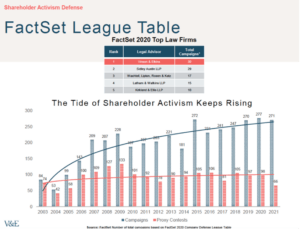

Vinson & Elkins’ Shareholder Activism Practice has consistently performed well in the activism defense league tables and rankings. It has ranked number #1 by FactSet for company and board representation based on the number of campaigns defended from 2016 – 2020; #1 for public company defense by Activist Insight in 2016 – 2020; #1 in Bloomberg’s inaugural league table for company defense in 2019, and most importantly, it is Tier 1 rated in The Legal 500’s Shareholder Activism rankings. We sat down with Lawrence Elbaum and Patrick Gadson, based in New York City, who co-chair the practice, to see what has made their team achieve such success.

What are the capabilities that have made V&E a destination practice in the area of shareholder activism work?

Lawrence: It really boils down to our experience. Today, our activism team at Vinson & Elkins is one of the most experienced and most knowledgeable company and board defense practices in this highly specialized area. We’ve seen just about everything, having defended over 150 activism campaigns during the past 6 years, so we know what to expect and how to handle it. We are also blessed to count among our team nearly 30 M&A, securities, governance and litigation attorneys to provide clients with omnipresent advocacy and support during these critical times that can feel like a corporate crisis.

Because of this, we can react quickly and with precision. We regularly defend companies against high-profile activists such as Starboard Value, Carl Icahn, Elliott Management, Engaged Capital, Jana Partners, Corvex Management, and Legion Partners. In situations like these, being at the ready is incredibly important. A board member calls you because they’ve just learned that an activist investor has made their enterprise a target. It’s important to them to know you’re prepared to represent them, and that they can leverage your expertise and experiences to navigate what oftentimes turn into extremely hostile and public contests for corporate control.

Patrick: This past year is just an example of that. We were engaged by MiMedx in the defense of the proxy fight of Prescience Point, eHealth, Inc. in the defense of the proxy fight of Starboard Value and the activism campaign of Hudson Executive, and First United Corporation in the defense of the proxy fight by Driver Management.

Experience drives insight. We’re now nearly done with the 2021 proxy season, and our activism defense practice has seen more activity than ever before, across all industries, from healthcare to banking. That’s a lot of insight. Unlike most firms, we have a multi-practice approach and capability, which affords us the ability to take these situations through entire complicated lifecycles, even if that includes litigation. Leveraging the talent of V&E’s preeminent Delaware law practice, as well as our strong ESG and corporate governance practices, allows us unparalleled representation capabilities.

Are there qualities that your lawyers have (or that you look for when hiring) that make the practice unique?

Patrick: I believe we are the only defense practice whose leadership includes someone who made his bones working for activists before transitioning to corporate defense. That gives us an “insiders” insight and understanding that our peers just don’t have. It’s one thing to believe you know what the other side is thinking, it’s entirely a different thing to have had to spend countless hours doing that thinking. In addition to that, the two of us co-lead a group of what is arguably the most experienced associates in the space. Each of us is completely client-obsessed. We lose sleep so our clients do not have to.

Is there anything that makes the practice’s approach unique?

Lawrence: We start every engagement by asking our clients what victory means for them, and then we begin the process of tailoring bespoke solutions to zealously help them achieve their goals. As we leverage experience from more than 150 defense engagements from the better half of the past decade, we also give our clients unvarnished and ego-free assessments about their chances of success.

Patrick: We always highlight alternative and often overlooked strategies that we believe result in more sustainable victories, involving the long-term peace between activists and companies. Because of our approach, those lawyers in the group have to be comfortable thinking creatively regarding today’s set of circumstances and tomorrow’s scenarios. We want our client’s companies to have optimal runway to focus on maximizing value for shareholders.

What have you done to train the next generation of lawyers (in your practice or throughout the firm) during the pandemic?

Patrick: We require our associates to understand the full range of matters with which we deal. We ensure that those who work with us, even at the associate level, have real-world exposure with clients, adversaries, opposing counsel, investment banks and activism industry-specific advisors. Shareholder activism defense is a multifaceted practice, and you need to train lawyers to look at it through multiple apertures.

About ESG

We’ve been reading that climate change and other ESG related issues are add fuel to the activist fire. Can you explain why that is the case and the impact of ESG on board governance?

Lawrence: Banks and investors are setting huge climate change and ESG-related capital goals, meaning some public companies may go from hearing very little from their investors and capital providers to hearing from everybody. ESG-activism is becoming a full-blown concern at the same time that companies and the market in general are still figuring out what it all means and what these commitments will require. Public companies may get caught in the misalignment if they are not prepared.

What can boards do to ensure that they are prepared and ready to handle these threats?

Patrick: Increasingly, investors have voting policies that address ESG matters. Boards need to treat voting policies and statements very seriously. While public companies often pay some attention to the voting recommendation policies of various entities like those active in the US, such as ISS and Glass Lewis, they do not always stay abreast of the changes taking place. We advise our clients to conduct robust ESG voting due diligence every year, including a benchmarking of their current company policies against those of ISS, Glass Lewis and institutional stockholders, even in the absence of a formal ESG stockholder proposal.

Lawrence: Board composition will become even more of a battleground during activist campaigns, so while they may not think they need a climate change expert on the board in times of calm, they will most likely wish for one in times of crisis. While there are a number of other steps that should be taken, there is more to be read on the topic at https://www.velaw.com/insights/money-meet-mouth-why-the-esg-war-is-just-beginning-and-what-to-do-about-it/

Do boards need to have a member who is an ESG specialist or are there other steps that they might take in place of that move?

Patrick: You may not need one particular specialist, but you do need to ensure that the board has the capability to understand those concerns and stay in front of all issues. Your legal personnel, your auditors, your marketing and HR departments should all be a part of that effort. They should all be involved in preparing policy and in executing appropriate plans.

About Board Protections in General

We’ve seen boards lose control of M&A scenarios, and as a result lose significant board seats. Are there actions that boards should be taking today to address this problem and avoid this in the future?

Lawrence: Yes, there are three considerations that companies often miss before announcing an M&A transaction, most often in all stock deals or deals involving both stock and cash. The three that immediately come to mind are:

1. As part of regular, “peace time” engagement with shareholders, engage in dialogue with them about the types of M&A, if any, they would like to see the company pursue and also about their views on M&A, in general. It is important to understand your shareholders’ – your owners’ – investment theses and to set their expectations as well.

2. Companies have one chance most often to explain the deal rationale and bona fides to shareholders. Companies are well-advised to begin work on these items as early as possible, prior to the agreement of a deal and to rehearse their presentations. It can be very difficult to rehabilitate even the greatest transaction that is not initially communicated properly to investors and the market.

3. Companies should not rush into a deal because they are dealing with public or private activism. Boards should be focused on getting the best deal with the best terms for shareholders, while being completely agnostic about how a consummated deal might affect their directorships.

Which area of ESG are activists focused on currently?

Patrick: That’s industry and company specific, but we advise companies keep their attention on the entire area. If a company is underperforming, then the next screen is for weakness in ESG factors. Maybe it’s the “E”, maybe it’s the “S”. Which letter isn’t as important as a company already being vulnerable because of operating and market performance. But at the end of the day, it’s still about performance. If you underperform, the ESG gods will not save you.