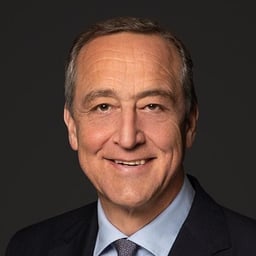

Glen Donath

Glen Donath is in the firm's White Collar and Regulatory practice. His practice focuses on white collar criminal defense, governmental enforcement actions, internal investigations, health care fraud and abuse, corporate compliance and complex civil litigation. A highly regarded former federal prosecutor, Glen has successfully represented health care providers, financial institutions, investment funds, insurance companies and various other corporations in an array of complex civil and criminal proceedings, including matters arising under securities, tax, Foreign Corrupt Practices Act (FCPA), environmental, healthcare, False Claims Act, bribery, Office of Foreign Assets Control (OFAC), anti-money laundering and other criminal statutes. He also has successfully defended many prominent corporate officers and high-ranking public officials in similar matters. Additionally, he has conducted internal investigations for major corporations and their audit committees. Glen previously served for a number of years as a Senior Assistant US Attorney in the Fraud and Public Corruption Section of the US Attorney's Office for the District of Columbia, where he conducted grand jury investigations and prosecuted cases involving a wide variety of white collar matters, including health care fraud, money laundering, mail and wire fraud, tax offenses, bankruptcy fraud, and government corruption. During his time as a federal prosecutor, Glen first-chaired dozens of trials involving a wide range of criminal offenses to successful verdicts. He received numerous Department of Justice Special Achievement Awards for sustained superior performance.Glen appears frequently in the media as an authority on white collar criminal defense and government investigations. Recently he has appeared on CNN Tonight with Don Lemon, CNN's Erin Burnett OutFront, and NPR's Morning Edition. He has also been quoted in various publications including the Wall Street Journal, Newsweek, Bloomberg Business Week, Fortune, Forbes, LA Times, AP, Reuters, and many others.