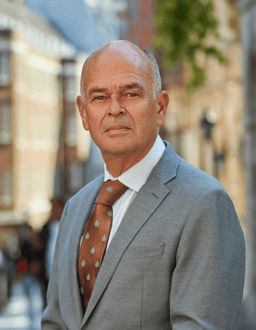

Michael Quinlan

- Phone020 7353 7884

- Email[email protected]

Position

Michael’s specialist area of practice is stamp duties and similar transaction taxes. Michael has been advising the financial services and real estate sectors for more than 20 years and has been involved in 17 stamp tax appeals in the UK and overseas. The most recent SDRT cases involved challenges under European law and, in both matters, Michael was engaged as technical and industry consultant by the successful appellants. Michael covers all areas of Stamp Duty, SDRT, Financial Transaction Taxes globally and Stamp Duty Land Tax operational assurance and advisory. He was the advocate for the successful appellant in Save & Prosper Securities v CIR (2000) Sp.C 251. Real estate: Michael represented the Law Society of England & Wales in the consultations leading to the introduction of SDLT in 2003. He has advised large real estate funds and property companies in relation to bespoke solutions to complex transactions and reorganisations involving UK properties worth billions of pounds. He has appeared as an advocate before the Tax Tribunal and as an expert witness before the Land Tribunal.

Education

King's College, Adelaide, South Australia; University of Adelaide (1984 LLB, 1985 GDLP, 1988 LLM).