The pricing of transactions between associated enterprises located in various states could potentially affect the amount of taxes collected by each state involved. To protect their tax bases, tax administrations around the world turn their attention to transfer pricing policies of multinational enterprises.

Transfer pricing in a nutshell

The pricing of transactions between associated enterprises located in various states could potentially affect the amount of taxes collected by each state involved. To protect their tax bases, tax administrations around the world turn their attention to transfer pricing (“TP”) policies of multinational enterprises.

Increasing amount of tax audits aims to verify whether the prices set in cross-border transactions between related entities (so called “transfer prices”) are set in line with the arm’s length principle. The arm’s length principle requires that transfer prices reflect the prices that would have been set between independent enterprises in comparable transactions and comparable circumstances.

Key Issues

|

What is transfer pricing?

In simple terms, transfer pricing refers to the pricing of transactions between associated enterprises. For multinational enterprises (“MNEs”), transfer pricing is very important from a business and operational perspective. In the modern, globalized world MNEs do not operate in multiple jurisdictions as a single entity. Instead, they create complex corporate groups with numerous entities that are active in different countries. Transfer pricing allows MNEs to identify and properly remunerate value contributing factors of each member of the MNE group. It provides a reliable metric to determine the profitability and performance of each group entity and thus enables effective resource allocation.

How transfer prices affect profit allocation and taxes?

At the same time, the allocation of profits and/or costs between MNE group entities operating in different jurisdictions has a significant bearing on the group’s income tax position in these jurisdictions. To illustrate that, let’s have a look at an example.

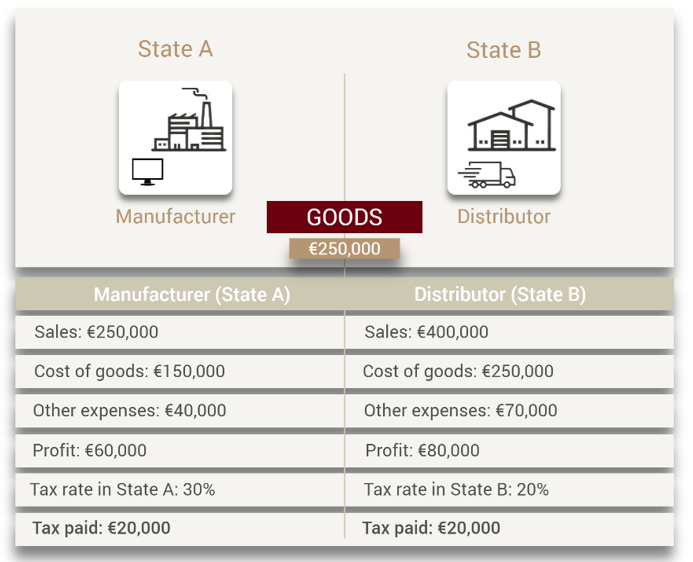

The Manufacturer produces television sets in State A. The sets are sold to an associated distribution entity, the Distributor, in State B. The Distributor resells the products in State B to end customers.

The Manufacturer sells the TV sets to the Distributor at a transfer price of €250,000 euro. After deducting the cost of goods and other expenses (€190,000 euro in total), the Manufacturer is left with a profit of €60,000 euro. This income is taxed at a rate of 30%, resulting in total tax liability in State A of €20,000 euro.

Moving on to the Distributor, the transfer price for the TV sets (€250,000) becomes the cost of goods for the Distributor. We then aggregate them with other expenses (€70,000) and arrive at total expenses of €320,000. After deducting total expenses from the sales to end customers (€400,000), the Distributor is left with a profit of €80,000. This would then be taxed in State B at a rate of 20%, resulting in €20,000 euro in taxes.

To sum up, in this example total profit of the MNE group on the transaction amounts to €140,000, and the total tax liability amounts to €40,000.

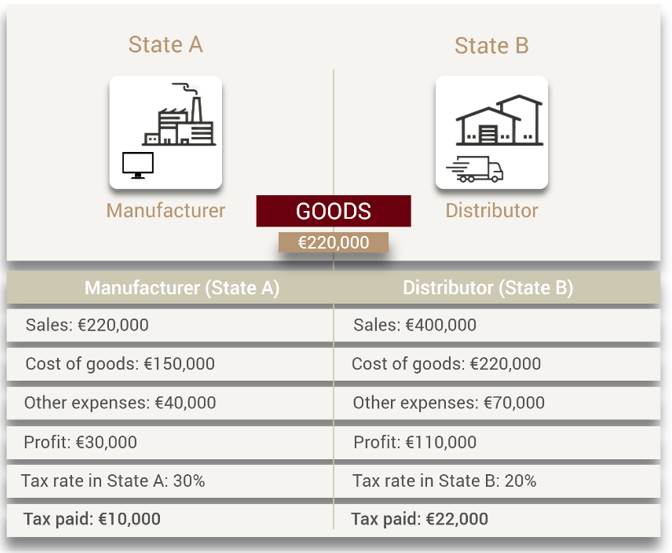

Nonetheless, income taxes are a cost of running a business, and MNEs have a legitimate interest in reducing their total tax liabilities through legal means. This could potentially be achieved by allocating more of the total profits from the transaction to State B which has a lower income tax rate. To do that, the MNE would lower the transfer price between the Manufacturer and the Distributor. Let’s illustrate it with an amended example.

It is evident that a simple change of the transfer price, with all other factors remaining the same, resulted in the reduction of the MNE’s total income tax liability on that transaction from €40,000 to €32,000. Moreover, the allocation of tax revenues between States A and B changed significantly. Following the change of the transfer price, State A will only be able to collect 50% of its previous tax revenues (i.e., €10,000 instead of €20,000).

The arm’s length principle

The differences between the tax rates in various jurisdictions create an incentive for international business to allocate their profits in a tax efficient manner. This clearly conflicts with the interests of the states which want to increase their tax revenues. As a way of resolving these conflicts, many national and international laws adopted a consensus on calculating adequate transfer prices: the arm’s length principle. In particular, the arm’s length principle has been included in Articles 9 of the OECD and the UN Model Tax Treaties.

Under the arm’s length principle, a transfer price will be considered adequate, if it reflects the price that would have been set between independent enterprises in comparable transactions and comparable circumstances. If tax authorities deem that transfer prices do not reflect the arm’s length principle, they can impose additional tax on the companies involved, often with interest.

Essentially, the arm’s length principle imposes an obligation to compare the conditions adopted in a transaction with an associated enterprise with the conditions that “would have” been adopted under “comparable circumstances” between two independent parties. We describe in more detail the process and factors governing such comparison in our separate article: The Arm’s Length Principle.

To correctly calculate the arm’s length price for the transactions between associated enterprises, MNEs use transfer pricing methods. We provide more guidance on transfer pricing methods recognized by the UN and the OECD Transfer Pricing Guidelines in our article on Transfer Pricing Methods.

What this means for you?

Transfer prices determine the allocation of profits between different states and impact the amount of income taxes that each of these states can collect. It is, therefore, no wonder that countries aiming to protect their tax bases are shifting their attention towards transfer pricing. In recent years new transfer pricing regulations have been introduced in many countries. At the same time, the established transfer pricing regimes have grown in scope and complexity. Transfer pricing policies of MNEs are increasingly often subject to heavy scrutiny by tax authorities worldwide.

In November 2022, Malta has introduced its first Transfer Pricing Regulations. Starting from year 2024, the Regulations impose transfer pricing documentation obligations on Maltese companies engaging in intra-group transactions. It is expected that Malta tax authorizes will ramp up their efforts in the field of transfer pricing. Taxpayers involved in transactions with related entities should make sure that their transfer prices conform with the arm’s length principle. Transfer prices should be calculated using an appropriate TP method and ideally supported by comprehensive TP documentation.

How we can help

Our team of experienced advisors can help to identify, assess, and mitigate potential transfer pricing risks in your business and to develop a sustainable, tax efficient transfer pricing policy for the future. As a collaborating firm of Andersen, leading global Tax & Legal advisors, we offer the comfort of years of experience in this highly contentious area.

Get in touch with us to learn how we can help you to manage your transfer pricing risks so that your business remains in compliance with Malta Transfer Pricing Regulations whilst retaining its operational effectiveness.