Please give us an overview of the current legal market in Cyprus and how any recent developments have impacted your practice?

The most significant development in the current legal market is an unprecedented tightening of regulatory scrutiny and focus on abuse of the financial and banking system. Since the beginning of 2018 the Cyprus government and regulatory authorities have come under pressure from the American government to prevent Cyprus being used as a conduit for money laundering, terrorist financing and sanctions avoidance.

During the Manafort trial it emerged that Cyprus was used as a conduit for illegitimate payments, and the American authorities have made clear that if Cyprus does not take effective action, Cyprus banks will be denied access to the SWIFT system and to correspondent accounts with banks in the US. Several American officials have visited Cyprus over the past few months to press this issue.

On 14 June the Central Bank of Cyprus issued a circular to credit institutions it regulates advising them against opening new bank accounts or continuing existing accounts with companies that are regarded as ‘shell’ or ‘letter box’ companies. The guidelines, which are shortly to be incorporated into the Central Bank’s anti-money laundering directive, stipulate that trading companies with no effective place of business and management, and hence no substance, will not be permitted to maintain bank accounts in Cyprus, and that trading companies incorporated in jurisdictions recognised as tax havens will have to become tax resident in an appropriate tax jurisdiction in order to continue banking in Cyprus.

What significant trends exist in the Tax market presently? Are you seeing these just domestically or internationally as well?

The crackdown on insubstantial companies is the latest manifestation of a significantly increased emphasis on business substance, both at home and overseas. Transfer pricing arrangements are coming under increasing scrutiny and tax authorities around the world are increasingly ready to challenge what they perceive to be abusive structures and arrangements. With increased transparency and automatic exchange of information, companies which do not have real substance run the risk of losing the benefits of Cyprus tax residence and becoming liable to pay tax elsewhere.

Indeed, a company lacking sufficient substance may be entirely disregarded by foreign tax authorities, running the risk that, in addition to any taxes payable by the company in Cyprus, its income is imputed to the beneficial owners in their own country and taxed there. The availability of a notional interest deduction in Cyprus provides an incentive to companies to increase their capital and economic substance and benefit from reduced taxation on new equity.

What are the three biggest challenges to practising Tax in Cyprus at the moment?

By and large, Cyprus is a benign environment for tax practitioners and for their clients. Tax legislation is modern, straightforward and stable. This means that practitioners and their clients can plan ahead with reasonable confidence that the rules will not be changed at short notice.

How does Tax fit into the firm as a whole? Is it easy to collaborate with other teams?

The benefits of the Cyprus tax system, and the comprehensive network of double tax agreements, mean that tax is a feature of almost every corporate or finance transaction. There are additional incentives for particular sectors, including shipping, intellectual property and funds management, so there is constant close cooperation between our tax specialists and their colleagues in other practice areas.

What advice would you give to the next generation of Tax lawyers?

Tax and international tax planning are fascinating, challenging and rewarding areas of the law and Cyprus is a great place to practise them.

What are your predictions for Tax in Cyprus over the next five years?

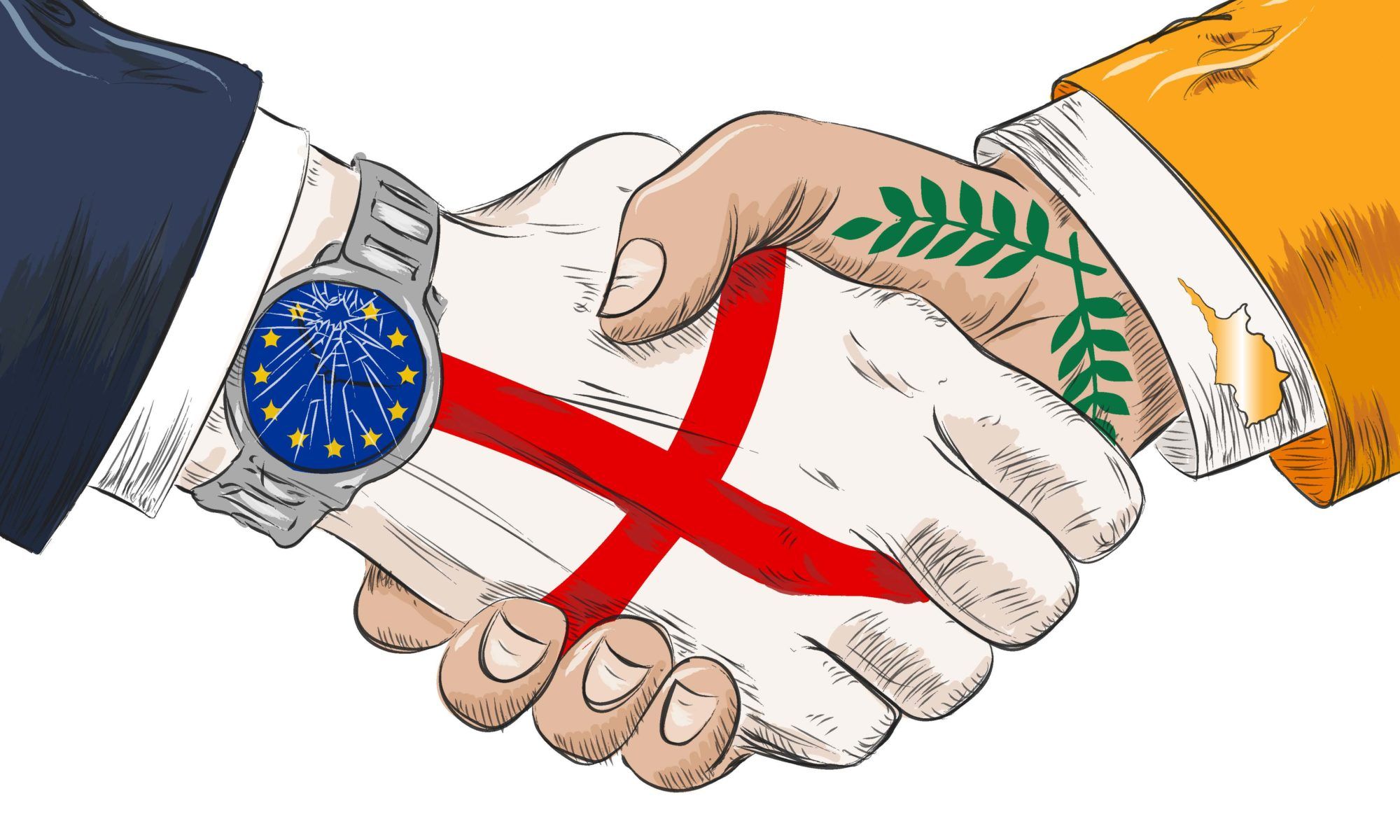

Given Cyprus’ status as an EU member state and its reputation for best practice and compliance with international standards, the main influence on tax law is likely to be EU legislation and international initiatives such as the Organisation for Economic Cooperation and Development (OECD)’s base erosion and profit shifting (BEPS) project. In addition, the government is committed to maintaining an internationally competitive tax environment and further incentives, consistent with EU and OECD standards, are likely to be put in place to stimulate businesses. With Cyprus’ strategic location and other benefits for business, tax practitioners are likely to stay busy.