Thailand has emerged as a highly attractive destination for international businesses seeking to establish their presence in the Asian market.With its robust economy, strategic location, comprehensive connectivity, skilled workforce, affordable business costs, excellent business environment, and government support, Thailand offers a compelling proposition for foreign investors. Our research explores the International Business Center (IBC) in Thailand, highlighting the country’s advantages and investment opportunities.

Economic Advancements and Skilled Workforce

Thailand’s remarkable transformation from a low-income country to an upper-middle-income economy has positioned it as a magnet for foreign investors. Through the continuity of supportive policies and privileges, Thailand has become the second-largest economy in Southeast Asia. Leveraging its strengths in both agriculture and manufacturing, Thailand offers diverse opportunities for foreign companies, making it an ideal regional hub.

Thailand’s well-educated and skilled workforce plays a crucial role in attracting foreign businesses. With eight universities ranked in the top 200 in QS Asia University Rankings, Thailand offers quality higher education. The government also prioritizes vocational education programs to enhance the capabilities of the workforce. Additionally, the Board of Investment (BOI) supports tax incentives for companies establishing education and vocational training institutes, ensuring a skilled labor pool aligned with international standards.

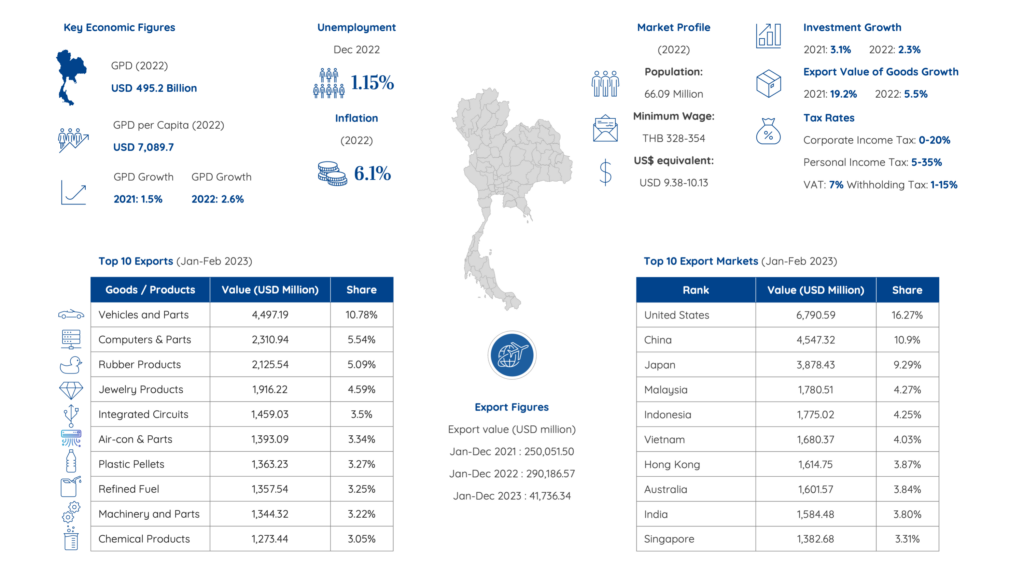

Figure. Thai economy as of February 2023.

Geographic Location, Comprehensive Connectivity and Infrastructure

Situated at the crossroads of Asia, Thailand serves as a gateway to the Asian market. As a member of ASEAN and surrounded by the fast-growing sub-region of CLMV (Cambodia, Laos, Myanmar, and Vietnam), Thailand provides access to over 240 million consumers. Furthermore, it enjoys proximity to major international markets such as China and India. Thailand’s participation in various free trade agreements (FTAs) and its membership in the Regional Comprehensive Economic Partnership (RCEP) further enhance its position as an attractive business destination.

Thailand has emerged as an attractive destination for multinational companies looking to establish their regional headquarters. With its favorable business environment, strategic location, excellent connectivity, and a skilled workforce, Thailand has successfully attracted 329 multinational companies under the BOI incentives since 2015. Key source countries for companies setting up headquarters in Thailand include Japan, Singapore, Hong Kong, and France. In June 2021, the BOI revised the IBC package, allowing companies to provide lending to affiliated companies under specific conditions, even if they are not operating as Treasury Centers.

Thailand’s commitment to improving connectivity is evident through its infrastructure development initiatives. Projects such as high-speed rail links, new airports, expanded seaports, and improved road networks strengthen cross-border trade and investment opportunities. These initiatives, scheduled to be completed by 2025, create a favorable environment for foreign investors. Emphasizing digital infrastructure, Thailand also focuses on building broadband networks, submarine cables, 5G, and IoT capabilities, ranking it favorably in terms of digital capacity and readiness.

Business-Friendly and Cost-Effective Environment

Thailand’s commitment to creating a business-friendly environment has resulted in improved rankings in global indices. The country’s efforts to streamline bureaucratic procedures and application processes have been recognized, contributing to its rise in the World Bank’s ease of doing business rankings. Foreign investors perceive Thailand as a potential and competitive choice for establishing their businesses.

Thailand’s competitive business costs make it an attractive option for foreign companies. It ranks favorably in terms of low startup costs, reasonable corporate tax rates, and low prime office occupancy costs. The country also offers a relatively cheap cost of living, providing affordable accommodation, food, transportation, and healthcare facilities. This combination of affordable business costs and quality of life creates an excellent environment for expatriate professionals.

Investment Opportunities in the International Business Center (IBC)

Thailand’s International Business Center (IBC) offers a range of incentives to attract multinational companies. The IBC, introduced in 2018, supports companies providing qualifying support services or treasury services to their affiliates. To qualify, companies must meet specific conditions related to capital, operating expenditure, and qualified employees. Thailand has successfully attracted numerous multinational companies as regional hubs, especially in the automotive and electronics sectors.

- Qualification and Benefits of IBCs

To qualify as an IBC, companies must meet specific criteria set by the Thai government. These include being established under Thai law, having a minimum paid-up capital of 10 million Baht, meeting annual operating expenditure requirements, and employing a certain number of qualified personnel. Once qualified, IBCs can benefit from various incentives and tax breaks provided by the Board of Investment (BOI).

- Activities Promoted by IBCs

IBC packages offered by the BOI cover a wide range of activities to support efficient business operations. These activities include general business management, procurement of raw materials, research and development, technical support, marketing and sales promotion, human resources management, financial advisory services, economic and investment analysis, credit management, financial management services of the Treasury Center, international trade business, money lending services to associated enterprises, and other supporting services. By promoting these activities, the BOI aims to enhance the competitiveness of IBCs and attract multinational companies to Thailand.

Significance of Treasury Centers

Thailand is a popular choice for setting up Treasury Centers (TCs) in Asia. These centers assist businesses in managing foreign currency funds for Group Companies (GC) both in Thailand and overseas. The country offers competitive corporate income tax rates, which are lower than other top economies in the region. Additionally, TCs in Thailand enjoy waivers from withholding tax on dividends and interests. As of August 2021, 39 Treasury Centers operated under multinational corporations in various industries, including automotive, electronics and electrical (E&E), and food. Prominent manufacturers such as Panasonic, Sony, Uni-charm, and Mitsubishi have chosen Thailand as their location for Treasury Centers.

Government Support

Thailand’s government agencies play a crucial role in supporting and facilitating the establishment of International Business Centers (IBC) in the country. With a focus on providing incentives and streamlining processes, the government aims to attract international businesses and promote economic growth. This article explores the various forms of government support available for IBCs in Thailand. The Board of Investment (BOI), Revenue Department, Department of Business Development, and Bank of Thailand, are dedicated to supporting investors in setting up and operating IBCs. These agencies work collaboratively to ensure a smooth and favorable environment for international businesses.

- BOI Incentives

The BOI offers non-tax incentives to promote investment in IBCs. These incentives are designed to encourage high value-added services. Companies that receive a certificate of investment promotion from the BOI under the IBC category are exempt from applying for a Foreign Business License (FBL) and obtaining a Foreign Business Certificate (FBC) from the Department of Business Development.

- Incentives from the Revenue Department

The Revenue Department provides tax incentives for IBCs in Thailand. These incentives aim to reduce the corporate income tax burden for qualifying companies. The specific incentives available can vary depending on the nature of the IBC’s operations and the services it provides.

- Department of Business Development

The Department of Business Development, affiliated with the Ministry of Commerce, plays a vital role in the establishment of IBCs. It oversees business registration processes, affirms business documents, and issues necessary licenses and certificates. IBCs need to complete the application process at the Department of Business Development to obtain the required permits.

- Bank of Thailand

The Bank of Thailand (BOT) is responsible for enforcing regulations related to Treasury Centers (TCs). TC owners must submit their applications to the Department of Business Development and provide the necessary documents to the BOT to obtain a license. Additionally, TCs are required to submit monthly data on transactions and investments to the BOT, including lending and borrowing transactions, deposit transactions, and investments in debt securities.

Conclusion

Thailand’s International Business Center (IBC) is a testament to the country’s commitment to attracting foreign investment. With its favorable location, comprehensive connectivity, skilled workforce, affordable business costs, supportive business environment, and government incentives, Thailand offers a host of opportunities for international businesses. The IBC serves as a strategic platform for companies to establish their presence in Thailand and expand their regional operations. As Thailand continues to enhance its infrastructure and foster an enabling business ecosystem, it remains a compelling choice for global players seeking to tap into the vibrant Asian market.