- Introduction

The Grand-Duchy of Luxembourg is the place to be in Europe for the structuring and the setting-up of regulated and un-regulated investment funds of all types, despite a decrease in assets under management (AuM) due to the economic crisis since early 2022 and the rising interest rates since. The global economic insecurity was followed by the postponement of the launching of many new investment products, or a significant abandon of investment projects. New investment ideas currently arise, since the interest rates became more or less stable in the meantime, and more and more new investment funds are structured and established in Luxembourg in the last one year. The small country in the heart of Europe is still the most important hub for investment funds1 on the continent – ranking just behind New York as number two worldwide. Luxembourg is only big as Manhattan, but offers six nice golf courses, internationally ranked…

The country’s overall tremendous success as a fund domicile started in 1988, when the first European Directive 85/611/EEC of 20 December 1985 for harmonized investment funds2 had rapidly been transposed into national Luxembourg law as a “first mover”. Luxembourg quickly understood the opportunities that offer a Europe-wide harmonized fund-legislation for cross-border distribution inside the European Union (EU). In the following years, important distribution activities related to Luxembourg domiciled UCITS with the “EU Passport” throughout the EU has been developed, while nearly all UCI’s actual portfolio management in terms of asset allocation was – and still is – located outside Luxembourg. The dominant Since 1988, the relevant fund industry, composed by all necessary service providers (Custodian banks, Management companies, Central administrators, Domiciliation companies, Statutory Auditors etc.), grew rapidly. During more than two decades, Luxembourg tremendously developed as a UCI domiciliation location. The next milestone for Luxembourg’s success as a hub for UCIs was the entry of the AIFMD in 2013.3 This Directive, once again after the UCITS success story, was rapidly transposed into national law in 2013 and since, a continuously growing number of regulated alternative investment funds (AIFs) can be observed.

Since 2016, the newly introduced regime of the semi-regulated “Reserved Alternative Investment Fund” (RAIF) with “EU Passport” came on top and encounters a never seen success !

All relevant players in the world of UCIs are present in Luxembourg. More than 330 fund management companies, 260 authorized AIFMs and 600 registered AIFMs are present in Luxembourg. Most of them come from Germany, Switzerland, USA, France and the UK. Luxembourg domiciled investment funds are distributed to over 76 countries in Europe, Asia, the Middle East and the Americas.

“ESG”4 and sustainability became more and more important over the last three years for the design of new investment products. According to the Global Green Financial Index 6 Luxembourg ranks among the Top 5.

A key factor for this tremendous success story is certainly closely linked to an unmatched political stability and a stable and rewarding tax environment in the Grand-Duchy for decades. Luxembourg’s Financial Supervisory Authority, the Commission de Surveillance du Secteur Financier (CSSF) applies the highest control standards and is worldwide recognized.

2. Global Situation of Investment Funds in Luxembourg (31 January 2024)

Today, the AuMs of UCIs domiciled in Luxembourg amount to EUR 5‚326.332 billion as at 31 January 2024.5

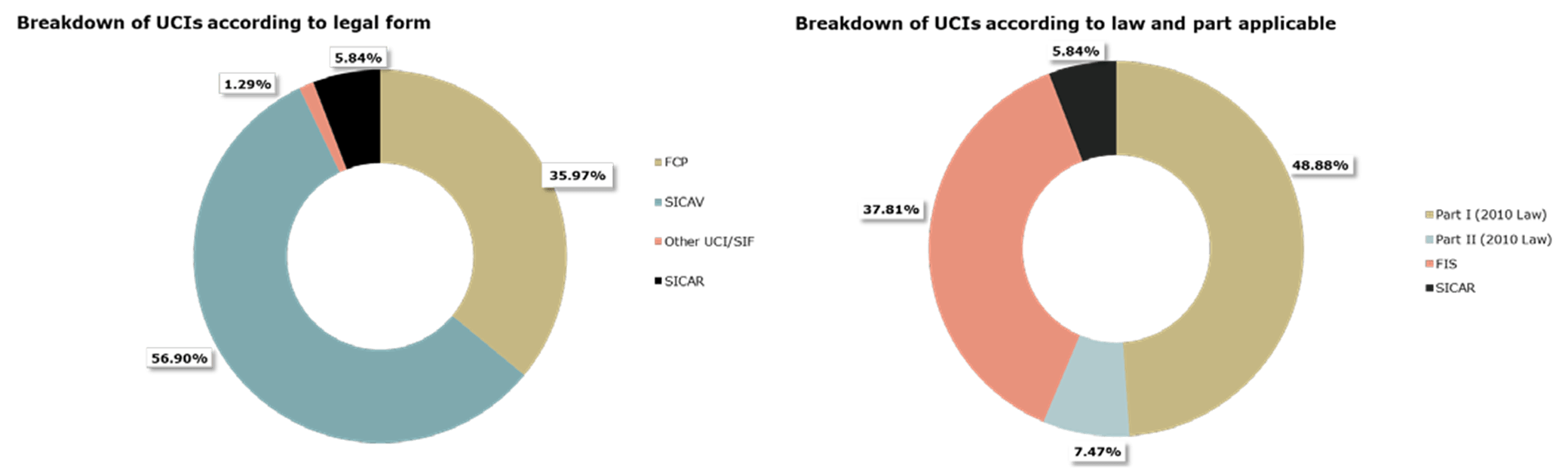

A snapshot of the development dated 31 January 2024 of Luxembourg domiciled UCIs is as follows6:

| FCP | SICAV | Other UCIs/SIFs | SICARs | Total | |

| Part I (2010 Law) | 813 | 785 | 0 | 0 | 1‚598 |

| Part II (2010 Law) | 109 | 134 | 1 | 0 | 244 |

| SIFs | 254 | 941 | 41 | 0 | 1‚236 |

| SICARs | 0 | 0 | 0 | 191 | 191 |

| Total | 1‚176 | 1‚860 | 42 | 191 | 3‚269 |

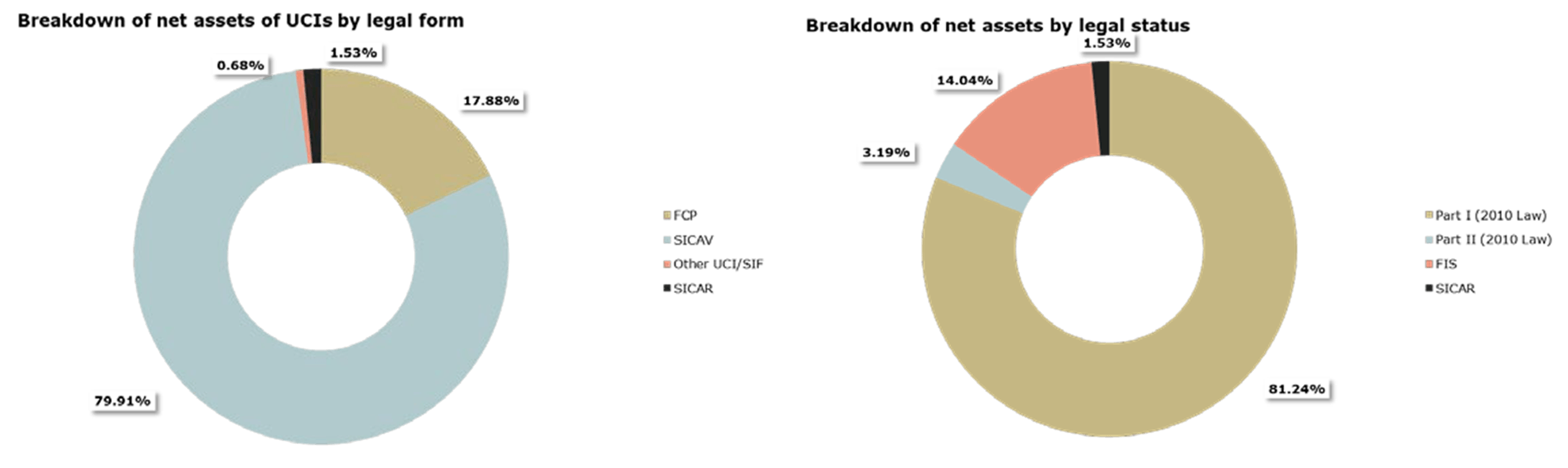

| in billion EUR | FCP | SICAV | Other UCIs/SIFs | SICARs | Total |

| Part I (2010 Law) | 680.428 | 3‚646.840 | 0.000 | 0.000 | 4‚327.268 |

| Part II (2010 Law) | 51.147 | 118.751 | 0.148 | 0.000 | 170.046 |

| SIFs | 220.758 | 490.882 | 35.925 | 0.000 | 747.565 |

| SICARs | 0.000 | 0.000 | 0.000 | 81.453 | 81.453 |

| Total | 952.333 | 4‚256.473 | 36.073 | 81.453 | 5‚326.332 |

Equity markets continued to rally and that it is improving slightly in Europe. Equity markets also benefitted from the publication of quarterly results, which mostly met or exceeded expectations. In that context, the US and European equities UCI categories posted positive monthly performances. The Asian equities UCI category registered the best monthly performance, mainly due to China, which rebounded from multi-years lows, after the government announced several interventions to support the economy and the markets, notably with a view to reduce mortgage rates. All the other equities UCI categories also performed well, including Japanese equities while the Yen weakened, but with the exception of Latin American equities, which posted a slightly negative performance.

In February 2024, the equity UCI categories registered an overall slightly positive capital investment with inflows, mostly in the European equities UCI category, being partially offset by outflows in the UCI categories Global market equities, Asian equities and Latin American equities.

3. Regulatory framework for Luxembourg domiciled investment funds

a. Fund vehicles

Luxembourg UCIs can be set-up in the contractual form (Fonds commun de placement – FCP) or in the corporate form (Société d’investissement à capital variable – SICAV or Société d’investissement en capital fixe – SICAF).

(1) Fonds commun de placement – FCP

The FCP is comparable to a simple “pool of assets”, without legal personality, as a fund vehicle. Therefore, there is need for a Management Company (ManCo) that acts for the FCP on behalf of the investors who are joint owners (“Unitholders”) of the FCPs’ assets. The constitutional document of a FCP are the Management Regulations, which contain all rules relating to the investment policy, the procedures and all contractual relationships. This document is a “contract” entered into between the ManCo/AIFM and the Custodian Bank. Unitholders buy units in the FCP issued by the ManCo/AIFM, and which represent a portion of the “pool of assets” in the FCP. The unitholders become party to the “contract” and their relationship with the ManCo/AIFM is determined by the sales prospectus (also denominated “Issuing Document” or “Private Placement Memorandum – PPM” for AIFs). The unitholders rights are limited to the amount of their contribution and, since a FCP has no corporate structure, they have no voting rights.

(2) Société d’investissement à capital variable – SICAV or Société d’investissement en capital fixe – SICAF

UCIs in the corporate form are the investment companies with variable capital (SICAV) or with fixed capital (SICAF). Both can be used for any types of Luxembourg domiciled UCIs. SICAVs are much more used than SICAFs in practice. The advantage of a SICAV is that, despite the corporate form, each capital contribution or redemption does not need a notarial deed, nor another official formality. The amount of capital is at all times equal to the net asset value (NAV), calculated with the ManCo/AIFM on a regular basis. After each subscription or redemption, the SICAV’s NAV increases or decreases automatically. SICAFs do not play an important role in practice.

Each Luxembourg domiciled UCI can be structured as a stand-alone fund or as an umbrella structure with multiple “sub-funds” (or “compartments”). Between each sub-fund, there is a strict segregation of assets. This means that one sub-fund is not liable for the other sub-fund’s assets and liabilities. The umbrella is the “virtual” corporate or contractual fund structure. Each sub-fund is, technically spoken, a bank account under the umbrella structure and can be provided with different share-classes with varying features (i.e. fees, dividends etc.).

b. Fund Products

The Luxembourg world of UCIs is divided into UCITS and AIFs.

(1) UCITS7

UCITS go back to 1988 (see I. above) and target the widest range of investors possible, in particular retail investors. The sole object is the collective investment in transferable securities and/or in other liquid financial assets of capital raised from the public and which operates on the principle of risk-spreading. The units of UCITS products are, at the unitholders’ request, re-purchased or redeemed, directly or indirectly, out of the UCITS’ assets.

UCITS provide the highest investor protection and therefore, the investment restrictions and eligible investments are more severe than in other fund products and provide higher transparency. UCITS regulations are unique and strong and enhanced risk controls are applied.

UCITS must appoint a Luxembourg based Custodian Bank, a Central Administrator, a “Chapter 15 Management Company”8 (unless it is a “self-managed SICAV/SICAF”) and an External Auditor.

UCITS must invest in “eligible assets”. In this context, the CSSF clarified that a UCITS should clearly disclose in its investment policy the categories of eligible assets in which it is authorized to invest (i) in order to achieve its investment goals, (ii) for treasury purposes and (iii) in case of unfavorable market conditions. There are two types of eligible assets, so called “core” and “non-core” investments, which terms are market practice use and not defined in the applicable regulations.

“Core”-assets for UCITS are directly mentioned in Art. 41 (1) of the Law of 10 December 2010 on UCIs, as amended, and are:

- Transferable securities admitted to or dealt on a regulated market, including (i) structured financial instruments (SFIs), (ii) transferable securities or money market instruments embedding derivatives or (iii) recently issued transferable securities or money market instruments;

- Money market instruments (MMIs);

- Deposits;

- Closed-ended investment funds (special conditions apply);

- Open-ended investment funds (special conditions apply);

- Financial derivative instruments (FDIs), including FDIs on financial indices; and

- Ancillary assets.

“Non-core” assets are those that are eligible under Art. 41 (2) a) of the Law of 10 December 2010 on UCIs, as amended, which is commonly called the “trash ratio”. This means that not more than 10% of a UCITS’ net assets can be invested in non-eligible transferable securities (e.g. private equity investments) and MMIs, whereby precious metals and certificates representing them are specifically prohibited.

Luxembourg based UCITS can easily be distributed in the European Union on a cross-border basis with the so called “European (Marketing) Passport”, which is linked to the product itself. Once established in Luxembourg, the EU-Passport can be obtained within 10 days via a regulator-to-regulator procedure, which is a pure formality.

From a tax perspective, UCITS are levied with an annual subscription tax (Taxe d’abonnement) of 0.05% on the fund’s assets (reduced to 0.01% in some specific cases). There is no further taxation on fund-level in Luxembourg.

(2) Alternative Investment Funds (AIFs)9

AIFs are fund products that are not UCITS and that fall under the AIFMD. In principle, all asset classes are permitted (except for SICARs, see below). The most important assets in which AIFs invest are real estate, private equity, and infrastructure. The regulated and semi-regulated AIFs that fall directly or indirectly under the CSSF’s supervision are:

(a) Specialized Investment Funds (SIFs)10

SIFs are required to comply with general diversification and risk management requirements but are not subject to detailed investment or borrowing rules. CSSF Circular 07/309 on risk-spreading rules provides that a SIF must ensure an “adequate” risk diversification. A SIF cannot, in principle, invest more than 30% of its assets or its commitments to subscribe to securities of the same nature issued by the same issuer. There are exceptions for investments e.g. in securities issued or guaranteed by an OECD Member State or by its local authorities or by supranational bodies or organisations of an EU, regional or worldwide nature. Target funds with comparable risk diversification principles are also eligible. In this context, each compartment of a target umbrella investment-fund may be considered as single issuer. Short-selling cannot, in principle, result in the SIF holding uncovered securities of the same nature issued by the same issuer representing more than 30% of its assets. When using FDIs, the SIF must ensure comparable risk-diversification of the underlying assets. Furthermore, the counterparty risk of OTC transactions must be limited according to the quality and qualification of the counterparty. The risk diversification rules apply on each compartment-level separately, should the SIF be established with an umbrella-structure. However, the CSSF may grant exceptions on a case-by-case basis (i.e. granting “ramp-up periods” to comply with the diversification rules later than after the legally imposed first year).

SIFs are subject to the CSSF’s direct supervision and must initiate a prior approval procedure on product level with the regulator.

(b) “UCI Part II-Funds”11

Part II of the Law of 10 December 2010 on UCIs, as amended, does not contain provisions regarding investment or borrowing rules for such UCIs Part II, but several CSSF Circulars and a “case-by-case” practice applied by the CSSF determine such rules. Eligible investments are therefore (i) transferable securities, (ii) alternative investments (i.e. hedge funds, real estate and private equity) and (iii) futures contracts and options. The risk diversification rules are quite flexible and can be discussed with the CSSF on a case-by-case basis. In practice, UCI Part II-Funds lost their importance over the years.

UCI Part II-Funds are subject to the CSSF’s direct supervision and must initiate with the regulator a prior approval procedure on product level.

(c) Investment Companies for Risk Capital (SICARs)12

A SICAR is an investment product without investment restriction rules (i.e. only one investment is eligible), which was designed for investments in “risk capital”. Eligible investments are quite restricted and the concept of “risk capital” is provided by CSSF Circular 06/241. In general, SICARs invest in private equity and venture capital, real estate investments are only permitted when there is a “development” factor (e.g. transforming warehouses into luxury lofts). A SICAR does not benefit from the numerous tax advantages of Luxembourg investment funds (i.e. only the subscription tax is levied), but various exceptions apply.

SICARs are subject to the CSSF’s direct supervision, and an application file must be transmitted which must include both “risk” and “development” aspects of the SICAR project.

(d) Reserved alternative investment funds (RAIFs)13

The RAIF is still the “rising star” in Luxembourg since its introduction in national law in 2016, since when it encounters a tremendous success.

The RAIF also qualifies as AIF, but is not directly supervised by the CSSF. Nevertheless, there is an indirect supervision since all RAIFs must appoint a fully licensed and supervised AIFM. The Luxembourg legislator considered that the strong supervision of AIFMs under the AIFMD must not necessarily be replicated on product level. Therefore, a RAIF is not subject to a prior approval procedure with the CSSF and can rapidly be launched. Another aspect of the RAIF’s success is that the EU-Passport for cross-border marketing in the EU is also available. It is unique that an AIF without direct supervision on product-level can be distributed with the EU-Passport in all EU Member States after a simple regulator-to-regulator procedure, without material approval by the regulator of the target state.

In a nutshell, the RAIF replicates the SIF- or the SICAR-regime, but without direct supervision by the CSSF. RAIFs have full flexibility with the assets it may invest in. There are no specific investment rules or restrictions, but a RAIF must adhere to the principle of risk-spreading (except when it opted for the SICAR-regime). It is in the responsibility of the RAIF’s governing body to ensure that the minimum diversification rules are complied with.

It can also be noted that a RAIF can be transformed into a SIF at a later stage, should direct supervision on product-level be necessary. This allows to start operating the fund quickly (“speed to market”) and to initiate a SIF approval-procedure with the CSSF on a parallel basis.

(e) European long-term investment fund (“ELTIF”)14

The European long-term investment fund (“ELTIF“) is an AIF for long-term investments, such as social and transport infrastructure projects, real estate and small and middle-sized enterprises (SMEs). The ELTIF regulatory framework is intended to facilitate long-term investments in these types of assets by institutional and retail investors and provide an alternative, non-bank source of financing for the real economy. In practice, ELTIFs had no significant success in Luxembourg so far as well as in other countries of the EU. Therefore, Regulation (EU) 2015/760 of the European Parliament and of the Council of 29 April 2015 on ELTIFs was put under review. Given the degree of overlap, the European Commission was reviewing the AIFMD and the ELTIF Regulation at the same time. The proposed amendments (“ELTIF 2”) to the latter entered into force on 10 January 2024 and aim to increase the use of ELTIFs across the EU for the benefit of the European economy and investors. This especially entails broadening the scope of eligible assets and investments, allowing more flexible fund rules that include the facilitation of fund-of-fund strategies, and lowering unjustified barriers that prevent retail investors from accessing ELTIFs. Probably ELTIF 2 will bring the so far outstanding success of this product in Luxembourg.

Common to all AIFs is that they raise capital from a number of investors with a view of investing it in accordance with a predefined investment policy. In principle and compared to UCITS, AIFs have the broadest investment possibilities, depending on the actual product chosen. They must appoint a Depositary (Bank or licensed “Professional of the Financial Sector” – (PSF)), depending on the nature of the assets under management), Central Administrator, fully licensed AIFM and an external Auditor. Eligible investors in all before mentioned AIFs are so-called “well-informed investors”, which term includes professional and semi-professional investors, (ultra) high net worth individuals, family offices etc.

SIFs, UCI-Part II Funds, SICARs and RAIFs that have appointed a fully licensed and supervised AIFM can distribute their shares or units with the so-called “European (Marketing) Passport” in the European Union without further material approval procedure by local regulators. The appointed AIFM will obtain such EU-Passport within 20 days from the CSSF that applies the regulator-to-regulator procedure beforehand. For such AIFs too, obtaining the EU-Passport is a matter of formality.

From a tax perspective, AIFs (except SICARs, see above) are levied with an annual subscription tax (Taxe d’abonnement) of 0.01% on the fund’s assets. There are no further taxes in Luxembourg applicable on fund level.

4. Corporate structures for investment funds

While an investment fund set-up in the contractual form (FCP, see above), which has no legal personality and is therefore no corporation, investment funds set-up in the corporate form of a SICAV or SICAF need a company form.

The constitutional document of an investment company is the articles of incorporation (also known as instruments of incorporation, articles of association or statutes) or the limited partnership agreement (LPA). SICAVs and SICAFs are also subject to the Luxembourg laws on commercial companies (in particular, the Law of 10 August 1915 on commercial companies, as amended) insofar as the laws governing the Fund Products (UCITS, UCI Part II, SIFs, SICARs or RAIFs) do not derogate from it. While a UCITS-SICAV must be set up as a public limited company (Société anonyme — S.A.) or a European company (S.E.), a SIF-SICAV and a RAIF-SICAV can be set up as a public limited company (S.A.), a private limited liability company (Société à responsabilité limitée — S.à r.l.), a partnership limited by shares (Société en commandite par actions — S.C.A.), a limited partnership (Société en commandite simple — S.C.S.), a special limited partnership (Société en commandite spéciale — S.C.Sp.), or a cooperative company organized as a public limited company (Société coopérative organisée sous forme de société anonyme — S.Co S.A.). A SICAV set up as a public limited company or a private limited liability company may be created for a single shareholder, enabling SICAVs to be incorporated by a single entity/person and permitting their creation for a single investor. A UCI Part II-SICAF, a SIF-SICAF or a RAIF-SICAF may take any commercial company form, such as the before mentioned legal forms or, in addition, the form of an unlimited company (Société en nom collectif). SICAVs and SICAFs incorporated under the form of a capital company (S.A., S.à r.l., S.C.A., S.Co S.A. or S.E.) are not tax transparent, while those investment companies formed as a partnership (S.C.S or S.C.Sp.) are generally treated as tax transparent entities. The difference between S.C.S and S.C.Sp. is that the latter is similar to the Scottish limited partnership, without legal personality, that has been introduced in Luxembourg law in 2016 in order to provide anglo-saxon investors with a well-known corporate vehicle.

5. Recent developments in 2024

In the course of 2024, new topics arose for the Luxembourg fund industry:

a. AIFMD 2

On 25 November 2021, the European Commission announced an amendment to Directive 2011/61/EU on alternative investment fund managers (“AIFMD 2“). The main amendments relate to (i) delegation arrangements, (ii) liquidity risk management, (iii) supervisory reporting, (iv) the provision of depositary and custody services, and (v) loan origination by AIFs. The European Commission recognizes the value of the delegation regime, which allows for an efficient management of investment portfolios. However, amendments are proposed to ensure that AIF managers retain core functions. A new Annex V of AIFMD 2 will be introduced that contains a list of liquidity management tools (LMT) available to AIFMs that manage open-ended AIFs. In order to better face redemption constraints under difficult market conditions, the portfolio managers of such AIFs should be required to choose at least one LMT from this list, in addition to the possibility of suspending redemptions. The European Commission also concluded that there is a need to harmonize requirements for AIFMs of AIFs that originate loans.

b. Modification of the Law of 12 July 2013 on AIFMs

The Luxembourg legislator improved and modernized the Luxembourg toolbox for investment funds and increased the attractiveness and competitiveness of Luxembourg as a financial center by modifying the Law of 12 July 2013 on AIFMs. The new law entered into force on 28 July 2023.

In a nutshell, the term “well-informed investor” now refers to the MIFID II-term “professional investor” and the minimum investment to fall under that definition is reduced to 100,000 Eur.

The time limit to reach the legal minimum amount is now extended to 24 months for SIFs, RAIFs and SICARs and to 12 months for UCITS.

In future, there will be less formalities to set-up a RAIF.

Many new dispositions relate to Part II-Funds.

Finally, authorized AIFMs shall have recourse to tied agents.

c. ELTIF 2

The ELTIF 2 regulation entered into force on 10 January 2024 (see above 3.b.(2).(e).). It aims to increase the use of ELTIFs across the EU for the benefit of the European economy and investors. The scope of eligible assets and investments is broadened, allowing more flexible fund rules that include the facilitation of fund-of-fund strategies, and lowering unjustified barriers that prevent retail investors from accessing ELTIFs.

Probably ELTIF 2 will bring the so far outstanding success of this product in Luxembourg.

6. Outlook

Many legal and regulatory changes will impact the Luxembourg fund industry in 2024. Some of them are likely to further developing the fund industry, such as the “retailisation” of AIFs, the widening of eligibility of permitted assets or the introduction of new products. A strong focus will certainly further be on ESG and the sustainability of the UCIs’ assets. The negative impact of the economic crisis on the UCIs’ evolution in terms of AuM seems to be stopped and inversed.

It is very likely that Luxembourg will further develop its financial place and defend its position as the most important fund hub in Europe.

Footnote(s):

1 Investment funds are generally known as “Undertakings for collective investment” – UCIs

2 Undertakings for collective investment in transferable securities – UCITS

3 European Directive 2011/61/EU of 8 June 2011 (AIFMD) for Alternative Investment Fund Managers (AIFMs).

4 Environmental, Social & Governance

5 Source: CSSF Communication No 278 – March 2024

6 Source: CSSF Communication No 278 – March 2024

7 Part I of the Law of 10 December 2010 on UCIs, as amended

8 Management companies according to chapter 15 of the Law of 10 December 2010 on UCIs, as amended

9 Law of 12 July 2013 on AIFMs, as amended

10 Law of 13 February 2007 on SIFs, as amended

11 Part II of the Law of 10 December 2010 on UCIs, as amended

12 Law of 15 June 2004 on SICARs, as amended

13 Law of 23 July 2016 on RAIFs, as amended

14 Regulation (EU) 2015/760 of the European Parliament and of the Council of 29 April 2015