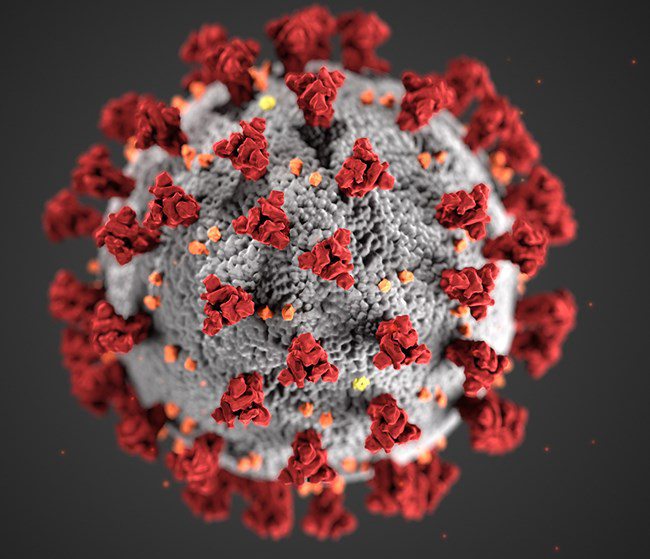

In conversation with leading practitioners, Barnaby Merrill considers the impact of Covid-19 on private equity funds and predictions for the market in 2021

In the bull market of 2019, private equity funds raised significant sums of money. Prequin, for example, estimated a total of $595bn, with so-called ‘dry powder’ estimated at a total $1.43tn. The latter figure is almost double the unspent capital estimated in 2015, an unsurprising phenomenon given the decline in PE-backed buyout deals during 2019; …

Continue reading “Private equity and the pandemic: What happened and what next?”

The ongoing crew change crisis caused by the coronavirus pandemic raises humanitarian concerns as well as a disruption to global trade, warn HFW’s Jean Koh and Emilie Brammer

Covid-19 has triggered many governments to prevent the transfer of seafarers through their territories to and from their home countries and vessels. This has left some seafarers stranded and others unable to join vessels to earn income. Governments attending the International Maritime Summit on Crew Changes noted deep concerns regarding this ‘global crew change crisis’, summarising …

Continue reading “Covid-19 and the mental health crisis at sea”

Briefing

Leading private equity sponsors investing in larger scale primary deals increasingly require innovative structuring solutions to access transactions that are not available via a conventional M&A process. Jersey investment holding vehicles provide an adaptable platform for delivering these solutions as well as for conventional buyouts. This article from Maples and Calder (Jersey) LLP, the Maples Group’s law firm in Jersey focuses on the features of Jersey holding companies that are attractive from a global Private Equity (PE) acquisition/structuring point of view and other uses of Jersey as part of the downstream investment process

One of the main attractions for top sponsors looking to maintain a stable of coveted assets is the ‘best in class’ investor return prospects which those assets have the potential to achieve. It has been suggested that the mid-market deal space (and within that the secondary and tertiary landscape) has been the most competitive and …

Continue reading “Jersey: Downstream structuring for top sponsors”

Briefing

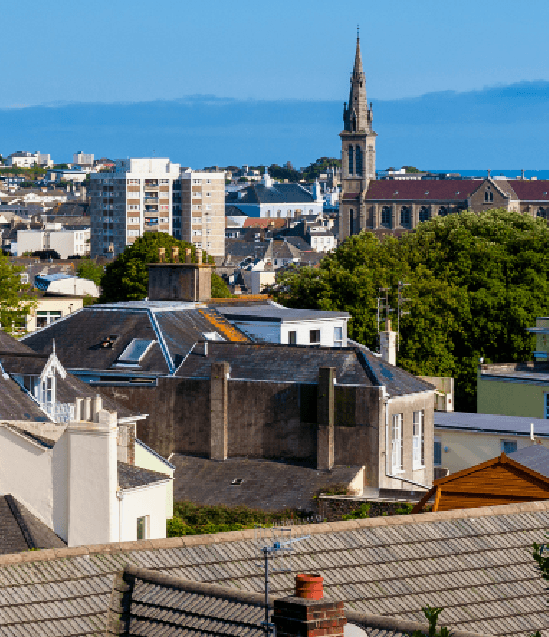

Dominic Wheatley, chief executive of Guernsey Finance, highlights new research on a specialist development for Guernsey

Guernsey’s funds sector is not alone in clearly seeing the merging of the private equity and private capital space. Private capital has become a normalised source of financing, while the investment management sector is seen increasingly as a gateway to a direct investment opportunity. A survey carried out by Guernsey Finance earlier this year at …

Continue reading “Private capital and private equity come together”

Briefing

Dr Andy Sloan, Chair of Guernsey Green Finance, outlines Guernsey’s role in tackling climate change through the breadth of financial services

It is difficult to ignore the issue of climate change today. Climate finance the issue of how the global population will make the changes required to limit global warning and give the planet a sustainable future tends to be a step away from the Extinction Rebellion protests taking place in London. However, climate finance is …

Continue reading “Climate finance – can demand come quickly enough?”

Briefing

What used to be a private office set up to deal with a wealthy family’s investments is now more complex and exciting than ever before, says Joe Moynihan, Chief Executive Officer, Jersey Finance

Family offices have been through a period of evolution in recent years. What used to simply be a private office set up to deal with a wealthy family’s investments, usually fairly safe and traditional in nature and decided by one single family leader, is now more complex and much more exciting than ever before. Over …

Continue reading “Family Offices for a New Generation”

Briefing

There must be mutual confidence and respect between industry and the regulator to achieve good compliance across the board, says Vicki Unsworth, head of the commercial and regulatory litigation team at Advocates Smith Taubitz Unsworth Ltd

The Isle of Man is widely considered to be a well-regulated jurisdiction with a robust regulatory framework overseen by the Financial Services Authority (FSA). Businesses across a variety of fields are licensed, regulated, and overseen to undertake business by the FSA or alternatively are, since the introduction and implementation of the Designated Businesses (Registration and …

Continue reading “Regulatory Pressures Afoot”