-

Overview

The State intervention, control and regulation regime for economic concentrations was born in 2012 with the approval of the Organic Law of Regulation and Control of Market Power (LORCPM); law that granted legal powers to the State to approve, subordinate or deny a concentration operation, if it is vertical or horizontal, discarding any possibility of intervention in conglomerate operations.

The national Merger control regime proposes three coexisting regimes, a) compulsory notification, b) informative notification and c) exempt from notification.

The current system has been reformed, introducing important traits typical of the European and Spanish regime in mandatory notifications. We refer to the evaluation procedure, which contemplates a first phase (fast track) of review up to 25 days, where it must a) Submit to the First Instance Resolution Commission (CRPI) the concentration approval report for not presenting risks to free competition (in a maximum of 15 days) or, immediately refer to the second phase, due to the fact that there are potential risks that must be analyzed with more time. In case there is no pronouncement in the first phase, the operator must pass to the second phase, whose initial term is 60 days, extendable for another 60 days term.

A controversial point in the reform is the autonomy of the investigation authority to distribute the time it must carry out its processes, powers that include the extension time established by the law, substantially reducing the real time of the Resolution Authority (CRPI), who must motivate its final decision in very short periods. Two aspects of the local regime to highlight are the legal possibility that a concentration be approved by administrative silence, when the maximum legal term and its extensions have expired, the State has not notified the resolution, and the possibility that the authority itself or an interested third party may challenge the concentration authorization already granted.

Finally, we believe that figures such as the pact of retailers or shareholders with low percentages compared to an atomization of the rest of the shareholding package, which allows a takeover or joint control of minority shareholders with the right to veto and the killer acquisitions are figures that, for now, are being barely supervised by the State.

-

Is notification compulsory or voluntary?

It is mandatory when there is a change of control or takeover (action that would reflect the possibility of influencing one over another, individually or jointly) and said change of control exceeds the thresholds determined by law.

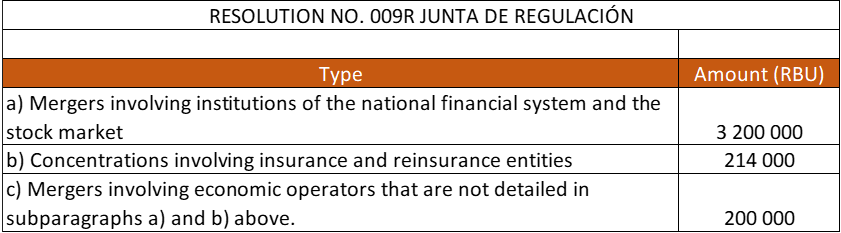

- Any change of control or takeover whose volume of business of the participants exceeds that established by the Regulatory Board in its Resolution 009, will be considered mandatory. The thresholds are divided into three areas; financial system 3.2 MM UBR; Insurance System UBR 214,000; other markets 200,000 UBR, or,

- Any change of control or takeover will be Mandatory when a share equal to or greater than 30% of the relevant market is acquired or increased.

Any processes in which internal structural reorganizations or intra-group processes are generated, are not and will not be considered by the Antitrust Authority as concentrations.

However, a notification is informative (or voluntary), when any of the mandatory requirements are not met, that is, it does not exceed the thresholds or quotas. It is important to differentiate voluntary notification from prior consultation since the latter is the legal possibility of any economic agent to consult whether the conditions of its operation make it mandatory or not.

Finally, exempt operations are those that, when executed, do not generate voting or convertible rights to the purchaser; or those that are executed on an economic agent liquidated or without activity in Ecuador in the last 3 years.

-

Is there a prohibition on completion or closing prior to clearance by the relevant authority? Are there possibilities for derogation or carve out?

A systemic interpretation of the norm, shows that for those processes of mandatory notification, there is an express prohibition to complete or close before, since the law itself, in addition to ordering the obtaining of authorization as mandatory, also indicates that “the acts will only produce effects between the parties or in relation to third parties once the provisions of the articles 21 or 23 of this Law have been fulfilled” means that any unauthorized operation cannot generate legal effects because it goes against the norm, however, said action has not been alleged to date as a limitation to the corporate registration as a result of a merger.

Consistent with this systemic vision, the law states that the lack of notification and unauthorized execution is a serious offense and punishable by 12% of the offender’s last year turnover.

For those circumstances in which acts of concentration have taken place, without prior notification, or while the corresponding authorization has not been issued, the state may order the deconcentrating, disinvestment, division or spin-off, as well as the cessation of control by one economic operator over another or others, when the case warrants it.

Finally, there are operations that do not constitute and economic concentration and can a) seek the temporary holding of the shares by entities whose normal activity includes the transaction and negotiation of securities on their own behalf or on behalf of third parties, which have been acquired for its resale; b) seek to acquire titles by mandate of authority in accordance with the rule of liquidation, bankruptcy or insolvency and, c) seek titles in seizure processes.

There are precedents in the case of operations whose notification was mandatory, and the interveners carried out previous acts, which were considered as prohibited actions by the LORCPM and were harshly sanctioned by the Competition Authority.

-

What types of transaction are notifiable or reviewable and what is the test for control?

Mandatory notifications are clearly delimited in the law, by enshrining the broad guidelines on economic concentration processes that must be notified sine qua non before the authority, following

“Economic operators involved in concentration operations, horizontal or vertical, that are carried out in any field of economic activity, are obligated to comply with the prior notification procedure established in this Law, provided that one of the following conditions is met:

a) That the total turnover in Ecuador of all the participants exceeds, in the accounting year prior to the operation, the amount established by the Regulatory Board in current unified basic remuneration.

b) In the case of mergers involving economic operators engaged in the same activity, and because of the merger, a share equal to or greater than 30% of the relevant market for the product or service is acquired or increased at the national level or in a defined geographic market within it.

Any other vertical or horizontal process in which one of the above conditions is not met, authorization by the Superintendence of Economic Competence (SCE) -i.e. the Antitrust Agency- will not be required.

However, the SCE may request ex officio or at the request of a party that a concentration operation be notified.

-

In which circumstances is an acquisition of a minority interest notifiable or reviewable?

It is the criterion of the SCE that the percentage of participation is not the critical element to suppose that control arises or not, the decision is qualitative and not quantitative. We could affirm that it is accepted by the practitioners and the Authority, that in the face of minority changes they will be subject to the merger control regulations, when there is a change in the characteristics of the control, be it joint or exclusive, or when the creation of a joint venture and competing economic operators contribute to all or part of their business to the newly created entity, for example.

The most common examples are made visible through the imposition of a minimum quorum at shareholders meeting for decision-making, such as approval of the budget and the business plan, appointment of the senior managers, investment plans, etc.

Finally, regarding those minority acquisitions in which there is no alteration in the existing control, nor the capacity of decisive influence of the acquiring retailer, it is not mandatory to notify.

-

What are the jurisdictional thresholds (turnover, assets, market share and/or local presence)? Are there different thresholds that apply to particular sectors?

For hose mandatory notification processes, whose analysis is the volume of business of the participants, Resolution 009 of the Regulatory Board of the Superintendence of Economic Competence (JRSCE) through Official Gazette No. 662 of November 6, 2015, defined the turnover table like this:

Therefore, any merger processes whose business volume effectively exceeds the value of the Unified Basic Remuneration (UBR, RBU in Spanish) must by subject to mandatory notification within 8 days from the date of conclusion of the agreement. Emphasizing that the State defined volumes for different activities, such as financial and insurance as these markets are of higher economic magnitude.

Now, for those mandatory notification processes, whose analysis is the market share, the State set 30% of the relevant market, as the maximum measure or share that the acquirer can acquire or increase, from which it must compulsorily request authorization.

Regarding the applicability of literal a) and b) to vertical and horizontal mergers, it is the opinion of the Superintendence that «there are no legal provisions or considerations of an economic nature that support that a vertical merger operation is outside the scope of application of the literal b) of the article 16 of the Law», In this sense, the commission under article 16 literal a) of the LORCPM applies to horizontal or vertical concentration operations, as there are no legal provisions that allow an exclusionary interpretation or contrary to the conclusions that have been expressed in the acquittal to this consultation» (Official Letter N. DSSCE-2013-375) therefore a merger process may require mandatory notification, according to the random application of the literal a) or b).

Another of the innovative elements in the Ecuadorian system is the fact that the SCE through its administrative procedural management instructions, has established that, in horizontal operations, (prior to the transaction) the Herfindahl-Hirschman index (HHI) of the affected relevant market must be less than 2,000 points and the ex post variation of the same index must be less than 250 points. In the case of horizontal operations, the HHI exercise will be replicated in all relevant affected markets; and for vertical operations, the operators involved, or their group must have a market share of less than 30% in the vertically integrated markets. In vertical operations, the investigation authority will value the same exercise of an HHI of less than 2,000 points prior to the transaction, in each affected vertical market.

Regarding the volume of business, it is understood as the amount resulting from the sales of products and the provision of services carried out by those involved in the operation. Now, how to calculate it? the law and the development of precedents of the national authority itself, have been decanting how to calculate it, for this it must be considered in addition to the volume of directly participating operators, considering equally those operators in which more than half of the subscribed capital, more than half of the voting rights, power to appoint more than half of the administration members, control of surveillance, or of whoever has the capacity to direct their activities. Regarding the setting of the volume of business, the threshold or the quota can be satisfied by only one of the parties, regardless of whether it is the purchaser or the acquired party. The thresholders or quotas can refer to the national or regional geographic market. It is pertinent to clarify that, any concentration operation that implies the acquisition of a branch of activity, business unit, establishment or, in general, of a part of one or more economic operators and regardless of whether said part has its own legal personality, only the volume of business related to the part object of the acquisition will be considered, in what corresponds to the acquiree. A complex aspect for the threshold system in the country is that the Regulatory Board charged by law to dictate or review the thresholds has not been met since 2017 to the present, an aspect that has generated regulatory and operational difficulties for the SCE.

-

How are turnover, assets and/or market shares valued or determined for the purposes of jurisdictional thresholds?

Ecuador fixed the dollar of the United States of America as legal tender; in this sense, the threshold is determined by reference to the Unified Basic Remuneration (UBR), which is a factor that is updated every year, by government provision. Therefore, every year, the threshold is adjusted to a valuation of the UBR (in dollars of the United States of America)

The period to consider the UBR and therefore its validity for the calculation of the threshold is one year, since the UBR factor is updated annually, because of the negotiation between employers and workers, who agree on the next UBR, (they consider factors such as inflation rates, consumer price indexes, labor productivity). Traditionally, negotiations or government decisions are executed between December and January. Due to the foregoing, the thresholds determined by the UBR are adjusted each year to the valuation once it is published in the Official Gazette.

The response to an evaluation of the volume of business and whether it is not exceeded or not, will always be an eminently technical decision that will be made in accordance with the information available at the time in which the request is addressed to the SCE.

In the cases of thresholders and their calculation based on assets, there are several accounting valuations measures, one of which could be the amortized cost of the asset, if they will continue to receive flows from that asset, or their fair value with changes in profit and loss. In accounting terms, we consider IFRS 9 and IFRS 13 recommendable.

-

Is there a particular exchange rate required to be used to convert turnover and asset values?

N/A

-

In which circumstances are joint ventures notifiable or reviewable (both new joint ventures and acquisitions of joint control over an existing business)?

N/A

-

Are there any circumstances in which different stages of the same, overall transaction are separately notifiable or reviewable?

The tradition of the SCE in the last 10 years has been to evaluate the entire transaction, regardless of whether it contemplates different relevant markets or transactions. The interdependence of the related parties is the most important element for the single global analysis. There are no circumstances for separate reviews, to date.

-

How do the thresholds apply to “foreign-to-foreign” mergers and transactions involving a target /joint venture with no nexus to the jurisdiction?

The LORCPM clearly stipulates that all economic operators, national and foreign, who currently or potentially carry out economic activities in all or part of the national territory, and those who carry out economic activities outside the country, are subjected to it, to the extent that their acts, activities, or agreements produce or may produce effects in the national market.

Therefore, the regime of economic concentration is perfectly applicable to foreign operators, once the precautions that establish a mandatory notification have been complied with. However, the thresholds or quotas determined in the Resolution 009 of the JRSCE, are applied equally to all economic operators, regardless of whether they are national or foreign.

Historically, it has been through that operators without nexus or connection in the local jurisdiction are undetectable, however, this type of detection is traditionally made through the exchange and collaboration of the competition authorities and their interrelation, which is why it is always recommended that the companies, even when they do not have a link in the jurisdiction, at least submit the informative notification or query to the SCE.

-

For voluntary filing regimes (only), are there any factors not related to competition that might influence the decision as to whether or not notify?

There are sectors that are more sensitive than others; in this sense, notifications that have an informative or voluntary nature, it is advisable to make visible factors not related to free competition, such as the social impact that may be associated with food markets, pharmaceutical, or sectors where national companies recognized as flags or banners of the local economy, to name a few. The social and labor factor are elements that have a lot to do with making economic decisions in Ecuador.

-

What is the substantive test applied by the relevant authority to assess whether or not to clear the merger, or to clear it subject to remedies? Are there different tests that apply to particular sectors?

The substantive criterion for reasons of legal certainty is defined generically in the Law, and it is these that must motivate a decision of approval, subordination, or denial. Examples of these criteria to be evaluated may be: the state of the competition in the relevant market; the degree of market power of the economic operator in question and that of its main competitors; the need to develop and/or maintain the free competition of economic operators in the market; the circumstances of whether, as a result of the merger, market power is generated or strengthened or there is a significant decrease, distortion or obstacle, clearly foreseeable or proven, of the free concurrence of economic operators and/or competition: the contribution that the merger could make to:

a) the improvement of production or marketing systems; b) the promotion of technological or economic progress in the country; c) the competitiveness of the national industry in the international market as long as it does not have a significant effect on the economic welfare of national consumers; d) the welfare of national consumers; e) if such contribution is sufficient to offset certain and specific restrictive effects on competition; and f) the diversification of the social capital and the participation of the workers.

-

Are factors unrelated to competition relevant?

The Ecuadorian competition authority under the current administration has characterized its decisions on economic concentrations on purely technical criteria. Now, there are markets, where the local laws have established the need to have pronouncements from regulatory authorities, it is the case of telecommunications to cite an example; in such cases, the regulatory criteria obey or may obey political or circumstantial criteria that have nothing to do with competition and that could be relevant when motivating a decision.

-

Are ancillary restraints covered by the authority’s clearance decision?

Restrictions are a type of limitation that, at the discretion of the parties, makes the operation viable. We believe that these will be admissible by the Antitrust Authority, when they generate concrete and significant of the general interest, in the field or industry in which they are established, when they increase efficiency or generate benefits in favor of consumers or users, justifying their application. In this practice of the SCE, it is customary to present the accessory restrictions and their respective justification to the authority, being able to conclude a priori that, when the concentration approved, such restriction measures are covered by the authorization. Now, there are precedents where the competition authority has limited its coverage of analysis to legality in terms of free competition, an example of which are the non-competition agreements in accordance with the precedents of the SCE, the have a validation or acceptance for periods maximums ranging from 3 to 5 years, depending on market conditions.

-

For mandatory filing regimes, is there a statutory deadline for notification of the transaction?

Concentration operations that require prior authorization must be notified for prior examination, within 8 days from the date of the conclusion of the agreement that will give rise to the change of control or takeover. From when to count the 8 days term? This will depend on the type of agreement and the nature of the parties, for example, if we analyze a case of merger, transfer of assets or acquisition of rights or titles between legal entities, the terms run from the time the general meeting resolves to carry out the operation and this is recorded in minutes. In the rest of the scenarios, the term will be counted from the moment in which there is evidence of the will of the parties to carry out an agreement.

-

What is the earliest time or stage in the transaction at which a notification can be made?

According to our criteria, the earliest stage in which it can be submitted for authorization by the SCE is when the parties have signed a Memorandum of Understanding (MOU). Based on authority precedent, we consider that the signing of a non-binding document does not comply with the element of change of control or takeover, a requirement to present a mandatory notification.

However, the notification must be reduced to writing, and be accompanied by the project of the legal act in question, which includes the names or corporate names of the economic operators or companies involved, their financial statements for the last financial year, their participation in the market and other data that allow knowing the intended transaction. Therefore, sometimes it is not prudent to make the notification at its earliest stage, if you do not have all the documentation exposed ready.

-

Is it usual practice to engage in pre-notification discussions with the authority? If so, how long do these typically take?

For our professional practice, it is not a common practice to engage in prior conversations. However, prior to the notification of an economic concentration, the economic operators involved may request work meeting with the National Intendency for the Control of Economic Concentrations (INCCE), tending to preliminarily analyze the documentation to be presented, to that said authority may require additional information. Accordingly, the law stipulates the obligation to notify economic concentration operations.

-

What is the basic timetable for the authority’s review?

In those prior notification procedures, except those of an informative nature, the SCE must decide within a term of sixty (60) calendar days from the filing of the request with all the respective documentation, its resolution of authorization, subordination, or denial.

However, the 60-day term is made up of the stages of receiving documents, verification, investigation, and resolution (term that will run once the notification of the initiation of the investigation has been made). Within the investigation period, the national administration for the control of economic concentrations will conduct a procedure divided into two phases.

Phase 1

Evaluation of the concentration operation, for which it has 15 days term, to determine the innocuousness’ or not of the operation in the Ecuadorian market. (Issues to the asses; there is direct or indirect activity of the acquirer in the geographic market or not or exceeds the share of 30% of the relevant market. It will also determine the initial HHI and its ex-post variation.)

Assessing the fulfillment of such criteria and circumstances of each operation, which may lead to the conviction of the absence of negative effects on the market and the innocuousness’ of the proposed operation, within the term (15 days) the INNCE will send a report to the CRPI concluding its opinion.

In the case that, after assessing the criteria and circumstances, the administration determines that the concentration merit further analysis, before the expiration of the initial term of the 15 days, it will order the continuation of phase 2. (It can also migrate to phase 2 by silence of the quartermaster)

Phase 2 (The operation warrants further investigation)

The extension will depend directly on the time the administration takes to investigate. In the case that you have decided to migrate to phase 2, you will have a remaining term until completing 55 days of investigation to issue your report. In case you start phase 2 automatically, you will have a term of 38 days to issue your report.

The resolution in cases where there is innocuousness of the operation on the relevant geographic and market or service market, will be resolved within a term of 10 days. In the rest of the scenarios, it will depend on the time you have arranged to use the INNCE for investigation.

-

Under what circumstances may the basic timetable be extended, reset or frozen?

a. When any interested party must be required to provide documents and other necessary element of judgement, for the time between the notification of the request and its effective fulfillment or, failing that, for the expiration of the granted period.

b. When reports or acts of simple administration that are mandatory and determine the content of the resolution must be requested from the same or a different administration, for the time between the request and the receipt of the report. this term of suspension may not exceed forty-five (45) days in any case.

And the general term may be extended only once for up to sixty (60) additional term days if the circumstances of the examination so require.

-

Are there any circumstances in which the review timetable can be shortened?

N/A

-

Which party is responsible for submitting the filing?

The total responsibility of the presentation is of the economic operator that acquires or takes control, this can be translated into the absorbent in case of merger between companies or economic operators, by the economic operator to which all the effects of a merchant will be transferred, by the economic operator that is going to acquire the property or any right over shares or capital participations or debt securities, by the economic operator whose members of administrative body will also become part of the administrative bodies of another economic operator, by the economic operator to whom the assets of another economic operator will be transferred or who will acquired control over the adoption of ordinary or extraordinary management decisions.

In the case that several economic operators are going to acquire control over another economic operator, the notification will be made jointly. To this end, a common attorney will be appointed who will represent them throughout the authorization procedure for the economic concentration operation.

-

What information is required in the filing form?

The following information must be submitted:

1. The names or corporate names of the economic operators or companies involved. 2. Address of the economic operators or companies involved. 3. Nature of the activities carried out by the economic operators or companies involved, specifically indicating the goods or services marketed by each of them. 4. Relevant market or markets in which those involved in the merger operate, determined in accordance with article 5 of the law. 5. Business volume of the participants broken down and calculated in accordance with article 17 of the law. 6. Quotas of participation in the relevant market of each of the participants in the concentration operation. 7. A detailed description of the relationship of each of the operators with the companies belonging to the same group that operate in any of the markets affected by the economic concentration operation, indicating their domicile and specifying the nature and means of control with respect to said companies or economic operators that belong to the group, among others.

-

Which supporting documents, if any, must be filed with the authority?

The following supporting documents must be filed:

1. Copy of the documents related to the draft legal act that will give rise to the concentration operation. 2. Financial statements for the last financial year of each of the economic operators involved in the concentration operation. 3. Analysis, reports, and studies that are considered relevant. 4. Request for confidentiality regarding the information provided part of it. The SCE, after the corresponding analysis, will give a request. 5. Sworn statement that the information provided in the notification and its attached documents is true and that the opinions, calculations and estimates have been made in good faith.

-

Is there a filing fee?

Yes, and who is obliged to pay the fee in favor of the SCE is the economic operator that makes the mandatory or informative notification. However, the rate to be paid by the notifying operator is calculated with respect to the volume of income of the economic operator on which the taking or change of control falls in accordance, based on the volume of income of the year immediately prior to the notification. Finally, the filing fee will be calculated considering the base rate.

-

Is there a public announcement that a notification has been filed?

No. The processes and officials have important restrictions on the disclosure of information.

-

Does the authority seek or invite the views of third parties?

The current administration is in the habit of requesting information from third parties that may participate in the relevant market affected by the merger. Firstly, to request information on holdings and sometimes to answer questionnaires aimed at determining factors such as substitutability of supply or demand, for example.

The subjects that can be consulted, are of all kinds, can be from associations, competitors, suppliers, recipients, or consumers. Usually, this process is done in the research phase,

-

What information may be published by the authority or made available to third parties?

The general rule in the processes that are processed in the SCE is confidentiality therefore, those who take part in carrying out investigations or in the processing of procedures are obliged to keep confidentiality, reserve, and secrecy about the facts of which they had knowledge. (Including parts). Now, as a public institution, under the current administration, it usually publishes the authority decision on its website and in its official gazette. However, the position of absolute reverse for the parties or third parties that the SCE instructs is not peaceful, since there is national and international legislation (ACHR) that protects the right of access to information; circumstance that has generated judicial pronouncements that contradict the position of the SCE. In recent proceedings, the CRPI disclosed final reports to third parties on the grounds that confidential information was protected. There is no peaceful position of this issue.

-

Does the authority cooperate with antitrust authorities in other jurisdictions?

N/A

-

What kind of remedies are acceptable to the authority?

Historically, there are important precedents for the Antitrust Authority regarding behavioral and structural remedies. The frequency of acceptance of the same will always be linked to the ability of the proponent to demonstrate that the criteria of proportionality, applicability, effectiveness, and verifiability are met to counteract the risks of anti- competitive actions that may arise from a merger. These criteria are essential when evaluating behavioral or structural remedies in a concentration, it is worth noting that any authorization that is subordinated to the fulfillment of conditions requires the operators to adopt them within a maximum term of ninety (90) days after notification of the resolution. If an additional term is required, the SCE may grant it provided that it evidences that it has made all the necessary efforts and it has been impossible to comply with them within the aforementioned term. In case o not executing them in the term, the concentration will be denied.

-

What procedure applies in the event that remedies are required in order to secure clearance?

N/A

-

What are the penalties for failure to notify, late notification and breaches of a prohibition on closing?

In the cases where the SCE is aware of concentration operations that should have been previously authorized, it will immediately initiate an investigation process, preliminary actions, and consultation with third parties. Once the investigation procedure has concluded, a reasonable resolution will be issued confirming whether the economic concentration operation was not subject to mandatory notification and authorization; or it will indicate if the operation should have been notified or if it was carried out before being authorized, in which case it will indicate that the acts have not produced legal effects between the parties or in relation to third parties.

If there have been economic effects, in the same resolution, the Superintendency will impose the deconcentrating measure, or corrective measure necessary to reverse said effects, without prejudice to the sanctions provided for in the LORCPM, which can reach up to 12% of the Business volume of the infringing company or economic operator (the person or persons responsible for notifying) in the year immediately prior to the imposition of the fine.

-

What are the penalties for incomplete or misleading information in the notification or in response to the authority’s questions?

N/A

-

Can the authority’s decision be appealed to a court?

Yes, every decision can be challenged in Administrative and Judicial headquarters. The first of them through resources of reconsideration, appeal, or extraordinary review. Likewise, before a court through subjective or objective contentious action. It is essential to highlight that the judicial challenge is not suspensive with respect to preventive measure and corrective measures in any case, except for the suspension of the fine provided that the injured party or sanctioned party pays security for 50% of the values set by the competition authority, through insurance policy or bank guarantee issued in favor of the court.

-

What are the recent trends in the approach of the relevant authority to enforcement, procedure and substantive assessment

N/A

-

Are there any future developments or planned reforms of the merger control regime in your jurisdiction?

As a result of our interaction with the authority, we know that there are proposals to reform the current merger control regime, specifically on a conditional threshold for those cases where one of the operators that alone meets the threshold, and intends to acquire a marginal operator, so that you do not have to request authorization or can request review, aspect that can be dictated by the JRSCE. We are concerned about these reform proposals in a way that they may be facilitating the killer merger

Ecuador: Merger Control

This country-specific Q&A provides an overview of Merger Control laws and regulations applicable in Ecuador.

-

Overview

-

Is notification compulsory or voluntary?

-

Is there a prohibition on completion or closing prior to clearance by the relevant authority? Are there possibilities for derogation or carve out?

-

What types of transaction are notifiable or reviewable and what is the test for control?

-

In which circumstances is an acquisition of a minority interest notifiable or reviewable?

-

What are the jurisdictional thresholds (turnover, assets, market share and/or local presence)? Are there different thresholds that apply to particular sectors?

-

How are turnover, assets and/or market shares valued or determined for the purposes of jurisdictional thresholds?

-

Is there a particular exchange rate required to be used to convert turnover and asset values?

-

In which circumstances are joint ventures notifiable or reviewable (both new joint ventures and acquisitions of joint control over an existing business)?

-

Are there any circumstances in which different stages of the same, overall transaction are separately notifiable or reviewable?

-

How do the thresholds apply to “foreign-to-foreign” mergers and transactions involving a target /joint venture with no nexus to the jurisdiction?

-

For voluntary filing regimes (only), are there any factors not related to competition that might influence the decision as to whether or not notify?

-

What is the substantive test applied by the relevant authority to assess whether or not to clear the merger, or to clear it subject to remedies? Are there different tests that apply to particular sectors?

-

Are factors unrelated to competition relevant?

-

Are ancillary restraints covered by the authority’s clearance decision?

-

For mandatory filing regimes, is there a statutory deadline for notification of the transaction?

-

What is the earliest time or stage in the transaction at which a notification can be made?

-

Is it usual practice to engage in pre-notification discussions with the authority? If so, how long do these typically take?

-

What is the basic timetable for the authority’s review?

-

Under what circumstances may the basic timetable be extended, reset or frozen?

-

Are there any circumstances in which the review timetable can be shortened?

-

Which party is responsible for submitting the filing?

-

What information is required in the filing form?

-

Which supporting documents, if any, must be filed with the authority?

-

Is there a filing fee?

-

Is there a public announcement that a notification has been filed?

-

Does the authority seek or invite the views of third parties?

-

What information may be published by the authority or made available to third parties?

-

Does the authority cooperate with antitrust authorities in other jurisdictions?

-

What kind of remedies are acceptable to the authority?

-

What procedure applies in the event that remedies are required in order to secure clearance?

-

What are the penalties for failure to notify, late notification and breaches of a prohibition on closing?

-

What are the penalties for incomplete or misleading information in the notification or in response to the authority’s questions?

-

Can the authority’s decision be appealed to a court?

-

What are the recent trends in the approach of the relevant authority to enforcement, procedure and substantive assessment

-

Are there any future developments or planned reforms of the merger control regime in your jurisdiction?