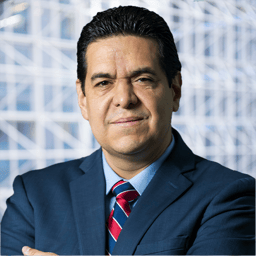

Scott Tindall

Scott is a partner in the firm’s Infrastructure, Energy, Resources, and Project (IERP) team. He advises on a wide range of infrastructure and energy work (including major development projects, PPP projects and project finance transactions), as well as electricity generation, transmission and supply arrangements, energy transition issues, ESG and related legal and regulatory issues in the energy and infrastructure sectors.

He has 20+ years of experience advising governments, developers, investors, banks and other financial institutions on some the largest and most complex deals in the global infrastructure and energy markets and has been involved in deals in the United Kingdom, Continental Europe, Africa, Asia and Australia.

Scott focusses principally on transactions in the energy, energy storage and energy transition sectors, and has advised on nuclear, oil and gas, LNG, hydrogen, power and renewable energy (including onshore and offshore wind, solar, tidal, EfW, biomass, carbon capture, use and storage (CCUS)) deals. He also has experience advising on major transactions in the aviation, aerospace and defense, social infrastructure, transport, telecommunications and waste sectors.

He has advised on joint ventures, M&A, financings, refinancings and restructurings and distressed projects in a variety of infrastructure and energy sectors.