Global Reach Through Treaties: Armenia has signed over 50 bilateral investment treaties (BITs) and double taxation [elimination] treaties (DTTs) with countries worldwide, including the United States, Canada, Switzerland, and China. Armenia is a member of several multilateral treaties (including the Convention on the Settlement of Investment Disputes between States and Nationals of Other States (ICSID) Convention and the Energy Charter Treaty) aimed at encouraging and protecting investments. These treaties provide investors with legal certainty, protection, and reduced tax burdens, fostering a secure and predictable business environment.

Championing Open Trade: Armenia’s commitment to international trade extends to its World Trade Organization (WTO) membership. This membership ensures adherence to multilateral trade rules, further solidifying Armenia’s reliable and transparent trading partner position.

At the Heart of Eurasia: As a member of the Eurasian Economic Union (EAEU), Armenia enjoys tariff-free trade with Russia, Belarus, Kazakhstan, and Kyrgyzstan, a market of over 200 million consumers. This membership simplifies customs procedures and opens doors to a vast economic area.

Beyond the Basics: This is just the tip of the iceberg. Armenia boasts a simplified business registration process, a competitive corporate tax rate of 18%, and a skilled and educated workforce. Its strategic location between Europe and Asia, coupled with a growing tech sector and a thriving tourism industry, adds further appeal.

Explore the Potential: Whether you’re an entrepreneur eyeing new markets, a lawyer advising clients on cross-border investments, or a business leader seeking expansion opportunities, Armenia stands ready to welcome you with open arms. This Doing Business guide serves as your compass, navigating the legal intricacies and illuminating the path to success in this dynamic and promising nation.

Main Trade Sectors:

Armenia’s economy is mainly based on agriculture, mineral extraction, renewable energy (hydro and solar) generation, telecommunications services, ICT, jewellery production and sale, banking and financial sectors, and tourism.

- Services represent 52.8% of GDP and employ 51% of the active population.

- Agriculture plays a significant role in Armenia’s economy, contributing to 11.3% of the GDP and employing 24% of the workforce.

- Armenia possesses substantial deposits of copper, molybdenum, zinc, gold, and other metals, forming the basis for the country’s mining industry and main exports. The mining sector is still a major contributor to GDP and exports.

- Renewable energy is well-developed, including traditionally developed hydropower plants, with solar energy solutions emerging in the recent decade. In general, the energy sector is an important part of the economy, and Armenia exports electricity, with the mining sector being a significant consumer.

- The ICT sector is also growing and is considered a priority by the government; in addition to many assistance programs, IT startups can benefit from a beneficial tax regime.

- The banking sector has grown in particular: it is considered a solid and stable sector composed of 18 commercial banks (banks.am).

Business Environment (specific considerations Foreign Investors)

The Republic of Armenia has an “open-door” policy for foreign investments. It is one of the most open investment regimes among the CIS countries. The legislation allows smooth processes of starting and conducting business in Armenia and provides investment protection mechanisms through national and international instruments.

Key factors to consider when starting your business in Armenia:

- Լimited liability company (one of the most common types of legal entities in Armenia) can be registered through an accelerated process in less than an hour (provided that the founders and the director are present in Armenia in person.

- The standard registration process of Limited Liability Companies and Closed Joint Stock Companies usually takes 1-2 days (with certain exceptions for CJSCs.

- With very few exceptions (mostly licensed media /television and related/ activities), there is no local participation requirement; companies in practically all sectors are allowed to have 100% foreign participation.

- The directors, members of boards and any other employees of the company may be foreign citizens (note that employment permit and residence permit requirements may still be applicable), and they don’t have to reside in Armenia.

- There is no minimum charter capital requirement for any type of company (there are very few sector-specific exemptions – mainly in the financial sector).

The law “On Foreign Investments” guarantees national treatment and non-discrimination of foreign investors. It explicitly determines that the laws applicable to foreign investment cannot be less favourable than those governing the property rights and investment activities of Armenian citizens and legal entities. Armenian law does not determine requirements for pre-approval or approval of such foreign investment by any state body, and the investment can be carried out without any prior interaction with the government or without any prior authorisation.

The only exception is that foreign citizens and persons without citizenship have no right to own land in Armenia (given the exemption from this rule, in practice, the limitation applies only to agricultural land and forests). However, foreigners are allowed to use land through long-term lease contracts and obtain other rights (such as the right of development) that do not grant a right of ownership. Furthermore, the limitation does not apply to fully foreign-owned companies incorporated in Armenia, meaning the land can be owned through an SPV without restriction.

Benefits and Incentives for doing business in Armenia.

There are certain benefits to doing business in Armenia. The Armenian government has implemented various policies and programs to promote entrepreneurship and attract foreign investment. Some of the incentives and incentives and benefits for doing business in Armenia include:

- Armenia ranks one of the highest in the Logistics Performance Index: 3rd in the CIS region, with excellent customs and logistics quality performance.

- Armenia has 4 Free Economic Zones with NO profit tax, VAT, or property taxes.

- Armenia allows 100% foreign ownership of local business entities.

- Equal opportunities for local and foreign investors.

- “Grandfathering” investment-related legislation stabilisation clause for five years after the [each] investment.

- Armenia has no restrictions on remittances, repatriation of profits, or proceeds.

- A sustainable banking system following international standards and best practices.

- Free currency exchange, stable local currency.

The Government of Armenia provides incentives for businesses, including tax exemptions for activities in bordering and other communities, customs duties exemptions for importing certain goods and equipment, tax benefits for the IT and medical sectors, and many more.

Legal System, Foreign Investment Restrictions

Legal System։

Armenia uses the continental civil law system. The Civil Code of Armenia is based on the Napoleonic Code, whereas the German model shaped administrative legislation.

Judicial Order:

Armenia’s civil court system consists of three tiers. The first tier is the court of general jurisdiction of the first instance, which is the lowest level. The second tier is the Court of Appeal, and the highest tier is the Court of Cassation, serving as the supreme authority in the system. In addition to the court of general jurisdiction, specialised courts are also allowed by the Constitution; specialised administrative, bankruptcy and anti-corruption courts are created and functioning.

In terms of the hierarchy within this three-tier structure, decisions made by the Court of First Instance can be appealed to the Court of Appeal, and decisions made by the Court of Appeal can further be appealed to the Court of Cassation.

Enforcement of foreign judgements and awards:

Foreign or international arbitration awards or a foreign court decision can be recognised and allowed to be enforced in Armenia. Court practice on the matter is quite rich and positive. In addition to international treaties allowing for such recognition and enforcement, Armenian procedural legislation has enlarged the possibilities of such recognition. Since 2018, the Armenian civil procedure code has foreseen the possibility of recognising and enforcing the foreign court order on the grounds of reciprocity, which is presumed to be present unless proven contrary.

Arbitration and Mediation:

Armenia’s arbitration legal framework is based on UNCITRAL principles. As a member of the New York Convention, the arbitral awards rendered in Armenia can be enforced in other New York Convention member countries and vice versa. There are a number of arbitration centres offering parties a range of institutional options to administer their disputes. Additionally, ad-hoc arbitration can be utilised, affording parties the flexibility to customise proceedings to their specific requirements, thus consolidating Armenia’s reputation as a jurisdiction conducive to arbitration.

Armenia is a signatory to the Singapore Convention on Mediation. Further, the domestic legislation under the Law on Mediation comprises regulations regarding the certification of mediators. In some cases, parties are required to attempt mediation before pursuing court action. However, it’s important to note that mediation is not widely utilised in Armenia. Additionally, the Financial System Mediator’s Office, established by the Central Bank of Armenia (CBA), handles disputes between financial institutions licensed by the CBA and their clients. Despite its name, this office functions more as a Financial Ombudsman rather than a mediation process. Nonetheless, it serves as a popular alternative dispute resolution mechanism in the financial sector, aiming to safeguard the rights of customers.

Taxation

The following are the general types of taxes which are paid in Armenia:

- value-added tax (20%),

- profit tax (18%),

- Income tax for dividends (5%) /applicable only to individuals/,

- property tax (0,05%-1,5 % from the market value price of the property),

- income taxes (20%; certain exceptions are applicable depending on the nature of income),

- excise taxes,

- turnover tax (1.5-10% of turnover for businesses that are not VAT payers) is a beneficial tax regime for small businesses.

Armenia has treaties on excluding double taxation and preventing fiscal evasion with 51 counties.

Further, Armenia is a member of the EAEU, which leads to the regulation of custom-related matters as per the EAEU customs code by the country through the implementation of similar rules into the local legal acts.

Corporate legislation:

Limited Liability Companies (LLC) and Closed Joint Stock Companies (CJSC) are two main types of corporate vehicles. LLCs are usually used as an SPV with one participant or for simpler arrangements. CJSCs are better fitted for situations when there is a more complex relationship between the shareholders, and the relationships thereof should be regulated. Particularly, the law on JSC indicates the option of concluding a shareholder agreement between shareholders. The legislation further regulates the shareholding option scheme of employees and foresees more complex corporate law regulations.

The legislation recognises the fiduciary duties of executive bodies (including the board and the director). It indicates certain instances where the corporate veil may be pierced. The company’s shareholders may be brought to liability (e.g., within bankruptcy proceedings), which are limited and are interpreted by courts in a restricted manner.

Competition law:

Competition Protection Commission of the Republic of Armenia is the main state body carrying out control over compliance with competition law requirements. The RA Law on Competition Protection indicates the main principles and regulations of the competition law.

In certain instances, the Mergers and Acquisition as a concentration are subject to declaration before the commission (depending on the volume of assets and income of the parties to the concentration). Furthermore, the legislation indicates regulations aimed at protecting consumers and competitors from unreasonable reductions or increases in prices, anti-competitive agreements, cartels, unfair competition, etc.

It is noteworthy that the legislation considers the group of persons as an economic entity, and respectively, when carrying out control over compliance of laws, considers not only the separate individual and legal entity in isolation but also individuals and legal entities having affiliation therewith jointly.

Labour law.

Armenia has been a member state of the International Labour Organisation since 1992. The main legal framework governing labour relations in Armenia consists of the Labour Code and pertinent international agreements. Labour relationships are mainly based on labour contracts, which must be concluded between the parties prior to the commencement of employment.

The legislation can generally be considered employee-centric. The legislation limits the situations and cases when the employment contract may be terminated unilaterally (which is, however, in line with similar European regulations) and only through procedures regulated by law. However, the employer is fully authorised to choose the structure of the company and the number of employees they need as an exercise of the constitutional principle of freedom of entrepreneurship/economic activity, which means, in practice, the layoffs cannot be subject to external control regarding the bases of such action. Further, the employees have the right to form representative bodies, such as trade unions or workers councils, which are elected by workers’ assemblies or conferences. Additionally, the Law on Trade Unions governs and ensures the rights and activities of trade unions in Armenia. However, trade unions are not established well in Armenia, and in general, even where they are present, they are not very active in labour law-related processes.

Current Opportunities and Future Prospects

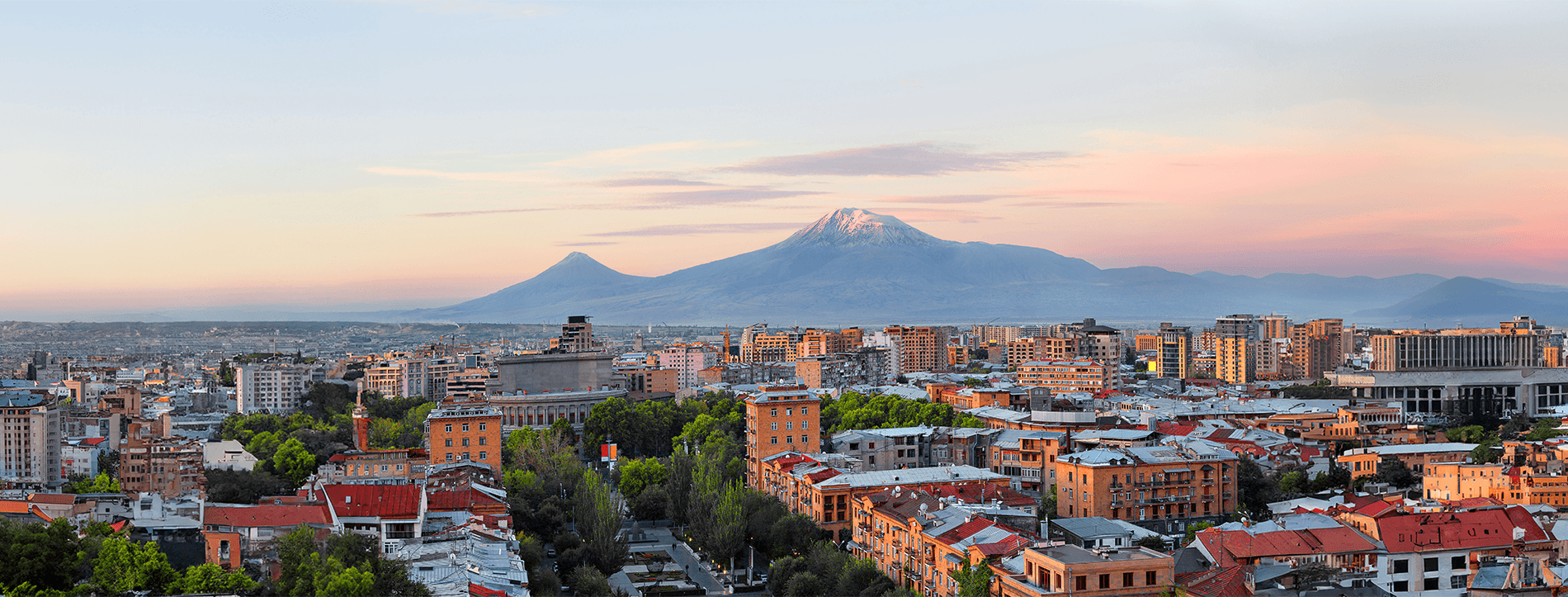

Development and construction are booming in and on the outposts of the capital city. Mostly, it is residential and business area construction is taking place.

The IT sector in Armenia continues to be a highly advanced and desirable business field. It is currently elevating its market position, partly due to the influx of major IT companies relocating from Russia.

Mining, banking, financial institutions, and energy business activities are well-developed yet remain attractive for investment opportunities.

Officials are focusing on agriculture and capital markets to improve the current situation, i.e., developing high-margin agriculture production and having a more active and advanced capital market.

Keep in mind!

Armenia is a member of the Committee of Experts on Evaluating Anti-Mօney Laundering Measures and the Financing of Terrorism – Moneyval. Thus, the relevant legislation was adopted and has been applied after that in the territory of Armenia.

Business entities which are registered in the country are obliged to declare their ultimate beneficial owners. The information about ultimate beneficial owners is publicly available data.

Although this creates certain additional obligations for businesses operating and creates a necessity for additional resources, this provides additional transparency measures in the business operations and creates additional mechanisms for combating and preventing ML-TF practices.

Top tips to takeaway “What to know before Investing”

Depending on the nature and volume of investment, it is important to retain relevant consultants (or at least to receive general advice from them) to assist the investors throughout the process of investment and subsequent implementation of the projects:

- It is critical to hire a [local] tax and accounting consultant at all times to ensure that accounting and tax reporting obligations and the related payment obligations are duly complied with.

- Depending on the nature of the project, it is recommended to have a legal consultant,

- If the investment plan may have any environmental law-related implications, it is recommended to hire not only a relevant legal practitioner but also a consultant of ecology or of a respective field to evaluate the feasibility of the project from the perspective of environmental law requirements.

Further, it is advised to:

- Reach out to relevant business associations (currently in Armenia, you can find such associations including the Armenia chapter of the International Chamber of Commerce, American Chamber of Commerce, British Chamber of Commerce, German Business Association, French Chamber of Commerce and Industry, European Business Association and many more /please check with your local chamber of commerce and industry and with Embassy in Yerevan to see if they have representatives or affiliated organisation in Armenia).

- It is not necessary to schedule meetings with state authorities or relevant ministries unless they are explicitly required for the project’s objectives, such as during the implementation of a PPP (Public-Private Partnership). While these meetings may yield positive outcomes for social media purposes, they rarely contribute substantially to the project’s development and investment. Additionally, any verbal advice provided by the state authorities on the spot, without reviewing project documents, should be treated with caution, as the relevant officials may not have a comprehensive understanding of the project and its processes. It is essential for consultants to cross-check and verify any such advice before considering it applicable to the specific project.

Join now and be part of a vibrant business community that constantly innovates, perfects its skills and creates value while enjoying Armenia’s stunning landscapes, rich culture, and welcoming people.

Don’t miss the unique opportunity to grow your business in Armenia, where Concern Dialog law firm can be your primary navigator!