Positioned as a crucial middle corridor between Asia and Europe, Türkiye has gained growing significance in commercial relations, influenced by factors like the Russia-Ukraine war, Middle East instability, and the supply chain impacts of Covid-19, alongside substantial investments in infrastructure and defence. This has positioned Türkiye as one of Europe's most dependable routes for transporting goods. Consequently, with extensive production possibilities, a qualified workforce, a strategic location, modern logistics infrastructure, and attractive incentive packages, Türkiye is increasingly enhancing its geo-political importance as a bridge between East and West, capable of meeting diverse business needs.

In addition to these commercial advantages, the young and active population, the dynamic free market economy, as well as its economy’s strong performance over the past decade boots the Country's future growth potential. In terms of both imports and exports, as a Customs Union member Türkiye is the EU’s sixth-largest commercial partner and reciprocally Türkiye’s top partner for imports and exports, as well as a source of foreign direct investment, is the EU (FDI).

Despite a devastating earthquake in February 2023 and various other negative factors, Türkiye's robust economic expansion has persisted, leading to the development of a diverse range of industries and an increased production and import-export capacity over the past 20 years. More than 24 cities with populations of over one million people each contribute to Türkiye’s growing domestic market. We provide a rising local demand infrastructure for global enterprises with our young and vibrant population, which has an average age of 34[1], making us the country with one of the youngest populations among European Union member states. Additionally, Türkiye boasts a substantial number of qualified engineers, further contributing to its strengths on the global stage.

Türkiye's economic landscape[2] in the fourth quarter of 2023 exhibited resilience and growth, with the GDP expanding by 4.0 percent. The services sector, including construction, led the charge with a notable 3.6 percent growth, followed by the industrial sector at 1.9 percent and the agricultural sector at 0.5 percent. Adjusted for seasonality and calendar variations, the GDP demonstrated a 1 percent increase in the fourth quarter. The cumulative growth for the entire year reached an impressive 4.5 percent in 2023. The buoyancy extended to fixed capital investments, surging by 10.7 percent, while both private and public consumption expenditures saw significant upticks of 9.3 percent and 1.7 percent, respectively. Despite net exports contributing a negative 0.6 percentage points to growth, construction investments and machinery/equipment investments witnessed robust increases of 7.5 percent and 14.0 percent, respectively. Notably, private consumption played a pivotal role, contributing 6.7 percentage points to growth, while public consumption added a commendable 0.2 percentage points to economic expansion during this period. These robust economic indicators underscore Türkiye's attractiveness and resilience for businesses looking to invest and thrive in the dynamic Turkish market.

The escalating impact of the Russia-Ukraine war, coupled with the repercussions of instability in the Middle East, particularly threats on logistic routes, has triggered a ripple effect in the global economic landscape. The growing sequence of events stemming from these geopolitical challenges is contributing to Türkiye's geopolitical significance in the broader economic perspective.

The Turkish economy has been growing in 2023, as a consequence of steps and supports implemented to buffer the negative impacts of the Covid-19 epidemic, devastating earthquake happened in February 2023 effecting 11 highly populated cities and other geo-political challenges on the economy. In the face of growing inflation in the aftermath of the global economic instability, Türkiye, sought to maintain rapid growth while protecting and then increasing employment. Monetary and fiscal policies were developed following this framework, which included returning the orthodox economic policies after the general elections happened in the 2nd quarter of 2023., while also cutting different taxes, increasing some incentives for certain sectors and, raising the minimum wage.

Hence, by continuing its uninterrupted growth pattern following the global crisis, the Turkish economy gained tremendous achievements. Economic activity remained strong in 2023 and continues its growing momentum. In addition to rising raw material and energy costs as a result of the Russia-Ukraine conflict, disruptions in regional supply chains had little impact on the Turkish economy’s growth performance. The Turkish economy grew thanks to increased domestic and overseas demand. Moreover, aided by recent developments and successful bilateral agreements, Türkiye's dynamic economy has earned international recognition, prompting credit rating agencies like Fitch to upgrade Türkiye's credit ratings[3]. Notably, these agencies have also revised Türkiye's credit outlook from "stable" to "positive," reflecting the positive trajectory and strengthening financial position of the country.

The export quantity index[4] climbed by an average of %5.0 on November 2023 compared to the same period the previous year, while the import quantity index decreased by 7.8 percent. Despite the significant global trade contraction of 2 trillion dollars, Türkiye's exports maintained an upward trend throughout 2023. Notably, in the commemorative year of the Republic's 100th anniversary, 2023 marked a remarkable achievement for Türkiye as it set a new record in exports, reaching a notable 255.8 billion dollars[5].

WHAT ARE THE ADVANTAGES OF YOUR COUNTRY AS A BUSINESS LOCATION?

Our country is appealing to international investors due to its diverse production potential, qualified workforce, strategic location, sophisticated logistics infrastructure, and incentive packages that meet a variety of needs. Situated at the convergence of strategic trade routes across three continents and hosting the second-largest population in Europe, Türkiye is a key player on the global stage. With a population of approximately 85.2 million people as of 2022, Türkiye presents a multitude of opportunities for investors, leveraging its strategic location, diverse demographics, and economic potential.

Türkiye’s investment advantages are appealing to investors, and we may discuss these investment incentives through the following points: The Turkish economy’s strength and inclusion among the world’s 20 most powerful economies. Türkiye’s strategic location is on two enormous continents, encircled on all sides by three seas: the Black Sea, the Mediterranean Sea, and the Aegean Sea. In addition to its lengthy marine borders with Africa, it has an internal sea, the Sea of Marmara. The Turkish government provides investors with government services in order to entice them to invest in Türkiye. Türkiye’s vast geographical area offers several opportunities for investment in a wide range of areas. The variety of tourism destinations available in Türkiye, as well as the complexity of its infrastructure and dispersion over various Turkish states, open up larger and more expansive business opportunities.

WHAT ARE THE BUSINESS STRUCTURES IN YOUR COUNTRY?

A business in Türkiye can be formed in various ways, and its structure may differ as outlined below;

i. Joint Stock Company

A corporation with its capital divided into shares, a Joint Stock Company confines its liability for debts solely to its assets. Moreover, shareholders' responsibilities are limited to the capital shares acquired through established methods, thus confining their obligations solely to the payment of the agreed-upon capital amount to the company. Initiating a Joint Stock Corporation requires at least one founder shareholder, who can be either an individual or a legal entity, and there is no specified maximum limit on the number of shareholders.

The minimum capital requirement is TRY 250,000.00 (Two Hundred Fifty Thousand Turkish Lira), with a lower cap of TRY 500,000.00 (Five Hundred Thousand Turkish Lira) for companies adhering to the Registered Share Capital System. Entities planning to go public and falling under the Capital Markets Legislation often opt for the registered share capital system. Additionally, real estate can be contributed to corporations as capital, provided there is an expert appraisal report supporting the valuation. A Joint Stock Company can be established for any lawful economic purpose, without restrictions unless expressly prohibited by law, and its existence can be either limited or unlimited in duration. However, industries such as financial leasing businesses, banks, and insurance companies necessitate approval from the relevant ministry or other state organizations for the establishment of a Joint Stock Company. In such cases, obtaining an approval letter from the ministry before establishing the corporation may be a prerequisite. It's important to note that any modifications to the Articles of Organization for companies operating in these specified industries are also subject to the same approval process. The founding shareholder is obligated to draft and sign the Articles of Association, with their signatures attested by a notary public. The Articles of Association must encompass essential details such as the field of activity, capital, nominal values of shares, authorities, address, and representatives of the Joint Stock Company. Additionally, they appoint the initial members of the Board of Directors. It is crucial to emphasize that introducing a provision into the Articles of Organization is only permissible if expressly allowed by law.

A Joint Stock Corporation must consist of two governing bodies: the General Assembly and the Board of Directors. The Board of Directors, operating under the oversight of the General Assembly, manages and represents the corporation. The Board holds the authority to decide on any transaction or matter necessary to achieve the company's overarching goals. Notably, membership on the Board of Directors does not require shareholder status; it can be held by either a real or legal person.

ii. Limited Liability Company

A Limited Liability Company is established by one or more individuals or legal entities with a specified capital. Similar to shareholders in a Joint Stock Company, the liability of Limited Liability Company shareholders is limited to the capital shares they have acquired. However, shareholders in a Limited Liability Company may be subject to additional payments and supplementary liabilities as stipulated in the Articles of Association. This provision is occasionally employed to define extra payment responsibilities for shareholders, serving as a preventive measure against a company's potential financial challenges.

A Limited Liability Company can be established with a minimum capital of TRY 50,000.00 (Fifty Thousand Turkish Liras), divided into shares valued at TRY 25.00 (Twenty-Five Turkish Liras) or multiples thereof. This can be initiated by at least one shareholder, with a maximum limit of 50 (fifty) shareholders, and is designed to engage in any lawful economic activity.

The two indispensable organs of a Limited Liability Company are the Shareholders' Assembly and the Manager or Board of Management. It is important to note that the management and representation of a Limited Liability Company are overseen by a manager and/or a Board of Management. It is crucial that at least one shareholder possesses managerial authority. Moreover, in the case of multiple managers, one must be designated as the Head of the Board of Managers. The management and representation of the Limited Liability Company can be delegated to one or more shareholders, all shareholders, or a third party. Managers hold the authority to make decisions and conduct any matters related to management not expressly delegated to the general assembly by law or the Articles of Association.

iii. Independent Audit

It is critical to explain that Companies are subject to Independent Audit pursuant to Turkish Audit Principles as per the Turkish Commercial Code and in accordance with the terms of the 2018-11597 numbered Presidential Decree, and companies subject to Independent Audit are also required to create a website and allocate some of this website to the announcements required by law.

iv. Company Establishment Process

In Türkiye, the business formation procedure is facilitated by an electronic system known as MERSİS, and the supporting documents are transmitted to the trade registration following the submission of an online application to the system. The documents specified in the relevant regulations of the Company types for the establishment of the Joint Stock Company and Limited Liability Company shall be registered before the respective Trade Registry Office of the city where the Company will be founded.

CURRENT OPPORTUNITIES & FUTURE PROSPECTS

Exploring or expanding business endeavours in Türkiye is a strategic choice for foreign investors, given the country's position as one of the world's fastest-growing economies. Türkiye's appeal stems from its advantageous geographical location, diverse economy, and the array of investment opportunities supported by the government. The Investment Office of the Presidency of the Republic of Türkiye plays a pivotal role in promoting these opportunities globally, providing comprehensive assistance to investors throughout the entire process—before, during, and after their entry into Türkiye.

Indeed, there are other compelling reasons to make an investment in Türkiye, as stated in the below mentioned-opportunities;

i. ‘Istanbul Finance Centre’, the establishment steps of which are almost completed

he Istanbul Financial Centre ("IFC") is designed to enhance the financial competitiveness of the Republic of Türkiye on the global stage. Its objectives include contributing to the growth and expansion of financial markets, fostering the development of diverse financial products and services, reinforcing integration with international finance and capital markets, and adapting to technological advancements in financial markets. Furthermore, the IFC aims to facilitate the management of activities by foreign credit institutions, financial entities, and organizations, as well as other individuals and entities, domestically and position itself as one of the leading global financial centres.

Law No. 7412 on IFC regulates the provisions on the field, management and operation of IFC and the activities carried out within the scope of IFC and primarily discounts, exemptions, other tax advantages and some conveniences are envisaged primarily for companies holding a participant certificate. The IFC aims to bring together a diverse array of financial institutions and organizations, including banks, capital markets institutions, participation finance companies, financial investment and portfolio management companies, and insurance companies within a unified location. Incentives are structured to encourage sustainable and participatory approaches across all financial services, with a special emphasis on fostering international trade activities.

In addition to its emphasis on strategic sub-sectors such as banking, insurance, green finance, financial technologies, and participation finance, the Istanbul Financial Centre (IFC) strives to provide support to portfolio management, wealth management, project finance, fund management, and reinsurance companies operating within the international financial services sector, aligning with global best practices. Furthermore, the IFC aims to foster a comprehensive ecosystem in the region by supporting financial services activities, including the involvement of consultancy, IT, telecommunications, and financial technology companies. This multifaceted approach is geared towards establishing the IFC as a hub for a diverse range of financial services and related industries. The eligibility for discounts, exemptions, and other tax advantages outlined in the Law is contingent upon obtaining a participant certificate, maintaining an office space, and engaging in the export of financial services. However, for regulations focused on attracting qualified human resources, the sole requirement is obtaining a participant certificate and having a designated office space.

In this regard, the IFC stands as a highly prized opportunity for both local and international investors, providing a comprehensive platform for various exemptions and incentives. With its strategic focus on fostering key financial sub-sectors, including banking, insurance, green finance, financial technologies, and participation finance, the IFC aims to create a conducive environment for entities engaged in portfolio management, wealth management, project finance, fund management, and reinsurance within the international financial services sector. The prospect of benefiting from discounts, exemptions, and tax advantages, subject to conditions such as obtaining a participant certificate, maintaining an office space, and exporting financial services, makes the IFC an attractive destination. Moreover, the regulations tailored to attract qualified human resources further enhance the appeal of the IFC, making it a sought-after hub for investors looking to capitalize on a wide array of financial opportunities and incentives.

ii. Information and Communication Technologies in Türkiye

Türkiye's Information and Communication Technologies (ICT) sector has evolved into a crucial component of the national economy, showcasing remarkable growth with exports surpassing USD 2 billion to key regions including the EU, Middle East and North Africa (MENA), Asia, and North America. The ICT sector, encompassing software, hardware, equipment, and services, plays a pivotal role in Türkiye's international trade, with over 70 percent of exports directed to the EU—highlighting the European Union as Türkiye's primary export destination in this sector. This robust performance underscores the sector's significance and its ability to contribute substantially to Türkiye's economic landscape on a global scale.

The ICT sector, estimated to have garnered around USD 19 billion in International Direct Investment (IDI) since the early 2000s, has emerged as a significant driver of employment in Türkiye. The sector has created jobs for over 185,000 individuals, reflecting its substantial impact on the national workforce. Notably, more than 40 percent of the employment in the ICT sector is attributed to Research and Development (R&D) personnel, underscoring the sector's commitment to innovation. Furthermore, a noteworthy 58 percent of the sector's employees are under the age of 35, emphasizing the dynamic and youthful nature of the workforce contributing to the growth and vibrancy of Türkiye's ICT industry. The ICT sector holds a strategic position in Türkiye, evidenced by its recognition as a priority sector, leading to a series of initiatives aimed at fostering investments in this domain. One pivotal measure is the R&D Law, instituted in 2008, and subsequently renewed and reinforced in 2016. This legislation delineates specific R&D areas and provides a spectrum of incentives. The incentive package encompasses critical benefits such as corporate tax exemptions, Value Added Tax (VAT) exemptions, and social security premium support. These proactive steps underscore Türkiye's commitment to promoting innovation and technological advancement within the ICT sector, making it an attractive destination for both domestic and international investors.

According to the ‘Technology Development Zones Statistics – February 2024’ report of the Ministry of Industry and Technology, it is stated that there are 101 Technology Development Zones (“Technopark / Silicon Valley”) in Türkiye as of January 2024, 89 of which are actively operating and 12 of which are still in infrastructure works. When the statistics on Technoparks are analysed, it is seen that in all Technoparks;

- There are 10.275 companies and 464 of these companies are foreign companies or companies with foreign partners,

- 841 incubation companies,

- The total export rate reached 10,2 billion USD as of January

- A total of 108.360 people has been employed

- 997 projects have been completed by utilising incentives and 15.558 projects are still ongoing,

Türkiye's young technical personnel pool, supported by various initiatives, has begun to generate unicorn companies. With this momentum, Türkiye is confidently progressing towards the creation of numerous additional unicorn companies, attracting a growing interest from foreign investors.

iii. Defence and Aerospace Industry in Türkiye

The Turkish defence and aerospace industry has undergone a comprehensive transformation in the last decade. With its unprecedented achievements in recent years, Türkiye is now one of the fastest developing countries in the fields of defence and aerospace. The experience of Turkish defence and aerospace companies, which are engaged in many different initiatives, offering products that compete on a global scale and playing key roles in international projects, and the importance they attach to quality are clearly evident. With their skilled workforce and state-of-the-art technology infrastructure, Turkish companies are able to offer global solutions to many countries that meet their local requirements. These Turkish companies are active in many critical areas of the defence and aerospace sector, from indigenous design development to domestic production, from modernisation to modification, from R&D activities to international projects.

In the years when the infrastructure of the domestic defence industry was being established, the preferred method of working was to cooperate with countries and companies that were prominent in the international arena, and to engage in joint production. This approach has enabled the national defence industry to successfully carry out numerous defence projects such as the MİLGEM warship, ALTAY main battle tank, ATAK helicopters and unmanned aerial vehicles (UAVs). Building on these experiences, Türkiye has started to undertake indigenous projects such as the KAAN, ANKA unmanned aerial vehicle, the HÜRKUŞ light attack and armed reconnaissance aircraft, the GÖKTÜRK satellite, the light utility helicopter and the fighter jet. In addition, projects have been initiated to develop some important subsystems and technologies to support these programmes. Today, with the contribution of many indigenous projects, the Turkish defence industry has reached a highly developed position in terms of its capabilities, quality and competence. The Turkish defence industry not only meets the needs of the Turkish Armed Forces, but is also one of the major players in the highly competitive international defence market. In the coming years, when important national defence projects will be completed, the share of the Turkish defence industry in domestic and international markets will increase.

As of 2024, Türkiye has significantly bolstered its defence capabilities by allocating USD 40.5 billion for its defence budget. This marks an impressive increase of approximately 250% compared to previous years, underscoring Türkiye's commitment to strengthening its defence capabilities and ensuring national security. in parallel with the development of the Turkish aerospace and defence sector in the last decade, export and international cooperation opportunities for Turkish companies have also increased. Thus, in January 2024, the Turkish Defense and Aerospace Industry sector achieved exports totalling 330 million 248 thousand US dollars which figures indicate a notable growth of 18.4% compared to January 2023, highlighting the sector's sustained positive performance in international trade.

In 2022, the defence and aerospace industry achieved exports amounting to USD 4.4 billion. Breaking a new record in 2023, the industry increased this figure to USD 5.5 billion. Thanks to its advanced and qualified production capacity, the sector is poised for continued growth in 2024, setting a positive agenda for prospective investments in the industry. In addition, while defence projects with a budget of approximately USD 5.5 billion were being carried out in 2002, the current project volume has reached USD 55.8 billion, an increase of approximately 10 times. Considering the ongoing projects in the tender process, this amount is estimated to be over USD 60 billion.

An additional noteworthy development is the ambitious target set for the number of air passengers, reaching 230 million 822 thousand 123, as indicated in the "Aircraft, Passenger, Cargo Series and Forecasts Report" published by the General Directorate of State Airports Authority (DHMI) under the Ministry of Transport and Infrastructure. Building on the previous year's total of 214 million 232 thousand 985 passengers, which includes direct transit passengers, the projection for the current year anticipates a substantial increase of approximately 7.7 percent. This growth trajectory, encompassing both domestic and international routes, contributes significantly to Türkiye's overarching goal of establishing itself as a prominent civil aviation centre.

iv. Government support for local and foreign investments Türkiye

Türkiye has strengthened its position as a country that attracts foreign capital from all over the world, owing to the long-term prospects and chances it provides to investors. Foreign direct investment regulations in Türkiye require equal treatment of foreign and domestic investors. There is also an incentive mechanism for investments in Türkiye, which is carried out in collaboration with the Ministry of Industry and Technology and is tied to the location of the investment, its value, and the industry in which the investment will be made. In this context, the state offers significant advantages to investors, including the potential of exemption from value-added tax, reductions in customs charges, and exemption from customs tax, in addition to providing a location for investment and other possibilities and capabilities. To assist investors and small earners, the Turkish government approved the investment program in 2021, which was signed by Turkish President Recep Tayyip Erdogan, and stipulated the allocation of 138.3 billion TL (the dollar exchange rate at the time was about 7.5 TL) to implement 3,091 projects, and then in 2022, the Turkish government approved the investment program in 2021, which stipulated the allocation of 138.3 billion TL (the dollar exchange rate at the time was about 7.5 The sum allotted for investment climbed dramatically at the start of 2022, reaching 184.3 billion TL for investment in various economic sectors in Türkiye. In this context, the Presidential Investment Office has introduced a range of incentive programs, encompassing general, regional, strategic, and project-based incentives, such as VAT exemption, customs duty exemptions, corporate tax reduction, income tax withholding support, and land allocation, aiming to foster an ideal investment environment for investors. Therefore, in 2024, it is anticipated that Türkiye will introduce additional incentives to attract a higher number of investors, both local and international, fostering an investment-friendly environment with a diverse range of opportunities.

v. Infrastructure is available for any form of investment

With a focus on enhancing speed and safety in transportation and communication infrastructure, Türkiye has set ambitious targets, including the construction of 1,760 kilometres of new highways by 2028 and an additional 3,767 kilometres between 2029 and 2035. As part of the broader goal to establish Türkiye as a logistics base, the share of railways in transportation investments is projected to reach 60 percent by 2023. Furthermore, there is a commitment to providing 100-megabit per second internet service to every home, aligning with the objective of ensuring high-speed and widespread connectivity. In the realm of telecommunications, Türkiye is actively pursuing the goal of achieving 100 percent population coverage with 5G technology, positioning itself as a favourable destination for investments in this cutting-edge sector. Moreover, Türkiye is actively exploring opportunities within the framework of its aspirations to advance into 6G technology, emphasizing its openness to innovative and forward-looking investment ventures.

vi. Diversity and distinctiveness of investment opportunities

Aside from the availability of a robust and integrated infrastructure, the investor in Türkiye has numerous distinct advantages, the most notable of which is the number of investment opportunities in many areas. Where the investment alternatives with economic feasibility develop for individuals who want to invest in Türkiye, and we discuss some of these options below: Türkiye’s industrial investment. Investment in agriculture and food. Investing in the service industries. Commercial venture. Türkiye Real Estate Investing. Information and communication Medicine and Healthcare Services in finance

vii. Potential to achieve outstanding returns

One of the most crucial things that makes an investment in Türkiye appealing is the chance of obtaining exceptional profits. As a suitable environment for investment in Türkiye, the country’s laws encouraging it, the country’s strategic location and proximity to major markets on three continents, and Türkiye’s possession of a modern and advanced infrastructure network (seaports, air, highways, and internal and external train lines) that aid in the transportation and exportation of various products quickly and easily. The availability of a skilled and strong workforce, as well as acceptable and affordable pay, are all determinants of the strength of investment in Türkiye, and the confirmation of its financial feasibility proves that investing in Türkiye is practicable. The availability of a professional and strong workforce, as well as appropriate and affordable pay, are all determinants of the strength of investment in Türkiye, and the confirmation of its financial feasibility proves that investing in Türkiye is viable and beneficial.

Türkiye's growing geopolitical significance, heightened by factors like the war between Russia and Ukraine, coupled with its exceptional services across land, sea, and air routes—particularly in the logistics sector—alongside its pivotal role as a connection point between the East and the West, positions the country as a promising investment destination with the potential for a high rate of return.

viii. Consistent economic growth

One of the benefits of investing in Türkiye is that its economy is promising. The Turkish economy has dominated global economic growth indicators, ranking second after Britain in economic growth indicators among the Organization for Economic Cooperation and Development’s most developed countries during the second quarter of 2023, with a growth rate of 4%. Thus, in the last quarter of the previous year, Türkiye emerged as the second-fastest-growing economy among OECD member countries, as indicated by annualized economic growth data. Croatia secured the top spot with 4.3 percent growth, followed by Slovenia at 2.2 percent. Within the G20 nations, China led with the highest growth rate of 5.2 percent, followed by Indonesia at 5 percent, with Türkiye ranking third on the list.

Meanwhile, Türkiye’s exports climbed to 255,8 billion in 2023 while global trade contracted by 2 trillion dollars last year, this export value was recognized as the highest in the Republic’s history. Foreign trade volume climbed 52 billion 110 million dollars. All of these indicators of the Turkish economy’s strength highlight the benefits and significance of all types of investment in Türkiye.

ix. The increasing trend towards Türkiye from all countries of the region

The increased orientation towards Türkiye from all countries in the region is within the context of the factors attracting investment to Türkiye, especially since recent supply chain turmoil has resulted in a shift in the paths of the global economic giants towards Türkiye, and the availability of factors such as strategic location, investment environment, infrastructure, and manpower, among others that we have already mentioned. This offers an advantageous environment for bringing global corporations to Türkiye. Nonetheless, the recent spike in global shipping prices has strengthened Türkiye’s appeal to major European investors. The substantial rise in transportation costs, as well as the spread of the Coronavirus, the war between Ukraine-Russia, the instability in the Middle East have transformed Türkiye into an investment magnet, owing to the geographical and cost benefits it offers to many worldwide corporations.

Several prominent European corporations across industries including furniture, pharmaceuticals, textiles, and packaging have unveiled new investment plans in Türkiye, leveraging its advanced infrastructure and extensive logistical capabilities. Fitch, the international credit rating agency, affirmed in its latest report that Türkiye is poised to reap significant advantages from alterations in European supply chains. This influx of investment and positive evaluations further solidify Türkiye's appeal as a strategic destination for businesses looking to capitalize on its favourable economic landscape. The amended Turkish laws provide remarkable benefits for foreign investors, as newly established companies in Türkiye are given a period ranging from 6 months to a full year to organize their operations before being subjected to tax accounting and before meeting the “five Turkish employees for every foreign employee” formula.

The amendment to the law on granting Turkish citizenship through investment, which reduced the value of the foreign investment in Turkish real estate from $1 million to $400,000 in exchange for obtaining Turkish citizenship in exchange for real estate, is one of the most prominent titles of Turkish attraction to Arab capital. The change to the Naturalization Law also allows for the issuance of Turkish citizenship to people who deposit approximately $500,000 in the Turkish treasury or employ approximately 50 Turkish workers in a foreigner-owned investment in Türkiye.

x. A stable environment in various fields

Trade and economic openness with all countries of the world, as well as the diversity of its investment fields, have resulted from its political stability to a significant extent, and its acceptance of the free economy strategy for many years. Through its strategic location, free trade network, excellent logistical infrastructure, diversification of production sources, tax benefits, and skilled Labor, Türkiye provides multinational enterprises with an appropriate environment to access the global value chain. As a result, Türkiye’s strategic location has attracted numerous multinational corporations as a hub for production, export, and management, allowing them to participate more efficiently in the global value chain.

xi. Promising government plans towards expansion in all fields of investment and economy

Türkiye is adopting an innovative economic approach based on encouraging investments, creating an environment conducive to job growth and sustainability, imposing low-interest rates, balancing the demand for foreign exchange by reducing imports, increasing exports, benefiting from a competitive exchange rate, and increasing investments in order to form an economic structure capable of resisting external shocks by attracting foreign direct investment to Türkiye rather than hot mopping up. Türkiye has increased its share of government investments in the 2022 budget, which experts believe is justified in order to achieve the 2023 dream projects.

Meanwhile, Turkish Finance Minister Mehmet Şimşek has expressed optimism that the rising inflation rate, influenced by global factors and the devastating earthquake in February 2023, will decrease in 2024. He anticipates that this year will bring significant gains for Türkiye, emphasizing the country's commitment to reinforcing its economic plan and attracting both domestic and international investments. These statements underscore the government's positive outlook and ambitious goals for advancements in various investment sectors, enhancing the overall appeal and viability of investment prospects in Türkiye.

All of the factors listed above should serve as motivation for any potential investor considering an investment in Türkiye. There is also some good news about our country. TOGG, Türkiye's world-class design model and 100% Turkish automobile, concluded the year 2023 as the leader in electric car sales. This achievement highlights its effective competitive strength in both national and international markets and it is expected that TOGG will conquer Europe beginning in 2024, is no longer a simple endeavour that repositions Türkiye as a car manufacturer on the global stage. Furthermore, technological advancements in our country continue to reverberate around the world. The autonomous software and pilotless “fully autonomous” flying car AirCar, which was founded in Türkiye’s Silicon Valley in 2017 and is both an investor and a developer, pushes us closer to a future in which flying cars roam the skies. AirCar’s first prototype and test flight have been accomplished. The electric and fully autonomous vehicle, having a range of 80 kilometres with one passenger and 50 kilometres with two passengers, is scheduled to fly over Istanbul in 2025.

HOW DOES THE LEGAL SYSTEM OPERATE? WHAT SHOULD CLIENTS BE MINDFUL OF WHEN DOING BUSINESS IN YOUR JURISDICTION?

Türkiye's legal system, grounded in civil law principles, shares fundamental similarities with that of continental Europe. Operating as a civil law country, Türkiye possesses a codified set of laws delineating the procedures to be adhered to within its jurisdiction. This codification of rules stands as a crucial appeal for foreign investors, as the requirements, consequences, and liabilities are clearly stipulated in primary legal sources, including the constitution, laws legislated by the parliament, and decrees issued by the Presidency. Additionally, secondary sources, such as by-laws, regulations, and communiqués, contribute to providing a comprehensive legal framework for investors navigating Türkiye's legal landscape.

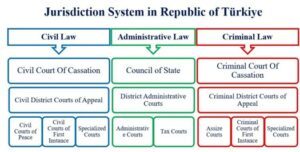

In general, the Turkish legal system is divided into three levels: first-instance courts, district courts, and supreme courts.

The above-mentioned chart illustrates the fundamental structure of the court system, encompassing specialized courts for specific legal subjects. Notably, within civil law courts, one can find entities such as commercial courts, consumer courts, enforcement courts, family courts, Labor courts, and more. Additionally, current regulations in Türkiye mandate the use of mediation before initiating legal proceedings, particularly in Labor and commercial cases. This mandatory mediation step has proven advantageous for investors, as it allows for the swift enforcement of contracts without incurring court costs or additional expenses. Thus, this policy has, in turn, is an outstanding opportunity for investors to invest in Türkiye. Turkish Courts, in particular, want written evidence before deciding on any matters, therefore gathering documentation before applying to any court is crucial. In this regard, we encourage all of our clients not to act unilaterally on any of their operations without first consulting with their lawyers, because most transactions in Türkiye must comply with the form requirements specified by the relevant laws.

FOREIGN INVESTMENT RESTRICTIONS

The Foreign Direct Investment Law Numbered 4875 (“FDI Law “) and the Regulation on the Implementation of the Foreign Direct Investment Law are the primary regulations that establish Türkiye’s foreign direct investment regime. According to the FDI Law, an FDI is defined as follows Turkish law:

“...Convertible cash capital in currencies that are traded by the Turkish Central Bank, Company Securities, Machinery and Equipment and Industrial and intellectual property rights that are brought to Türkiye from overseas or; rights related to the profit, revenue, money receivable or investment having financial value used in the investment, Rights for exploration and extraction of natural resources, that provided domestically in order to;

Establish a new company in Türkiye or,

Acquire shares outside the stock exchanges or acquiring a shareholding in an existing company through acquisitions that provide at least 10% of the shares or equal voting rights...”

A Foreign Direct Investment, as per the aforementioned definition, is treated on par with domestic investment. However, under prevailing regulations, foreign direct investments cannot be subject to expropriation or nationalization unless deemed necessary for the public interest, and in such cases, appropriate compensation must be provided. Consequently, as outlined in the FDI Law, there are no limitations on the amount of foreign investment, except in certain sectors governed by specific regulations. This regulatory framework aims to foster an environment conducive to foreign investment in Türkiye, ensuring fair treatment and protection of investors' interests.

Secondly, net profits, dividends, sales proceeds, liquidation and compensation, licensing fees, management fees, and similar agreements, as well as payments related to foreign loans, including principal and interest, and foreign credit transactions arising from the activities of Foreign Direct Investments in Türkiye, can be freely transferred abroad through banks or special financial institutions. Thus, general rule ensures the ease of financial transactions and the facilitation of international fund transfers for entities engaged in Foreign Direct Investments within Türkiye and making Türkiye a top investment – friendly country in MENA region.

INCENTIVES FOR DIRECT INVESTMENTS

The new investment incentive scheme has been specifically designed to stimulate projects that have the potential to lessen the country’s reliance on intermediate goods, which are critical to the country’s vital industries.

Among the key goals of the new investment incentive system are to reduce the current account deficit, expand investment supports offered to less developed regions, increase the number of support elements, promote clustering activities, and encourage investments to provide technology transformation.

The new investment incentive system, which went into effect on January 1, 2012, is divided into four distinct regimes. The following incentives are available to both domestic and foreign investors:

i. General Investment Incentive Practices

Irrespective of the investment region, all projects meeting the specified capacity standards and minimum fixed investment amount receive support under the General Investment Incentive Practices. These practices primarily encompass exemptions such as VAT on purchased equipment and customs duty exemptions.

ii. Regional Investment Incentive Practices

While the sectors to be supported in each region are defined by the region’s potential and the local economic scale sizes, the intensity of the supports to be offered varies based on the region’s level of development. These essentially cover land allocation, interest rate support, corporate tax reduction, and exemptions like VAT on construction and machinery, as well as customs duty exemption.

iii. Large Scale Investment Incentive Practices

Türkiye’s potential as a technology-specific investment issue is promoted in order to develop R&D capability and competitiveness. These essentially cover land allocation, interest rate support, corporate tax reduction, VAT exemption on construction and machinery, customs duty exemption, social security premium support, energy support, purchase guarantee, and facilitation in permitting processes.

iv. Strategic Investment Incentive Practices

Within the scope of Strategic Investment Incentive Practices, investments that meet the following conditions are supported:

- The domestic manufacturing capability of the product to be manufactured with the investment should be less reliant on imports.

- Minimum investment of TRY 50 million; and

- Minimum added-value of 40%. (This condition is not applicable to refinery and petrochemicals investments)

- The total import value of the product to be created with investment should have been at least USD 50 million in the previous year (excluding the products that are not locally produced)

Each practice has a different type of benefit in order to these incentive practices, such as VAT exemption, customs tax exemption, tax discount, social insurance premium support, income tax withholding discount, social insurance premium support, interest rate support, land allocation, and VAT refund.

WHAT TO KNOW BEFORE INVESTING

The Republic of Türkiye has become the first destination for all foreign investors worldwide since the Republic of Türkiye has one of the world’s fastest expanding economies, owing to its geographical location, diverse economy, and government-supported investment opportunities. According to the Doing Business Report, Türkiye has risen 10 positions to 33rd out of 190 countries. It is apparent that Türkiye has made significant progress in economic spheres, particularly when comparing all positions in the index over the last two years. Türkiye’s expectation is ranked 20th on the following ranking. All of the improvements and the rate of economic growth encourage investors to make direct investments within Türkiye’s borders.

Furthermore, the Turkish government continues to enact new legislation and reforms in order to improve the activities of Turkish corporate life, such as cost reduction and expedited procedures.

Also, last year may have been the year for Türkiye to publish new rules and reforms, because Türkiye wanted to boost investments with new regulations and reforms and actually achieved its goals. Thresholds and exemption amounts, in particular, were changed in the normal manner at the start of the year. A new income tax circular (No 314) introduced several tax exemptions for internet sales of homemade products beginning in April 2021. For 2024, the corporate tax rate has been set at 25%.

Indeed, there are customized solutions for each individual investor, acknowledging that a one-size-fits-all framework is neither relevant nor correct for all business endeavours in Türkiye. As a result, investors have the flexibility to conduct business in Türkiye and carry out their operations through a variety of legal structures. In making these decisions, factors such as the business plan, exit strategy, commercial structure, minimum capital, shareholders' obligations, liability and responsibility of executives, audit processes, and mandated penalties are carefully considered. For most investors engaging in economic activities in Türkiye, the establishment of corporations, branches, or liaison offices is a common practice. It is important to note that the Turkish Commercial Code numbered 6102, which has been in effect since July 2012, applies to corporate companies incorporated in Türkiye.

In light of the receding impacts of Covid-19 on global supply chains, the substantial negative effects of the Russia-Ukraine war on energy prices and the overall global trade rate, coupled with the ongoing instability in the Middle East, Türkiye emerges as an attractive destination for both foreign and local investment. Its strategic geo-political location, commercial potential, and the array of incentives and exemptions offered to investors contribute to positioning Türkiye as an ideal investment hub in 2024, showcasing a resilient environment amidst global challenges.

Best Regards,

Kılınç Law & Consulting

References

[1] https://data.tuik.gov.tr/Bulten/Index?p=Adrese-Dayali-Nufus-Kayit-Sistemi-Sonuclari-2023-49684#:~:text=Ortanca%20ya%C5%9F%20ayn%C4%B1%20zamanda%20n%C3%BCfusun,%2C7'ye%20y%C3%BCkseldi%C4%9Fi%20g%C3%B6r%C3%BCld%C3%BC.

[2]https://www.sbb.gov.tr/buyume/#:~:text=Mevsim%20ve%20takvim%20etkilerinden%20ar%C4%B1nd%C4%B1r%C4%B1lm%C4%B1%C5%9F,4%2C5%20oran%C4%B1nda%20b%C3%BCy%C3%BCme%20kaydetmi%C5%9Ftir.

[3] https://bigpara.hurriyet.com.tr/haberler/ekonomi-haberleri/fitch-turkiyenin-kredi-notunu-yukseltti_ID1479857/

[4] https://data.tuik.gov.tr/Bulten/Index?p=Dis-Ticaret-Endeksleri-Kasim-2023-49644

[5] https://tim.org.tr/tr/turkiye-2023te-255-8-milyar-dolarla-ihracatta-yeni-bir-rekora-imza-atti#:~:text=K%C3%BCresel%20ticaretteki%202%20trilyon%20dolarl%C4%B1k,milyar%20dolarla%20ihracatta%20rekor%20tazeledi.