VINT & Aletheia Attorneys and Consultants | View firm profile

This article examines the governance structures of various business entities in Ghana, such as Sole Proprietorships, Partnerships, Companies Limited by Shares, Companies Unlimited by Shares, Companies Limited by Guarantee, and External Companies.

It offers a comprehensive overview of the governance framework applicable to these business types in Ghana. The objective of this article is to clarify the governing framework for these entities, facilitating informed decision-making, ensuring regulatory compliance, and promoting long-term business sustainability.

Effective business governance in Ghana aims to ensure accountability, transparency, fairness, and responsible management, fostering investor confidence and sustainable business operations. Below is an overview of the governance structures for the various types of businesses in Ghana:

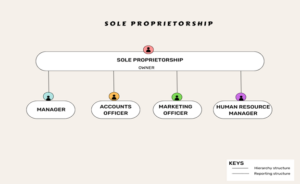

1. Sole Proprietorship: To ensure sustainability, the governing structure of a sole proprietorship should reflect its unique characteristics as a business owned and managed by a single individual. The proprietor has full control over decision-making, retains all profits, and assumes all losses, with unlimited liability that extends to personal assets. This means there is no legal separation between the owner and the business. Under the Registration of Business Names Act, 1962 (Act 151), sole proprietorships are required to register their business names to ensure public transparency. This structure is widely adopted in Ghana due to its simplicity and low startup costs. Sole proprietorships commonly known as Enterprises are used by Small and Medium Enterprises (SMEs) such as provision shops, hair dressing salons, jewelry shops, clothing shops, make-up studios, etc.

● Governance Structure: This framework focuses on the sole proprietor, who holds ultimate responsibility for all business aspects, managing tasks directly or through delegation. The key duties include strategic decision-making, financial management, legal compliance, and daily operations. To ensure sustainability, a sole proprietor must establish accountability systems, maintain accurate records, adopt sound financial practices, and stay informed about regulatory requirements and market trends. The governance structure must typically include the following roles, which can be handled internally or outsourced:

i. Manager: Oversees the day-to-day operations of the business, ensuring smooth functioning and efficient execution of tasks.

ii. Account Officer: Responsible for bookkeeping, managing financial records, and ensuring compliance with tax and financial regulations.

iii. Marketing Officer: Handles promotional activities, market research, and customer engagement to drive business growth and brand visibility.

iv. Human Resource Manager: Manages recruitment, employee relations, training, and compliance with labor laws, ensuring a productive and motivated workforce.

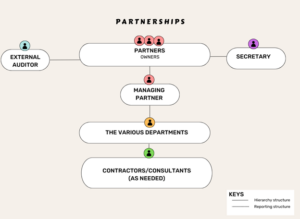

2. Partnerships: According to the Incorporated Private Partnerships Act, 1962 (Act 152), a partnership is made up of a minimum of two (2) and a maximum of twenty (20) persons who engage in profit-making business. Their relationship is determined by a Partnership Agreement duly signed by all partners. Partnerships are commonly used by professional service firms like law, accounting, and consulting agencies.

● Governance Structure: This framework, governed by a partnership agreement, designates partners as both owners and the primary governing body. The agreement outlines the partnership’s operations, roles, and decision-making processes. While all partners share ownership, a managing partner is often appointed to handle day-to-day operations. The tenure and structure depend on the partnership agreement, with individuals typically becoming partners through experience, performance, or capital contribution, as specified.

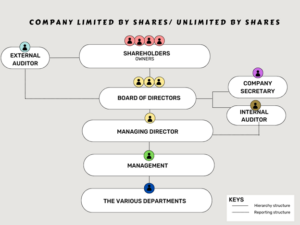

3. Company Limited by Shares and Unlimited by Shares (Private and Public):

A company limited by shares is owned by shareholders whose financial responsibility is restricted to any unpaid amount they owe if the company faces debt. In contrast, an unlimited company has shareholders with unlimited liability, meaning if the company faces debt, their personal assets can be used to cover business debts. Both companies are governed by the Companies Act, 2019 (“Companies Act”) as well as their constitutions. A shareholders’ agreement is also usually entered to regulate the relationship among the shareholders. There are two types of companies limited by shares/unlimited by shares:

A. Private Company Limited by Shares/Unlimited by Shares: Formed with a maximum of 50 shareholders. These companies cannot offer shares to the public.

B. Public Company Limited by Shares/Unlimited by Shares: Formed with a minimum of 50 shareholders. There is no restriction on the number of shareholders. These companies can offer shares to the public.

● Governance Structure for Company Limited by Shares/Unlimited by Shares (Private and Public): This framework outlines a clear governance hierarchy as below;

i. Shareholders: The ultimate owners.

ii. Board of Directors: They are led by a Chairperson for the purpose of meetings. They also set goals, monitor performance, approve budgets, and establish policies.

iii. Chief Executive Officer (“CEO”): Oversees the Management team to ensure the Board of Director’s directives are implemented while serving as a liaison between the Board of Directors and Management.

iv. Company Secretary: Reports to the Board of Directors and ensures legal and constitutional compliance, maintains records, records minutes, issues meeting notices, and oversees the preparation and filing of annual audited financial statements.

v. External Auditors: Reports to the Shareholders and independently reviews financial statements to ensure accuracy and compliance with legal and regulatory standards, providing an objective assessment for stakeholders.

vi. Internal Auditor: Administratively reports to the CEO and functionally reports to the Board of Directors, specifically the Audit Committee of the Board. They evaluate internal processes, financial records, and compliance with company policies and regulations, focusing on improving operational efficiency and risk management within the organization.

vii. Heads of Department: Ensures that their respective departments run smoothly and help achieve the organization’s goals

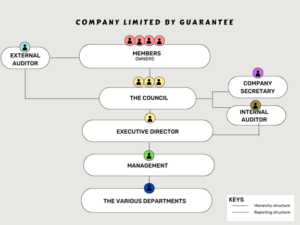

4. Company Limited by Guarantee: This is a distinct type of company, governed by the Companies Act. In such a company, the members’ financial responsibility is limited to the amount they have agreed to contribute in the event the company is wound up. This structure is commonly used for non-profit, social, or charitable organizations, with the primary focus on the advancement of a specific cause rather than generating profits for members. Examples of such a company include; churches, clubs, associations, and professional bodies such as the Legal Bar Associations, Institute of Architects, and Pharmaceutical Societies. There are two types of companies limited by guarantee. They are:

a. Private company limited by guarantee: Has membership restricted to 50 members.

b. Public company limited by guarantee: Has no membership limit.

● Governance Structure: This framework closely resembles that of companies limited by shares but with distinct terminology. Instead of shareholders, the term Members is used. The Board of Directors is referred to as the Council. For the sake of meetings, the Chairperson presides over the Council. The Management team is overseen by the Executive Director.

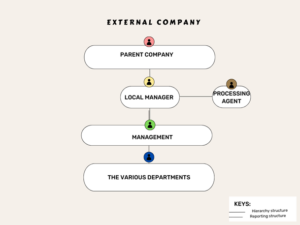

5. External Company: An external company is a business established in another country operating in Ghana through a physical presence, like a branch or office.

● Governance Structure: This framework clearly outlines the operations of such a company in Ghana. A local manager, qualified under the Companies Act, is appointed to perform functions similar to those of a managing director. Additionally, a processing agent such as a law firm or an accounting firm is designated and authorized to receive legal documents on behalf of the company.

CONCLUSION

In conclusion, the governance structures or framework for businesses in Ghana are designed to ensure that they operate sustainably, fostering long-term success and effectiveness. By following these structures, businesses can thrive while contributing to a strong and reliable economic ecosystem in Ghana.

By: Nana Ekua Quansar

Pupil

VINT & Aletheia Attorneys & Consultants