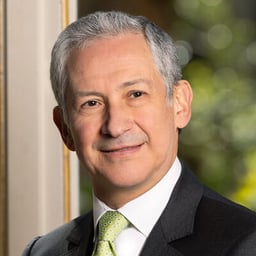

Thomas Vogel

Thomas Vogel is a partner in the Paris and Frankfurt offices of Latham & Watkins. Mr. Vogel leads the Structured Finance and Derivatives Practices and the Fintech Industry Group in Paris. He is also a member of the Financial Regulatory Practice and the Global Digital Assets & Web3 Practice.

Mr. Vogel regularly acts for global financial services firms, investment managers, hedge and investment funds, sovereign funds, and UHNW individuals. He advises on structured finance transactions, alternative investment structures across asset classes including structured strategic equity solutions, structured fixed-income transactions (delivered in synthetic format through derivatives instruments or in funded format through debt securities), strategic contingent hedging transactions, regulatory capital and synthetic risk transfer transactions, NPL portfolio transfers, synthetic credit, fund, energy, catastrophe and longevity derivatives, structured repo, and stock-lending transactions.

Mr. Vogel also advises emerging companies, decentralized autonomous organizations (DAOs), financial institutions, and investment managers on complex regulatory challenges in the development of bespoke financial crypto-asset and cryptocurrency technologies or DeFi market solutions including token sales, trading, refinancing, clearing, and settlement solutions on distributed ledger technology. He also advises clients on domestic and cross-border cutting-edge Fintech initiatives. He has also advised numerous corporates on innovative NFT and semi-NFT projects.

Mr. Vogel regularly advises clients on financial regulatory issues (including in the crypto space) and pre-contentious financial disputes in the context of mediation, arbitration and litigation procedures, as well as on internal derivatives compliance programs and derivatives clearing documentation.

Mr. Vogel has acquired years of transactional experience in New York, London, Hong Kong, and Tokyo both as a private practitioner (with a Magic Circle firm) and senior in-house counsel (with a leading US investment bank in New York). In recent years, he has represented clients in multi-billion dollar structured transactions in Europe, Asia, and the Middle East.

Mr. Vogel is a member of the Frankfurt Bar Association.