1998 seems like a lifetime ago, where global e-commerce was a futuristic fantasy for ordinary people just discovering the internet. Yet 1998 was year zero for the European Union’s Data Protection Directive – the basis for legislation protecting personal data across member states today.

Out of this world

Outside of the catwalks of Milan, there’s probably nowhere on earth where fads come and go as quickly as in Silicon Valley. For every groundbreaking idea or transcendent success story, there are one hundred others that have just as quickly gone by the wayside.

GC Think Tank – Navigating the Corporate Crisis

Attendees

- Karen Braun, Sullivan & Cromwell

- Diane Brayton, The New York Times Company

- Jennifer Daniels, Colgate-Palmolive

- John Finley, The Blackstone Group

- Robert Giuffra, Sullivan & Cromwell

- Howard Harris, BMW of North America

- Paul Holmes, Finsbury

- Mihir Mysore, McKinsey & Company

- Pilar Ramos, MasterCard Worldwide

- Bob Rooney, Enbridge Inc.

- Joseph Shenker, Sullivan & Cromwell

- Catherine McGregor, The Legal 500

The GC’s role in a crisis

What role should the general counsel play in a crisis? How central should they be?

All crises require a point person to be decisive and lead the company through uncertainty. Oftentimes, companies turn to individuals from the c-suite to serve in this role. But increasingly, general counsel are finding themselves both coordinating and leading crisis response, given that the fallout often goes hand-in-hand with legal challenges.

The general counsel needs to act quickly by:

a) Defining the crisis.

b) Assembling a team.

c) Creating a flexible plan.

d) Instilling confidence to successfully implement the plan.

A) Defining the crisis

Crises come in all shapes and sizes. In some cases, the crisis is so huge that a company’s existence is at stake. But it is equally important to identify when a matter is at the lower end of the crisis scale. It is necessary for the general counsel to classify crises against levels appropriate to a company’s culture and industry.

Levels of Crisis:

a) Level 1: Low – problem identified, but probably only has one day in the press cycle.

b) Level 2: Medium – problem identified and seems significant, but diminishes over time.

c) Level 3: High – problem is an ‘existential crisis’ where the brand is at risk, affecting employees, the board of directors and potentially even the public at large. For a public company, this type of crisis will often have a significant impact on the share price.

Real life tip: Some companies have situation alerts, which immediately warn the GC of an impending situation if a certain number of criteria are met. These alerts can help tease out themes. For example, are there systematic compliance failures which could be building to a major crisis? Are there problems with the chain of command in certain departments or jurisdictions?

B) Assembling a team

A general counsel will typically have a substantial Rolodex of contacts in a variety of industries, who will be able to serve as trusted advisers in a crisis. Advisers will include (but aren’t limited to) people in the following areas:

- Outside counsel

- Outside financial consultants

- Public relations professionals

- Government/regulatory experts

- Trade groups

Real life tip: Don’t panic and ‘over-lawyer’. Less can often be more, as advice may become confusing and contradictory. If a ‘black swan’ event hits, it might appear that immediately consulting a range of advisers is best, but often this is not the case.

When you are in surgery, you don’t want five doctors, each with a scalpel, performing the operation – just one skilled surgeon being allowed to get on with the job.

C) Creating a flexible plan

Information available during a crisis, particularly in the first 24 hours, will often be imperfect. The general counsel must take steps to assess the facts and how they correspond to plans already in place, adjusting responses to the press, regulators and the public accordingly. As more information is obtained, the response plan must also take into consideration regulatory, litigation and communications issues, aligning the strategy of all three.

D) Instilling confidence to successfully implement the plan

The company’s employees, particularly those in the c-suite and on the board of directors, will look to the GC to provide assurance that they are effectively handling the process, which means that the GC needs to:

- Educate and secure the trust of executives.

- Communicate effectively, including with interested parties outside the company.

Real life tip: Understand that not all news is created equally.

Social media can descend into noise, and sound bites can become ‘facts’. To avoid this happening, wait for the facts, and assess them thoroughly before making pronouncements in the media. Initial statements can address that all facts are not known, and that the company is waiting to gather these.

As with any leader, the GC needs to remain calm in a crisis in order to be effective. Therefore, the GC:

- Must not lie or cover up.

- Must not speak out of ignorance.

- Must wait to speak until they have the facts, and avoid adding to legal implications.

- Must be human, showing heart and compassion.

- Must manage a news cycle that moves in seconds.

Using these guidelines, GCs across industry sectors can develop a framework that will not only mitigate damage from a present crisis, but could also avoid future crises.

Top 10 tips for managing a crisis

- Define the level.

- Create a flexible but succinct strategy.

- Keep a Rolodex of experts handy – these may vary by geography.

- Manage up, down and sideways, working effectively with a variety of constituencies, both internal and external.

- Remain poised and juggle issues. While the immediacy of the crisis may seem overwhelming, the general counsel needs to remain attuned to potential follow-on risks, such as litigation and regulatory enforcement.

- Manage executives effectively, including providing practical advice for the board.

- Understand that not all news is created equally and develop different strategies for different types of outlets, in conjunction with professionals internally and externally.

- Practice makes perfect and working through simulated crisis exercises can help GCs be thoughtful and in control.

- Identify red flags as soon as possible. Developing an alert system that can identify issues as soon as they are raised can avert or at least give an early warning of an impending crisis.

- Understand cultural differences when identifying and dealing with crises. The ability to report concerns and reporting style may vary from jurisdiction to jurisdiction. Similarly, methods of coping with the crisis will not be a ‘one-size-fits-all’ experience.

Trusted adviser: the power of collaboration

Collaboration is cited as one of the key challenges facing business today. That challenge can be exacerbated for lawyers, due to the very nature of what they do. While humans are inherently social animals, we are just as likely to compete with one another when resources are scarce and conditions are dynamic or uncertain. For some, that could characterise the modern law firm!

Continue reading “Trusted adviser: the power of collaboration”

Dinner with GC: Silicon Valley

Patent ‘trolls’, or non-practising entities, remain a thorn in the side of innovating companies in the US and abroad. But recent developments in both the courts and legislature are simultaneously attempting to deal with the issue – amounting to what could be a sea change for intellectual property law.

Inspiring the next generation: not a moot point

Palo Alto may conjure up images of unbridled wealth, hip workplaces and Tesla dealerships, but there is another side to Silicon Valley and its environs – that of East Palo Alto, with its underprivileged schools and one in four youths living in poverty.

Continue reading “Inspiring the next generation: not a moot point”

If you build it, he will come

Over the past year, I’ve spent a lot of my time talking to GCs, in-house legal teams and partners in private practice, to ensure that what we are doing at The Legal 500 matches up to the needs of the market.

Passing the baton: succession planning for GCs

Succession planning in the c-suite is a high-stakes game. Even well-managed transitions in the top jobs can lead to stock price fluctuations and queries about a company’s strategic direction and goals.

Continue reading “Passing the baton: succession planning for GCs”

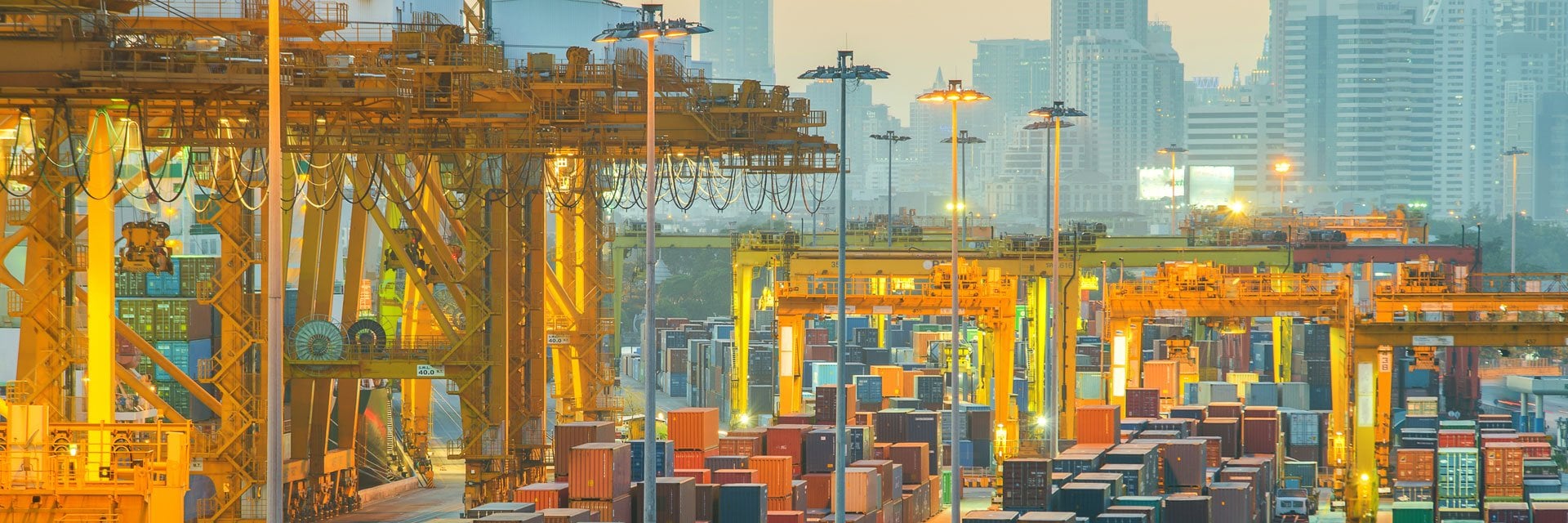

Foreword: Todd McClay

Asia Pacific is a very important part of the world and one whose significance continues to grow. These are a group of countries with large populations who are starting to grow very, very quickly. Individually, their economies are developing, while their engagement with the global economy is changing. Increasingly, they’re seeking external investment, while demand from consumers for goods and services continues to grow.

Recalibrating the global trade compass

For the past three decades, Asia Pacific has been the engine of growth for the global economy. In the wake of the East Asian financial crisis in the late 1990s, a gradual opening of economies and markets, most notably from China, has led to a boom – establishing new pillars of global economic strength alongside traditional mature economies in the region.