Setting the agenda

For the vast majority of organisations in the UK, the appetite for risk remains a factor that is set at the board level, as reported by 76% of those who took part in our research. While an increasing number of general counsel do have a seat at the board, the tendency to split the general counsel and company secretary roles in the UK – more so than in other jurisdictions – means that while most will offer an advisory role, direct input into the final decisions on risk appetite remains the exception, rather than the rule.

Where general counsel more commonly play a role is in setting the litigation and regulatory risk frameworks, although this was still largely the responsibility of the board in organisations. For the 77% of respondents who reported that their company had a risk management framework that covered litigation and regulatory risk, 46% said that this was set by the board, compared to 36% who reported this was a responsibility of the general counsel.

Companies where the general counsel was responsible for setting the regulatory and litigation risk framework were much more likely (62%) to cite data-related issues as a primary source of risk for the business, than for those whose framework was set by the board (40%). Organisations with a general counsel-led framework were also less likely to point to reputational and PR issues as a source of risk (20%) versus those where it was set by the board (43%).

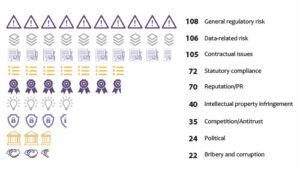

General regulatory risk was the most frequently cited source of risk for respondents. Of the 201 total respondents surveyed, 108 said it was a source of risk for their business, with many pointing to a swathe of new rules and regulations muddying the waters for general counsel when advising their businesses.

What are the biggest sources of litigation or regulatory risk facing your organisation?

‘[There has been a] wealth of new regulatory requirements introduced – market abuse regulations, Modern Slavery Act, gender pay reporting requirements, GDPR, payment practices reporting requirements, revised UK Corporate Governance Code, revised payment services directive and new ePrivacy regulations,’ says Sara Mackie, group general counsel of French Connection.

‘Navigating what these requirements are and ensuring we remain compliant is becoming an increasingly complex task.’

A number of general counsel also made reference to changing policies of enforcement for existing regulations, which means that a lack of predictability is creating new risk to be accounted for. One general counsel working in education surmised new enforcement standards for their industry as ‘an increasing reliance on using compliance as an assurance system by central government agencies.’

Freeths Comment

‘There’s no doubt that over the last 18 months or so our clients are seeing not only a wider spectrum of litigation and regulatory risks emerging, but also increasing frequency of those risks crystallising into situations that need to be addressed and resolved.’ – Philippa Dempster

‘Over the next 12 months we expect the trend to continue; for example there will be more drivers such as litigation funding and technology being used with increasing sophistication to launch group actions against corporates.’ – James Hartley

More than 18 months on from the introduction of GDPR, data-related issues remain a concern for a number of general counsel, with 106 respondents citing it as a primary source of risk. Many noted that GDPR had been a wake-up call for their business and had led to more stringent policies and controls internally, while at the same time increasing awareness to the inherent risk apparent to a degree that most hadn’t previously been appreciated.

With the research for this project focusing purely on general counsel based in the UK, perhaps somewhat surprising was the relatively small number of general counsel who reported political risk as being a major source of risk for their organisation (24 respondents). While the uncertainty caused by Brexit – both for business confidence and from a regulatory standpoint – was frequently brought up by those who cited political risk as a concern, most general counsel say they are taking a ‘wait and see’ approach.

Taking responsibility

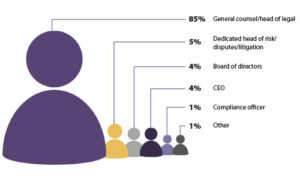

While it remains rare for general counsel to be directly responsible for setting the level of risk tolerance for an organisation, the overwhelming majority of respondents (85%) said that as the general counsel, it was under their purview that litigation and regulatory risk ultimately rested. For a number of those who participated in the research for this report, they viewed taking on that responsibility as an opportunity to demonstrate their value to the wider business.

This highlights an interesting dichotomy – on the one hand general counsel tend to have the responsibility for regulatory and litigation risk, but on the other hand it is usually the board that sets the level of risk appetite and the framework covering the risks.

‘It does enhance my position to be viewed by the organisation as someone who is able to predict, pre-empt and manage risk dynamically,’ says Ben Watts, general counsel of Kent County Council.

‘I am seen as someone who manages the disaster or difficult situations, and am able to gain control and create opportunity from that.’

Another general counsel – who was not authorised to comment publicly – noted that in some instances, regulatory and litigation work could be turned into a business driver.

‘It does pay to be seen as a risk manager rather than preventer, challenging the notion of what is a problem and what is an opportunity for business benefit,’ they say.

‘For example, we have been net profitable in general litigation this year, thanks to identifying opportunities and subsequently, pursuing them through the hard work from our disputes and litigation team.’

The ability to take on this role, however, did vary by sector. Those working for businesses that involved sensitive or highly regulated products and services, or those involved in public procurement, were more likely to have responsibilities for risk divested across multiple functions.

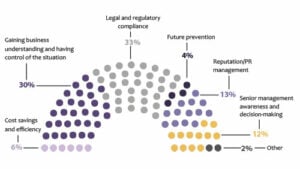

When responding to a risk that has eventuated, what should be the first priority?

‘Having both a pragmatic approach to risk and a broad view of the various factors in play, with a focus on delivering viable solutions, can enhance our reputation as counsel,’ says one general counsel from the construction sector.

‘But in our case, government approval is often necessary and that does not always result in a logical outcome.’

When assessing risk, the use of risk matrices was by far the most frequent method employed by general counsel, with 182 of those surveyed indicating it was a part of their personal and organisational toolkit. GCs tended to develop those matrices internally too, with only 16 respondents saying that they used external consultants for this purpose.

The use of external consultancies (not including law firms) in assessing risk was the second most popular method used by general counsel, with 40 of those surveyed saying that they have played a role.

While still representing a small proportion of the overall market, the use of AI-assisted tools across a range of business functions is gradually becoming more popular. While only 11 of those surveyed said that they were currently utilising AI solutions pertaining to risk, a number noted that technologies including cognitive analytics, data mining, machine learning, language processing and predictive analytics were either on their radar or being considered for use within their organisations.

One of those already utilising AI solutions for risk management was Jimmy Elliott, general counsel – Europe at the SAS Institute, who noted that while these tools present opportunities, they also came with their own set of risks.

Freeths Comment

‘Risk-management solutions, such as “Freeths Protect”, can be invaluable for businesses to evaluate a risk situation and formulate a route map for a controlled resolution.’ – James Hartley

‘Ethical data science and the use of AI have to be considered as a source of risk. We are an analytics company, so customers will look to us for enablement, best practices and governance recommendations,’ he says.

‘As with all risk management though, this also presents opportunities for us to differentiate our services in the market.’

Resource and reward

Anecdotally, it’s common to hear from general counsel that the legal department is increasingly being asked to take on more work, without the required injection of resources to facilitate it. But the results of our survey would suggest – at least when it comes to litigation and regulatory work – that businesses recognise the value and importance of this work.

91% of respondents reported that their legal department was either moderately (56%) or well-resourced (35%) to effectively assess and manage litigation and regulatory risk.

Those who felt that their legal department was well-resourced for handling risk almost exclusively had both their overall risk tolerance (84%), as well as (if applicable) their litigation and regulatory risk frameworks (75%) set by the board. It was also very likely that such organisations had been involved in formal litigation or regulatory activity in the past 12 months (84%)

For those GCs who felt that their department wasn’t sufficiently well-resourced, they were far less likely to have a company risk management framework covering litigation and risk (50%) than their well-resourced counterparts (13%). They were also far more likely to involve external law firms or consultants in their risk assessment efforts (83% vs 26%).

In your organisation, under whose purview does litigation and regulatory risk mostly fall?

Interestingly, the types of risks that general counsel reported were facing their businesses were markedly different between well-resourced and not well-resourced departments, too. Those that weren’t well resourced were much more likely to report reputational and PR risk as a primary source of risk (100% vs 21%) and far less likely to report data-related risk (33% vs 53%) as a concern.

Looking outside

For most of the in-house counsel surveyed as part of this research, the role of external law firms and consultancies in assessing and managing risk was limited. While 38% said that they did use these services in their risk assessment efforts, this was primarily limited to general consultative work. Instead, our research showed a strong preference for keeping as much work as possible in-house when it pertained to risk management.

‘I find that external advice helps to test my assumptions in difficult corners and avoids an echo chamber,’ says Watts.

Those who did utilise external firms in their risk assessment efforts were significantly more likely (70%) to have an established route map agreed with senior management to inform action and decision-making on litigation and regulatory issues, than those who did not (35%).

When a risk had materialised, in-house counsel were also divided in their approach about when the best time to consult or instruct outside was. 20% of respondents said that they engaged external service providers immediately after a risk had eventuated, 25% said that they did so only when a matter had escalated, while 49% waited until the point when they were considering litigation to engage.

Many respondents expressed dissatisfaction with the lack of certainty and predictability of external costs, particularly where regulatory and litigation work was concerned.

‘It is still a change for external law firms to accurately price with certainty across the life span of litigation or regulation work. While elements can be priced, there is a reluctance to fix prices on what might be more uncertain aspects of litigation,’ says David Morgan, general counsel at CPL Industries.

‘Cost is used as a tactical tool in litigation and the inability to forecast cost is a huge problem,’ adds Rolf Althen, group general counsel at Acteon Group.

Freeths Comment

‘There’s an increasingly tricky balancing exercise for GCs – on the one hand they are having to manage an ever widening spectrum of potentially high impact risks, whilst understandably wanting to defer going external until they really need to, because of the still too frequent problem of spiralling external costs.’ – James Hartley

‘We’re finding that our GC clients need a combination of deep expertise and insight, together with cost certainty for each stage of a matter. It is only with this combination that commercial solutions can be delivered which are of real value to the GCs we work with.’ – Philippa Dempster

‘We find that the earlier we get brought into to situations, the more control we can help GCs achieve when it comes to them managing internal decision-making by the board.’ – James Hartley

‘Corporates need to keep horizon scanning in order to pick up quickly on embryonic threats, so as to decide early on how to prepare and how to manage the risk.’ – Philippa Dempster

‘The charging structures of the firms are still in the last century. The litigation process is not controlled sufficiently by the courts; disclosure is still too complex and not focussed enough on the issues.’

When considering the type of provider to use, counsel were also divided. 47% said that they typically used domestic UK law firms, with 35% usually turning to international firms. Somewhat surprisingly, specialist litigation boutiques accounted for only 7%, with a number of respondents indicating that they had no experience using these types of firms.

External assistance

Third-party litigation funding is either a weapon or a tool for GCs. On the risk side, funding is one of the important drivers of increasing numbers of large-scale claims against corporates. Conversely, the ability to hedge litigation risk and bring in cash to fund a claim is attractive to some companies as they can pursue claims that might otherwise be left alone.

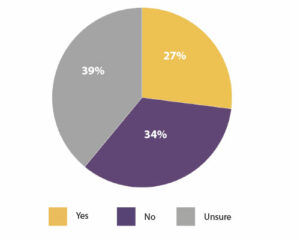

That said, one of the more interesting findings as part of this research, was learning just how divisive the issue of third-party litigation funding is amongst general counsel. Only 27% of general counsel supported the concept of third-party funding, with 34% against it and 39% unsure.

In the past decade, third-party litigation funding has become a more prevalent and sophisticated concept in the UK. No longer solely the domain of specialist funders, law firms, investment banks and insurance companies alike have entered the market and offered products relating to the financing of litigation.

‘It is good to have it as an option when there are other cash demands on the business and where it can be an effective way of funding the immediate costs off the P&L,’ says Morgan.

‘In certain circumstances it could be a significant benefit to a business, effectively taking away the negative financial impact of an adverse result and allowing a claim to be included as a business asset, freeing up investment in business opportunities and growth rather than legal costs,’ adds Tom Marke, general counsel for Europe at Multiplex Group.

‘On the flip side, funders require a strict budget/recovery ratio and good prospects of success. Why would you go to funding if you have good prospects and have to split recoveries with another party?’

Do you support the concept of third-party litigation funding as a benefit to your business?

While the issue of third-party litigation funding was divisive – particularly amongst those who said they had used it before – what stood out was the overall lack of experience most respondents had with using it.

While there were benefits apparent for mitigating risk for substantial disputes, a number of general counsel were apprehensive about ceding any control over litigation by bringing in a third party. While funders are prohibited from taking over litigation and exerting undue influence or control on proceedings, the loss of any autonomy when handling legal proceedings was prohibitive for a number of those who participated in our research.

‘I don’t think it would be considered by our board as appropriate, as it would wish to retain control at all times,’ says one general counsel from the healthcare industry.

‘Third-party funding introduces unnecessary complexity and control issues. It’s much better to bear the cost, keeping things simple and fully understood, while retaining control of the proceedings,’ adds one general counsel from the food and beverage sector.

Freeths Comment

‘We have certainly seen an uptick in the use of third-party funding to launch claims that would otherwise have died. There is still a lot of capital out there, coupled with increasing proactivity by funders who are spotting big-ticket claim opportunities.’ – James Hartley

‘We’re also seeing quite a lot of activity by US law firms and funders, who can see opportunities in the UK to transfer their successful models over here, particularly in class action litigation against corporates.’ – Philippa Dempster

‘The GCs we work with who view litigation as a financial investment decision tend to be better placed to make decisions on whether funding will be of any benefit to their business. That approach usually answers the question of whether the cost of funding is worthwhile.’ – Philippa Dempster

‘There are usually six key factors that we discuss with GCs to guide them on whether funding would be a good option for their business – it normally becomes self-evident once we have the initial discussions.’ – James Hartley

A number of general counsel noted that solutions such as third-party funding were adding further complexity to the prospect of litigation, with the options available becoming difficult to distinguish and navigate. One general counsel from a major multinational however had the opposite opinion, saying:

‘Certainly things are getting more complex, but I don’t necessarily think that is a bad thing. I think it is up to in-house counsel to understand the options at their disposal and provide effective advice on how to proceed, based on what’s available and what will produce the best outcome for the business.’