-

How often is tax law amended and what is the process?

The frequency of tax law amendments in the Maldives can vary as there are no set fixed intervals between amendments.

To amend a tax law, a draft amendment is prepared by Ministry of Finance and submitted to Peoples Majlis (“Parliament”) where it is assigned to a relevant committee for review and debate. After the committee review, the draft amendment is debated on the floor of Parliament. If the amendment is approved by the parliament, it is sent to the President of the Maldives for his approval. The President has fifteen days from receipt of a bill to either assent to it or return it to the People’s Majlis for reconsideration, potentially proposing amendments. If the People’s Majlis re-passes the bill, even without amendments, by a majority of its total membership, the President is then obligated to assent to it and ensure its publication. Once the amendment has been signed into law by the President, it is published in the official government gazette. The amended tax law then becomes effective on the specified date, which may be immediate or at a future time.

-

What are the principal administrative obligations of a taxpayer, i.e. regarding the filing of tax returns and the maintenance of records?

The Maldives has a self-assessment tax system, and both the corporate entities and Individuals are required to prepare and file their tax returns electronically via the Maldives Inland Revenue Authority (“MIRA”)’s online portal (“MIRA Connect”).

Taxpayers are required to maintain all accounting records and supporting documents for a minimum period of five years from the end of the taxable period, unless otherwise instructed by MIRA to retain them for a longer duration. The records must be readily accessible to MIRA officials upon request.

-

Who are the key tax authorities? How do they engage with taxpayers and how are tax issues resolved?

There are three main authorities in relation to tax policy, tax administration and tax appeals in Maldives.

- Ministry of Finance: The tax policy unit of ministry of finance is involved in formulating tax policies in Maldives with the consultation from public. The unit is also responsible for drafting tax laws and proposing amendments to the tax laws.

- Maldives Inland Revenue Authority: The primary tax authority in the Maldives responsible for enforcement of tax laws, implementation of tax policies, collection of taxes and ensure taxpayer compliance. MIRA also provides technical input to the tax policy unit.

- Tax Appeal Tribunal: The Tax Appeal Tribunal is a special body where taxpayers can challenge decisions made by MIRA. It serves as a place for individuals and entities to dispute MIRA’s rulings on matters such as tax assessments, penalties, claims in accordance with tax laws.

Within MIRA there are tax offices open throughout the country where taxpayers can visit to file returns and engage with MIRA officials to resolve tax issues. MIRA also operates MIRA Connect where taxpayers can file their tax returns and make payments. Taxpayers can also resolve and clarify minor tax issues via the MIRA website.

If a taxpayer has any disagreements with a tax assessment, they can file an objection with MIRA which is discussed within an internal committee before issuing an objection review report. If the taxpayer is not satisfied with the objection review by MIRA, they have the option to appeal with Tax Appeal Tribunal within 60 days. The decision by the tribunal can be appealed at High Court and the Supreme Court of Maldives.

-

Are tax disputes heard by a court, tribunal or body independent of the tax authority? How long do such proceedings generally take?

The Maldives has a dedicated Tax Appeal Tribunal specifically for adjudicating matters related to tax laws, which is an independent body established to resolve tax disputes between taxpayers and tax authorities.

Under the Tax Administration Act, if a taxpayer objects to a decision made by MIRA within 30 days, MIRA has to decide and respond to the taxpayer within 120 days and taxpayers have 60 days from the date of MIRA’s notice of objection to file an appeal at the Tax Appeal Tribunal if they are unhappy with the MIRA judgment.

Within 180 days of the appeal’s filing date, the Tribunal should consider and render a decision on it. In the event that a just resolution cannot be found in the allotted time frame, the members of the tribunal may choose to extend the appeal’s decision-making process by a maximum of 90 days.

If a taxpayer is not satisfied with the decision of the Tribunal, they have the option to appeal the decision to the High Court and subsequently to the Supreme Court of the Maldives.

An appeal filed before the High Court shall be concluded within 180 days from the filing of the appeal. Should MIRA or taxpayer appeal the decision of the High Court at the Supreme Court, the decision of the Supreme Court should also be concluded within 180 days as stipulated in the Tax Administration Act

However in practice the duration of tax proceedings can vary depending on the complexity of the case, the volume of cases pending before the tribunal and courts, and other factors.

-

What are the typical deadlines for the payment of taxes? Do special rules apply to disputed amounts of tax?

The Maldives has fixed return filing and payment deadlines for each type of tax. The below outlines the types of tax returns and their filing/payment deadlines:

Type of Tax Return Frequency Filing/Payment Deadline Corporate and Personal Income tax Thrice a year First Interim return and payment is due by the 30th July of the tax year Second interim return and payment is due by the 31st January of the following year

And the Final Tax return and payment is due by the 30June of the following year

Employee Withholding Tax Monthly 15th of the following month Non-resident Withholding Tax Monthly 15th of the following month Green Tax Monthly 28th of the following month Goods and Services Tax* Monthly 28th of the following month Airport Tax & Fees Monthly 28th of the following month Tourism Land Rent Quarterly 30th of the following month after the quarter end. Duty Free Royalty Monthly 10th of the following month * Businesses with monthly income surpassing MVR 1,000,000 are mandated to collect and remit Goods and Service Tax on a monthly basis. Conversely, those below this threshold have the option to remit GST either monthly or quarterly.

Taxpayers are not required to settle the entire disputed tax amounts to appeal. However, to appeal an assessment of MIRA at the tribunal, the taxpayers are required to pay an amount not less than 25% of the disputed amount.

If the dispute ends in favor of the taxpayer, any amount paid to MIRA will be refunded to the taxpayer. However, if the appeal is not resolved in the taxpayer’s favor, the taxpayer will be required to pay the remaining amount of the disputed tax.

-

Are tax authorities subject to a duty of confidentiality in respect of taxpayer data?

Yes, all taxpayer-related information that comes into the possession of the tax authorities is considered confidential under the Tax Administration Act except in the following circumstances:

- Information currently available from the public domain

- Information of a person who has given written consent for its disclosure

- Information revealed during civil and criminal proceedings

- Information given to employees of tax authority for the purpose of administration of tax laws

- Information revealed to obtain advice on the interpretation of tax laws

- Information disclosed in compliance with double tax agreements or tax information exchange agreements

- Information outside the scope of double tax agreements or tax information exchange agreements but should be disclosed to the officers authorized to administer the tax laws of a foreign country or territory regarding an individual who is liable to pay taxes in the Maldives.

- information disclosed in accordance with any agreement reached between the Maldivian government and a foreign authority to prevent or look into any criminal activity.

- information disclosed for incorporation into Government statistics, without withholding the taxpayer’s identity.

- Information related to a defaulter of tax or fine payable.

-

Is this jurisdiction a signatory (or does it propose to become a signatory) to the Common Reporting Standard? Does it maintain (or intend to maintain) a public register of beneficial ownership?

Maldives is a signatory to the Common Reporting Standard (“CRS”) with the first reporting year for CRS being 1 January 2021 – 31 December 2021. All reporting financial institutions are obligated to submit CRS returns detailing all the reportable accounts for the year 2021 by 31 July 2022.

The Maldives Monetary Authority is working on updating and maintaining the beneficial ownership of reporting entities. The primary purpose of this requirement to ensure persons are not hiding behind legal entities, corporate vehicles and trusts to conduct various illicit activities, including fraud, money laundering and terrorism financing. However, the government has yet to address on the publication of the beneficial ownership of reporting entities.

-

What are the tests for determining residence of business entities (including transparent entities)?

Tax residency is determined based on the form of the business entity registration.

In the case of an individual, any person:

- whose permanent place of living is in the Maldives; or

- who is present in the Maldives or intends to be present in the Maldives for an aggregate of 183 (One Hundred and Eighty-Three) days or more in any 12 (Twelve) month period commencing or ending during a tax year; or

- who is an employee or official of the Government of the Maldives and is posted overseas during a tax year.

In the case of a company, a company:

- that is incorporated in the Maldives; or

- that has its head office in the Maldives; or

- the control and management of which is in the Maldives.

In the case of a partnership and other unincorporated bodies, a partnership or unincorporated body:

- that is formed in the Maldives; or

- the control and management of which is in the Maldives.

In case of a trust, a trust;

- that is formed or settled in the Maldives; or

- that is operated in the Maldives at any point in time during a tax year; or

- that is a heritage trust of a deceased person who was resident in the Maldives; or

- that carries on any business in the Maldives.

The Maldives does not have a regulatory framework for “transparent entities”.

-

Do tax authorities in this jurisdiction target cross border transactions within an international group? If so, how?

Yes, cross border transactions between associated entities is one of the most if not the most common dispute between the MIRA and taxpayers.

The most common controlled transactions reviewed and disputed by the MIRA are intra-group financing and intra-group service transactions.

The “Arm’s Length Principle” is for the benchmark for pricing transactions between associated parties. As per the Income Tax Act[i] (Law Number 25/2019) (“ITA”) “Arm’s length terms” means the terms on which a transaction or an arrangement would have been made, or might reasonably be expected to have been made, if it had been made between persons that are not associates and in comparable circumstances. This means that, under comparable circumstances, transactions between associated parties should mirror the terms and conditions that would exist between independent parties. The ITA specifically stipulates the use of the Arm’s Length Principle for related party transactions. There are instances where the MIRA has contested the substance of the intra-group loan transactions reclassifying these in full or in part as equity contributions by shareholders, resulting in adjustments to tax deductions against interest expenses.

Where the tax authority is of the opinion that a cross-border transaction within an international group is not on arm’s length terms, the common practice is to disallow the transaction in part or full.. However, there have been instances where the tax authority has brought the transaction to arm’s length terms during their audits.

One of the notable cases on Intra-group financing transactions concluded by the High Court includes MIRA v CDLHT Oceanic Maldives Pvt Ltd (case no. 2021/HC-A/274) and MIRA v Sanctuary Sand Maldives Pvt Ltd (case no. 2021/HC-A/275) where clarity was provided regarding the deductibility of interest on a loan transaction between related parties and requirement to perform a comparability analysis in determining whether a transaction is at arm’s length. It is important to note that both these cases have been appealed at the Supreme Court of Maldives and a decision is yet to be issued.

-

Is there a controlled foreign corporation (CFC) regime or equivalent?

The Maldives has a world-wide tax system and Controlled Foreign Company (“CFC”) provisions rules apply when a company, partnership, trust or other entity that is not a resident of the Maldives is controlled by 5 (five) or fewer residents of the Maldives.

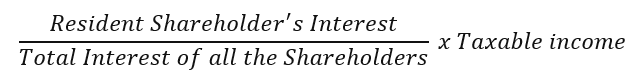

Any resident of the Maldives who owns 10% or more of the foreign entity’s share capital is required to include the foreign entity’s share of taxable revenue in their taxable income. This is calculated using the following formula;

Any resident of Maldives that is required to include the share of the foreign entities in their taxable income must submit the form “Schedule 5 – Reporting of share of taxable income from Controlled Foreign Entities” (for each entity that they hold more than 10% in the share) along with their annual income tax returns submissions.

Any amount already included in a resident’s taxable income under these CFC rules will not be included again when the foreign entity distributes that income to the resident.

To determine whether a resident of Maldives holds 10% of the share of the foreign entity, the interest of all associates who hold interest in the share capital should be considered.

-

Is there a transfer pricing regime? Is there a "thin capitalization" regime? Is there a "safe harbour" or is it possible to obtain an advance pricing agreement?

Transfer Pricing Regime

The Maldives has had a transfer pricing framework in place since the introduction of the Business Profit Tax Act in 2010. These requirements were further expanded and applied more rigorously under the ITA, which came into affect in 2020. The Tax Authority is empowered to review transactions between associated entities and make adjustments where it determines that such transactions are not conducted at arm’s length.

The MIRA issued the Transfer Pricing Regulation on 10 June 2020 setting out the categories of transactions subject to Transfer Pricing Documentation (“TPD”) requirements. Subsequently, on 20 January 2021, the County-by-Country Reporting Regulation was outlining the CbCR obligations and identifying entities required to submit these reports to MIRA.

Exemptions from preparation of documentations are given at entity level and transaction level, provided the predefined conditions set out in the Transfer Pricing Regulation are met. The Maldivian TPD framework adopts the OECD-recommended three-tiered approach, comprising the Master File, Local File, and Country-by-Country Report, where applicable.

Thin Capitalization Regime

The thin capitalization rule is followed in the Maldives. The following entities are however exempted from this rule;

- Commercial banks licensed under the Maldives Banking Act

- Insurance businesses or finance leasing businesses or housing finance businesses or non-banking financial institutions licensed to conduct financing business under the Maldives Monetary Authority Act

- Persons categorized as micro, small or medium sized businesses under the Law on Small and Medium Enterprises

- State-Owned Enterprises, of which the Government of the Maldives directly holds majority of the ordinary share capital

Apart from the above entities interest payable to banks and non-bank financial institutions licensed by the Maldives Monetary Authority are also out of the scope of thin capitalization.

Interest deductible after application of the thin capitalization rule is capped to a maximum of 30% of Tax-EBITDA (Earnings before Interest, Tax and Amortization). Any non-deductible interest can be carried forwarded to a period of 10 years from the year it was incurred.

Safe Harbour Rules

The Maldives currently does not have any safe harbor rules.

Advance Pricing Agreements (APA)

Taxpayers can apply for Advance Pricing Arrangements (“APA”) with MIRA. APAs can in some cases be made between associates of taxpayers regarding the appropriate transfer pricing methodology for a set of transactions, to mitigate transfer pricing related issues. APAs can be made bilaterally or multilaterally under the Advance Pricing Arrangement Regulation.

A person who is granted an APA is required to file an annual compliance report with the Tax Authority confirming the terms of the APAs are complied in the tax year.

-

Is there a general anti-avoidance rule (GAAR) and, if so, how is it enforced by tax authorities (e.g. in negotiations, litigation)?

The Maldives has General Anti-Avoidance Rule (“GAAR”) under the ITA. GAAR applies where the Commissioner General of Taxation has reasonable grounds to believe that an arrangement or transaction was undertaken with the purpose of avoiding tax.

Enforcement by Tax Authorities (e.g. in negotiations, litigation)

Pursuant to the ITA, the Commissioner General of Taxation has the power to void an arrangement or transaction arrangements or transactions if there are reasonable grounds to believe that tax avoidance or reduction of tax liability was one of the purposes of the arrangement or transaction. MIRA also has the discretion to act when it believes that a person has been deceitful in tax payment.

- Interaction with Advance Pricing Agreements:

An APA cannot be established if the proposed transaction involves tax avoidance or tax evasion or fraud.

- Mutual Agreement Procedure (“MAP”):

Taxpayers can request MAP assistance for tax that results from the application of the general anti-avoidance rule. In such cases, the Competent Authority of the Maldives will engage in consultations with the Competent Authority of the other jurisdiction. However, taxpayers should be aware that such claims of taxation not in accordance with the convention may not necessarily be resolved, and double taxation may not be eliminated

Under the Maldivian ITA, GAAR does not apply to:

- Where the arrangement or transaction is undertaken by a business categorized as a micro, small, or medium-sized business under the Law on Small and Medium Enterprises

- Where the arrangement or transaction is made in respect of an exempt income

- Where the arrangement or transaction is made exempt under a Regulation formulated pursuant to a Tax Act

The Tax Administration Act has mandated civil and criminal penalties should the tax authority identify that a person has committed an offence knowingly, intentionally, with the intention to evade or to facilitate a taxpayer to evade tax payable under a tax law.

-

Is there a digital services tax? If so, is there an intention to withdraw or amend it once a multilateral solution is in place?

There are currently no digital service taxes levied in the Maldives.

However, discussions to broaden the Goods and Services subjected to Goods and Service Tax are currently under discussion and have been included in the Maldives Medium Term Revenue Strategy for 2024-2028 published by the Ministry of Finance in June 2024.

The Government has yet to confirm on the method adopted for taxing digital services.

-

Have any of the OECD BEPS recommendations, including the BEPS 2.0 two-pillar approach been implemented or are any planned to be implemented?

The Maldives is a member of the OECD/G20 Inclusive Framework on BEPS having joined in November 2017, and is committed to implementing the minimum standards under BEPS Measures

Compliance with BEPS Minimum Standards

- Countering Harmful Tax Practices (BEPS Action 5):

- Preventing Tax Treaty Abuse (BEPS Action 6):

The ITA includes a General Anti-Avoidance Rule, which allows the Commissioner General of Taxation to void arrangements or transactions where tax avoidance was a purpose. The Income Tax Regulation provides further criteria for determining such tax avoidance.

- Country-by-Country Reporting (CbCR) (BEPS Action 13):

The Tax Administration Act mandates that “Multinational entities which are resident in the Maldives to prepare and submit their Country-by-Country report”, aligning with the BEPS initiative for greater tax transparency.

- Making Dispute Resolution Mechanisms More Effective (BEPS Action 14):

The Maldives has established a legal framework for Mutual Agreement Procedure (MAP) under the Tax Administration Act and Regulation. The MIRA, through its International Relations and Cooperation Department, acts as the competent authority for handling MAP cases.

Taxpayers can initiate a MAP request when they believe actions by one or both tax administrations result or will result in taxation not in accordance with a tax treaty. MAP is accessible for issues such as transfer pricing issues, juridical or economic double taxation, determination of country of residence, and attribution of profits to a permanent establishment.

The Tax Administration Act also authorizes the government to enter into Double Tax Agreements (DTAs) for avoiding double taxation, tax recovery, preventing avoidance, and information exchange. The Maldives currently has tax treaties in force with the UAE and Bangladesh, and has signed treaties with Malaysia and Hong Kong (not yet in force). These treaties generally follow Article 25(1)–(3) of the OECD Model Tax Convention, aligning with BEPS Action 14.

Other BEPS-Related Measures Implemented

- Controlled Foreign Company (CFC) Rules: The ITA contains specific provisions regarding “Controlled foreign entities” (CFEs), designed to address profit shifting to low-tax jurisdictions discussed in depth under Question 10 above.

- Thin Capitalisation Rules: The ITA includes provisions addressing “Thin capitalisation”, which typically limits interest deductions to prevent tax base erosion.

- Transfer Pricing Documentation and Arm’s Length Principle: The ITA mandates the preparation and maintenance of TPD for transactions and arrangements between associated parties.

- Automatic Exchange of Information (AEOI): The Tax Administration Regulation includes a framework for “Automatic Exchange of Information (AEOI)” and specifically references the “Common Reporting Standard” (CRS) as published by the OECD, requiring financial institutions to comply with due diligence and reporting requirements

While the Maldives is an active participant in the international consensus and framework that developed BEPS 2.0, Maldives has yet to domestically enact legislation to implement the specific rules of Pillar One (Amount A or B) or Pillar Two (GloBE Rules or STTR) into its national tax laws.

-

How has the OECD BEPS program impacted tax policies?

To comply with the OECD BEPs projects four minimum standards, introduction of mandatory Country-by-Country Reporting requirements through regulations was issued in January 2021. A mechanism for Mutual Agreement Procedures has been established, with procedures outlined for cases where tax treaties allow such procedures.

Maldives’ tax policy on transfer pricing is largely based on the OECD Transfer Pricing Guidelines, mandating that transactions between associated parties be conducted at arm’s length terms.

The ITA in the Maldives includes specific rules to limit the deductibility of interest expenses to counter BEPS risks associated with interest, ensuring that deductions reflect the business’s income or operations.

The Maldives has brought several changes to its legal and regulatory framework to comply with international standards for transparency and exchange of information, including beneficial ownership information, for tax purposes

-

Does the tax system broadly follow the OECD Model i.e. does it have taxation of: a) business profits, b) employment income and pensions, c) VAT (or other indirect tax), d) savings income and royalties, e) income from land, f) capital gains, g) stamp and/or capital duties? If so, what are the current rates and how are they applied?

The following taxes are implemented and enforced in the Maldives.

a) Income Tax:

The income tax rates in the Maldives depends on the corporate entity form.

Income tax rate for incorporated businesses including companies and partnerships is:

- 0% on taxable income not exceeding MVR 500,000 (tax-free threshold).

- 15% on taxable income exceeding MVR 500,000.

Income tax rate for Individuals is a progressive tax rate as follows.

- Income not exceeding MVR 720,000 at 0%

- More than MVR 720,000 but not exceeding MVR 1,200,000 at 5.5%

- More than MVR 1,200,000 but not exceeding MVR 1,800,000 at 8%

- More than MVR 1,800,000 but not exceeding MVR 2,400,000 at 12%

- Any income exceeding MVR 2,400,000 at 15%

For commercial banks operating in the Maldives, a flat tax rate of 25% is applicable on their whole taxable income for the tax year.

Furthermore, businesses operating in international transport is taxed at 2% on their gross income sourced from the Maldives.

b) Employment Income and Pensions:

Employers are required to withhold employee withholding taxes on employees that’s receives a remuneration of more than MVR 60,000 per month. The employee withholding tax rates are progressive and as follows:

- Income not exceeding MVR 60,000 at 0%

- More than MVR 60,000 but not exceeding MVR 100,000 at 5.5%

- More than MVR 100,000 but not exceeding MVR 150,000 at 8%

- More than MVR 150,000 but not exceeding MVR 200,000 at 12%

- Any income exceeding MVR 200,000 at 15%

c) VAT (or other indirect tax):

GST rates are sector-specific and apply regardless of the business entity’s

form. For businesses in the tourism sector, effective from 1st July 2026, 17% is imposed on all goods and services not falling under zero-rated or exempt categories. Conversely, entities in non-tourism sectors are subject to a standard GST rate of 8% on all goods and services not falling under zero-rated or exempt categories

d) Savings Income and Royalties:

There are no taxes levied on the savings income in the Maldives. However, through the non-resident withholding tax mechanism, where royalty payments are made to non-residents, a withholding tax at the rate of 10% is required to be withheld and paid to MIRA.

e) Income from Land:

Maldives has implemented a tourism land rent on the land area of islands and plots of land leased out for the purpose of developing and operating tourist establishments and varies for islands situated in different atolls of the Maldives.

Rent received for the lease of land and buildings in the Maldives are also considered taxable income.

f) Capital Gains:

Gains from the sale of movable, immovable, intellectual, or intangible property, which are not eligible for tax depreciation (commonly called as “capital allowance”), result in capital gains. These gains are calculated by subtracting the asset’s cost base and associated direct disposal expenses from the total sales proceeds. Typically, capital gains are consolidated within the annual income tax declaration. However, transactions falling under the category of “offshore indirect transfer,” involving non-resident sellers, require special attention.

In such cases, the buyer is obligated to withhold 10% of the sale price as a withholding tax, payable to the tax authority upon the triggering event (earlier of the payment or ownership transfer date). The remaining 90% is remitted to the seller. If the actual tax liability on these gains is lower than the withholding tax, the seller can seek a refund by including relevant details in their annual income tax return

g) Stamp and/or Capital Duties:

On 11 July 2021, Revenue Stamp Act was repealed with effect from the date of publication. The repeal of stamp duty is meant to bring convenience and improve the ease of doing business. As such, currently there are no stamp duties levied in the Maldives.

-

Is business tax levied on, broadly, the revenue profits of a business computed in accordance with accounting principles?

Taxable profit is determined by adjusting accounting profit in accordance with provisions outlined in the ITA and the Income Tax Regulation. Notable adjustments include limitations on deductibility of interest expenses and head office expenses. Interest expenses paid to non-approved financial institutions are capped at an annual rate of 6%, with further application of thin-capitalization rules for all interest expenses except those to banks and non-bank financial institutions licensed by the Maldives Monetary Authority. Head office expenses are restricted to a maximum of 3% of revenue.

Specific conditions must be met when claiming deductions for pension expenses, employee welfare expenses, donations, bad debts, and provisions for bad debts. No deduction is permitted for accounting depreciation or amortization; instead, a specified deduction called “capital allowance” is allowed against qualifying capital expenditure.

Additionally, no deduction is allowed for any expenditure incurred to generate exempt income, fines incurred on breach of any law or regulation.

A non-resident person conducting business in the Maldives through a permanent establishment (“PE”) is required to pay income tax on the profits attributable to that PE. The general principle for taxing business profits is that profits are taxable in the source country (Maldives) if an enterprise has a PE there, and to the extent that the income is directly attributable to the activities of that PE. However, the following expenditure incurred by a PE in the Maldives to its head office or an associated party of the head office are non deductible.

- Fees paid as royalty in respect of a patent or right.

- Commission paid for a specific service performed for, or for management services provided.

-

Are common business vehicles such as companies, partnerships and trusts recognised as taxable entities or are they tax transparent?

In the Maldives, companies, partnerships, and trusts are recognized as taxable entities and they are separate legal entities that are subject to taxation on their own income.

-

Is liability to business taxation based on tax residence or registration? If so, what are the tests?

The Maldives has a world-wide tax system and the liability to business taxation in the Maldives is based on the tax residency of such personnels. While tax residents are taxed on their world-wide income, non-residents and temporary tax residents are only taxed on income sourced from Maldives.

To prevent jurisdictional double taxation, the Maldives provides a mechanism for its tax residents to claim against Foreign Tax credit

Foreign tax” refers to a tax imposed by a foreign country that is of a similar character to income tax imposed under the Maldivian ITA.

-

Are there any favourable taxation regimes for particular areas (e.g. enterprise zones) or sectors (e.g. financial services)?

Under the ITA, Section 12-1, the President has the discretionary power to exempt specific business projects or industries from income tax for a period determined by the President.

When granting an exemption under this Section, the following is taken into consideration:

- The effect that the exemption will have on State revenue

- The economic and social impact of such exemption

- A measure of attainability of intended objectives as regards such exemption

The exemptions are mainly provided for projects funded through government budget.

Apart from this, The Maldives Special Economic Zone Act published in the Gazette in 2014 also provides tax incentives for certain development sectors in the Maldives. These include;

- Industrial estates

- Export processing zones

- Free trade zones

- Enterprise zones

- Free ports

- Single factory export processing zones

- Offshore banking units

- Offshore financial services centers

- High-tech parks

The incentives for developers and investors of special economic zones includes capital goods import duty relief, business profit tax relief, up to 10-year goods and services tax relief, up to 10-year withholding tax relief and sales tax exemption for foreign shareholder land purchases.

The zones are aimed at expanding the Maldives economy beyond tourism, and will provide the above mentioned incentives to varying degrees for key industries, including manufacturing, logistics and transportation, financial services, R&D, property development and others.

The Law on Foreign Investments in the Republic of Maldives is also structured to enable the government of Maldives to waive duty and tax on investments carried out in the country for a period at the government’s discretion.

-

Are there any special tax regimes for intellectual property, such as patent box?

Currently there are no special tax regimes for intellectual property.

-

Is fiscal consolidation permitted? Are groups of companies recognised for tax purposes and, if so, are there any jurisdictional limitations on what can constitute a tax group? Is there a group contribution system or can losses otherwise be relieved across group companies?

The current income tax regime mandates individual tax returns for each group company. However, the parent entity is required to submit consolidated financial statements for all group companies, adhering to international accounting standards, when filing the company’s corporate income tax return.

Though a consolidated account is to be submitted with the tax return, each entity is liable for taxes at its individual capacity. However, where a company belongs to a group of companies, the tax-free threshold of MVR 500,000 is distributed among the group’s entities that are subject to income tax in Maldives.

Companies are not permitted to offset business losses at the group level. Instead, losses can be utilized at the individual company level for up to 5 years

-

Are there any withholding taxes?

The Maldivian tax regime incorporates three main withholding tax mechanisms: Employee Withholding Tax (“EWT”), Non-Resident Withholding Tax (“NWT”), and Capital Gains Withholding Tax (“CGWT”). The obligation to withhold and pay the tax to MIRA is on the person carrying on business in the Maldives who makes the payment to the party..

EWT was introduced in April 2020 requiring employers to withhold from the employees taxable remuneration and settle these to MIRA on a monthly basis..

Furthermore, the ITA requires a person carrying on a business in the Maldives and who makes a qualifying payment to a non-resident to withhold a fixed amount depending on the nature of the payment.

The table below shows the payments liable for non-resident withholding taxes and the tax rates applicable.

Income Type Tax Rate Rent in relation to immovable property situated in the Maldives 10% Royalty 10% Interest (except interest received by a bank or non-banking financial institution approved by Commissioner General of Taxation in Maldives) 10% Dividends 10% Fees for technical services (FTS) 10% Commissions received in respect of services provided in the Maldives 10% Income received in respect of performances in the Maldives by public entertainers 10% Income received for carrying out research and development in the Maldives 10% Insurance premium 10% Income received by a contractor 5% However, it should be noted that, the Government of Maldives and Government of the United Arab Emirates signed a DTAA where certain payments subject to withholding tax is exempt when they are made between residents of the countries and the party does not have a PE in the other country.

Under the said DTAA, non-resident withholding tax is 10% on Rent in relation to immovable property and payments made in respect of performances in the Maldives by public entertainers. A 7% is levied on the royalty payments between residents of the countries and withholding tax is not levied on other categories of payments, given that such entites does not have a PE in the Maldives.

With the enactment of ITA in 2019, income derived by a non-resident from the disposal of movable, immovable, intellectual or intangible property are subject to Capital gains withholding taxes in Maldives as well.

The payer (withholding agent) must withhold 10% of the gross amount of payment for transactions subject to CGT. This applies to non-residents or persons whose residency cannot be determined

-

Are there any environmental taxes payable by businesses?

A Green Tax is levied on tourists staying at tourist establishments in the Maldives. The funds collected from the Green Tax is lodged into a green fund which plays a pivotal role in the implementation of various environmental development projects across different islands of the Maldives. These initiatives encompass essential areas such as water and sewerage infrastructure, shoreline protection endeavors, and waste management projects.

From 1 January 2024 onwards tourist resorts, integrated tourist resorts, tourist hotels, resort hotels, hotels with more than 50 registered rooms, hotels operated in uninhabited islands, tourist vessels, tourist guesthouses with more than 50 registered rooms, tourist guesthouses operated in uninhabited islands, and any other similar tourist establishments are required to charge USD 12 for each 24-hour stay per tourist.

Hotels with 50 or fewer registered rooms and operated in inhabited islands, and tourist guesthouses with 50 or fewer registered rooms and operated in inhabited islands, are required to charge USD 6 for each 24-hour stay per tourist.

Plastic Bag Fee is a fee collected under the Waste Management Act by businesses operated in the Maldives on plastic bags provided free of charge or sold at the point of sale effective from 18 April 2023 onwards. The rate of the Plastic Bag Fee is MVR 2 per plastic bag.

-

Is dividend income received from resident and/or non-resident companies taxable?

While dividends received by a tax resident of the Maldives from a tax resident entity are exempt from income taxes, dividends obtained through other means are considered taxable income at the shareholder level. For non-resident recipients, however, a flat withholding tax rate of 10% applies to dividends.

However, dividends received from entities which are non-residents are taxable as regular income. As such, dividends received by a local corporation from its foreign subsidiary are taxable, as the foreign subsidiary is considered a non-resident for income tax purposes

-

What are the advantages and disadvantages offered by your jurisdiction to an international group seeking to relocate activities?

The Maldives can be a viable option for international groups seeking to relocate activities tax incentives offered by the free trade zones and special economic zones.

According to data published by the International Monetary Fund (IMF), the Maldives is one of the fastest nations to recover from the economic effects of the COVID-19 pandemic which ensures business stability for investors seeking to relocate.

The Maldives also Ranks the 3rd in Paying taxes in the South East Asia in the ‘Ease of Doing Business rankings’ published by the World Bank.

The Maldives currently does not have an extensive treaty network, however the double tax avoidance agreement with the United Arab Emirates and Bangladesh and Malaysia which helps to effectively avoid double taxation.

While the country offers strategic advantages, the potential challenges such the infrastructure limitations, dependence on tourism and current low credit ratings should be carefully considered

Maldives: Tax

This country-specific Q&A provides an overview of Tax laws and regulations applicable in Maldives.

-

How often is tax law amended and what is the process?

-

What are the principal administrative obligations of a taxpayer, i.e. regarding the filing of tax returns and the maintenance of records?

-

Who are the key tax authorities? How do they engage with taxpayers and how are tax issues resolved?

-

Are tax disputes heard by a court, tribunal or body independent of the tax authority? How long do such proceedings generally take?

-

What are the typical deadlines for the payment of taxes? Do special rules apply to disputed amounts of tax?

-

Are tax authorities subject to a duty of confidentiality in respect of taxpayer data?

-

Is this jurisdiction a signatory (or does it propose to become a signatory) to the Common Reporting Standard? Does it maintain (or intend to maintain) a public register of beneficial ownership?

-

What are the tests for determining residence of business entities (including transparent entities)?

-

Do tax authorities in this jurisdiction target cross border transactions within an international group? If so, how?

-

Is there a controlled foreign corporation (CFC) regime or equivalent?

-

Is there a transfer pricing regime? Is there a "thin capitalization" regime? Is there a "safe harbour" or is it possible to obtain an advance pricing agreement?

-

Is there a general anti-avoidance rule (GAAR) and, if so, how is it enforced by tax authorities (e.g. in negotiations, litigation)?

-

Is there a digital services tax? If so, is there an intention to withdraw or amend it once a multilateral solution is in place?

-

Have any of the OECD BEPS recommendations, including the BEPS 2.0 two-pillar approach been implemented or are any planned to be implemented?

-

How has the OECD BEPS program impacted tax policies?

-

Does the tax system broadly follow the OECD Model i.e. does it have taxation of: a) business profits, b) employment income and pensions, c) VAT (or other indirect tax), d) savings income and royalties, e) income from land, f) capital gains, g) stamp and/or capital duties? If so, what are the current rates and how are they applied?

-

Is business tax levied on, broadly, the revenue profits of a business computed in accordance with accounting principles?

-

Are common business vehicles such as companies, partnerships and trusts recognised as taxable entities or are they tax transparent?

-

Is liability to business taxation based on tax residence or registration? If so, what are the tests?

-

Are there any favourable taxation regimes for particular areas (e.g. enterprise zones) or sectors (e.g. financial services)?

-

Are there any special tax regimes for intellectual property, such as patent box?

-

Is fiscal consolidation permitted? Are groups of companies recognised for tax purposes and, if so, are there any jurisdictional limitations on what can constitute a tax group? Is there a group contribution system or can losses otherwise be relieved across group companies?

-

Are there any withholding taxes?

-

Are there any environmental taxes payable by businesses?

-

Is dividend income received from resident and/or non-resident companies taxable?

-

What are the advantages and disadvantages offered by your jurisdiction to an international group seeking to relocate activities?