carbon Neutral Ports (CNP) and support measures for fuel conversion in manufacturing industries being separately considered for decarbonization, and to achieve seamless support for the social implementation of hydrogen and ammonia.

III. Long-Term Decarbonized Power Source Auction Scheme

(i)Overview of the Scheme

In order to achieve carbon neutrality by 2050 and stimulate demand for hydrogen and ammonia, new investments in decarbonized power sources are necessary. However, such investments require substantial initial funding, and without a foreseeable investment payback, investors may hesitate to invest. To address this, a system called the ‘Long-Term Decarbonized Power Source Auction Scheme’ (the “Scheme“) is being considered, which aims to enhance the foreseeability of the initial investment payback for investors.

The Scheme is currently under consideration and is planned to be introduced from the fiscal year 2023 as a special auction within the capacity market auction. Under the Scheme, winning bidders will receive capacity payments (the “Capacity Payment(s)”) equivalent to the fixed costs of their invested decarbonized power sources for a period of 20 years. The information described below is based on the discussions and materials from the advisory committees, mainly the ‘Long-Term Decarbonized Power Source Auction Guidelines’ and the ‘Eleventh Interim Summary of the Electricity and Gas Basic Policy Subcommittee’s Study Group’ (the “Interim Summary“) published in June 2023.

In a broad sense, the outcome for winning bidders under the Scheme is as follows:

- They can receive Capacity Payments equivalent to the fixed costs, including capital costs, operation and maintenance costs and profit margin, for a period of 20 years.

- On the other hand, they are obligated to return approximately 90% of the profits earned from their auctioned power sources in markets other than the capacity market (wholesale market, non-fossil fuel market, and other markets; collectively, “Other Markets”) to the Organization for Cross-regional Coordination of Transmission Operators, Japan (“OCCTO”).

The following sections provide a more detailed overview of the system.

(ii)Decarbonized Power Sources Covered by the Scheme

The Scheme covers various types of decarbonized power sources, among which hydrogen and ammonia-related sources listed below are included.

| 1. New construction projects for coal-fired power plants with hydrogen and ammonia co-firing. |

| 2. New construction projects for LNG-fired power plants with hydrogen and ammonia co-firing.[8] |

| 3. Retrofit projects for existing coal-fired power plants to enable hydrogen and ammonia co-firing. |

| 4. Retrofit projects for existing LNG-fired power plants to enable hydrogen and ammonia co-firing. |

| 5. Retrofit projects for existing oil-fired power plants to enable hydrogen and ammonia co-firing. |

※Note that in all cases, for hydrogen, it is limited to cases where hydrogen accounts for 10% or more of the total calorific value, and for ammonia, it is limited to cases where ammonia accounts for 20% or more of the total calorific value.

Regarding the above-mentioned hydrogen and ammonia co-firing power sources, it is essential to achieve hydrogen and ammonia mono-firing by 2050. Therefore, bidders are required to submit a decarbonization roadmap (the “Decarbonization Roadmap“)[9] toward full conversion to mono-firing by 2050 at the time of bidding, and they will be further required to submit updated Decarbonization Roadmaps at appropriate stages. Failure to make reasonable efforts to achieve the Decarbonization Roadmap[10][11] may be considered a serious violation, allowing the capacity securing agreement (the ”Capacity Securing Agreement”) to be terminated by OCCTO.

The hydrogen and ammonia targeted by the Scheme will initially include what is commonly known as gray hydrogen and ammonia. However, to achieve carbon neutrality by 2050, conversion to blue or green hydrogen and ammonia is necessary. Therefore, the Decarbonization Roadmap must outline the transition to such fuels. In cases where there is no progress in such transition to blue or green hydrogen or ammonia, without valid reasons for not taking such measures (such as lack of business visibility including procurement environment for fuels), it may be considered a serious violation, and OCCTO may terminate the Capacity Securing Agreement. These actions are part of the requirements and penalties described later.

(iii)Bid Price

(a) Costs included in the bid price

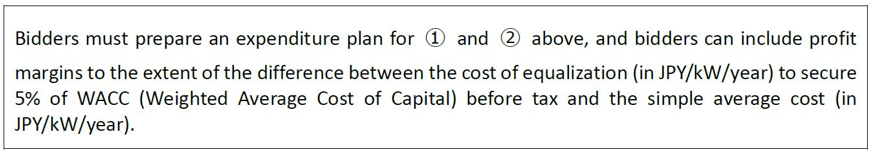

The costs that can be included in the bid price are comprised of (i) capital costs, (ii) operation and maintenance costs and (iii) profit margin. The breakdown is as follows, with the notable feature being the ability to include a certain level of business remuneration. It should be noted that the costs.

① Capital Cost

| Construction cost | 110% of the following costs[12] (10% on top of the 100% is a contingency reserve[13]):

|

| Grid connection cost | Based on the latest estimate of grid connection cost, the amount calculated by the operator. [16] |

| Decommission cost | 5% of the construction cost |

② Operation and maintenance costs

| Property tax | Property tax incurred by holding the respective power source during the Support Period. |

| Personnel expenses | Salaries and other compensations for personnel required to maintain the respective power source during the Support Period. |

| Repair costs | Repair costs necessary for maintaining the respective power source during the Support Period. |

| Aging repair costs | Capital expenditures necessary for maintaining the respective power source during the Support Period.[17] |

| Generation-side wheeling charges | kW-based charge amount for generation-side wheeling charges incurred by holding the respective power source during the Support Period. |

| Business taxes | Business taxes listed below, which are incurred by maintaining the respective power source during the Support Period.

【Revenue levy】 (Total amount of capital expenses, operation and maintenance costs, and profit margin excluding business taxes (revenue levy) (in JPY/kW/year))× (1 – Tax rate). 【Capital levy】 (Construction costs) × (43% of self-capital ratio)× (Tax rate). 【Value-added levy】 ((Profit margin for the respective power source) + (Personnel expenses for the respective power source) + (Lease costs for the respective power source)) × (Tax rate). |

| Other costs (outsourcing fees, consumables, etc.) | Other costs necessary for maintaining the respective power source during the Support Period. However, certain items, such as business taxes (revenue levy) and corporate taxes, which are not permitted to be included in the bid price, are excluded. |

③ Profit margin

(b) Maximum bid price

To minimize the burden on the public, maximum bid prices will be set for each type of power source. For hydrogen and ammonia-based power generation, the following maximum bid prices are planned.

| Hydrogen | New construction of hydrogen-based power generation (10% or more hydrogen blending) | 48k(JPY/kW/year) |

| Retrofitting existing thermal power plants for 10% or more hydrogen blending | 100k(JPY/kW/year) | |

| Retrofitting existing thermal power plants for 20% or more ammonia blending | 74k(JPY/kW/year) | |

(iv)Response to Cost Increases after Winning a Bid

(a) Response to Price Fluctuations

The duration of the Scheme is set for 20 years, starting from the completion of the construction of the power source facilities and the commencement of capacity supply. However, there may be a time lag between the bidding point and the commencement of capacity supply, and the winning bidder may face the risk of price fluctuations, as the bid price does not include any risk premium for price fluctuations. To address this issue and make investments more feasible, the amount of Capacity Payment will be adjusted annually based on the Consumer Price Index (CPI).

(b) Response to Cost Increases other than Price Fluctuations

Apart from price fluctuations, there is a possibility of unforeseen cost increases due to factors such as rising interest rates, higher tax rates or additional investments resulting from regulatory changes, which were not anticipated at the time of bidding. However, considering that a 10% contingency reserve is allowed for construction costs, and the inclusion of pre-tax Weighted Average Cost of Capital (WACC) of 5% as profit margin, Capacity Payment adjustments for non-price fluctuation costs will not be made.

Nevertheless, in cases where substantial cost increases occur due to reasons beyond the responsibility of the operators, which may jeopardize the continuity of the business, the authorities are considering potential system-level responses, such as allowing operators to participate in future Decarbonized Power Source auctions again.

(v)Relationship between Supply Chain Support System, Cluster Development Support System, and the Scheme

In addition to the Scheme, which provides support for the establishment of large-scale commercial supply chains for hydrogen and ammonia, there are ongoing considerations for the Supply Chain Development Support and the Cluster Development Support, as we explained above. As a result, there is a possibility of overlapping support when two or more of these three support schemes are applied simultaneously. To address this, the following coordination measures have been proposed to streamline the support process:

| If the application of the other two schemes has been decided before bidding for the Scheme | To prevent double support, the support amount that overlaps between the Scheme and the other two schemes will be deducted when bidding for the Scheme. |

| If the application of either or both of the other two schemes has not been decided before bidding for the Scheme | The support amount that overlaps between the Scheme and the other two schemes will be deducted when bidding for the Scheme. Additionally:

(i) If it is determined within three years after excution of the Capacity Securing Agreement that any of the other schemes will be applied: The countdown for the deadline for commencement of capacity supply will begin from that point. (ii) If it is not determined within three years after execution of the Capacity Security Agreement or if the support amount from the other schemes is lower than the expected support amount: In the case of market withdrawal due to the above reasons, it will be treated as a force majeure event, and market withdrawal will be allowed without imposing Economic Penalty for Market Exit (discussed below). |

(vi)Refund of Revenue from Other Markets

The winning bidder is required to refund to OCCTO the amount calculated by multiplying the profit from Other Markets (calculated by subtracting the variable costs[18] from the revenue from Other Markets; the ”Operating Profit from Other Markets“) by the refund rate specified below. The refund rate is determined based on a certain percentage.

| (A) the Operating Profit from Other Markets up to the amount of profit margins included in the bid price. | 95% |

| (B) the excess portion, if the Operating Profit from Other Markets exceeds the difference between (i) the result of (Contract Unit Price[19] × Contract Capacity[20]) and (ii) (the applicable main auction price of the capacity market (area price where the power source is located) × Contract Capacity ). | 85% |

| (C) the Operating Profit from Other Markets between (A) and (B). | 90% |

It should be noted that the refunds will be settled on an annual basis instead of monthly basis since the non-fossil fuel value is tradable on a yearly basis, and the income is confirmed in May of the following year.

Furthermore, the above discussion assumes that the amount of Operating Profit from Other Markets is positive. However, there is a possibility that because of escalation of the variable costs that is beyond expectations, the amount of Operating Profit from Other Markets may be negative. In such cases, the winning bidder is not obliged to pay Operating Profit from Other Markets for the relevant fiscal year and any deficit for such fiscal year can be rolled over to the calculation of the Operating Profit from Other Markets in the next fiscal year. Further, with respect to hydrogen and ammonia power generation, addressing the risk of losses may be considered through other external systems such as the Supply Chain Support System, which operate outside of the Scheme.

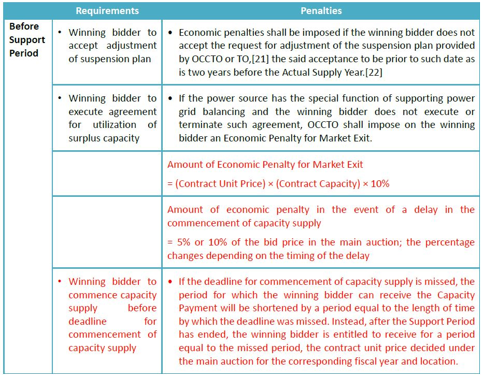

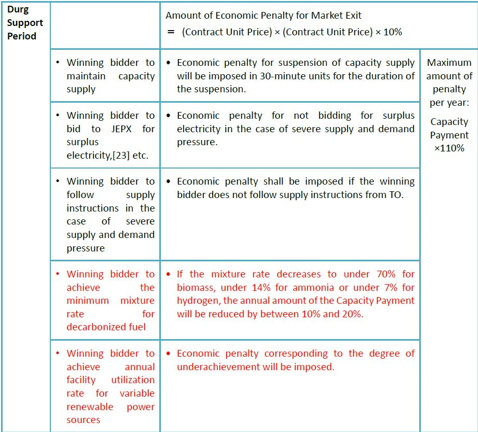

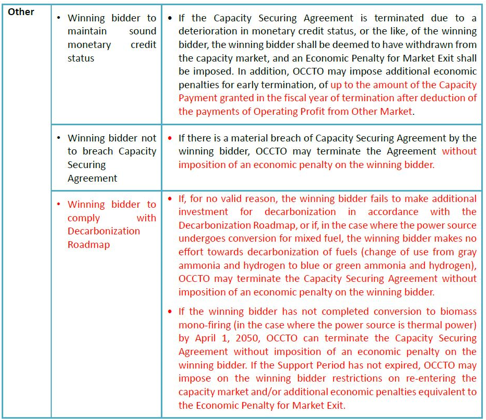

(vii)Requirements and Penalties

Because the Scheme forms part of the capacity market auction scheme, the Scheme incorporates the mechanisms of “Requirements” and “Penalties” (this latter being a mechanism where penalties are imposed for failing to meet certain requirements) originally implemented in relation to the capacity markets. Additionally, there are certain specific requirements unique to the Scheme. The overall framework is as set out below. (Black font represents the requirements of the current capacity market, while red font indicates the specific requirements for the Scheme.)

Source: Electricity and Gas Basic Policy Subcommittee, System Review Working Group, Eleventh Interim Report, Page 70

The focus should be on the red, particularly (1) the requirement to commence capacity supply before the deadline, (2) the requirement for the minimum mixing rate of decarbonized fuels, and (3) compliance with the Decarbonization Roadmap.

Regarding (1), a deadline for commencement of capacity supply will be set for each power source, and the winning bidder must commence capacity supply before such deadline. For hydrogen and ammonia power generation, the deadline for commencement of capacity supply is defined as the last day of the fiscal year that falls 11 years after the execution date of the Capacity Securing Agreement (or 7 years if the relevant legal and regulatory assessments are unnecessary). Failure to comply with this requirement will result in a reduction of the period for receiving the Capacity Payment based on the Scheme, with the shortened period’s capacity payment being calculated using the main capacity market’s auction price for that fiscal year.

Regarding (2), with respect to hydrogen, a mixing rate of 7% or more is required, and for ammonia, a mixing rate of 14% or more is required. Failure to meet these requirements will result in a reduction of 10% or 20%[24] in the annual capacity commitment payment.

Regarding (3), special attention is needed for hydrogen and ammonia power generation. As described in (ii) above, if there is no reasonable effort to achieve the Decarbonization Roadmap, this will be considered a serious violation, and OCCTO can terminate the capacity commitment contract.

IV. Conclusion

Regarding the Supply Chain Development Support and the Cluster Development Support, discussions on the

system design have continued even following the release of the interim summary on January 4th of this year. With respect to the Long-Term Decarbonized Power Source Auction Scheme, the 11th interim summary was published on June 21st of this year, and the details of the Scheme’s implementation starting next year are currently being finalized.

To achieve the commercialization of hydrogen and ammonia around 2030, there is not much time left for preparation, and it is expected that discussions will accelerate in the near future. Therefore, it is necessary to continue monitoring how these discussions develop, and we aim to provide further updates by newsletter once significant progress is made.

View original article here.

Authors: Jiro Mikami, Partner, Yoshihisa Watanabe, Partner, Eiji Miyagi and Saori Kawai

[1] The Agency for Natural Resources and Energy, “The Interim Summary of the Joint Meeting of the Hydrogen Policy Subcommittee and the Ammonia and Decarbonized Fuels Policy Subcommittee” (January 4, 2023)(https://www.meti.go.jp/shingikai/enecho/shoene_shinene/suiso_seisaku/pdf/20230104_1.pdf)

[2] Although fossil fuel prices have fluctuated significantly in recent years, for example, in March 2023, the price of LNG, when converted to hydrogen supply cost, was JPY 24 per Nm3.

[3] The 6th Basic Energy Plan (Approved by Cabinet in October 2021), page 79.

(https://www.enecho.meti.go.jp/category/others/basic_plan/pdf/20211022_01.pdf)

[4] The hydrogen and ammonia supply projects eligible for support are generally required to be clean. However, as an exception, operators of grey projects who are capable of providing an explanation on the prospects of decarbonization will be considered to be eligible for support.

[5] For the revision of the Hydrogen Basic Strategy, see the article “The Japanese Basic Hydrogen Strategy ” (September, 2023) by Jiro Mikami, Yoshihisa Watanabe, Eiji Miyagi, and Saori Kawai, in NO&T Japan Legal Update No.40.

[6] The reference price calculated by operators using a forward-looking approach is merely a forecast, and for businesses with high novelty, such as hydrogen and ammonia ventures, future predictions can be challenging. Additionally, business expenses can increase due to global inflation, soaring raw material costs, or currency fluctuations, while operational costs can decrease due to reduced electricity costs. To maintain flexibility in responding to such market dynamics, the approach of reviewing the reference price periodically (e.g., once every 5 years) by considering the actual performance in relation to the outlook of the business is currently under consideration.

[7] When calculating the strike price, operators set a target capacity utilization rate. As the support amount may be reduced if the actual capacity utilization rate falls below this target, operators may be tempted to set a lower target capacity utilization rate. However, setting a target rate that is overly conservative could raise concerns about excessive support for surplus production. To address this issue, providing support only for the surplus production amount after deducting the CAPEX equivalent from the strike price is being considered based on the idea that, once the target capacity utilization rate is achieved, the CAPEX should already be recovered and support should focus on the surplus production beyond that point.

[8] Considering that there are currently no anticipated bidding projects and it is challenging to set a maximum bid price for LNG-fired power plants with ammonia co-firing, these projects will not be included in the first round of auctions under the Scheme.

[9] The necessary items to be included in the decarbonization roadmap are as follows: “Construction period”, “Operation period for each decarbonization ratio”, “Bid timing in the Scheme for investments to improve the decarbonization ratio”, “The type of decarbonized fuel to be used, including gray, blue and green categories”, “Assumptions and conditions”.

[10] In cases where technological advancements allow for improvements in the co-firing ratio and retrofitting to achieve higher ratios becomes technically feasible, and there is a clear prospect of securing business viability, including the procurement environment for fuels, failure to revise the Decarbonization Roadmap without valid reasons despite being encouraged to do so is considered an example of non-compliance.

[11] Conversely, cases where valid reasons are recognized include:Situations where economic feasibility cannot be expected due to environmental assessments or regulatory strengthening, and there is no prospect of ensuring business viability. Cases where retrofitting for exclusive combustion (e.g., replacing a 1 million kW ammonia co-firing power plant with a 500,000 kW exclusive ammonia power plant) results in reduced output based on considerations of the technological development status, capacity size of the exclusive combustion plant, and supply-demand situation. Regarding the applicability of “no prospect of ensuring business viability,” there have been requests in Public Comment No. 12 of the Interim Summary for careful consideration of the views of businesses. In response, opinions from members of the system study working group suggest that, considering the possibility of unforeseen events during the implementation of future technologies such as exclusive combustion, it may be necessary to create opportunities in forums like the council to confirm the reasons before determining contract cancellations. The process should include measures to ensure that the recognition of serious violations is made carefully and avoids becoming a heavy burden on investment incentives for businesses aiming to transition to exclusive combustion.

[12] If the facilities participating in the auction have received subsidies from the national or local government, the amount of those subsidies must be deducted from the bid price. Moreover, it is not permitted to receive such subsidies after winning the auction, except for cases under the Supply Chain Support System and the Cluster Development Support System for hydrogen and ammonia.

[13] To address the risk of construction cost escalation, a 10% contingency reserve is allowed. However, this 10% contingency reserve cannot be applied to the portion of the capital cost already incurred and the remaining book value of existing power generation assets that are not covered by the Scheme (specifically, the remaining book value × (1 – percentage of kW covered by the Scheme) at the beginning of the Support Period).

[14] The fuel-related facilities are limited to those installed for receiving unloaded fuel upon arrival in Japan.

[15] ”Support Period” means the period for which a winning bidder can receive the Capacity Payment in accordance with a Capacity Security Agreement.

[16] If the actual settlement amount is lower than the grid connection cost incorporated in the bid price, the Capacity Payment amount will be adjusted by the difference.

[17] If the assumed usage period spans across the Support Period, the amount will be limited to the proportionate share based on the duration included within the Support Period.

[18] Specifically, the costs that are deducted from the revenue from Other Markets include fuel expenses, waste treatment and decommission costs, consumables expenses, generation-side wheeling charges (kWh charges), business taxes (revenue levy), business taxes (capital levy) and business taxes (value-added levy), among others.

[19] ”Contract Unit Price” means the unit price per kW of capacity to be supplied per year by the winning bidder, which is to be stipulated in the Capacity Securing Agreement.

[20] ”Contract Capacity” means the capacity of power agreed to be supplied by the winning bidder under the Capacity Securing Agreement.

[21] ”TO” means a general transmission and distribution business operator.

[22] ”Actual Supply Year” means each fiscal year of the Support Period.

[23] ”JEPX” means Japan Electric Power Exchange, the electricity market in Japan.

[24] With respect to hydrogen, if the mixing rate is not less than 3.5% but less than 7%, there will be a 10% reduction in the payment; while if the mixing rate is not less than 0% but less than 3.5%, the reduction will be 20%. With respect to ammonia, if the mixing rate is not less than 7% but less than 14%, there will be a 10% reduction in the payment; while if the mixing rate is not less than 0% but less than 7%, the reduction will be 20%.