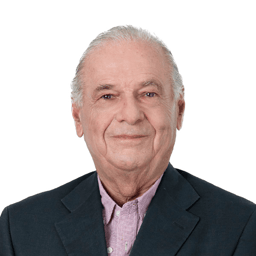

Alexandre Bastos

Alexandre Bastos joined CMS Francis Lefebvre in 1999 and became a partner in 2016.

He practices in insolvency and restructuring with a focus on emergency procedures and preventive procedures. His work covers ad hoc mandate, conciliation (debt restructuring, standstill agreements, putting collateral in place, and negotiations with the Interministerial Committee for Industrial Restructuring, CIRI), company restructuring through the adoption of rescue or receivership plans, takeover of troubled companies, and management of court-ordered bankruptcy procedures. Alexandre Bastos also acts for clients in insolvency and restructuring litigation related to creditor rights conflicts, and in civil liability proceedings against directors, etc.

He supports all parties, from the company in difficulty and buyer to the shareholders, creditors and other contractors.