In the bull market of 2019, private equity funds raised significant sums of money. Prequin, for example, estimated a total of $595bn, with so-called ‘dry powder’ estimated at a total $1.43tn. The latter figure is almost double the unspent capital estimated in 2015, an unsurprising phenomenon given the decline in PE-backed buyout deals during 2019; a total of $393bn in deals closed, down a full $100bn from the previous year. Venture capital deals similarly declined, falling to a combined $224bn compared to $271bn in 2018.

Given the continuing growth of the global economy, particularly in the US, what was the cause of this slowdown? When speaking to private equity practitioners in late 2019 and early 2020, a common refrain echoed: valuations are too high. Many assets were deemed to be overvalued by fund managers, with only growth areas such as healthcare and technology continuing to see increased investments. When asked, most practitioners discussed the possibilities of a recession in 2020, or perhaps early 2021, as the likely solution – reducing valuations and increasing the possibilities for distressed acquisitions and buyouts.

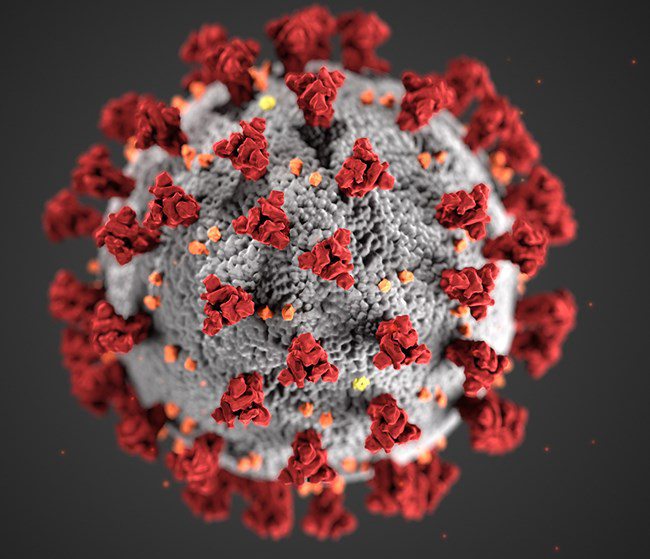

Fast-forwarding to late 2020, these prayers have been answered in an entirely unforeseen fashion. An astonishing economic shrinkage has occurred due to the Covid-19 pandemic has wiped billions of dollars off the value of businesses worldwide. The US economy has shrunk by 33.1% amidst stay-at-home orders and government-mandated business closures, only returning to growth in Q3 2020. The picture in the UK is similar, with a predicted 11% shrinkage across the year. The hospitality and retail sectors have been decimated, with many businesses forced to close indefinitely, while travel and leisure have similarly declined rapidly.

Conversations with London-based private equity lawyers in early summer 2020 revealed how the pandemic has – and has not – impacted the sector, both in terms of fund behaviour, strategy, and future planning. Although partners at major UK and US-headquartered law firms had different perspectives to their mid-market counterparts, the same picture slowly emerged – one of a sector challenged by 2020’s unprecedented events, but making small adjustments rather than wholesale changes to its operations.

Across the market, it became clear that funds briefly ceased active transactions in March, as economies were shuttered, and citizens ordered to stay at home. Portfolios became the priority, with GPs and LPs looking to protect their initial investments and ensure they were not responsible for insolvent assets. As March turned to April, however, funds were keen to continue deals begun in pre-Covid times, with major PE shops such as Kirkland & Ellis, Latham & Watkins, and Weil Gotshal & Manges closing multi-billion-dollar transactions throughout summer 2020.

Transactional partners across the US and UK were keen to point to their clients’ reserves of capital, which having been raised, needed to be spent. Similarly, fund formations across 2020 remained solid, with Blackstone announcing the close of its landmark BCEP II in September, with a total of $8bn raised. After an initial period of reflection, the funds have pressed on with planned investments as well as fresh capital raisings, anticipating a return to something approaching normality in Q1 or Q2 2021.

There have been sectoral impacts, however. Real estate-focused funds have struggled, while transactions in the retail, food, and hospitality industries have dried up. The much-discussed closure of popular London chain EAT by its owner JAB Holdings now seems increasingly prescient, as affected industries are forced to retrench and consolidate.

Emma Danks, head of the private equity team at Taylor Wessing, says: ‘We are certainly seeing an increased focus on deals involving assets that have shown resilience and that are likely to return to a normalised level of earnings fairly quickly post-Covid. This has a lot to do with investors’ desire to realise a return and shake off any hits they may have taken during the worst of the pandemic. Interestingly, this has gone together with a real shift in business models not just for the businesses being acquired but also in the strategy deployed by PE houses themselves.’

Despite these setbacks, the pandemic has not affected the prevailing trends identified in the happier economic times of 2019 – the growth in healthcare, life sciences, and tech-focused investments. With online and technology-based solutions increasingly prized as major businesses switch to home-working, and state-private partnerships working tirelessly to find palliative treatments and vaccines for Covid, it is unsurprising that private equity and venture capital investors alike have sought to acquire these increasingly valued assets, keeping transactional partners busy even as planned deals elsewhere are shelved or abandoned entirely. Venture capital funds in particular have remained active, with tech-focused firms reporting significantly increased new client demand and workloads.

Stephen Rosen, head of private equity in Cooley’s London office, notes: ‘I would expect PE interest in tech investing (and raising of funds specifically targeting tech) to increase even further. We are already seeing increased willingness from PE investors to consider deals on an annual recurring revenue basis; Tech verticals set to capitalise on the macroeconomic trends resulting from Covid (more remote working, less travel, etc.) look particularly well placed.’

What next?

Although initial optimism about a return to normality in Q4 faded given the resurgence of the virus this winter, practitioners anticipate transactional work will continue, with a vaccine and hopeful re-opening of economies due either late in Q1 or early in Q2 2021, funds are expected to retrain their eye on long-term targets, with valuations more to their tastes.

Rosen believes the way deals are done has changed, for the better: ‘Investors, their advisors, and finance providers have now become entirely comfortable originating, negotiating, and executing deals in a remote working environment, which has not ultimately proved as logistically challenging as one might have initially assumed. If anything, transactions, where there is a collective will to move with pace, are closing quicker than ever.’

Additionally, lawyers have been kept busy by non-buyout deals, including debt-backed transactions and Covid-inspired portfolio mergers and consolidations. Private M&A, GP-led restructurings, and secondaries have also continued apace, reflecting a sector adapting effectively to unusual times.

“Companies are going to need capital injections to facilitate these growth projections, for example, to release new products and address any issues in their supply chain,’ argues Danks. ‘This has in turn driven a need for portfolio companies to do bolt-on acquisitions. PE funds may also look at part-funding a deal via a founder’s roll over investment. This is about securing growth capital, but without a majority control position which a full buy-out brings.’

Danks also suggests that ESG as an investment strategy has been bolstered by the events of the pandemic, both for reasons of governance and stability: ‘There is increasing recognition that high ESG scoring companies are viable and often better vehicles for investment. They often have better governance and investors look keenly at integrating investments like this into their sustainability objectives.’

This is echoed by Rosen: ‘We are starting to see funds recognise the dual benefit that ESG investing can bring. Improving financial returns coupled with impactful socio-economic investments are increasingly important criteria for LP’s considering their PE allocation.’

A sector often associated with opportunistic behaviour in times of strife, private equity funds and their legal counsel are instead taking a long-term view, continuing existing strategies while also seeking to protect earlier investments and access newly-crucial sectors of the market along the way.