-

What proportion of transactions have involved a financial sponsor as a buyer or seller in the jurisdiction over the last 24 months?

The past two years continued to be marked by geopolitical tensions and conflicts, which sustained uncertainty across global markets. While supply chain disruptions eased compared to the pandemic era, companies still faced challenges in securing raw materials, spare parts, and skilled labor, particularly in sectors dependent on global trade routes. Energy and food prices remained volatile throughout 2024, though inflation across the euro area gradually declined from its peak levels in 2023. This allowed the European Central Bank (ECB) to begin a cycle of interest rate reductions, lowering its key rate from 4% to 3% by late 2024 and further to 2.5% by mid-2025, aiming to support economic recovery and investment activity.

Despite these improvements, corporate margins remained under pressure in early 2024 due to elevated input costs and cautious consumer spending. However, by the second half of 2025, sentiment improved significantly as financing conditions eased and inflation stabilized near the ECB’s 2% target.

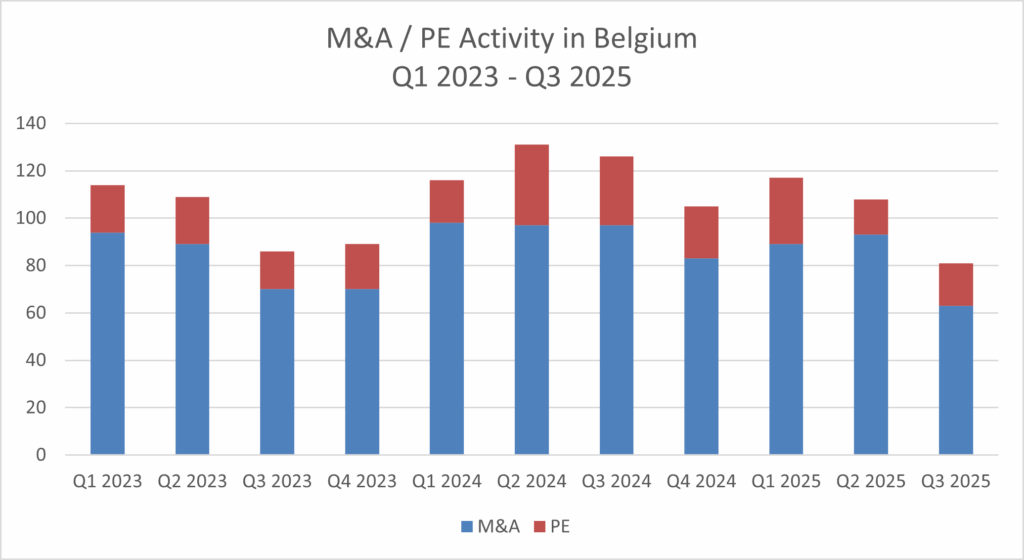

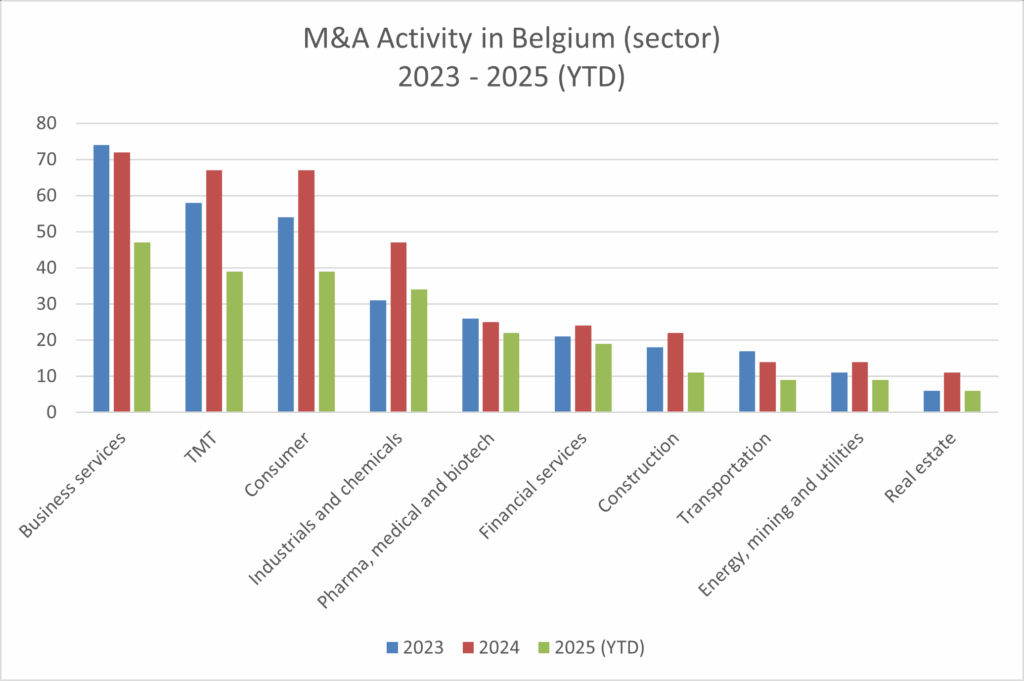

Global M&A activity, which had reached decade lows in 2023, began to recover in 2024, albeit gradually. Belgian deal activity mirrored this trend, with 2024 outperforming 2023 in terms of deal value and volume (as shown on the charts below), driven by renewed confidence and strategic repositioning by corporates. Key sectors contributing to this rebound included technology, healthcare, and industrials, while real estate continued to lag behind although showing signs of improvement compared to 2023.

Private equity (PE) sponsors faced significant headwinds in early 2024 due to high financing costs, but the situation improved markedly in the second half of the year. The proportion of deals involving financial sponsors rose from 19% in Q1 2024 to 35% in Q2, stabilizing around 33% in Q3 and Q4, supported by abundant dry powder and expectations of further interest rate cuts. By 2025, PE activity accelerated as debt markets normalized, enabling larger transactions and more competitive bidding processes.

Looking ahead, 2026 is expected to mark a further recovery in European and Belgian M&A markets, with deal volumes approaching pre-2022 levels. Key drivers include (i) lower cost of capital following anticipated ECB rate cuts to around 2% by early 2026, (ii) improved macroeconomic stability, with inflation under control and GDP growth returning to moderate levels, (iii) sectoral shifts, with technology, renewable energy, and healthcare expected to dominate deal flow, while real estate may gradually re-enter the top sectors as financing conditions improve and (iv) private equity resurgence, fuelled by record levels of dry powder and renewed appetite for leveraged buyouts.

Strategic buyers will continue to pursue consolidation and diversification, while financial sponsors are likely to focus on mid-market opportunities and carve-outs, given lingering caution around mega-deals.

-

What are the main differences in M&A transaction terms between acquiring a business from a trade seller and financial sponsor backed company in your jurisdiction?

Financial sponsors will seek a clean exit and more often dispose of assets through a controlled auction. This is one of the reasons that financial sponsors favour the locked box approach providing the possibility to distribute the consideration more quickly. The absence of any post-completion adjustment eliminates the need to hold back funds in case adjustment works against the seller. For the same reasons, sometimes financial sponsors are only prepared to give limited “fundamental” warranties (i.e. due existence, due authority and title to shares). Consequently, buyers of businesses that are owned by financial sponsors often take out warranty and indemnity insurance to ensure that business warranties can be obtained backed by appropriate financial protection.

-

On an acquisition of shares, what is the process for effecting the transfer of the shares and are transfer taxes payable?

Process for effecting the transfer of the shares

The formalities for effecting the transfer of shares under Belgian law are limited and depend on the type of shares. Shares in a Belgian limited liability company (BV/SRL or NV/SA) are usually registered, and the ownership of these shares must be recorded in the company’s share register. Title to registered shares is evidenced by their registration in the company’s share register. Consequently, at closing, the transfer of registered shares is perfected by recording such transfer in the company’s share register. Usually, parties grant a power of attorney to their local counsel to effectuate this. In recent practice, Belgian companies are increasingly utilizing electronic share registers through digital platforms, if this is provided for in their articles of association. Shares in a Belgian NV/SA or a listed Belgian BV/SRL can also be issued in dematerialized form, although it is very rare to encounter dematerialized shares in M&A transactions involving a financial sponsor.

No transfer taxes payable

As a matter of principle, there is no transfer tax, registration duty or stamp duty due on the sale of shares in a Belgian privately-held company, even if the company’s sole assets consist of real estate (except for cases of abuse or simulation). Transfers of listed shares are in principle subject to a tax on stock exchange transactions – extensive exemptions and caps are however available depending on the exact circumstances.

-

How do financial sponsors provide comfort to sellers where the purchasing entity is a special purpose vehicle?

Where the purchasing entity is a special purpose vehicle, financial sponsors seek to provide comfort to sellers by providing an equity commitment letter or parent guarantee from the purchasing fund. If the acquisition by the special purpose vehicle is funded through external financing, buyers will seek to provide the sellers with debt commitment letters from banks before the signing of the SPA.

-

How prevalent is the use of locked box pricing mechanisms in your jurisdiction and in what circumstances are these ordinarily seen?

Locked box pricing mechanisms are used in almost 60% of the transactions, a trend that has been increasing over the past few years. They are especially prevalent in transactions with a deal value of more than EUR 100 million. The locked box approach is the favoured approach of selling financial sponsors, allowing a clean exit and providing the possibility to distribute the consideration more quickly. The absence of any post completion adjustment eliminates the need to hold back funds in case adjustment works against the seller. It may be problematic for a buyer to agree to a locked-box mechanism where the target is carved-out from a larger group, since it is easier for the seller to manipulate leakage from the target, for example, by hedging agreements, allocation of group overheads, current accounts and intra-group trading. Generally, however, if carefully drafted, the indemnity for leakage should provide for an adequate remedy.

-

What are the typical methods and constructs of how risk is allocated between a buyer and seller?

Risk is most commonly allocated between a buyer and a seller through warranties and specific indemnities. In addition, parties sometimes allocate the risk of changes in circumstances between signing and closing by including a MAC clause.

It is common practice for the seller to give warranties relating to the business that is being sold. Several factors influence the scope of the warranties and the scope and outcome of the due diligence investigation is often an important factor in this regard.

Warranties

The inclusion of warranties in the acquisition agreement is the most common method of allocating risk between a buyer and a seller. Almost all acquisition agreements contain warranties by the seller. Typical standard warranties include a warranty with respect to the target company’s accounts, the target company’s compliance with laws, and the seller’s full and accurate disclosure. The seller’s liability under the warranties is usually made subject to an exception to the effect that the seller shall not be liable for damages on the basis of facts that had been disclosed to the buyer. In Belgium, full data room disclosures are considered market practice. Alternatively, disclosures are restricted to specific disclosure schedules or letters.

However, based on the requirement to carry out an agreement in good faith, the Court of Appeal of Liège (2 April 2015, see also a similar decision by the Court of Appeal of Ghent dated 18 February 2013) has decided that a buyer cannot invoke the indemnification obligation of the seller in relation to facts that it was aware of (or should reasonably have been aware of) even if such facts have not been explicitly referred to as ‘disclosed’ in the agreement. Consequently, it cannot be excluded that a Belgian judge would consider the data room disclosed even if the agreement does not explicitly provide for a data room disclosure. Taking this into account, purchasers should push for a reduction of the purchase price or a specific indemnity to cover risks that are known to it (see further below).

The seller’s indemnification obligation under the warranties is, moreover, typically made subject to both limitations in time and of the amount of the indemnification obligation. A general limitation in time of the seller’s indemnification obligation for claims under the warranties is included in almost all acquisition agreements. Belgian acquisition agreements often provide for a time limit tied to a full audit cycle to give the buyer the opportunity to discover any problems with its acquisition (i.e. 18- or 24-months following completion). Time limits will generally be longer for claims for breach of certain fundamental or specific warranties: (i) for title warranties, the time limit is often tied to the applicable statute of limitations, and (ii) for tax warranties, this will typically be within a short period after the last day on which a tax authority can claim the underlying tax from the target. Limitations of the amount of the seller’s indemnification obligation usually include both a de minimis threshold for individual claims as well as an aggregate de minimis threshold (“basket”) for all damage claims taken together. As a very general rule of thumb, the market usually refers to a basket of 1% of the purchase price and a de minimis of 0.1%. These thresholds do not typically operate as deductible amounts, and thus claims exceeding the thresholds are usually eligible for indemnification for the entire amount of the claim (“tipping basket”). As regards maximum liability, the seller’s liability is almost always capped. Depending on the deal size, we typically see ranges between 10% and 30% of the purchase price. The amount of the cap as a proportion of the purchase price tends to be inversely proportional to the deal value of the transaction.

Specific indemnities

In addition to warranties, a purchaser will want to include indemnities to cover specific risks identified during due diligence (e.g. tax, pending litigation or environmental pollution) of which it is difficult to identify the exact extent and thus the associated costs.

Specific indemnities are not qualified by disclosure and are not (entirely) subject to the agreed limitations of liability (e.g. time limitation, de minimis and basket). Indemnities are mostly given on a euro for euro basis. Although, in most cases indemnity claims will be subject to a separate cap (often the liability will be limited to an amount equal to the purchase price).

Such indemnification mechanisms are slightly less common in small transactions and competitive auctions. The use of specific indemnities has, however, increased during the last decade.

MAC clauses

It should also be noted that in transactions with a deferred closing, “Material Adverse Change” (“MAC”) clauses are sometimes used to allocate risks related to changes of circumstances in the period between the signing of the acquisition agreement and the closing of the transaction. Under a MAC clause, the buyer may terminate the acquisition agreement if there is a material negative change of circumstances during such period. MAC clauses are usually included as a condition precedent to closing, but sometimes also take the form of a “backdoor MAC”, i.e. a warranty by the seller regarding the absence of a material adverse change between signing and closing in combination with a termination right of the purchaser for breach of warranty. In Belgium, MACs are mostly used to protect against risks that are specific to the target company. General risks affecting e.g. the economy or the political climate in general are usually excluded. Buyers negotiating MAC exclusions will wish to include a ’disproportionally affects’ qualifier, thereby securing the right to still invoke the MAC clause if the target is disproportionally affected as compared to other companies acting in the same industry. In case of leveraged transactions, buyers will also try to ensure that the MAC clause in the acquisition agreement ties in with the MAC clauses in their financing agreements in order to avoid any ‘financing gap’.

A reform of the Belgian Civil Code has been implemented in respect of general contract law as per 1 January 2023. The new legislation mainly codifies certain principles previously only reflected in case law and increases the possibility for parties to take matters in their own hands. A novelty under Belgian law is the introduction of the “hardship” principle: a party shall be entitled to request the revision of a contract if its execution becomes excessively burdensome due to unforeseeable circumstances beyond the control of that party. Protection against hardship becomes as such the rule, unless it has been excluded by law or contract. This is in contrast to the previously existing Belgian legislation where obligors had to provide for explicit contractual protection to deal with any adverse consequences of unforeseeable circumstances. Particular attention has to be given to the drafting of MAC clauses in view of this law.

-

How prevalent is the use of W&I insurance in your transactions?

For years, Belgium lagged behind in the adoption of W&I insurance policies in M&A transactions, but following the catch up in the past few years it can now be considered a common feature of Belgian transactions. Selling financial sponsors that are looking for a clean exit are resorting to W&I in an increasing number of cases. In 2024, W&I insurance policies have been included in 50% of large transactions with high deal values (>100M EUR) with mid-market and especially smaller deals also showing a marked increase in W&I insurance usage (25% in 2024, up from 9% in 2020 in the 20-50M EUR segment). Also, in auction processes with higher sell-side negotiating power, W&I insurance has become a common feature. More and more other insurance products are entering the market such as tax insurance, which protects the insured against financial losses arising from a successful challenge by tax authorities of a known insured tax treatment.

-

How active have financial sponsors been in acquiring publicly listed companies?

While there have been a number of acquisitions of publicly listed companies by financial sponsors in Belgium in the past, such operations remain unusual on the Belgian private equity market. In 2025, the Deprez family, Greenyard’s reference shareholder, with the support of financial sponsor Solum Partners, launched a takeover bid for the shares not yet owned in Greenyard, a global market leader in fresh, frozen and prepared produce: fruits and vegetables, flowers and plants. The offer was successful and Greenyard was delisted on 4 September 2025.

Similarly, the De Nolf-Claeys family launched a public takeover for the shares not yet owned inRoularta Media Group, the multimedia group active in Belgium and the Netherlands, ultimately falling just short of the simplified squeeze-out threshold so that free float currently sits at a little over 5%.

In early spring, Alyrick, a special purpose vehicle incorporated by Alychlo, the family office of Mr. Marc Coucke, and Mr. Philippe Vlerick, entered into a number of private transactions with large shareholders of Smartphoto Group, resulting in the launch a of a mandatory public offer for all remaining shares in Smartphoto Group, which operates the smartphoto platform. The offer was successful and Smartphoto Group’s shares were delisted in July 2025.

On the strategic front, the pending public takeover offer in the real estate sector by Aedifica for Cofinimmo is noteworthy.

-

Outside of anti-trust and heavily regulated sectors, are there any foreign investment controls or other governmental consents which are typically required to be made by financial sponsors?

Belgium

While Belgium maintains an open policy towards foreign investment and foreign investors can generally freely incorporate new companies and establish subsidiaries, the Belgian legislator has adopted a foreign direct investment (FDI) screening regime which entered into force on 1 July 2023. This made Belgium one of the last EU member states to adopt legislation designed to protect its national security, public order, and strategic interests from the impact of FDI. This forms part of a wider EU trend towards greater scrutiny of foreign investment and trade.

Scope

Questions about the FDI screening mechanism’s scope remain, although an FAQ is available providing some clarity. Additionally, the ISC’s secretariat is actively addressing individual requests for further information from market participants.

The FDI process requires foreign investors who invest in Belgian entities falling under the Belgian FDI regime to file to the ISC. Generally, EU companies are not deemed “foreign investors” unless they have an ultimate beneficial owner (UBO) outside the EU. However, investors from EFTA States are classified as “foreign investors.”

Intra-group restructurings are not exempted. This means that transfers of shares in a Belgian entity from an EU company to another EU member state company, both having the same non-EU UBO, may need to be considered. A foreign investor is only required to file an FDI if they acquire control or a significant percentage of voting rights.

FDIs that result in control acquisitions or ownership of 25% or more voting rights in Belgian companies involved in certain sectors must be reported. These sectors include vital infrastructure, essential security resources, critical inputs, access to sensitive information, the private security sector, media freedom and plurality, and strategic technologies in the biotechnology sector.

Companies with access to sensitive information and personal data or the ability to control such information are also covered.

A lower threshold of 10% of voting rights applies to companies involved in defence sectors, energy, cybersecurity, electronic communication, digital infrastructures, and having a turnover exceeding EUR 100 million. It has been clarified that the sectors list is exhaustive. The impact of the reference to access to sensitive information and personal data is still uncertain as most companies have access to such information.

Supervision and enforcement

Members of the ISC hold significant ex officio powers to review transactions that have not been formally notified. While they lack the authority to reverse finalized transactions, they do maintain the ability to mandate structural adjustments and implement corrective measures. This power extends up to two years post-acquisition, or even five years in instances of demonstrable bad faith. These potential modifications encompass a wide range of alterations and should be interpreted in their broadest context.

Fines of up to 10% of the transaction value can be imposed for non-compliance, or 30% in cases of bad faith, but these will not be imposed for transactions signed before 1 July 2023.

Transactions signed before 1 July 2023 do not need a Belgian FDI filing, but the ISC can initiate an ex officio procedure up to two years after a non-notified acquisition of control or five years in the case of bad faith. It is unclear how often this procedure will be used for transactions prior to 1 July 2023, but it is believed it will be reserved for extreme situations only.

Key Figures

In its second year, the ISC received 100 FDI notifications, averaging 8-9 per month. Of these, only five triggered a second-phase screening and two notifications were withdrawn by the investors. At the time of the report’s publication, three screening processes had been fully completed following which one transaction was approved with mitigating measures (including placing certain technology, source code and/or know-how in the custody of a third party in Belgium; guarantees to ensure the continuity of certain processes; the appointment of one or more compliance officers). Additionally, the ISC requested additional information in relation to 16 non-notified investments to determine whether notification should have occurred.

The majority notifications involved the ‘data’, ‘digital infrastructure’ and ‘energy’ sectors. The prevalence of notifications concerning the ‘data’ sector raises questions the current definition “access to sensitive data, including personal data or the ability to control such data”, which may lead to an excessive number of notifications.

22% of all notifications involved internal restructurings, which are not exempt from the Belgian FDI regime. In 36.4% of these cases, the ultimate beneficial owner remained unchanged.

The report further highlights the dominance of U.S. investors, who accounted for nearly half of all notified transactions. The United Kingdom and Japan followed, while five notifications involved Chinese investors. Regionally, most investments affected the Flemish and Brussels regions, with fewer impacting the Walloon region.

Flanders

In line with similar initiatives in other European countries, the Flemish government has adopted a decree which entered into effect on 1 January 2019. Flanders accordingly has an ex post intervention mechanism in place for investments allowing foreign investors to control public authorities or related bodies that would entail a threat for the strategic interests of Flanders. It is not yet clear what the effect of the new FDI regime above will be on the Flemish FDI regime.

EU

On 20 June 2023 the EU Commission released its Economic Security Strategy which includes further plans to enhance the EU framework for foreign direct investment screening and even EU outbound investment screening.

In line with such Economic Security Strategy, on 24 January 2024, the Commission adopted five initiatives to strengthen the EU’s economic security at a time of growing geopolitical tensions and profound technological shifts. One of these initiatives concerns further strengthening the protection of EU security and public order by proposing improved screening of foreign investment into the EU, including a legislative proposal building on the experience gained by the Commission reviewing over 1,200 FDI transactions notified over the previous three years under the existing FDI screening regulation.

On 11 December 2025, the European Parliament and the Council reached a political agreement on the revised FDI Screening Regulation. The agreement introduces (among others):

- A mandatory minimum scope of sectors that must be screened by all Member States, including AI, quantum tech, semiconductors, critical infrastructures, electoral systems, and certain financial entities.

- Enhanced coordination and transparency, requiring Member States to explain how they accounted for the Commission’s or other Member States’ input.

- Optional creation of a single EU digital portal as a unified interface for filing.

-

How is the risk of merger clearance normally dealt with where a financial sponsor is the acquirer?

If merger clearance is required, it is standard practice to include this as a condition precedent to the closing of the transaction in the acquisition agreement. Merger clearances involving financial sponsors usually do not trigger competition issues, unless the financial sponsor has portfolio companies which overlap with the business of the target. Depending on the parties’ bargaining power, we see several practices for the allocation of the risk of merger clearance between the parties. Usually, the buyer bears the risk of any required divestments, although it is not uncommon for these risks to be capped in one way or another (e.g. no obligation for the buyer to offer divestments that are disproportionate to the contemplated transaction). However, in the context of transactions organized as competitive auctions, the acquisition agreement exceptionally includes a “hell or high water” clause, whereby the buyer is obligated to take all steps to satisfy the requirements imposed by the competition authorities (including divestitures) to obtain merger clearance.

-

Have you seen an increase in (A) the number of minority investments undertaken by financial sponsors and are they typically structured as equity investments with certain minority protections or as debt-like investments with rights to participate in the equity upside; and (B) ‘continuation fund’ transactions where a financial sponsor divests one or more portfolio companies to funds managed by the same sponsor?

Most minority investments by financial sponsors are structured as straight equity investments. Convertible bonds and subscription rights that can be converted into equity are also quite common, but usually only in addition to a substantial debt or equity investment. In co-investment transactions (e.g. management buyouts), the secondary investors are sometimes granted profit sharing certificates or shares without voting rights.

In the case of straight equity investments, financial sponsors typically subscribe to a capital increase of the target company in return for shares with preferred rights on dividends and liquidation proceeds as well as certain special rights bestowing control, or at least influence, over the target company.

Typical minority protections sought by financial sponsors include the right to information by periodic reporting, the right to appoint board members and/or the right to appoint board observer, and consultation or veto rights concerning certain decisions to be taken by the board of directors or the shareholders’ meeting. Moreover, certain “exit clauses” are usually sought by financial sponsors, the most common being standstill provisions, right of first refusal, drag-along and tag-along clauses, as well as put-options.

Minority investments are typically more recurring in early stage funding such as venture capital, although we do see an increasing number of re-investments of financial sponsors when exiting. A recent example was the exit of Summit Partners and Clinimetrics SA from CluePoints, where EQT Healthcare Growth Strategy and the EQT Growth Fund acquired a majority stake with a meaningful (minority) reinvestment from Summit Partners and the management team.

Europe has traditionally seen much lower levels of venture capital investments both in terms of total numbers as well as per capital, with extreme low levels in 2022 – 2023 (compared to extremely high levels of venture capital investments globally, including also Europe, in 2020 and 2021). In the first half of 2024 we started seeing again an increasing number of priced rounds also for growth financing with this trend continuing throughout 2024 and into 2025. The situation has also much improved for seed financings in many European countries with a vast number of new seed funds. In terms of sectors, most activity is seen in B2B SaaS, AI, and – more recently – defense.

-

How are management incentive schemes typically structured?

Most management incentive schemes are conceptually structured as either stock option plans or free share plans, the latter being less beneficial for Belgian tax residents from a tax and social security point of view.

In practice, Belgian employees are often offered options on the basis of a stock option plan issued by a foreign parent company. In such cases, these plans usually require some alteration to enable the application of the tax beneficial treatment of the Belgian tax law on stock options. We continue to see tax litigation with respect to plans set up by parent companies in the past, whereby Belgian tax authorities claim that expenses in relation to the stock option plan which are cross-charged to the Belgian employer, are considered non-deductible by the tax authorities.

In co-investment schemes, the shares are usually acquired directly by the managers as capital gains on shares are, in principle, exempt from personal income tax under current law. We have noticed however an increased awareness (and anticipate tax litigation) on the tax treatment applicable to capital gains realised on ratchet shares/shares with a sweet-equity component (i.e. whether the “disproportionate return” should not qualify as miscellaneous income taxable at 33% + local taxes). Where future exits do not take the form of capital gains but rather give rise to dividend upstreaming, additional structuring might be envisaged in order to try to lower or defer the tax pressure (dividends are – in principle – taxed at a flat rate of 30% in the personal income tax, however conditional lower rates may apply if e.g. the investment is held through a personal service company of the manager).

A tax reform is pending that would introduce capital gains taxation on financial instruments in the personal income tax for gains accrued as of 1 January 2026 (with specific valuation rules for shares obtained through an exercise of qualifying options), with applicable tax rates up to 10% (for sales to third parties). At the date of this article, the reform has not yet been submitted to Parliament.

-

Are there any specific tax rules which commonly feature in the structuring of management's incentive schemes?

The Belgian Stock Option Act of 26 March 1999 introduced a favourable tax regime for stock options in Belgium (“Stock Option Regime”), designed to stimulate the grant of stock options to employees, company directors and self-employed individuals.

In order to benefit from the Stock Option Regime, the options have a.o. to be offered in writing and accepted within 60 days following the offer date1. Taxation occurs at grant (60 days following the offer date), irrespective of whether the options are conditional or not (e.g., vesting conditions, performance based vesting criteria, etc.). The taxable basis is determined on a lump-sum basis. It varies between 9% and 23% of the value of the underlying shares and is taxed as professional income (effective tax rate ranging between approx. 5% and 12%). Capital gains realized on the subsequent sale of the underlying shares are as a rule not taxable (see however increased awareness around capital gains on ratchet shares/sweet equity instruments and pending law reform).

In addition, stock options granted to employees are, under the Stock Option Regime, exempt from social security contributions. This is a double advantage: no employer contributions (+/- 27% uncapped) nor employee contributions (13,07% uncapped) need to be paid with respect to this type of management incentive plans.

The Stock Option Regime is often set up in an international context, leading to possible mismatches and double taxation in the absence of a proper international structuring.

Please note that the preferential tax regime applicable to the Stock Option Regime is different from the grant of free shares, restricted stock (units) or phantom shares, for which taxation occurs at vesting (based on the value of the shares upon that date) and are taxable following the same rules mentioned hereabove (i.e. professional income taxable at progressive tax rates).

A favourable tax and social security regime also applies under certain conditions to restricted stock units. Provided that the employee and the employer mutually agree that the shares are blocked for an uninterrupted period of two years following vesting, social security contributions and income tax is calculated on 83,33% of the market value of the shares upon vesting. This favourable regime only applies to listed shares.

-

Are senior managers subject to non-competes and if so what is the general duration?

At senior level, non-compete clauses are relatively common. However, in practice we see that non-compete clauses for employees are rarely activated after termination of employment: in order for the non-compete to be valid, a consideration is to be paid equal to the employee’s salary for at least half of the restrictive period if the clause is activated. Often this is not considered worth the cost.

The validity conditions for non-compete clauses for self-employed managers are less stringent (e.g. in terms of consideration) and are therefore fairly standard in these types of agreements. The non-compete period for senior managers is usually set at 12 months following termination of their employment. In exceptional and justified circumstances, we sometimes see non-compete periods of 24 months.

The failure to comply with non-compete undertakings is, at least for managers acting as independent service providers, often sanctioned by liquidated damages, the amount of which is agreed in advance. The court may reduce the amount of the liquidated damages if it considers it to be manifestly excessive or set aside the clause if it deems it unfair and unlawful. Furthermore, pursuant to the case law of the Belgian Court of Cassation, if the (temporal and/or geographical) scope of the non-compete obligation itself is deemed to be excessive, the court can reduce the scope to its fair part when the agreement contains a severability clause.

-

How does a financial sponsor typically ensure it has control over material business decisions made by the portfolio company and what are the typical documents used to regulate the governance of the portfolio company?

In general, there are three main ways through which financial sponsors typically ensure some level of control over their portfolio companies:

a. Information rights: the least far-reaching method of ensuring some level of control is by imposing information covenants on the portfolio company towards the financial sponsor. This duty to inform the financial sponsor can be periodical, topical or a combination of both.

b. Nomination rights: financial investors, even when holding only a minority of the shares, may pursue the right to nominate one or more members, or observers, to the board of directors of the portfolio company. It is, however, important to note that each director of a Belgian company has the fiduciary duty to act within the company’s best interest, thereby disregarding the interest of its nominating shareholder. For this reason, financial sponsors sometimes prefer to only have observer seats on the board instead of actual board seats.

c. Veto rights: the most intrusive way of obtaining control as a minority investor is by requesting veto rights over specific corporate actions or material business decisions of the portfolio company, either at the level of the board of directors or the shareholders’ meeting. Veto rights are usually attached to a separate class of shares, which are issued to the financial sponsor. The governance of the portfolio company is usually regulated through a shareholders’ agreement and the articles of association of the company. Note that in Belgium the articles of association of a company are in principle publicly accessible. When structuring veto rights, a recurring point of attention is to make sure that also the subsidiaries of the portfolio company will be subject to the same reserved matters to ascertain that all decisions on reserved matters to be made within the portfolio group will ultimately be subject to the prior (direct or indirect) approval of the financial sponsor.

Further, reference is made to the use of pooling vehicles set out in Section 15.

-

Is it common to use management pooling vehicles where there are a large number of employee shareholders?

The use of a management pooling vehicle is indeed becoming a standard feature in Belgian companies with a substantial number of employee shareholders in the context of a management incentive plan (MIP). Management pooling vehicles allow for a large number of employees to obtain the economic benefit of being a shareholder, but without allowing them to have voting and/or meeting rights (i.e. the right to attend general meetings) or to become a party to the shareholders’ agreement.

A structure that is typically used in transactions involving a financial sponsor as acquirer, is a Dutch STAK or a private limited liability company (BV/SRL). A STAK can be used to pool shares that are acquired in another company, for instance shares acquired by employees in the framework of an incentive plan or management that has reinvested in the newly acquired company. The STAK then issues exchangeable depositary receipts to the owner of the shares. The STAK thus enters into an agreement with the owner of the shares, transferring legal ownership of the shares to the STAK, while the original owner maintains economic ownership of the shares. In this way, the original owner of the shares (now the depositary receipt holder) will receive dividends from the acquired shares, even though he or she is no longer the legal owner of the shares (and not entitled to vote with those shares). While this is generally not advised, also Belgian foundations are used as pooling vehicles.

Although not common, we also see other types of vehicles being used from time to time to organise the purchase of company shares by a large group of employees (whether or not at market value) following which these employees are entitled to dividend income which becomes payable if case certain targets are met. The pooling vehicle is in such situations usually a blocked bank account (employees have no access) from which payments automatically occur to each employee once payment conditions are satisfied in accordance with the incentive plan. These pooling vehicles may trigger tax issues (e.g. as they represent X number of shareholders – i.e. employees holding X number of shares, triggering typical shareholder rights and obligations for these employees although they do not effectively hold these shares).

In case a pooling vehicle is not yet established at the outset of a MIP, the plan often contains a clause containing a possible transfer of the MIP securities to a separate pooling vehicle. Such clause provides for the obligation to transfer the respective securities to a pooling vehicle, immediately upon request of the board of directors of the respective company, following which the respective beneficiary will be entitled to receive the proceeds (i.e. the economic rights attached to the securities) from those securities held in escrow by said holding structure, but all other rights (including voting rights) with respect to the securities will vest in the pooling vehicle.

-

What are the most commonly used debt finance capital structures across small, medium and large financings?

In Belgium, debt financing for private equity-backed structures is usually obtained through traditional bank debt facilities. Alternative debt finance structures, such as senior and mezzanine financing or unitranche facilities may also be considered depending on the transaction structure. For larger transactions, borrowers may opt for high yield bonds or broadly syndicated facilities.

We have also seen an increase in the use of borrowing base facilities to finance working capital needs which complement the term loan facilities that are mainly used to finance acquisition costs. Loans are usually syndicated either before or after the deal is done. For post-closing syndication, one of the main concerns for lenders is establishing a mechanism for transferring loans without costs or formalities while ensuring that the full security package benefits any new lenders. Solely based on recent professional experiences, we also notice an increase of remaining funding gaps being filled with vendor loans and/or earn-out arrangements.

-

Is financial assistance legislation applicable to debt financing arrangements? If so, how is that normally dealt with?

Under the Belgian Companies’ and Associations’ Code, the Belgian financial assistance rules apply to public limited liability companies (NV/SA), private limited liability companies (BV/SRL), and cooperative companies (CV/SC). Under these rules, such Belgian companies may not grant any advance, loan, credit or security (personal or proprietary) with a view to the acquisition or subscription of its shares by a third party, unless in accordance with a specific procedure and under certain conditions (it being understood that such procedure and conditions are slightly more flexible under the BV/SRL and CV/SC company forms, as compared to the NV/SA company form). Any advance, loan, credit or security granted in breach of the financial assistance rules is considered null and void. In addition, unlawful financial assistance may trigger the civil liability of the directors (both towards third parties and towards the company itself).

To date, the financial assistance procedures are rarely applied, since less stringent alternatives are conceivable. Where feasible, debt push downs structures may be implemented, however potential tax implications must be carefully considered as these structures have recently come under scrutiny by the Belgian tax administration. Another common way to deal with this problem is to divide the financing into various tranches whereby the Belgian target company is not required to grant security for the tranche applied towards the acquisition of its shares.

-

For a typical financing, is there a standard form of credit agreement used which is then negotiated and typically how material is the level of negotiation?

While small, bilateral financings are usually based on the relevant bank’s standard documentation, the large majority of acquisition financings will be based on the Loan Market Association’s (LMA) standard form leveraged facility agreement, mostly governed by Belgian law. The extent of negotiations greatly depends on several factors, including deal size, type of lenders, type and size of sponsor, sponsor’s strategy for the target group and the financial strength of the target group. When the LMA standard form documentation is used as the base, negotiations mainly focus on the commercial terms of the transaction and tailoring the credit agreement as much as possible to the structure of the deal.

-

What have been the key areas of negotiation between borrowers and lenders in the last two years?

Although the level of negotiation strongly varies per transaction, the principal areas of negotiation between borrowers and lenders have centred in the last years mainly on general undertakings (even more so for buy-and-build companies), financial covenants, (in particular the use of equity cures and the scope of EBITDA normalisations) and financial reporting. Interestingly, the leveraged loan market, including traditional banks, have shown a growing acceptance for looser covenants, likely due to increased competition within the market. Additionally, the impact and implementation of ESG and related performance indicators have become focal points in certain transactions, reflecting the growing importance of these considerations in the financial sector.

-

Have you seen an increase or use of private equity credit funds as sources of debt capital?

In recent years, we have seen a marked increase in the use of private equity funds as sources of debt capital. This can take the form of a mezzanine or Term Loan B type participation in a larger syndicated financing or a direct financing solely provided by one or more funds. The trend can be seen throughout the debt capital market, including acquisition financing as well as real estate financing for example. This is particularly the case for transactions where structural flexibility is more important than pricing. Bank lending, however, remains particularly relevant in alternative financings for providing cash management, hedging solutions and other ancillary solutions that cannot be provided by alternative lenders. Most recently, this trend has further increased. Private equity funds have been seen to increasingly offer debt funding through private credit funds, for example to finance LBOs.

Belgium: Private Equity

This country-specific Q&A provides an overview of Private Equity laws and regulations applicable in Belgium.

-

What proportion of transactions have involved a financial sponsor as a buyer or seller in the jurisdiction over the last 24 months?

-

What are the main differences in M&A transaction terms between acquiring a business from a trade seller and financial sponsor backed company in your jurisdiction?

-

On an acquisition of shares, what is the process for effecting the transfer of the shares and are transfer taxes payable?

-

How do financial sponsors provide comfort to sellers where the purchasing entity is a special purpose vehicle?

-

How prevalent is the use of locked box pricing mechanisms in your jurisdiction and in what circumstances are these ordinarily seen?

-

What are the typical methods and constructs of how risk is allocated between a buyer and seller?

-

How prevalent is the use of W&I insurance in your transactions?

-

How active have financial sponsors been in acquiring publicly listed companies?

-

Outside of anti-trust and heavily regulated sectors, are there any foreign investment controls or other governmental consents which are typically required to be made by financial sponsors?

-

How is the risk of merger clearance normally dealt with where a financial sponsor is the acquirer?

-

Have you seen an increase in (A) the number of minority investments undertaken by financial sponsors and are they typically structured as equity investments with certain minority protections or as debt-like investments with rights to participate in the equity upside; and (B) ‘continuation fund’ transactions where a financial sponsor divests one or more portfolio companies to funds managed by the same sponsor?

-

How are management incentive schemes typically structured?

-

Are there any specific tax rules which commonly feature in the structuring of management's incentive schemes?

-

Are senior managers subject to non-competes and if so what is the general duration?

-

How does a financial sponsor typically ensure it has control over material business decisions made by the portfolio company and what are the typical documents used to regulate the governance of the portfolio company?

-

Is it common to use management pooling vehicles where there are a large number of employee shareholders?

-

What are the most commonly used debt finance capital structures across small, medium and large financings?

-

Is financial assistance legislation applicable to debt financing arrangements? If so, how is that normally dealt with?

-

For a typical financing, is there a standard form of credit agreement used which is then negotiated and typically how material is the level of negotiation?

-

What have been the key areas of negotiation between borrowers and lenders in the last two years?

-

Have you seen an increase or use of private equity credit funds as sources of debt capital?