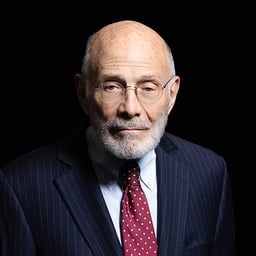

Betty Santangelo

Betty Santangelo focuses her practice on white-collar criminal defense and securities/bank enforcement. A former Assistant U.S. Attorney for the Southern District of New York, she specialized in securities and commodities fraud prosecutions. Her practice includes representing financial institutions (banks, broker-dealers, mutual funds, FCMs, insurance companies, investment advisers, hedge funds and private equity funds), other corporate entities and individuals in matters brought by the U.S. Attorneys’ offices, by various regulatory agencies, including the SEC, the bank regulatory agencies, the CFTC, FINRA, SIGTARP, international regulators (such as the FCA) and state and local prosecutors. Betty also has significant experience conducting internal investigations for these entities. In addition, she has served as an independent consultant in SEC enforcement matters examining both the NYSE and a regional broker-dealer. Prior to joining SRZ, Betty served as First Vice President and Assistant General Counsel for Merrill Lynch, where she managed the firm's securities and criminal regulatory investigations group and represented the firm and its employees in enforcement proceedings before federal and state regulatory agencies, and in criminal matters before U.S. Attorneys' offices and state prosecutors, as well as in foreign jurisdictions. She has also served as Division Director of the ABA Litigation Committee and Chair of its Securities Litigation and Broker-Dealer Subcommittees. She has contributed a chapter on “Representation Prior to Indictment” in the book Defending Federal Criminal Cases: Attacking the Government’s Proof (Law Journal Press, 2009, 2015), co-authored the “Civil and Criminal Enforcement” chapter of the Insider Trading Law and Compliance Answer Book (Practising Law Institute, 2011–2018) and contributed two chapters in Broker Dealer Regulation (Practising Law Institute, 2009–2010, 2014–2017). Betty is recognized as a leading lawyer by The Legal 500 US, The Best Lawyers in America, Ethisphere: Attorneys Who Matter, Expert Guide to the World’s Leading White Collar Crime Lawyers, Expert Guide to the World’s Leading Women in Business Law, Who's Who Legal: Business Crime Defence and New York Super Lawyers. She was also presented with the New York Chapter of the National Organization for Women's annual Women of Power and Influence Award. Nationally recognized for her expertise in corporate compliance issues, including anti-money laundering, OFAC and FCPA, Betty’s representation of financial institutions in white collar and regulatory matters frequently draws on these areas of expertise, including advising financial institutions on their anti-money laundering/OFAC/FCPA procedures. At Merrill Lynch, she was also responsible for oversight of all Bank Secrecy Act reporting and anti-money laundering activities, and the implementation of Merrill Lynch’s anti-money laundering procedures. Among her many professional activities, she has served as the Securities and Futures Industry’s representative on the Bank Secrecy Act Advisory Group of the U.S. Department of the Treasury. Betty also is a founding member of and has served as counsel to the Securities Industry and Financial Markets Association’s (SIFMA) Anti-Money Laundering and Financial Crimes Committee. In 2014, she was honored by SIFMA for her extraordinary contributions to the committee and recognized for her dedication to improving industry compliance. In 1998, the Financial Crimes Enforcement Network of the United States Treasury Department awarded Betty its Director’s Medal for Exceptional Service. That same year, she represented the U.S. securities industry at the Financial Action Task Force (“FATF”) meeting in Brussels, Belgium. In 2002, she represented SIFMA, the Futures Industry Association and the Investment Company Institute at the FATF meeting in Paris. Betty is a former adjunct professor at Fordham Law School, where she taught a course on money laundering and founded Fordham Law Women to raise awareness of the issues faced by women in the law school community. In 2019, Fordham Law established the Betty Santangelo Award to recognize female alumnae working to advance the careers of women in the legal industry. Betty is a much sought-after speaker on corporate compliance, anti-money laundering/OFAC/FCPA, white-collar criminal and securities law issues, including at SIFMA, the FIA, ACAMS, the ABA/ABA AML conference and FIBA. From the Emerald Literati Network she received an “outstanding paper” award in 2006 for an article she wrote on money laundering enforcement actions and a “highly commended” award in 2011 for an article she wrote on beneficial ownership information and USA PATRIOT Act obligations. In 2008, she won a Burton Award, which recognizes exceptional legal writing, for an article she wrote on the FCPA. She is a recipient of the YWCA Woman of Achievement award, as well as other awards.